Jay Powell’s confused and confusing performance at the post-FOMC presser on Wednesday did an excellent job of upsetting the Wall Street apple carts. After having given Wall Street what they expected—another pause on rate hikes—he proceeded to scare the bejesus out of the markets with his clumsy and contradictory words.

While there were many statements within the presser that gave Wall Street heartburn, there were a few statements that arguably would have given Main Street even more heartburn. One of these was his almost reflexive sunny optimism on the state of the US economy.

Recent indicators suggest that economic activity has been expanding at a solid pace.

However, a close look at a portion of the U.S. Census Data shows that sales activities in the US have not been expanding at a solid pace—or at any pace. In fact, several sales indicators are showing that the US may very well have entered a “retail recession” in the summer of 2022 which arguably is still ongoing.

That Powell apparently missed these indicators or their significance is appalling….yet here we are.

The possibility that retail slipped into recession sometime during 2022 is not new. Quite the contrary, even corporate media touched on the possibility in December, 2022.

The New York Times NYT published on Friday that retail sales fell in November despite Black Friday deals. That means that we are in a real slowdown of sales at this time. Despite this news, the Federal Reserve raised interest rates 50 basis points. Later that day, Professor Jeremey Siegel of the Wharton School at the University of Pennsylvania forcefully screamed on CNBC that the Federal Reserve is forcing us into a long-term recession.

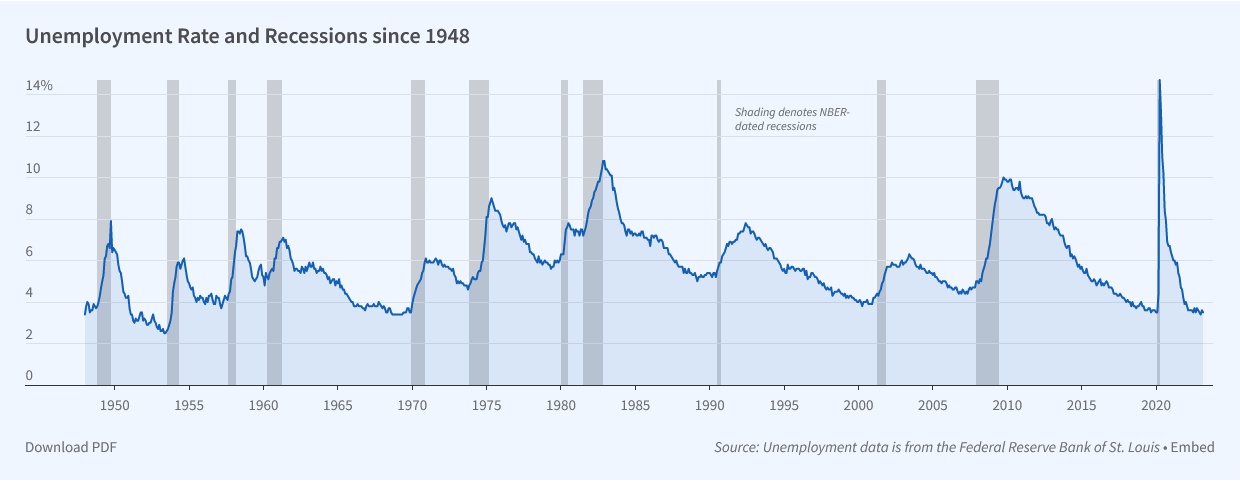

However, despite the fulminations of many (including this Substack), the National Bureau of Economic Research has refused to call a recession beginning in 2022, somewhat stubbornly clinging to the idea that the last recession the United States experienced was the Pandemic Panic recession in 20201.

To be sure, the question of whether or not there is a recession can be somewhat complicated2.

However, the National Bureau of Economic Research (NBER) Business Cycle Dating Committee (BCDC)—the committee responsible for identifying the dates of peaks and troughs that frame economic recessions and expansions—defines recessions differently: “A recession involves a significant decline in economic activity that is spread across the economy and lasts more than a few months.” In the committee’s view, three criteria—depth, diffusion and duration—each must be met to some degree to declare a recession.1 Thus, emphasis is placed on a variety of measures of economic activity rather than on a single measure, such as GDP growth.

