Good News! US Economy Added 311K Fake Jobs In February

Gotta Love That Lou Costello Labor Math

Wall Street did not expect this to happen. At all.

Wall Street economists polled on Wednesday anticipated the BLS Employment Situation Summary Report for February would yield approximately 225,000 new jobs for Americans. They got just a few more than that—presumably.

The forecast

The economy likely added 225,000 jobs in February, according to economists polled by The Wall Street Journal.

While such an increase would be historically strong, it would make a big slowdown from an originally reported 517,000 spike in employment in January.

The Bureau of Labor Statistics tweaked and fudged and added quite a few more than that.

Total nonfarm payroll employment rose by 311,000 in February, and the unemployment rate edged up to 3.6 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in leisure and hospitality, retail trade, government, and health care. Employment declined in information and in transportation and warehousing.

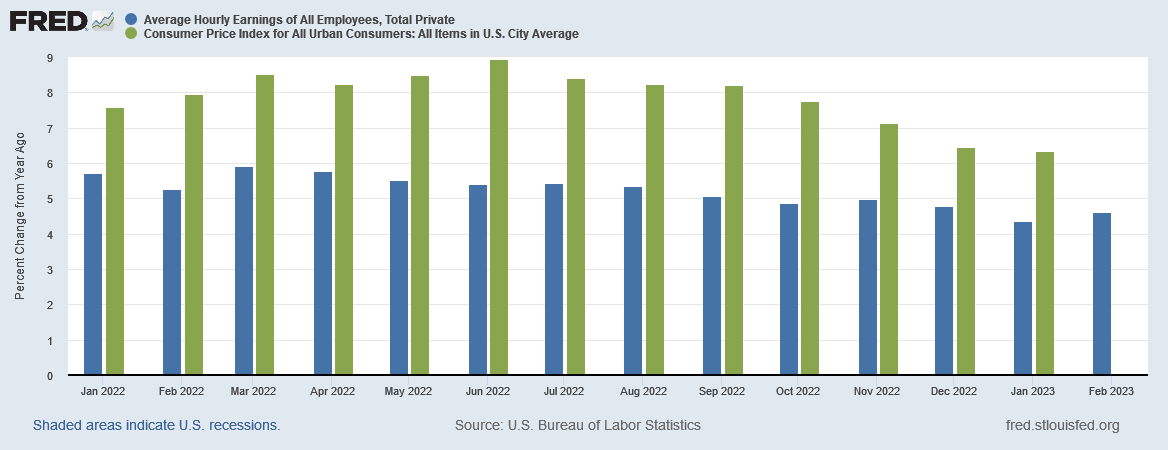

While job gains exceeded expectations, nominal wage gains (i.e., real wage losses) came in under expectations.

In February, average hourly earnings for all employees on private nonfarm payrolls rose by 8 cents, or 0.2 percent, to $33.09. Over the past 12 months, average hourly earnings have increased by 4.6 percent. In February, average hourly earnings of private-sector production and nonsupervisory employees rose by 13 cents, or 0.5 percent, to $28.42. (See tables B-3 and B-8.)

Overall the BLS report had something for everyone except those who wished the BLS grounded the jobs report in something other than the vaudevillian alternate reality of Lou Costello Labor Math. Unfortunately, the BLS Employment Situation Summary is once again an exercise in manipulated numbers and questionable seasonable adjustments

Corporate media, of course, lost no time in taking the jobs numbers at face value, perversely pleased that the jobs and wages number came in under inflation yet again.

The nonfarm payrolls report for February showed the labor market continued to grow at a robust pace last month, with the U.S. economy adding 311,000 jobs, more than the 225,000 that economists polled by the Wall Street Journal had expected.

Meanwhile, average hourly wages grew by 0.2%, a slower rate than the 0.3% rate economists had expected. It was also less than the 0.3% increase in January.

For his part, President Asterisk’s handlers happily tweeted out their enthusiasm for the fake statistics.

Applying their usual lack of critical thinking and attention to detail, the “experts” once again managed to gloss over several details that make the Employment Situation Summary increasingly problematic.

Most notably, the quality of the survey data that goes into the Employment Situation Summary has declined. Compared to the pre-pandemic era, response rates are down significantly.

Take January. Just 44% of businesses responded on time to the government’s employment questionnaire, compared to 60% in January 2020. Fewer responses can lead to exaggerated increases — or decreases — in employment.

