Even corporate media didn’t try to defend the Bureau of Economic Analysis’ First Quarter 2023 Advance Estimate last week. The reason is simple: the data….sucks.

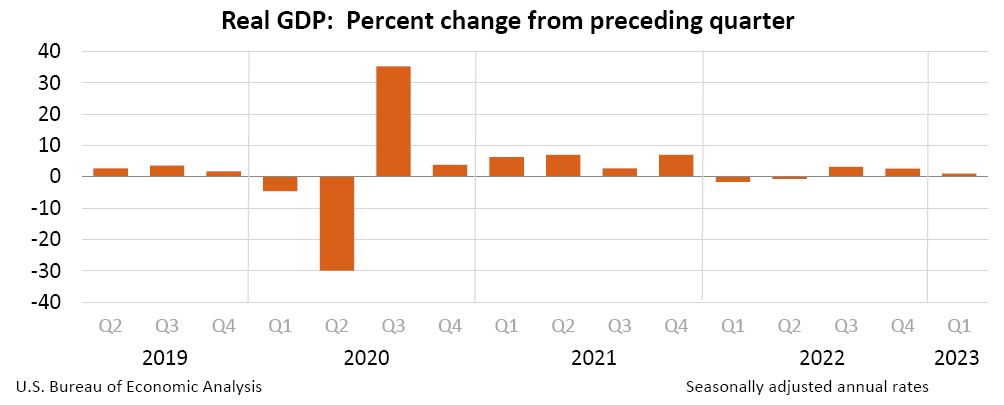

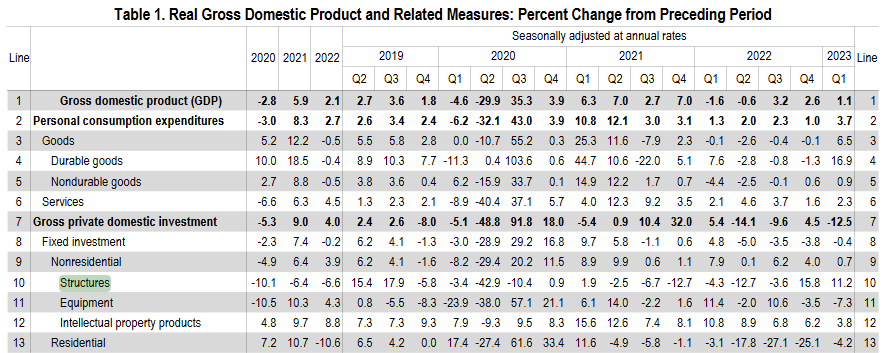

Real gross domestic product (GDP) increased at an annual rate of 1.1 percent in the first quarter of 2023 (table 1), according to the "advance" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 2.6 percent.

Even on its own terms a 1.1% rate of growth is best described as “anemic”. The only reason the media can avoid words like “recession” and “stagflation” is the problematic claim that the US economy grew at all.

Readers may recall from the discussion of the fourth quarter GDP data that the “annual rates” do not reflect the actual rate of growth over an entire year. The fourth quarter’s “annual rate” of growth of 2.6% does not mean the US economy grew even within that one quarter by 2.6%. It didn’t.

There is, however, one small point that needs to be emphasized here: at no time during 2022 did the national Gross Domestic Product increase by 2.6%. Growing at “annual rate” of 2.6% means that, had the percentage increase in calculated increase in GDP for just the fourth quarter were compounded across four quarters, the resulting increase would be 2.6%.

In other words, the reported increase is mostly wishful thinking, not articulated reality.

This, of course, also means that the US economy never achieved an actual annual growth rate of even 1.1% during the first quarter of this year.