Perhaps the most challenging scenario is that of a “rolling recession”, where different sectors of the economy experience recession conditions at different times.

Rather than an abrupt contraction Americans need to brace for, a “rolling recession” is already in progress, according to Sung Won Sohn, professor of finance and economics at Loyola Marymount University and chief economist at SS Economics. “This means some parts of the economy take turns suffering rather than simultaneously.”

This outcome confounds most traditional thinking about recessions, because if economic contraction occurs sector by sector, rather than across the broad swath of the nation’s economy, the overall economy could continue to show growth even as significant sectors contract.

Yet this nuance is still qualitatively different from the assertion that “economic activity has been expanding at a solid pace“. If there has been a rolling recession, we are still at a juncture where it is staggering that the Fed Chairman is unable to see that fact.

However, we can look at one part of the economy and see clear signs of recession even as the rest of the economy demonstrates expansion. In this instance, we are talking about sales activity.

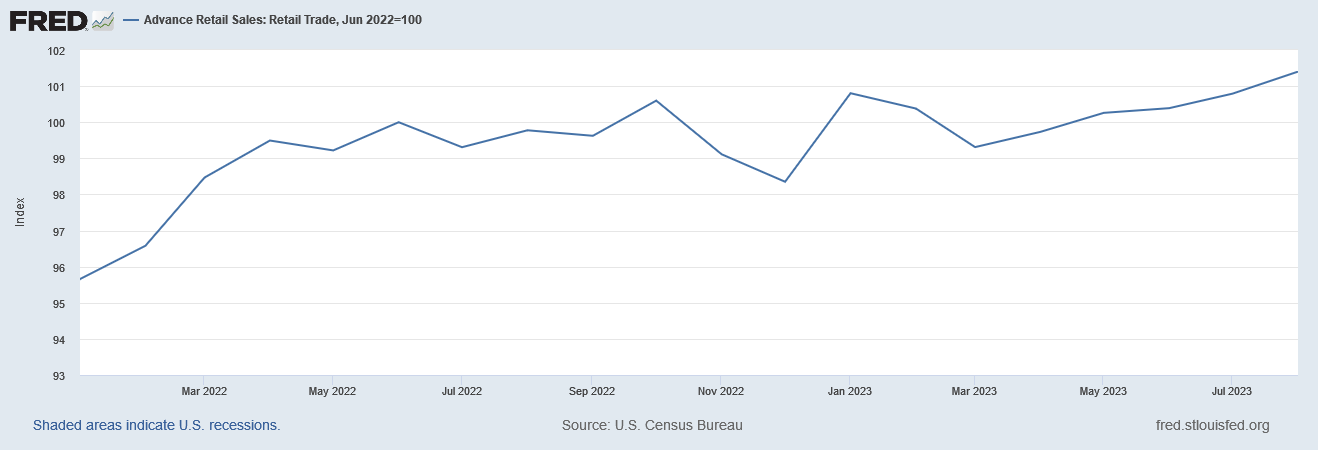

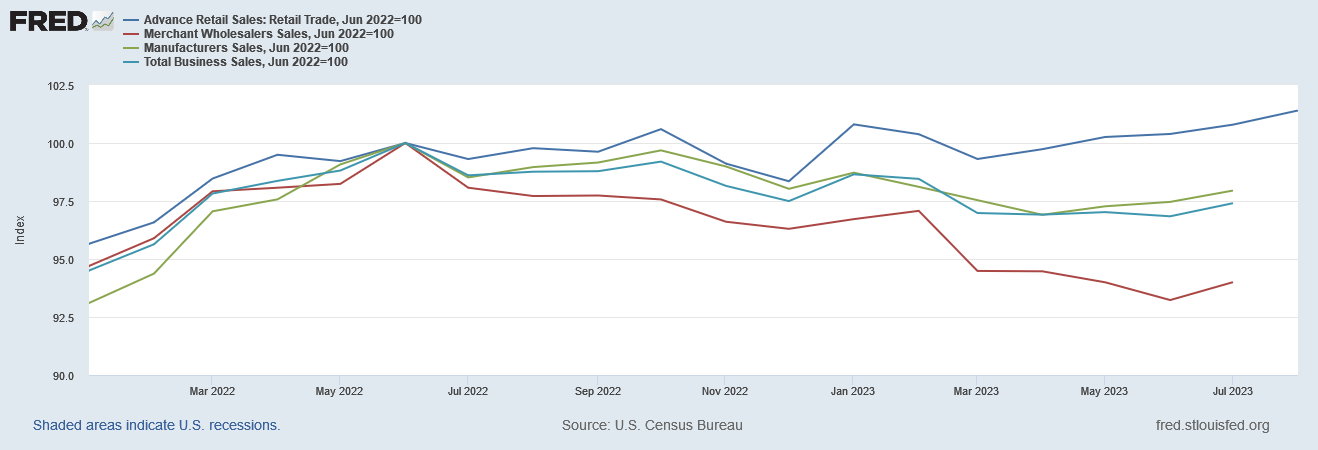

When we look at the Advance Retail Sales data from the U.S. Census Bureau for the past few years, we definitely see significant retail sales growth in the immediate aftermath of the Pandemic Panic Recession.

In fact, if we index the retail sales data to the end of that recession (~April, 2020), we see that retail sales have grown by more than 60% since then.

However, what we also see in both these charts is a flattening of the curve as we move to the right.

After about June of last year, retail sales growth in this country simply…stopped.

If we presume that this event would have to extend over at least two quarters to be a recession, we might still fall short of calling this an actual recession in retail sales, as we begin to see growth again by the end of the summer.

However, that later growth initially is choppy, with months of expansion trading off with months of contraction. Only after about March of this year does the retail sales data show steady, significant growth.

But wait….there’s more!

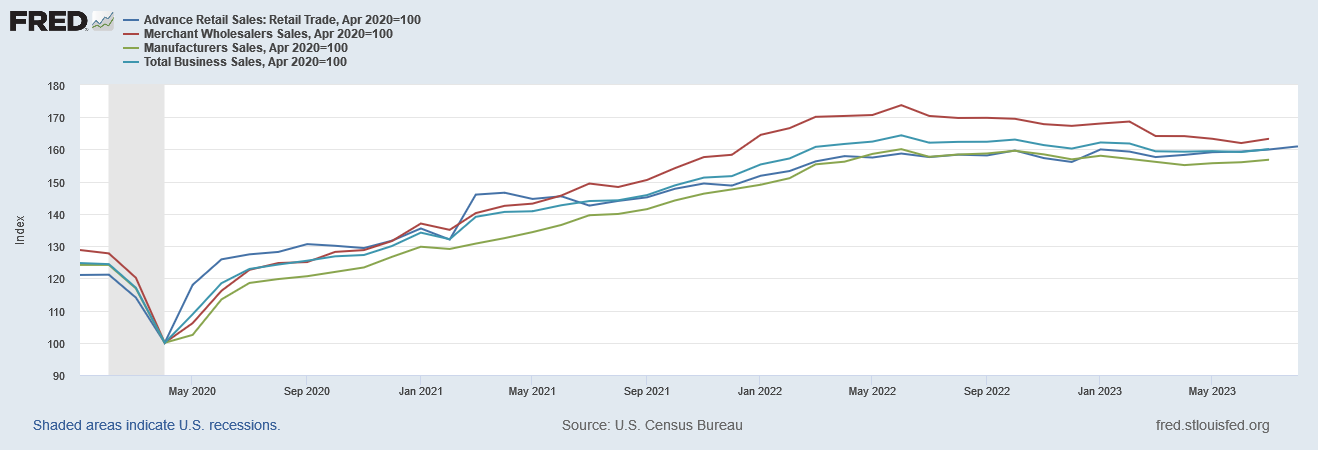

If we look at merchant wholesale sales, we see a clear downward trend beginning after June of last year.

