Greedflation: Is It A Thing?

Not Exactly. Inflation Does Not Generally Favor Corporate Profits

Readers already know what I think of Kamala Harris’ proposals for price controls as a solution to consumer price inflation: if there is one thing this country does not need it is a return to the disastrous Nixonian price controls of the 1970s.

However, given that inflation has taken a large bite out of the average paycheck, and food price inflation has been especially troublesome, we should not ignore the siren song in Kamala Harris’ argument that inflation is the result of corporate greed rather than any other economic pressure.

The problem with the “greedflation” narrative is that it just doesn’t withstand scrutiny. Corporate profits are up, as a rule, but what gets overlooked by the greedflation narrative is that inflation historically disadvantages corporate profits relative to nominal paychecks.

It hardly needs to be said that corporate profits are the eternal convenient scapegoat for politicians looking to showcase their populist chops, In this regard Kamala Harris’ has been quite pedestrian in her attacks, blaming corporate greed for the rise in food prices.

Vice President Kamala Harris is zeroing in on high food prices as her campaign previews an economic policy speech Friday in North Carolina, promising to push for a federal ban on price gouging on groceries as she looks to address one of voters’ top concerns.

Harris is putting particular emphasis on rising meat prices, which she says account for a large part of rising bills at checkout.

However, we should acknowledge that Harris’ greedflation narrative has gotten a few bits of narrative support, such as when emails from grocery giant Kroger executive Andy Goff appeared to document deliberate efforts by the grocery chain to goose food prices.

The grocery chain's top pricing executive testified to a judge on Tuesday that the store raised the prices of milk and eggs more than required.

'On milk and eggs, retail inflation has been significantly higher than cost inflation,' executive Andy Groff wrote in an email to his bosses in March.

Groff was forced to testify about his email as part of the ongoing antitrust lawsuit brought by the Federal Trade Commission in an attempt to stop Kroger's from buying rival chain Albertsons.

Even recent price cuts by discount big-box retailer Walmart appear to play into the “greedflation” narraitve.

In the February call, the president and CEO of Walmart U.S., John Furner, illustrated this concept well. “We took our French bread back to $1 which had been $1 for a long time and went up as inflation hit the market,” he said. “And we’re seeing results of that running about 40% over last year, so customers immediately responded. Rotisserie chicken is another one. That price has come down by $1. Customers are responding.”

Walmart’s changes are very much part of the zeitgeist. Just ask the U.S. major party presidential candidates. Both Kamala Harris and Donald Trump are campaigning on the promise of lowering food costs.

Regardless of the actual forces driving the price cuts, there is no denying that the optics are very easily spun as a greedy corporate giant caught gouging customers by newly-minted populist warrior Kamala Harris trying to cover itself.

However, a broader look at corporate profit trends over time do not support the greedflation narrative of corporations goosing prices solely to boost profits. If we look at nominal corporate profits relative to their employees nominal incomes, corporate profits derive clear benefit from low or falling inflation, while rising inflation has favored employee incomes.

Does this mean that the counter-narrative is correct? Not necessarily. The counter-narrative of robust competition holding corporations in check also runs aground on the evidence.

In the counter-narrative, there is no greedflation. If anything, there’s not enough greedflation.

There are both disreputable and respectable versions of this narrative—dumb and dumber, if you will—but they both run into the same problem: the evidence is against them. The dumber version, the one no economists endorse, says corporations got especially greedy, which made prices go up. If this were true, we could explain surges and drops in inflation as an effect of surges and drops in corporate greed. Since greed is limitless, prices would never drop and this is clearly at odds with observable facts and history.

Unfortunately, this counter-narrative also does not stand up to scrutiny.

Here’s the problem with the counter-narrative: corporate profits are up significantly relative to employee compensation since 2020.

First a word about analytical approach. While most discourses on inflation focus on prices, to understand the dynamics of corporate profits we need to compare them to an appropriate consumer metric. All consumers are, generally speaking, employees of somebody, and employee compensation is a valid business expense—i.e., a reduction in profits independent of inflation—and so comparing corporate profits to employee incomes reveals how inflation impacts businesses internal cost structures.