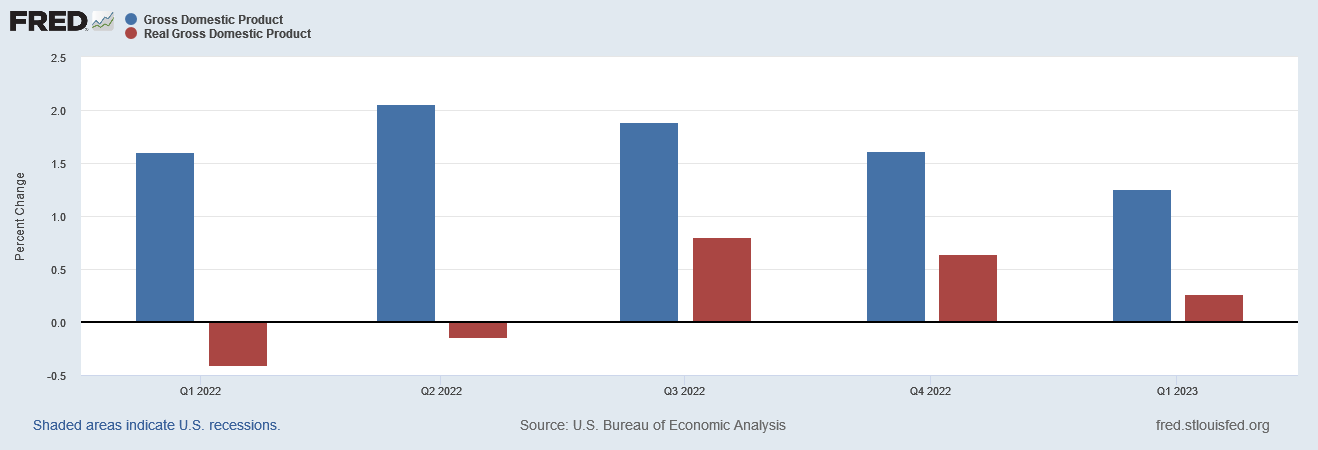

The growth that presumably did occur (remember, this is still an “estimate”) from the fourth quarter of 2022 through the first quarter of 2023 was 0.26%. 0.26% just doesn’t sound like a lot of growth.

The BEA compounds that quarterly percentage to get to the “annual rate” of 1.1%—which still doesn’t sound like a lot of growth (because it isn’t).

With either the quarterly rate or the annualized rate of GDP growth, one bit of math is unavoidable: GDP growth in the first quarter of 2023 was just over 41% of the fourth quarter of 2022—a fairly steep decline regardless of the absolute level of the change.

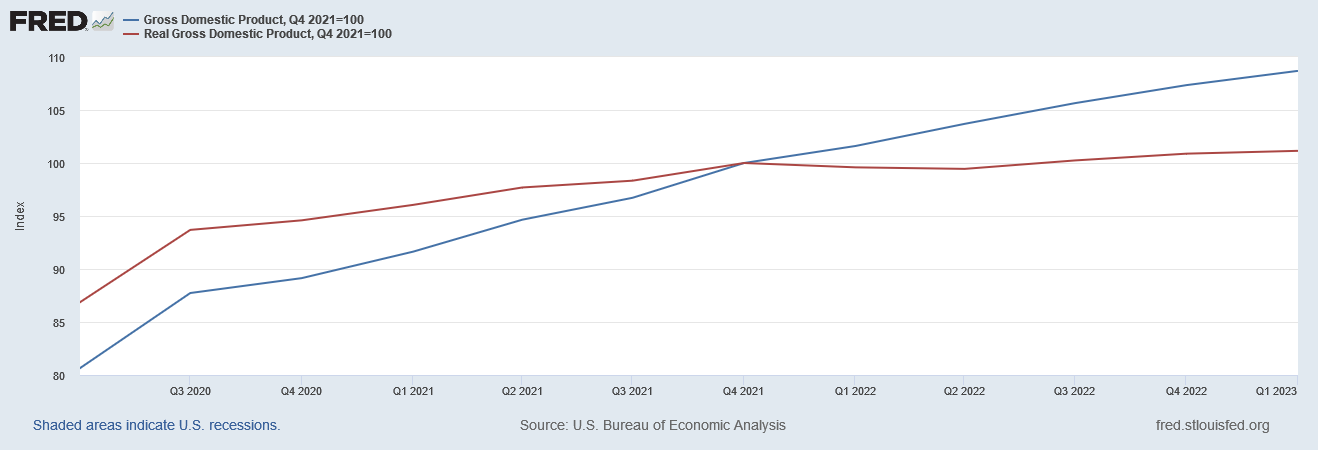

In fact, 1.1% is the total amount of real growth achieved by the US economy from the fourth quarter of 2021 onward.

If we index GDP (nominal and real) to the fourth quarter of 2021, we can see immediately from the index value of first quarter real GDP (101.1) that real GDP only increased by 1.1% across five full quarters.