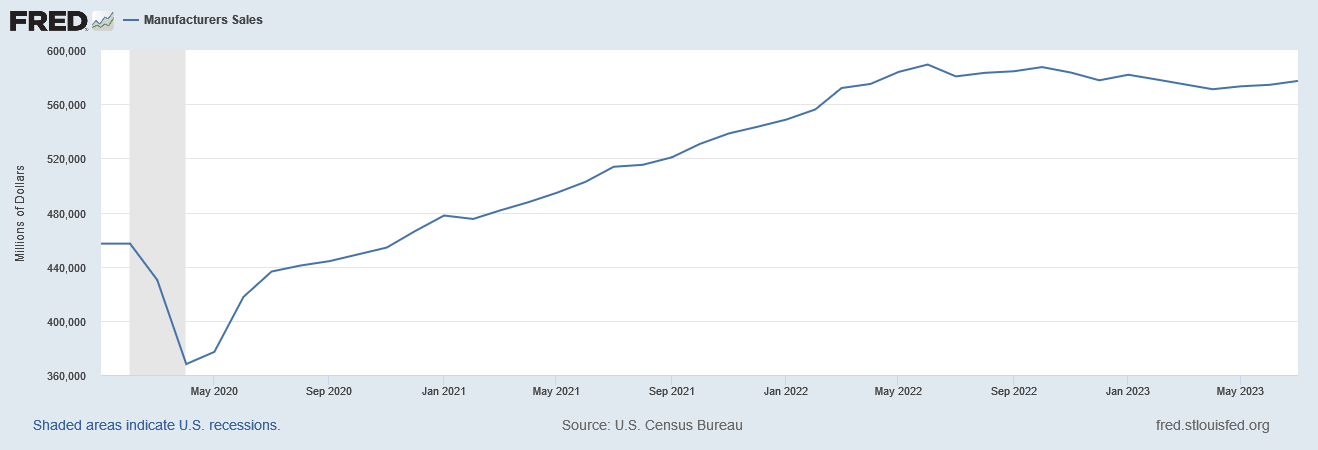

We see the same trend in manufacturer’s sales as well.

We see the same phenomenon in total business sales as well.

If we look at all of these sales figures together, we see a definite pattern of contraction beginning around June of 2022.

That contractionary pattern becomes very clear if we shift the index period to June, 2022.

Are these declining indicators proof positive of a recession? By themselves, they make a powerful case for a recession in retail and merchandising.