“Low response rates to the BLS’s establishment survey have made the initial estimate of job growth in any given month less reliable than has typically been the case,” said chief economist Richard Moody of Regions Financial.

Wall Street analysts apparently know the BLS data is mostly either tainted or just plain bogus, and don’t care. These are the people telling America how to invest their increasingly scarce (and inflated) dollars.

To take the BLS jobs report at face value requires the credulous acceptance of some rather unlikely employment dynamics.

In particular, we have to believe that February saw a surge of employment, despite there having been a decided collapse in job creation during the last half of 2022, per the BLS jobs data.

While not impossible, such a reversal from weakness is definitely not the statistical norm.

Additionally, within the unadjusted data, taking the narrative at face value requires glossing over the fact that the raw number of jobs added per the Establishment Survey portion of the report is 1,119,000 jobs. Out of the blue, the Establishment Survey added in the raw data roughly 3.6 times the seasonally adjusted number of jobs. The Household survey’s raw data showed job growth at 5.8 times the seasonally adjusted data.

Those are realistic corrections to make…..right?

Moreover, not only did the BLS report exceed Wall Street expectations, but it completely blew past the already problematic ADP National Employment Report.

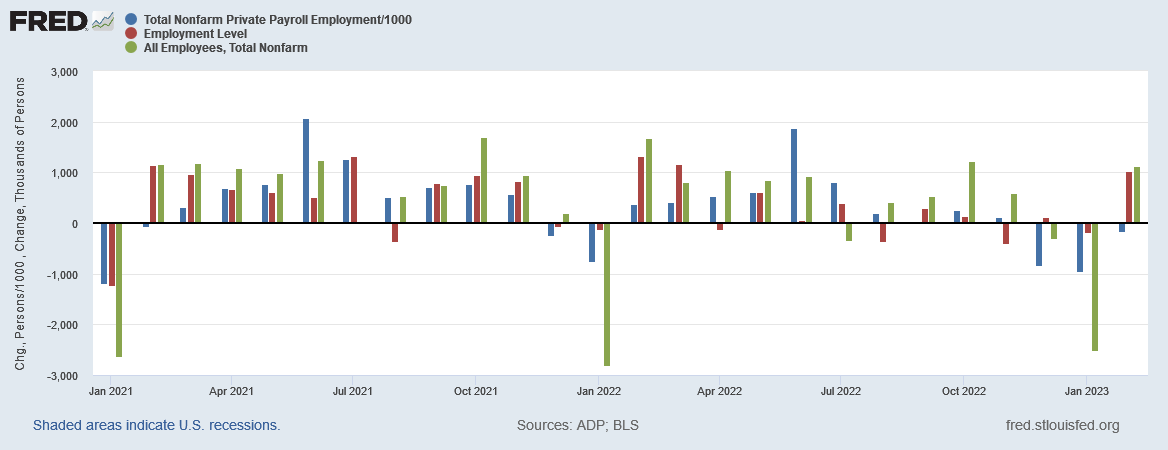

Within the raw data, the BLS Employment Situation Summary has to abruptly reverse a number of trends to get the positive numbers it does.