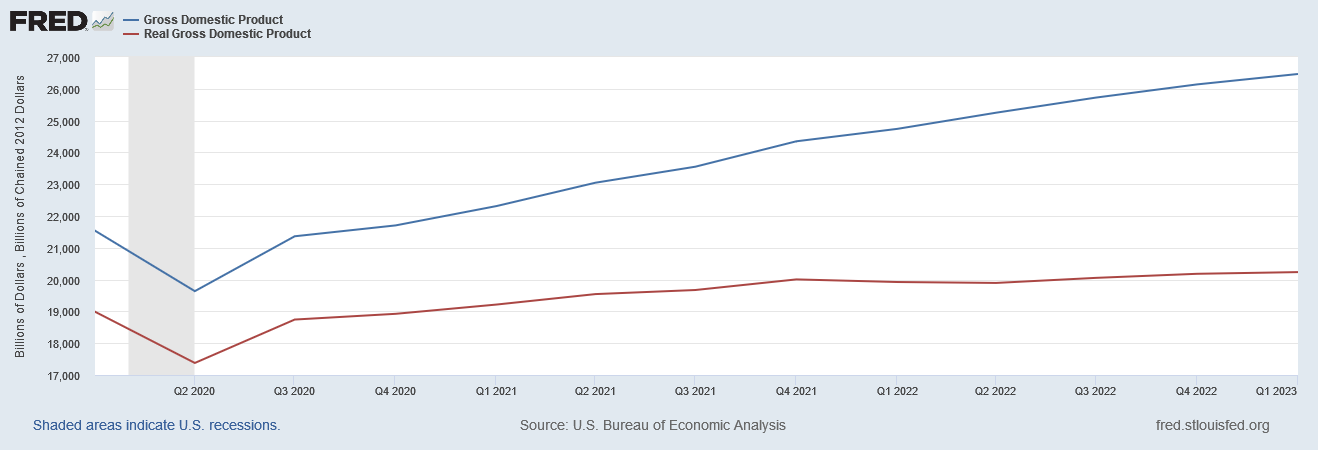

Even without indexing, we can see that real GDP growth effectively plateaued after Q4 2021, with minimal growth afterwards.

Virtually all of the GDP growth nominally recorded since then has been due to inflation. While nominal GDP growth from Q4 2021 on amounted to $2,116.744 Billion, real GDP growth only amounted to $229.697 Billion.

For the US economy that’s not a lot of growth.

What has been dragging the economy down has been the inability for any sector to sustain any substantial growth for any significant period of time over the past few years. As a simple inspection of the quarterly percentage changes reveals, virtually every category has had multiple periods of contraction since 2020.

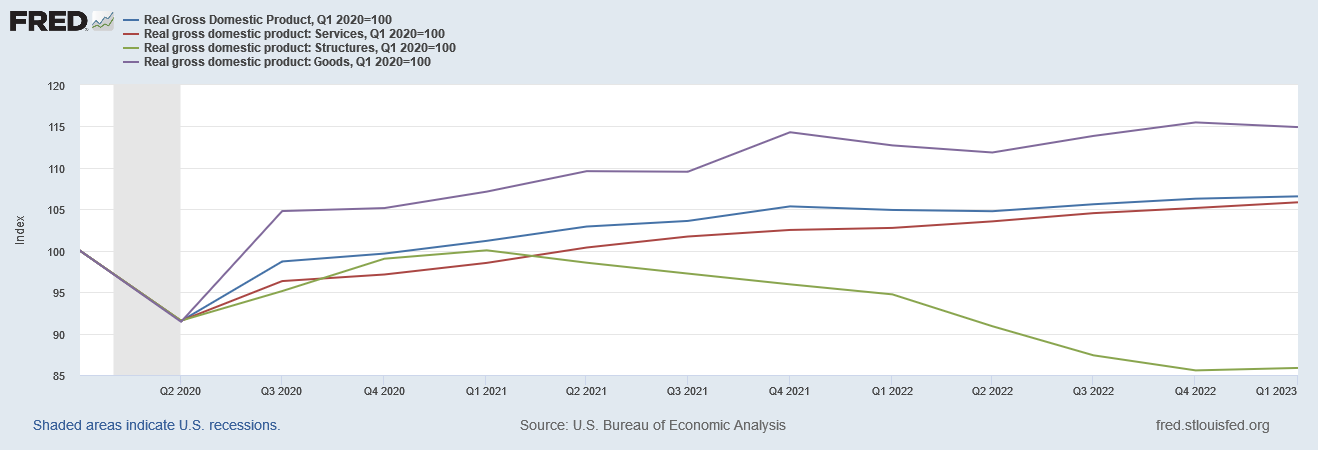

In broad strokes, if we index the GDP measurements for various broad categories, we see a significant leveling-off trend beginning in the fourth quarter of 2021. What doesn’t level off after 2021 declines.

There are two modes to the US economy of late: stagnation and contraction. “Growth” really is not a factor here.