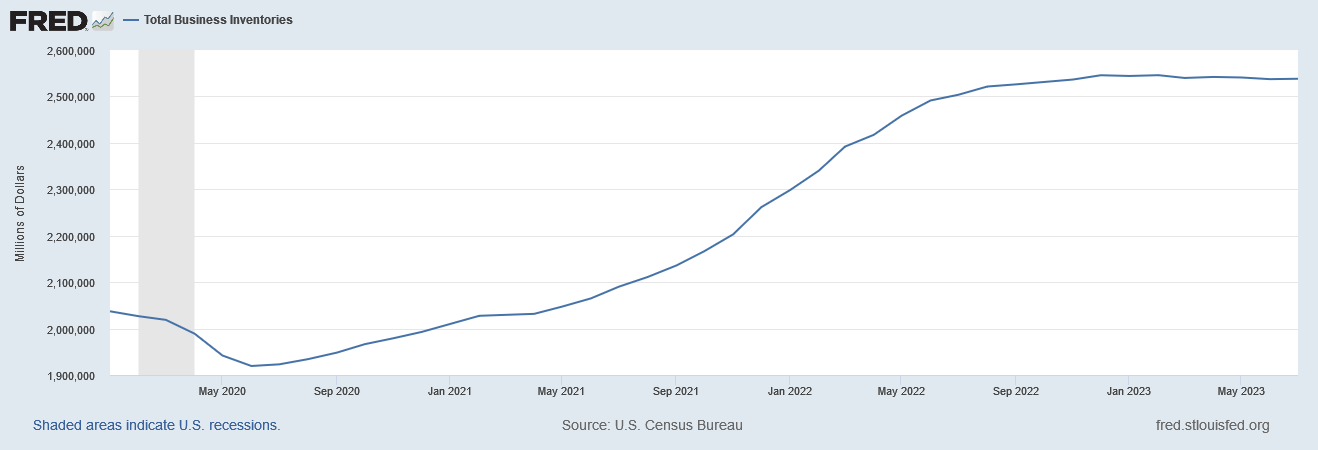

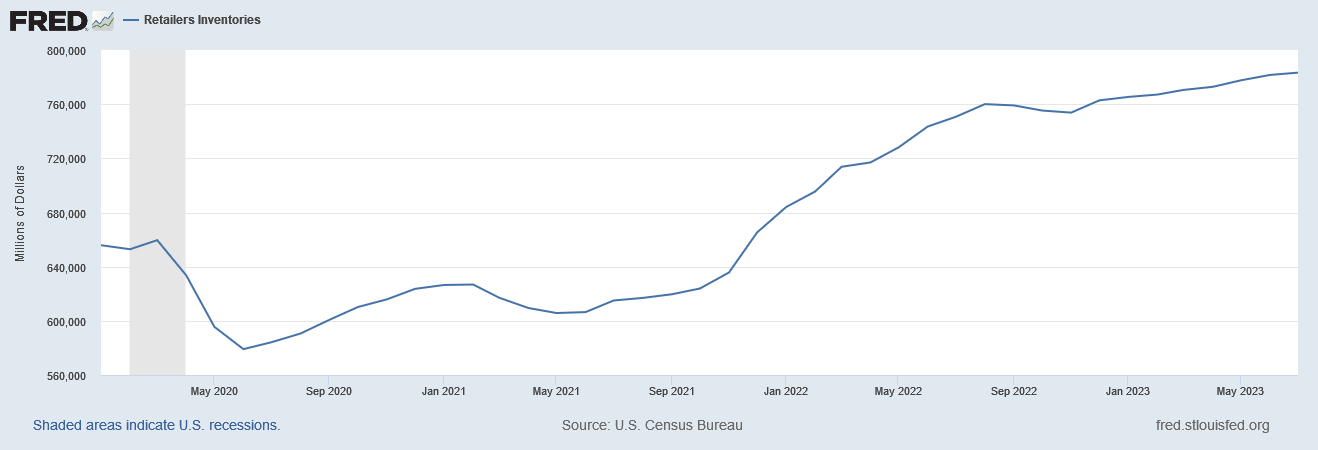

However, there’s still more data to consider: inventories.

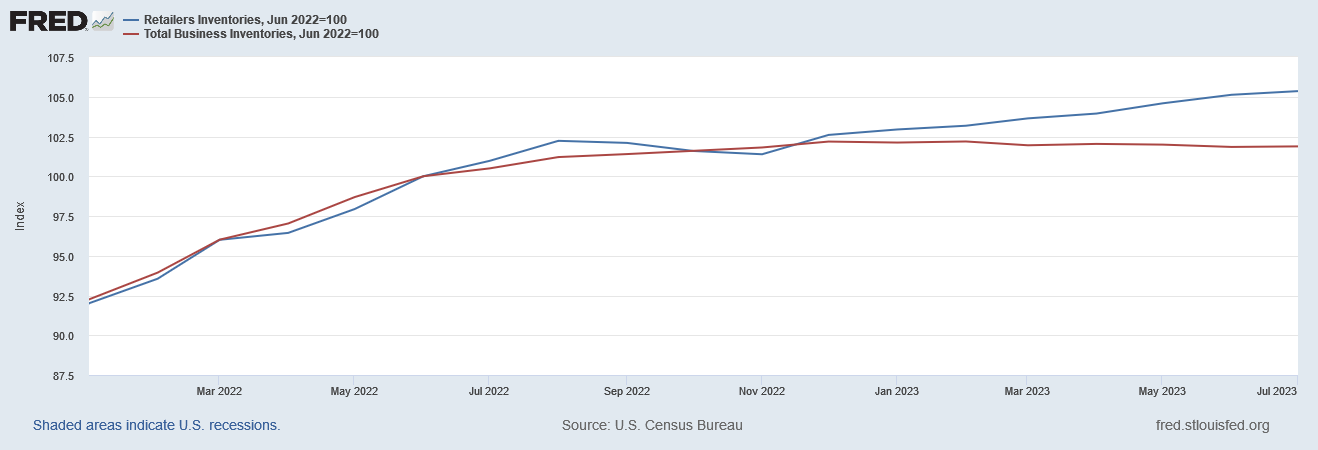

In that same time frame of June, 2022, business inventories also flattened out.