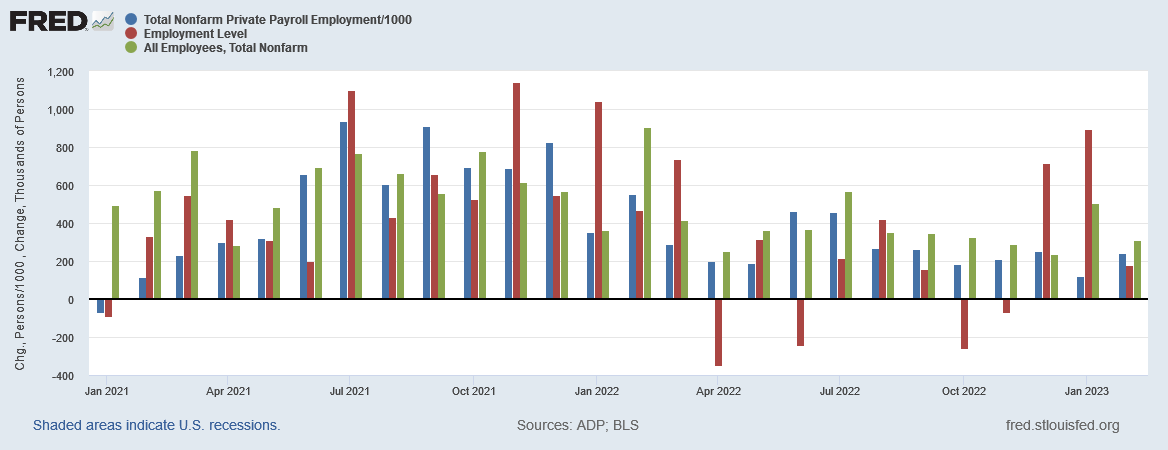

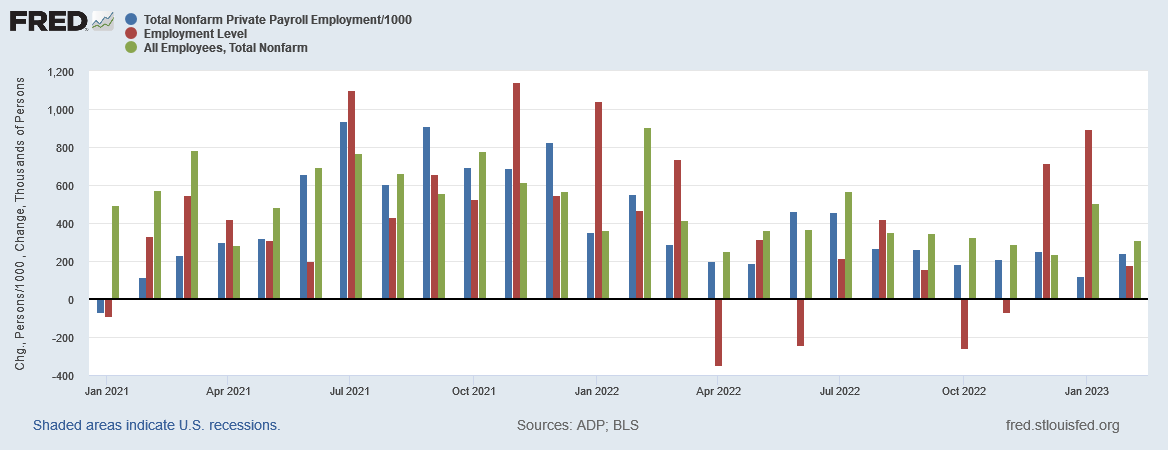

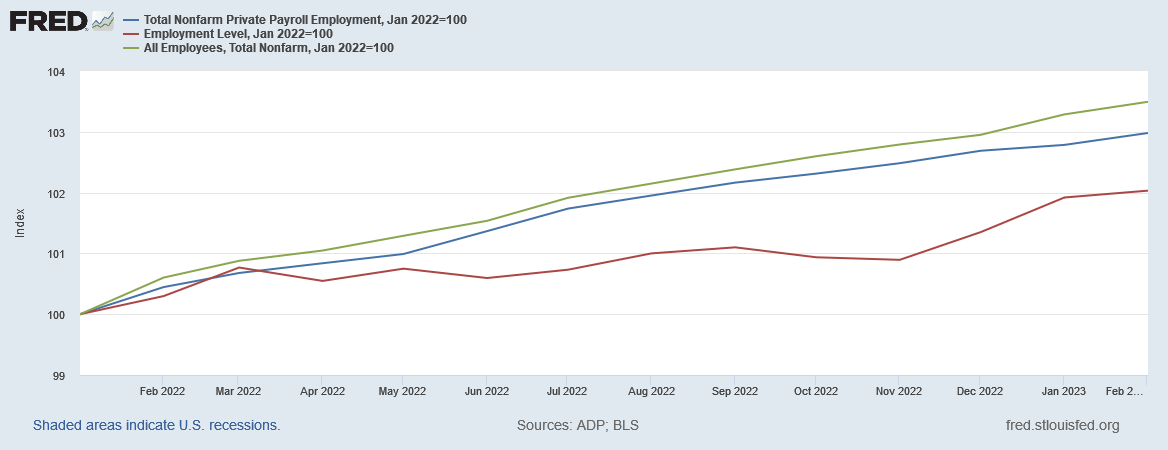

Within the seasonally adjusted data, the BLS jobs report’s Establishment Survey data has been gradually digressing from both the ADP report and the BLS jobs report’s Household Survey, both of which showed steeper year-on-year slowdowns than the Establishment Survey, making the “All Employees” metric the outlier.