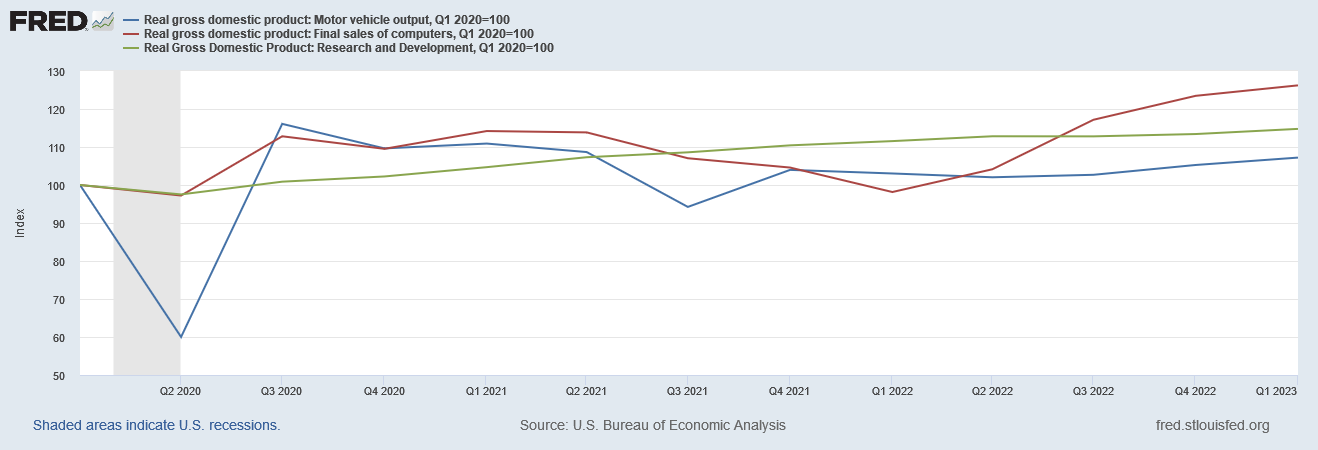

Even within the more notable components for the Goods and Services categories, there have been extended periods of decline. Only items such as R&D expenditures show a long-term growth trend.

Again…for the US economy, that’s not a lot of growth.

Of course, the BEA, along with the rest of the government, are not keen to admit such things. Even as they were preparing their final estimates for Q1 growth, they clung to the hope of more robust economic growth.

April 26, 2023

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2023 is 1.1 percent on April 26, down from 2.5 percent on April 18. After recent releases the US Census Bureau and the US National Association of Realtors, the nowcasts of first-quarter real personal consumption expenditures growth and first-quarter real gross private domestic investment growth decreased from 4.2 percent and -5.8 percent, respectively, to 2.7 percent and -8.0 percent, while the nowcast of the contribution of the change in real net exports to first-quarter real GDP growth increased from 0.26 percentage points to 0.30 percentage points.

April 18, 2023

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2023 is 2.5 percent on April 18, unchanged from April 14 after rounding. After this morning's housing starts report from the US Census Bureau, the nowcast of first-quarter real residential investment growth increased from -5.8 percent to -5.5 percent.

April 14, 2023

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2023 is 2.5 percent on April 14, up from 2.2 percent on April 10. After recent releases the US Bureau of Labor Statistics, the US Census Bureau, the US Department of the Treasury's Bureau of the Fiscal Service, and the Federal Reserve Board of Governors, the nowcasts of first-quarter real gross private domestic investment growth and first-quarter real government spending growth increased from -6.5 percent and 2.2 percent, respectively, to -5.9 percent and 2.6 percent.

Only at the very end of the review and revision process did the BEA even somewhat “come clean” and drop the numbers to values far more realistic, albeit far less encouraging—numbers which do not really show growth for the US economy.

Grudgingly, the BEA is skirting close to the reality that ordinary folk face every day: the economy is not growing.

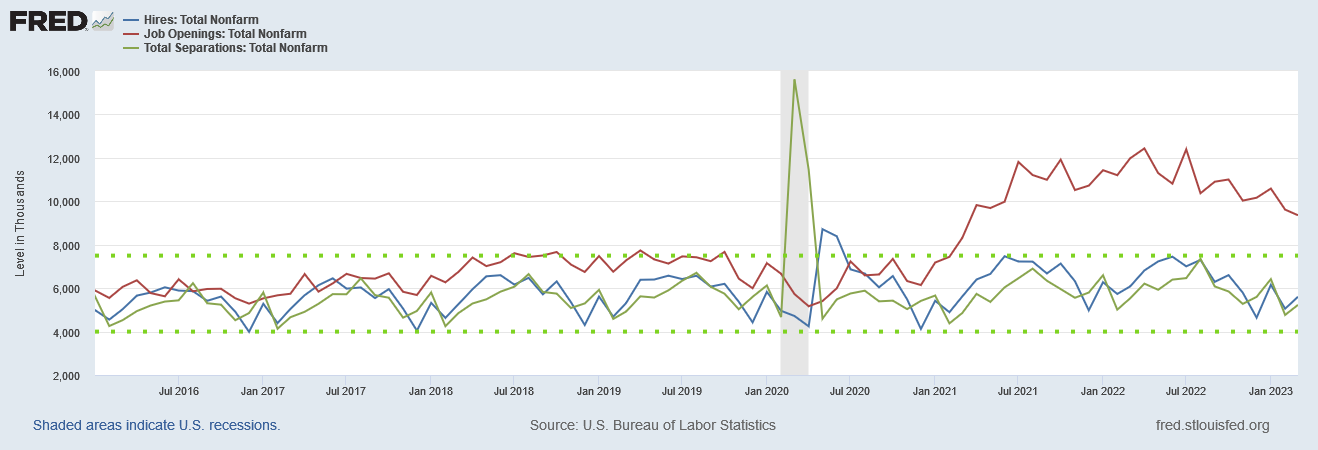

The numbers do not show a lot of growth for the simple reason that there just isn’t a lot of growth. The March Job Openings and Labor Turnover Summary is but the latest reminder of that.