While retail inventories did not exactly flatten out, there is still a dramatic slowdown in inventory growth after June of last year.

Index both around June of last year and there is an unmistakable slowdown which occurs.

Not only did retail sales stop growing across the board in June of last year, inventories also largely stopped growing as well.

Viewed independently from the rest of the economy, it is not difficult to conclude that retail sales entered into a recession beginning in June of last year. That business inventories are still flat and most sales segments are still in decline indicates that recession is ongoing.

Yet the recession indicators are not confined to just retail sales. There are at least two other economic inflections of significance which took place in June of last year.

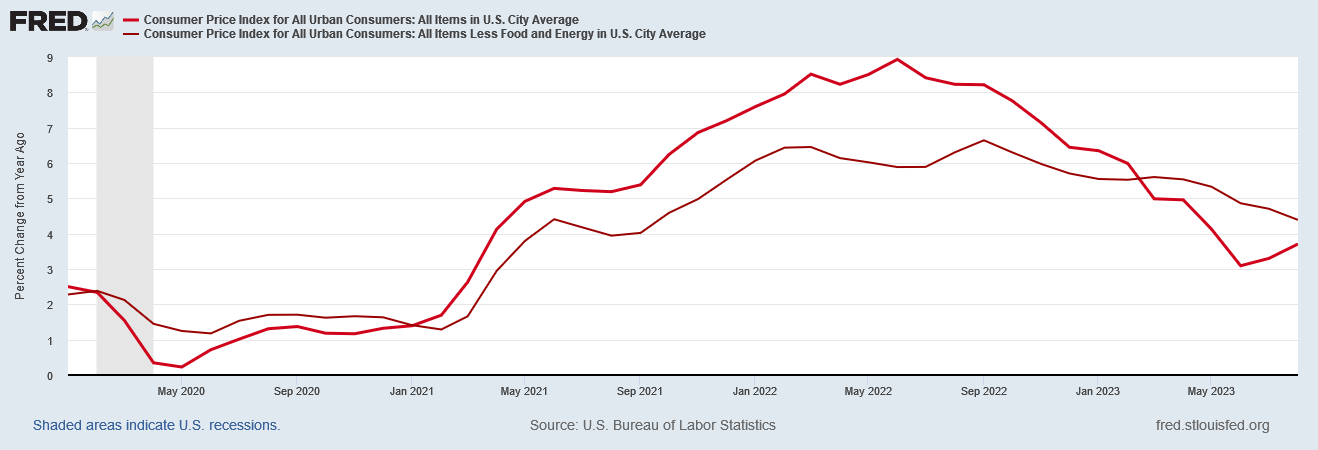

By far the most notable lies in the Consumer Price Index (CPI). After June, 2022, year on year percent growth in the CPI abruptly reversed and began to trend downward.

