Foreign Investment Votes "No Confidence" On China

The World Is "De-Risking" By Bailing On China's Shrinking Economy

It is now undeniable even to the corporate media that China’s economy is in serious trouble. It is slowing down, it is shrinking, it is deflating.

Investors are noting China’s problems and are responding predictably: they have started pulling their investment capital out of China.

The world’s second largest economy is struggling to attract foreign companies and investments, despite Beijing’s efforts to address its myriad economic challenges, according to new data from China.

A gauge of foreign direct investment (FDI) into China has slipped into the red for the first time since 1998, underscoring the country’s failure to stem capital outflows.

Direct investment liabilities, a measure of FDI, stood at minus $11.8 billion in the third quarter, according to data published by the State Administration of Foreign Exchange (SAFE) on Friday. In the third quarter of 2022, China’s direct investment liabilities was at $14.1 billion.

If foreign capital is a global vote of confidence in a country’s economy, China is getting a vote of “no confidence”.

While the FDI deficit for the third quarter of 2023 is only the second such deficit since China began tracking the data in 1998, the deficit itself is hardly a one-time anomaly. China has been losing foreign investment capital for months, in large measure because of China’s increasingly business-unfriendly economic policies.

China’s main measure of FDI, which is released by the Commerce Ministry, showed a decline of 8.4% in the first nine months of this year, accelerating from a 5.1% drop in the first eight months.

While rising geopolitical tensions are partly to blame for the exodus, foreign companies and investors have also grown wary of increasing risks in China, including the possibility of raids and detentions.

Overall, China’s aggregate store of foreign capital now stands at around $125 Billion, a significant decrease from the third quarter of 2022.

By comparison FDI increased in the US for the third quarter by a total of $74.634 Billion.

Whatever flaws the US economy has—and it has many—it is apparently preferable to the moribund and sclerotic Chinese economy.

To be sure, China’s problems are not merely economic in nature. It is also facing considerable geopolitical headwinds as conflict with the United States heats up. This is making many companies skittish about remaining invested in China, and are opting to repartriate their capital rather than leaving it inside China.

Wang Tao, chief China economist for UBS Investment Bank in Hong Kong, said the fall in foreign investment has been driven by factors such as “de-risking” efforts by Western governments and the high costs of borrowing in the US dollar.

“All foreign firms are concerned about political and commercial pressure from their governments, as well as other risks. Even though it might not be economically beneficial, they may still consider reducing their participation in China, moving towards the so-called China-plus-one strategy, by adding exposure to other countries,” Wang said at a seminar on Wednesday that focused on the current investment pattern and development prospects in China.

This is reflected as well by the reality that many Chinese firms are also trimming their investments in the United States.

Chinese businesses are reducing their investments in the U.S., driven by worsening bilateral relations and challenging business conditions. Rhodium Group reports that investment from China has plummeted from $48 billion in 2016 to a mere $2.5 billion in 2021.

A survey conducted by the China General Chamber of Commerce reveals that over 80% of Chinese companies, including Wanxiang America, identify the deadlock in bilateral relations as their primary obstacle. Unstable U.S. foreign investment policies have also raised concerns among these businesses.

In one respect, these investment shifts are unsurprising in the current geopolitical climate. We should remember that, in the last Republican Presidential Debate, all of the candidates were rather gung-ho about disinvesting and “de-coupling” from China.

Even in the clown show of a debate hosted by the RNC at the end of September, de-coupling from China was very much an idea at least candidate Nikki Haley thought whose time had come.

It is tough to attract investment capital when your best customer does not really like you!

However, by far the greater concern is China’s economic performance, about which investors are increasingly disbelieving of the “official” narrative. While China insists it will meet its 5% economic growth target, outsiders are increasingly skeptical about how China will get there (emphasis mine).

This reversal may reflect foreign disillusionment with China’s economic prospects and policymaking. Although the country will most probably meet its official growth target of 5% this year, it could shrink in dollar terms, according to the imf’s latest forecasts. China’s government has unnerved many investors with its overbearing reaction to the covid-19 pandemic, its regulatory crackdown on technology companies and its investigations of foreign due-diligence firms, including Bain, Capvision and Mintz.

Let that sink in for a moment: China is saying that it will meet its GDP growth target, but analysts and non-Chinese economists are speculating on the possibility of economic decline.

If the statistics are honest (“if!”), it should not be possible for the Chinese economy to grow by five percent per official metrics and decline by any amount in dollar terms. That such an outcome could even happen in China means investors are giving up on China ever providing realistic assessments of its own economic performance.

Bear in mind that, as I discussed yesterday, by the data China is releasing, its economy has already tipped into deflation. If inflation correlates to economic growth, deflation necessarily correlates to economic shrinkage.