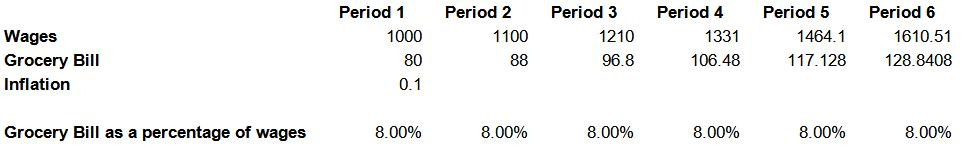

A major structural flaw both with the “price vs profits” dimensions of both the greedflation narrative and the counter-narrative which denies it is that they are making an invalid comparison. While inflation is experienced as consumer price rises, the economic harm to consumers comes not from the price increase but from a lack of a corresponding wage increase.

A moment’s thought is sufficient to establish that this is necessarily so: if prices rise by 10%, and wages rise by 10%, real incomes do not diminish, purchasing power does not diminish, and so inflation has no impact on the consumer.

In every period of high inflation, the problems for the average consumer arise because the increase in their wages rarely matches the rise in overall price levels.

Thus, if we want to gauge how corporate profits are doing as a result of inflation, we must compare corporate profits to employee compensation.

When we do, the data appears to show Kamala Harris to be correct:

As you can see, corporate profits relative to employee compesation took off after the Pandemic Panic Recession in 2020.

If we apply the inflation index as a deflator, we still see the same excess of corporate profit increase over that of employee compensation.

Clearly, corporations are just taking advantage of everyone, right? Not so fast. Between 2010 and 2019, corporate profits did not rise faster than employee compensation overall.

However, for the first half of the decade, when inflation was trending down, corporate profits rose faster than employee compensation. Only as inflation started rising did nominal corporate profits rise slower than nominal employee compensation.

The same holds true when we apply a CPI deflator to the decade’s data.

Even during the first decade of this century, a time when inflation was largely stable, corporate profits rose far faster than employee compensation.

Once again, adjusting for inflation does not change the picture.

One has to go all the way back to the 1980s to find a period with falling or stable inflation when corporate profits did not rise faster than employee compensation.

This is true even in real terms.

Until the past few years, the inflation experience in this country has been one of low inflation. Yet it has been in that low inflation environment that corporate profits have risen faster than worker incomes.

If corporate greed were a source of inflation, the low inflation environment of the past thirty years could not have happened. If corporate greed were a source of inflation, we should have had high levels of inflation every year going back to well before the (Biden-)HarrisAdministration. That just has not shown up in the CPI data.

Whether in the grocery store or at the gas pump, the problem of inflation is not that prices go up, but that they go up relative to income. That is always what makes things more expensive.

For the (Biden-)Harris Administration, this means, before Kamala Harris can articulate a meaningful policy regarding inflation, she has to first acknowledge that, in the first 18 months of their Reign of Error, real incomes in this country dropped significantly, and they have not yet recovered even to their January 2021 levels.

When Harris goes around cackling “Bidenomics” is working, this is what she defines as working—lower real personal income. Bidenomics is people having less money to spend.

As I’ve detailed already, we are not experiencing overall an expansion of labor markets in this country, but a contraction.

We are experiencing a true “jobs recession” and have been since November of last year.

A toxic labor market is what is holding down wages and has prevented meaningful growth in real income.

Kamala Harris’ “greedflation” narrative does not address this reality, nor can it. Her solution won’t work because it’s focuing on the wrong things. Without a stronger, healthier labor market to produce meaningful upward pressure in real income, any government intervention to force prices down will only succeed in forcing real income down as well.

The solution for prices being too high is for incomes to rise to match. Unfortunately for Kamala Harris, that is invariably a market solution, not a government one. Instead of trying to be the one to lead a government charge to “fix” the problem of prices, she needs to be the one leading a government charge to “get the Hell out of the way.”

Somehow, I don’t see her having the good sense to do that.

Several conversations last night with people looking for jobs said many companies are telling the applicants that there’s a hiring freeze, some are removing the job posting. I wonder how that’s accounted for? A financial forum I frequent also has had numerous posts in the past month of people getting laid off. Word on the street is the economy is really bad right now…plus food costs are skyrocketing, getting harder to live within our means and that’s with just the basics. With wages rising costs passed on to the consumer, who is under or unemployed it’s a vicious cycle. I hope they teach personal finance in high schools!

“Bidenomics is people having less money to spend.” A devastatingly on-point critique of Harris’ mindset regarding ‘greedflation’, Peter. The foolish woman had her brain poisoned with Marxist economics while she was growing up, and now her understanding of economies is hopelessly wrong. This misunderstanding is the source of my greatest fear regarding her as (shudder) President - her economic decisions would be catastrophic! Venezuelan economy, here we come.