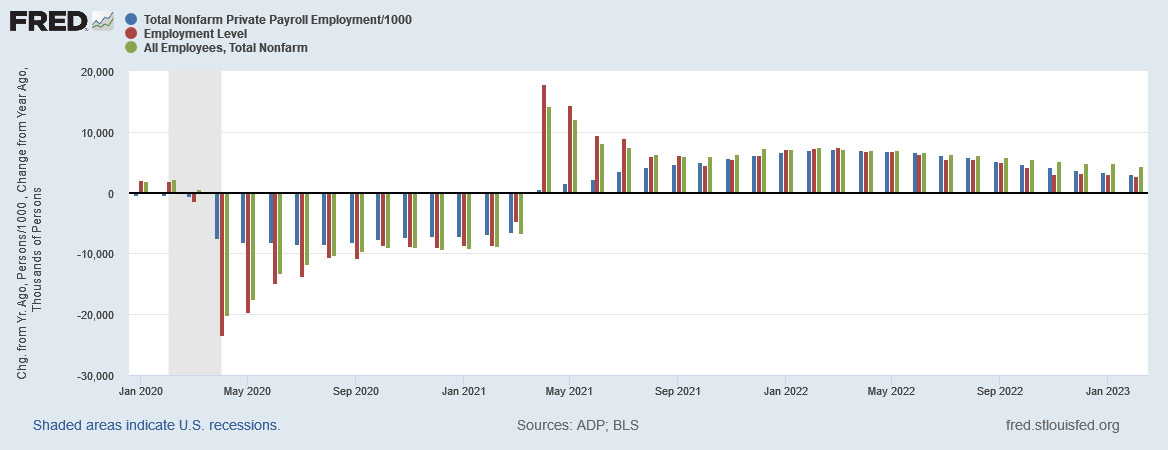

Speaking of outliers, we must note that the BLS jobs report presented in April of 2021 a most remarkable surge in year on year job growth, going from negative 6,616 jobs in March 2021 on the Establishment Survey to positive 14,184 jobs in April.

From that lofty perch, the trend in job growth has been downward ever since.

By comparison, the ADP National Employment Reports in 2021 showed a much more gradual pickup in employment which peaked in March 2022.

The ADP report, however, has shown declining job growth year on year since then. Moreover, the ADP report shows a largely similar decline when viewed month on month, albeit from an earlier peak of August 2021.

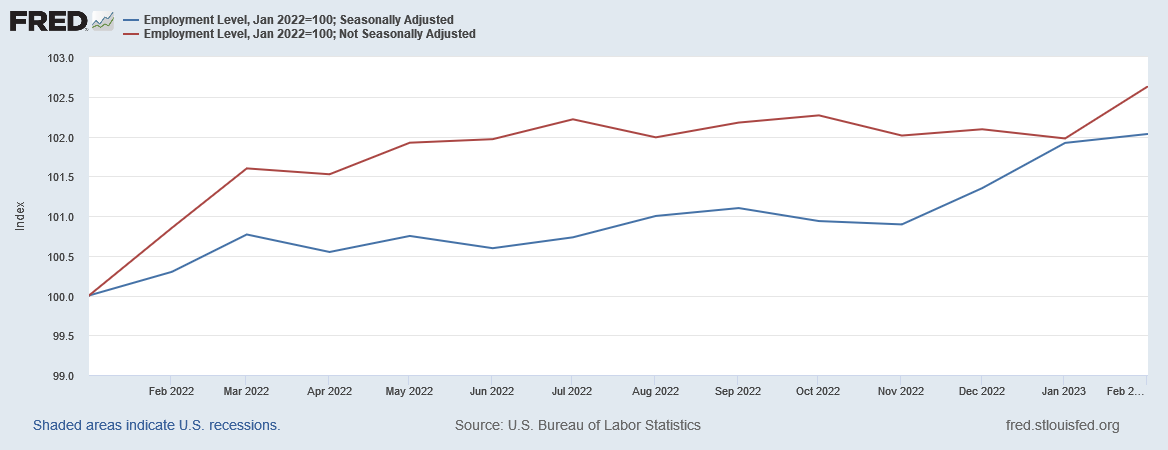

Nor should we forget the fact that in March of 2022 job growth fundamentally stopped, looking at the Household Survey’s Employment Level Data, a trend easily made visible when we index the headline stats to January of 2022.