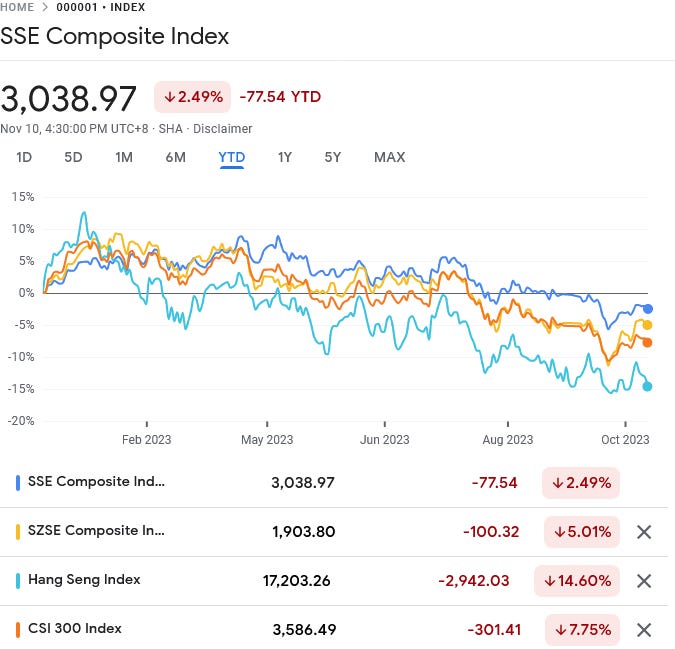

Yet even without the “official” data, one only needs look at China’s stock markets to appreciate why foreign investors are giving up on China. With the Hang Seng index deep in correction territory, and the CSI 300 index closing in on correction territory, Chinese stocks are not having a very good year.

This is coming on the heels of China’s premier real estate developer, Country Garden, defaulting on some $11 Billion of dollar-denominated offshore bonds.

That default was largely the consequence of the Chinese real estate sector completely collapsing over the past two years.

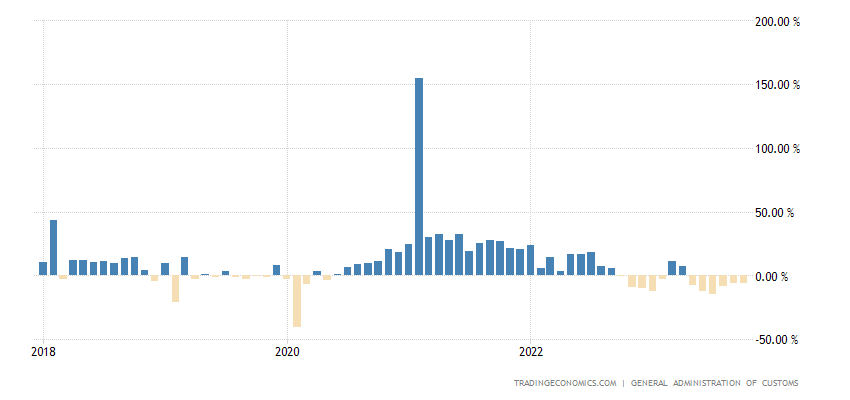

Meanwhile, China’s exports declined yet again in October.

Nor is this merely a recent developing weakness in the Chinese economy. China’s export engine has been sputtering even before COVID hit in 2020.

With such data being released by Beijing itself as the “official” economic data for the country, it was not hard last month to predict that China would slip into deflation, as it clearly is starting to do this month.

Even without the obvious geopolitical concerns, the economic concerns facing China make foreign investment problematic and even unwise for many globally invested companies. It should come as no surprise that they are repatriating their capital to invest it elsewhere.

Yet what makes the loss of investment capital particularly challenging for China is that, with moribund domestic consumption, it will be facing an uphill battle to get that investment capital back. While China’s large population on paper makes them an attractive market for any global enterprise, that population is not buying stuff nearly in proportion to their share of the global population. That limits the upside for any new investment from outside China.

With deflation taking hold in the economy, with declining exports and a collapsing property sector, China is starting to feel the effects of a “perfect storm” of economic challenges. Any one of these crises by itself would be a major battle for any economy. China is having to battle all of them simultaneously.

It is far too soon to say the Chinese economy is collapsing outright. However, China’s economic crises are getting worse, not better, and are likely to get worse still before there is any improvement. Whatever the level of “worse” is where terms like “collapse” become fitting for the Chinese economy, things are at the very least moving closer to that level, and will continue to do so.

What did China expect?

Covid from there? They want Taiwan after we just punished Russia economically for going into Ukraine? People just disappear if you disagree with the government. They held Canadian hostages a few years ago. They interfere with other country politics/elections and even influence people with their Tik Tok.

They are everywhere in the world. Even off the coast in Cuba! China has scared many away with their tactics. Hitting China financially as much as possible might wake them up.

Need to get all critical medication manufacturing out of China next. Until the good people of China get rid of their communist government …. I don’t trust them!!!

It is hard to imagine anywhere else worse than the US, but in a word, that's China.