Fictional Job Openings "Dropped" In November. Actual Hiring Plunged

"Soft Landing"? Try "Expanding Recession" Instead

Somewhat predictably, corporate media and the usual cadre of “experts” swooned over November’s Job Openings and Labor Turnover Survey report released yesterday by the Bureau of Labor Statistics, touting it once again as “proof” of labor market resilience within the US economy.

The number of job openings changed little at 8.8 million on the last business day of November, the U.S. Bureau of Labor Statistics reported today. Over the month, the number of hires and total separations decreased to 5.5 million and 5.3 million, respectively. Within separations, quits (3.5 million) edged down and layoffs and discharges (1.5 million) changed little. This release includes estimates of the number and rate of job openings, hires, and separations for the total nonfarm sector, by industry, and by establishment size class.

CNBC dutifully reported the numbers at face value, without noting the impact of “corrections” from the October report.

The department’s Job Openings and Labor Turnover Survey showed employment listings nudged lower to 8.79 million, about in line with the Dow Jones estimate for 8.8 million and the lowest since March 2021. Openings fell by 62,000, though the rate of vacancies as a measure of employment was unchanged at 5.3%.

UPI robotically reported the data to be in line with Wall Street estimates.

The overall total of job openings was in line with Dow Jones estimates but well below a series high of 12 million in March 2022.

Only Reuters noted the revisions from October, and even they minimized the significance of their magnitude.

Data for October was revised slightly higher to show 8.852 million job openings instead of the previously reported 8.733 million. Economists polled by Reuters had forecast 8.850 million job openings in November. Job openings are down from a record high of 12.0 million in March 2022.

Those revisions, however, highlight the degree to which the reported job openings in the country are largely fictional. The job openings data has been demonstrably overstated since the Pandemic Panic Recession, and recent declines in that number say next to nothing about the state of labor markets in the US.

Far more instructive are the hiring trends—and those tell a far less appealing picture.

To fully appreciate the latest jobs lunacy from the BLS, we must first examine the recent revisions to the job openings data.

The September job openings were revised down by approximately 200,000 in the October report, and the October job openings were revised up by approximately 119,000 in the November report (the current JOLTS report).

Note that the reported decline in job openings from the revised October level to the initial November level is 62,000. In other words, the “drop” in job openings is roughly half the upward revision to the October data.

We should also note once again that the headline data are the seasonally adjusted numbers. If we look at the unadjusted data, we see a far more substantial drop in the November job openings vs the revised October data.

The 104,000 upward revision to the unadjusted October job openings is a fraction of the 1.17 million decrease in unadjusted job openings between October and November.

The disparity between the seasonally adjusted and the unadjusted data raises a trust question: while the purpose of seasonal adjustment is to exclude normal seasonal variations in the overall trend, is a seasonal adjustment that virtually eliminates the month on month shift in job openings a reliable metric?