The number of job openings decreased to 9.6 million on the last business day of March, the U.S. Bureau of Labor Statistics reported today. Over the month, the number of hires and total separations were little changed at 6.1 million and 5.9 million, respectively. Within separations, quits (3.9 million) changed little, while layoffs and discharges (1.8 million) increased. This release includes estimates of the number and rate of job openings, hires, and separations for the total nonfarm sector, by industry, and by establishment size class.

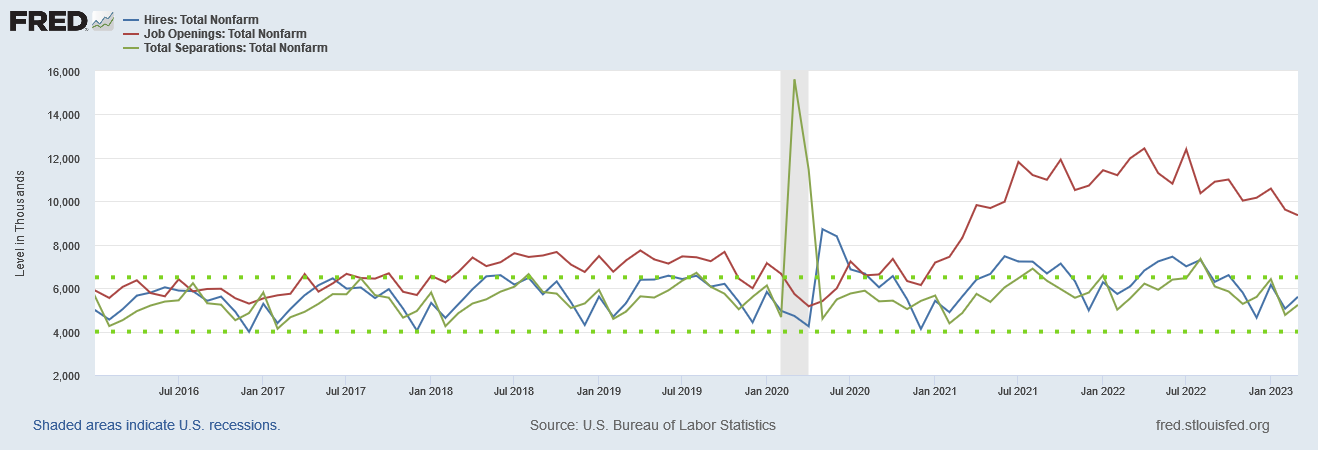

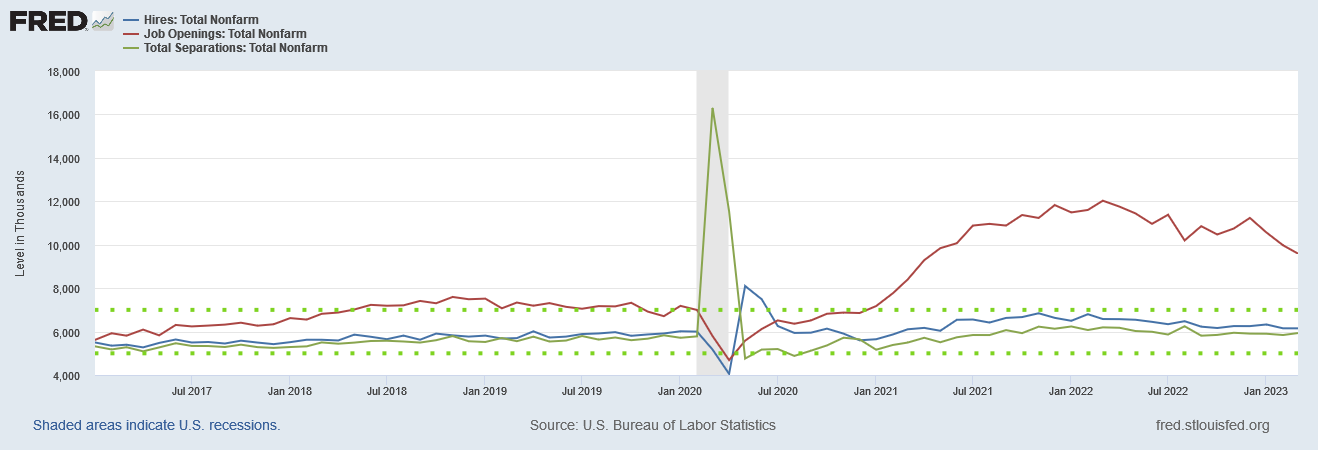

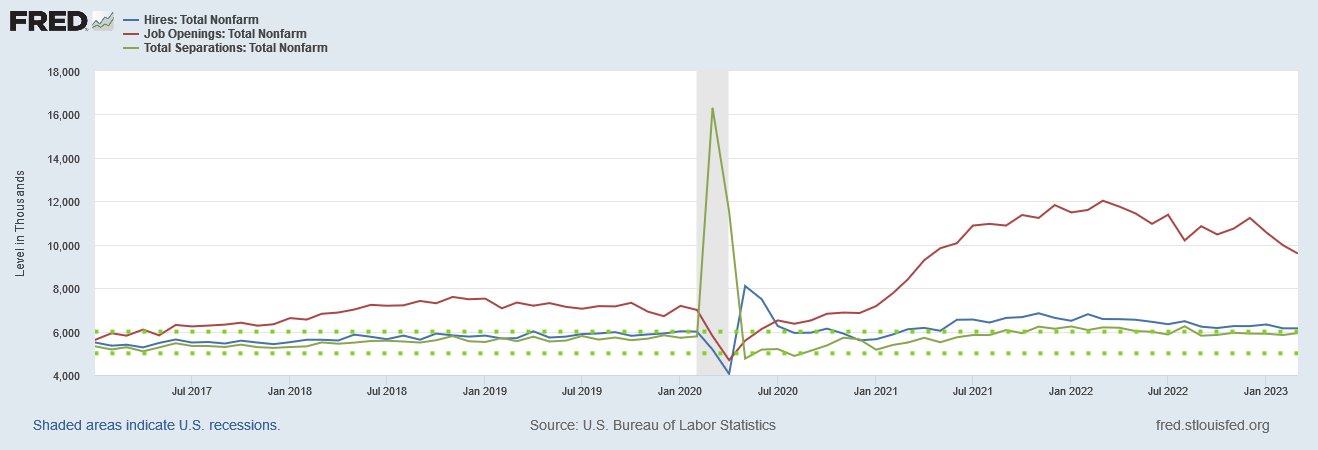

With respect to the total number of hires and separations for the month of March, the key words are “little changed.” Hiring patterns in this country for the past seven years have stayed almost entirely within a range between 4 million and 7.5 million jobs (unadjusted data), and March, 2023, was no different.

As regards the job openings data, a key distinction exists between the years immediately before the 2020 government-ordered recession and the years since: while the hiring data suggests a lower upper-bound to the range—6.5 million instead of 7.5 million—even at that lower bound pre-recession job openings were far closer to total hiring and firing patterns than they have been since the 2020 recession.

For all of the corporate media focus on job openings, the simple truth is that hiring patterns since the 2020 recession have never risen to reflect the surge in job openings.

Even the seasonally adjusted data shows a similar albeit narrower range—5 million to 7 million jobs—post pandemic.