That plateau extended in the raw data right through January of 2023, with February being the first notable increase since last March.

Whatever adjustments the BLS made in January, they have done nothing to give us greater confidence in the BLS employment data.

Wall Street, with its persistent fixation on what the Fed will do and not on whether the jobs data makes any sense, responded with its usual panic reaction that the strong headline number on the jobs report will force Jay Powell to go for a larger rate hike later this month.

The increase in employment last month followed a revised 504,000 gain (initially 517,000) in January, the government said Friday.

The large back-to-back increases could force the Fed to raise interest rates higher than it had planned to slow the economy and loosen up the tightest labor market in decades. The central bank meets March 21-22 to plot its next move

Faced with that awkward and equity-killing probability, the stock markets all declined.

Wall Street also proceeded to complicate the Fed’s position further by pushing yields down (remember, the Fed wants to see yields go up). The 1-Year, 2-Year, and 10-Year Treasury yield all dropped significantly.

How Wall Street moving rates in the opposite direction the Fed wants them to go will persuade the Fed not to attempt to push them higher with an outsized Federal Funds rate hike in two weeks is a question yet to be answered.

Make no mistake, the BLS jobs numbers do not make sense.

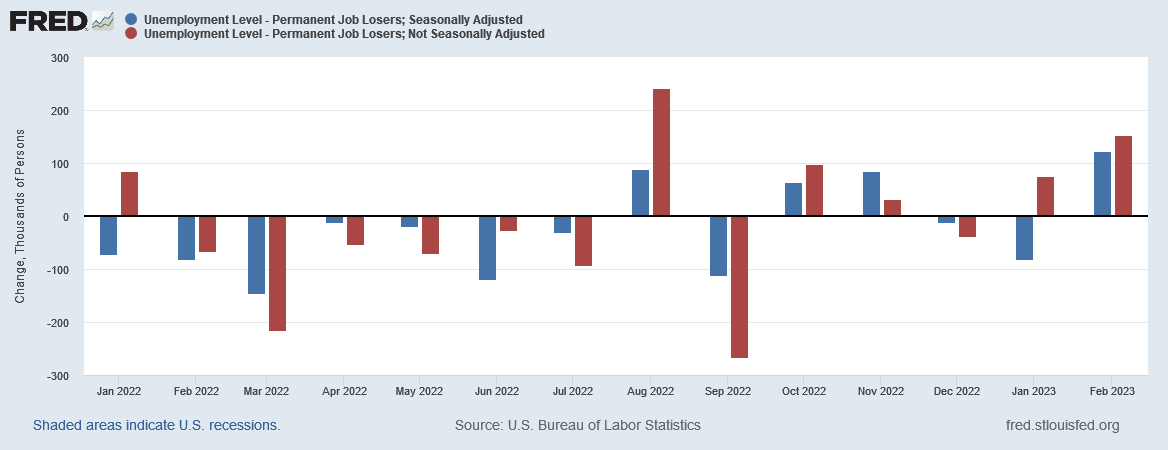

Despite the outsized job gains reported, the BLS also reported that unemployment rose with by a seasonally adjusted 242,000 in February.

223,000 of the newly unemployed simply lost their job.

123,000 of those have lost their job permanently.

The labor market pushed 77% as many workers out of a job as it created jobs for workers, and half of those pushed out are never getting their old jobs back.

Nearly as many workers were put out of work in February as were put to work.

Let that sink in.

Yet despite these significant job losses in February, the country still managed to post 311,000 new jobs—and all of this data somehow adds up to a somewhat “positive” Employment Situation Summary, showing once more how “robust” and “resilient” the US labor market is.

Don’t look at the 237,000 who filed unemployment for the first time last week, or the 1.9 million who have been on unemployment for multiple weeks.

Ignore the fact that the average duration of unemployment at 19.3 weeks is still higher than it was before the 2007-2009 Great Financial Crisis and recession—nearly 16 years ago.

Pay no attention to the year on year consumer price inflation, which outpaced year on year average hourly earnings gains for all of 2022—meaning real wages declined throughout 2022.

Don’t let any of those uncomfortable but true negatives detract from President Asterisk’s meaningless tweet about how well America has done on his befuddled watch. Go with the narrative, you can always trust the narrative…..

Screw that. Ignore the narrative. Look at the data and draw your own conclusions about job markets in the US.