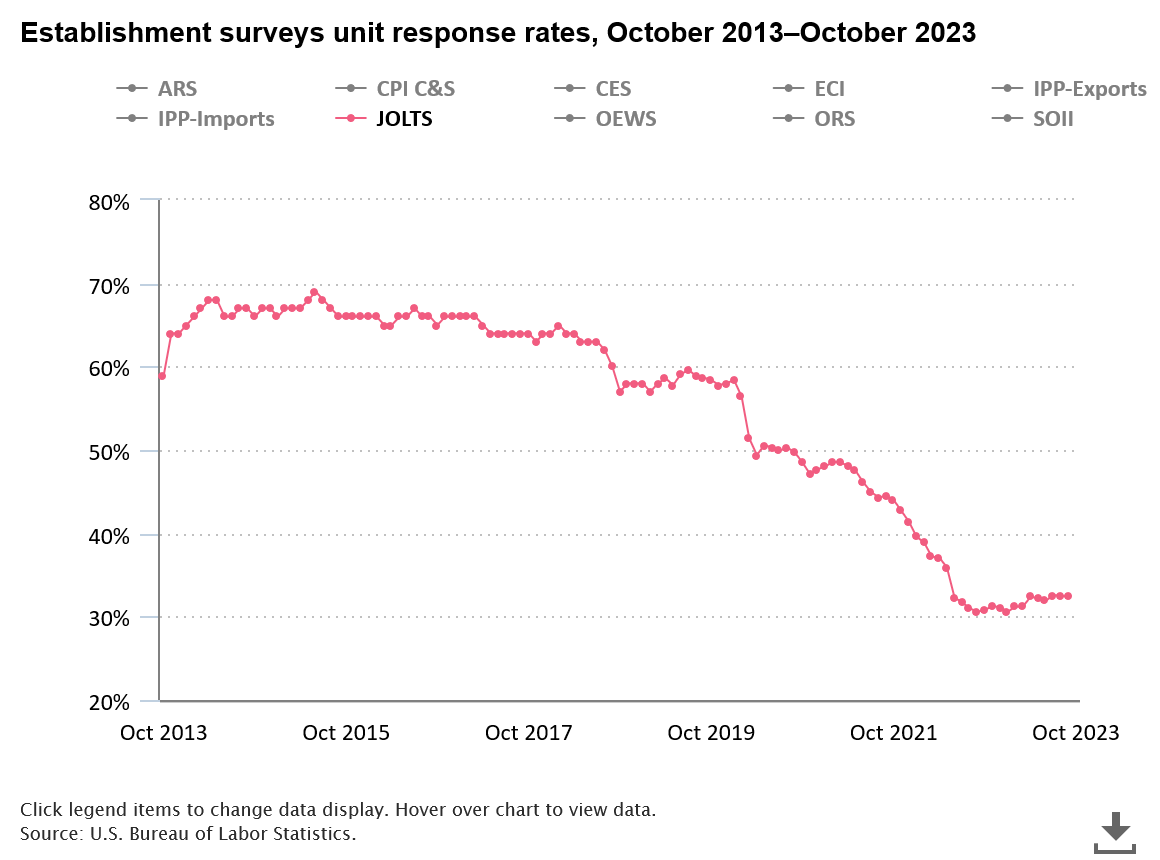

It certainly is difficult to put significant trust in survey data with adjustments of that size. That level of trust gets even smaller when one understands that the response rate on the JOLTS survey is an anemic 32%, and that it has plunged since the Pandemic Panic Recession.

Straight away, the reduction in the sample size suggests a similar reduction in the survey’s overall accuracy. For this reason alone, we should look askance at the seeming “surge” in job openings beginning in early 2021—an increase in job openings which is a fairly significant deviation from the historical trend.

In the wake of the 2008-2009 recession, there was not a similar surge in job openings, but rather steady growth in job openings from 2010 to late 2019. An unusual surge based on a sample set that is half the size of pre-COVID samples (when the response rate was approximately 55-60%) should immediately be called into question—yet the corporate media has never done so.

The job openings data is suspect as well because unemployment levels are at approximately the same level they were pre-COVID.

If there had been that much demand for labor, unemployment levels would have been pushed down even further, and they have not been.

As the job openings data is more suspect, the shifts in job openings are less meaningful.