The pre-pandemic range is again slightly narrower, at 5 million to 6 million jobs.

Yet even with the seasonally adjusted data, the job openings are still much closer to that range before the government-ordered recession than after it.

Despite the elevated numbers of reported job openings, aside from a brief interlude immediately following the recession, at no time has there been any trend on the part of the “hiring” to match the elevated reported openings. The economy simply hasn’t grown and pushed actual new hires up significantly beyond the historical ranges.

While the corporate media obsesses over the job openings metric as if it had any meaningful significance, the fact that hiring patterns have not risen to match it makes it a completely irrelevant—if not outright illusory—measure. Paychecks attend upon actual hires, not prospective openings for hiring, and so economic growth attends not upon job openings but upon hires and separations.

As the March JOLTS report says, as so many prior reports have said, the hires and separations in the US economy are “little changed”. Little change means little growth—which is exactly what the BEA says in its usual indirect anodyne bureaucratese.

As we have seen time and again, the state of the US economy is on par with the state of the global economy—both are weak. One does not need to look very far or very far to find data pointing to weak or no economic growth.

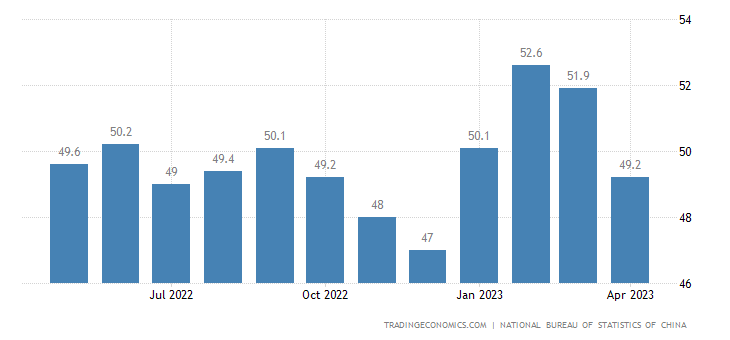

China’s Manufacturing PMI is pointing once again to contraction for China’s all-important “world’s factory” economy.