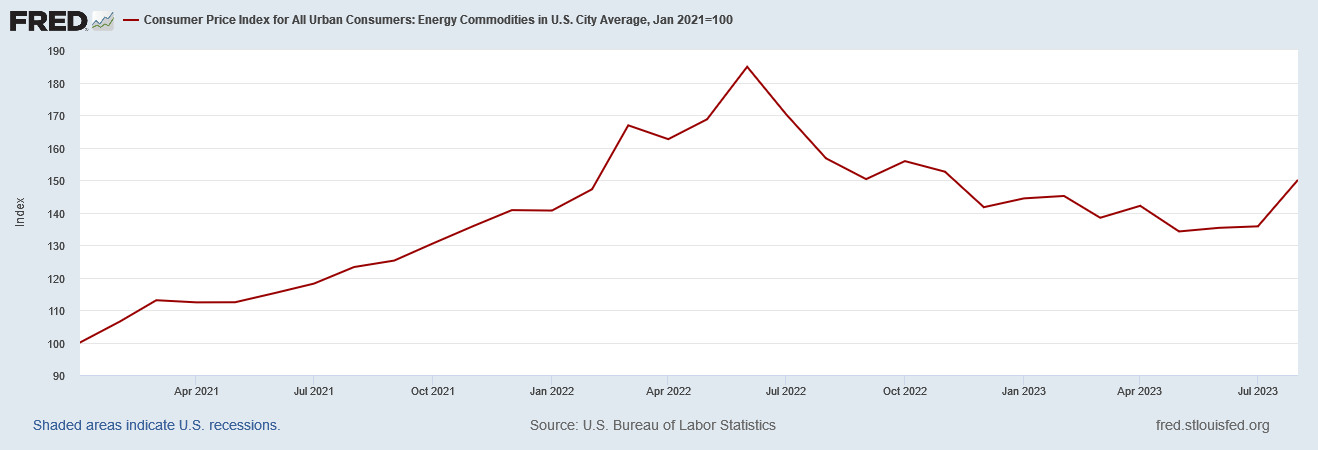

What powered this broad disinflationary trend? A downward trend in energy prices.

What is significant about the energy price trend is that the inflection point is the same as for retail and manufacturing sales—June of last year.

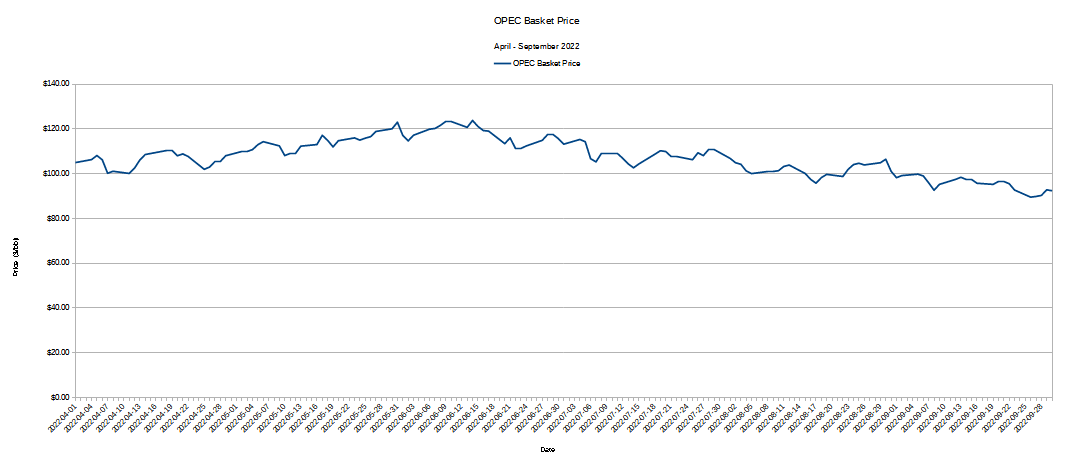

We have additional confirmation that this inflection point is real in the OPEC Basket oil price, which also peaked in June of last year.

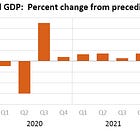

Ironically, this inflection point occurred just as the broader GDP metrics show the US economy emerging from two quarters of contraction.

While the NBER might blanche at declaring these serial contractions to be a formal recession, they nevertheless are serial contractions within significant sectors of the US economy. They are exactly what we would see in a “rolling recession”.

That we are still seeing evidence of serial contractions across significant sectors of the US economy means the recession is still rolling on. Amazingly, Jay Powell has overlooked all of this….and so here we are.

National Bureau of Economic Research. Business Cycle Dating. https://www.nber.org/research/business-cycle-dating.

Owyang, M. T., and A. H. Stewart. Is the U.S. in a Recession? What Key Economic Indicators Say. Sept. 2022, https://www.stlouisfed.org/on-the-economy/2022/sep/us-recession-what-key-economic-indicators-say.

A "rolling recession."

I know this, I feel like I'm the one getting "rolled."

Life (and economics) is complex. A smooth transition will lead to one result. A bumpy transition will lead to another entirely. Add to that: the longer a transition remains smooth, the bigger the bump will be when it comes.... and it always comes.