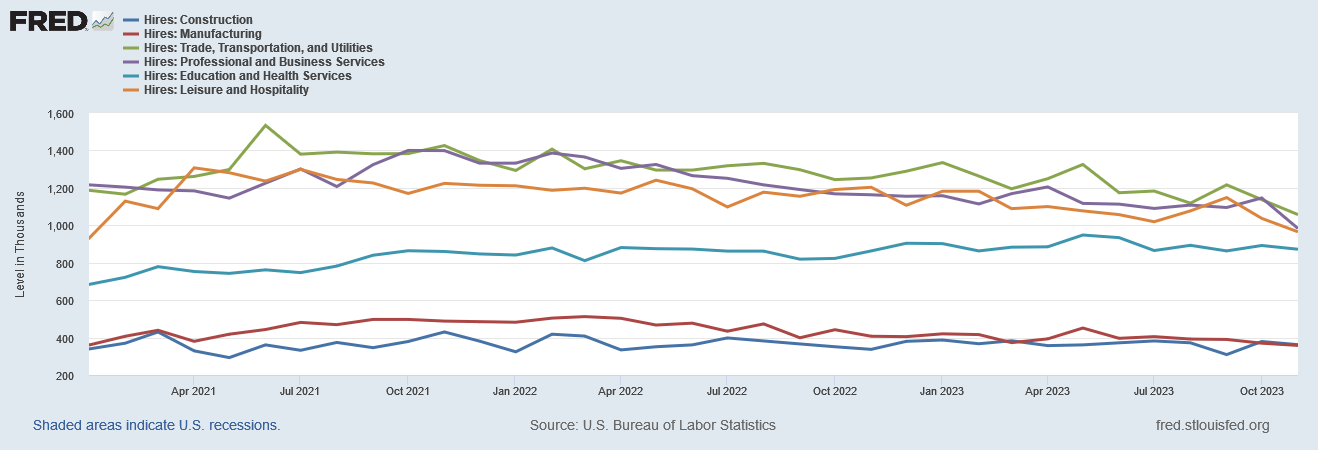

While we need to be equally cautious in working with the hiring data, we can nevertheless confirm the overall hiring trend—and that trend has been down for over a year.

Even alternate data sources, such as those provided by Opportunity Insights’ Economic Tracker, which is focused on measuring economic data shifts post-COVID, show that employment peaked in the summer of 2022 before bending down.

Opportunity Insights 8.9% drop in employment since January of 2020 lines up moderately well with the approximately 9.3% drop in hiring per the BLS since that same point in time.

The cooling trend in US job markets is demonstrably longer than the corporate media wants to admit.

How cool has hiring become? The seasonally adjusted total private hires in November is on par with the pre-COVID total private hires from December 2017.

Moreover, the decline in hiring has been fairly broadly distributed across all job categories.

When everyone is hiring fewer and fewer workers, that is not a good thing.

While the current regime will never admit it, the one thing the BLS hiring data does show is that “Bidenomics” has meant decreasing hiring for most of Dementia Joe’s Reign of Error.

After February of 2022, the month on month change in seasonally adjusted total private hires has been almost uniformly negative. Only in a handful of months has the month on month change been positive.

That negative month on month change is similarly broadly distributed across all job categories.

Nor do we need to look far to understand the consequence of this decline in hiring: the number of potential workers not in the labor force reached a minimum in April of 2022, and has broadly moved higher since.

Unemployment has stayed relatively low in this country despite the shrinking jobs market because workers have simply been leaving the labor force.

These trends are blissfully being overlooked by the economic “experts” on Wall Street, who seem content to look just at the headline JOLTS numbers for the moment and see only good news.

“Today’s JOLTS data is another signal that the Fed is delivering a soft landing,” said Ron Temple, chief market strategist at Lazard. “Today’s report is good news for American workers and the economy, but it also suggests to me that the Fed is unlikely to cut rates as aggressively in 2024, as markets currently indicate, given the risk of reigniting inflationary pressures.”

Shrinking hiring and softening labor markets are not signs of a “soft landing” for this or any other economy. They are signs of a recession.

Declining labor force participation is not a sign of a “soft landing” for this or any other economy. It is a sign of a recession.

These are signs that workers who lose their jobs are more and more often simply choosing to exit the labor force altogether. These are signs that there are far fewer actual jobs to be had than the distorted job openings data suggests. These are signs that the much ballyhooed “success” both of the Federal Reserve’s strategy on inflation and the current regime’s economic policies have delivered a stagnating, contracting economy that remains mired in the recession that it has endured since 2022.

More ominously, the larger recent declines in hiring are further indication that the recession is not easing, is not coming to an end, but is in fact getting deeper and progressively more severe.

The November JOLTS report is not good news. The November JOLTS report is not even “good bad news”. The November JOLTS report is straight up bad news.

The US economy is sick. US labor markets remain toxic. That is the real takeaway from the November JOLTS report.

Here’s something else that may be a leading-edge clue: the Wall Street Journal had a headline last week saying people are canceling their streaming services. Think about it - when your finances get pinched, you start eliminating discretionary purchases, right? Housing costs are up and food costs are up. Utilities, insurance premiums, education expenses, and the majority of all essential purchases have become more expensive. You review your budget, and downsize the streaming subscriptions from four to two. Could there be other reasons to cancel, such as annoyingly Woke content? Certainly. So I’m watching the headlines on clothing sales, Christmas spending, store closings, and so on. There have already been articles about declines in travel.

There’s just no way that the economy is as rosy as a Biden wants us to believe (until after the election)!

One neighbor was laid off from a trade association and another neighbor laid off at a headhunter/recruiting firm in November. My husband's company is using more and more independent contractors/providers from Peru and India. Just a couple corroborating factoids from my block.