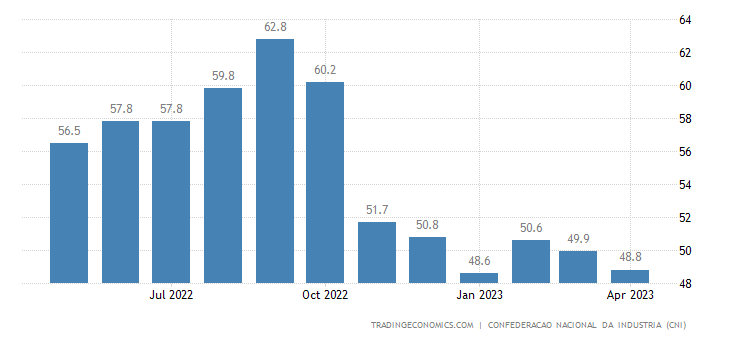

Brazil’s Industrial Entrepreneur Confidence Index has been collapsing over the past 6 months.

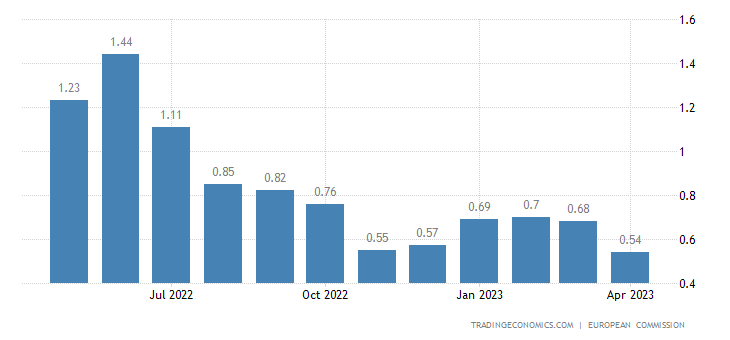

Business Confidence in the Euro Area has been on the decline since last June.

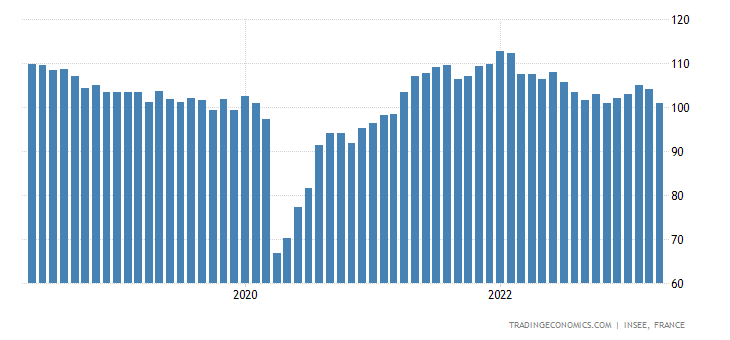

France’s manufacturing climate indicator has been trending down since early 2022.

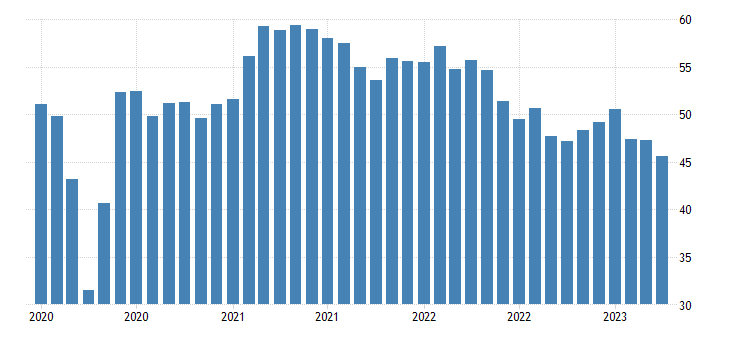

Meanwhile, France’s Manufacturing PMI has been trending down since early 2021.

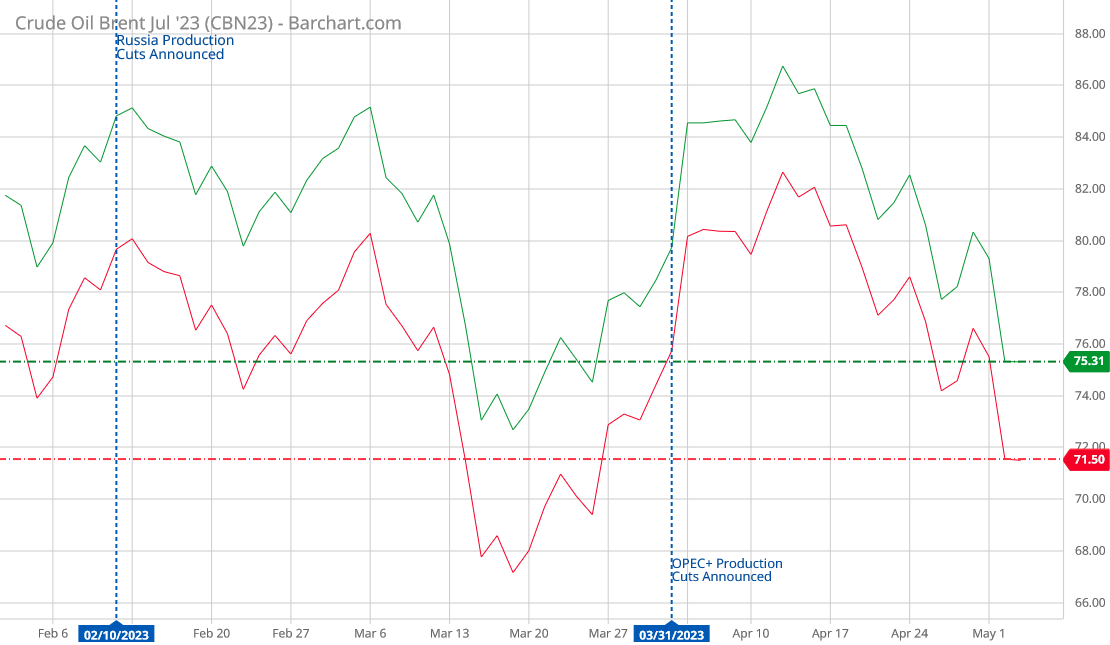

Even benchmark oil prices are flashing warning signs, as both Brent Crude and West Texas Intermediate dropped precipitously as First Republic Bank’s collapse spooked markets already convinced the Federal Reserve (and other major central banks) are hell-bent on raising rates into a recession.

Oil is now cheaper than when OPEC+ announced their production cuts, at which time oil was cheaper than when Russia announced its production cuts. The major oil producers are scaling back production and the price of oil is dropping—that’s a sign of little to no economic growth throughout the world. No country is needing more oil because no country has robust economic growth.

The markers of global recession are quite simply everywhere—and have been for the past year. Readers will remember that I have made this point multiple times over the past year.

Given the scope and amount of negative economic data, the insistence of corporate media that the economy is not yet in a recession is, ultimately, foolishness—and yet it is what they continue to insist, as sunny optimism remains ever the economic order of the day.

Still, there are reasons to expect that a recession, if it does come, will prove to be a comparatively mild one. Many employers, having struggled to hire after huge layoffs during the pandemic, may decide to retain most of their workforces even in a shrinking economy.

Some outlets deny even the possibility a recession is imminent.

Neither corporate earnings nor the latest GDP numbers imply we're careening toward an economic contraction.

Even the “pessimistic” view clutches desperately to the notion that the US economy is not (yet) in recession.

The government’s report Thursday that the economy grew at a 1.1% annual rate last quarter signaled that one of the most-anticipated recessions in recent U.S. history has yet to arrive. Many economists, though, still expect a recession to hit as soon as the current April-June quarter — or soon thereafter.

The undercurrent of optimism running through even the pessimistic views on the economy, the insistence that recession is not “yet” here, did not fare well against the first quarter GDP estimates. When economic growth drops by more than half, there are few ways to spin that news as anything even remotely good. Indeed the corporate media has largely embraced the message that the first quarter GDP shows the recession is still kept at bay, even though the concession is being made that recession will happen soon.

Behind the anodyne phrasings, however, beyond the silly optimism that insists the recession has not arrived and may not arrive, is the reality that a recession has been unfolding for some time now, and will continue to unfold. Economists might have a hard time seeing recession, but ordinary consumers, faced with the challenges and stresses of rising inflation and declining real wages, can easily spot a recession just by looking in their own wallets.

That is what we see in the first quarter GDP estimate—a recession in all but name.

Within the corporate media, recession is forever being anticipated, with the insistence that recession is not (yet) upon us. It’s coming, we are told again and again, but it’s not yet here.

Only it is. The data has already shown us that it is. The recession is here, and the recession is getting worse. And the data is showing the recession will be getting worse for a while longer yet, before any real recovery can hope to begin.

The only silver lining in this is the (mostly) demise of ‘woke’. The younger generation will have to stop being offended by everything, put down their books on gender studies, and start getting serious about obtaining marketable skills in a newly competitive job market. Reality wins again!