The first day’s trading activity after the Fourth of July holiday weekend was a chaotic and confused mess of buying and selling, with trading volume somewhat higher than in recent trading sessions. What started as a down day with significant declines on all major indices ended up a mostly positive day, with even the Dow only just missing making it into positive territory for the day.

The Dow Jones fell despite rallying into the close, with Nike (NKE) and Apple (AAPL) making some of the best gains. Tesla (TSLA) rose despite disappointing delivery data. A Warren Buffett stock fell even as it emerged Berkshire Hathaway (BRKB) had raised its stake.

A Good “Bad” Day

Yesterday’s trading left much of the financial media muddled and confused. The Dow’s “rallying into the close” was a steady move upward from an intraday low of 30,376.83 reached just after 11am Eastern Time.

While the timing differed, the same down-then-up trend was seen on all major indices, with the S&P 500 and the NASDAQ indices getting back into positive territory.

While the number of shares changing hands was somewhat muted during the middle of the day, the pace of activity quickened during the last hour of the trading session.

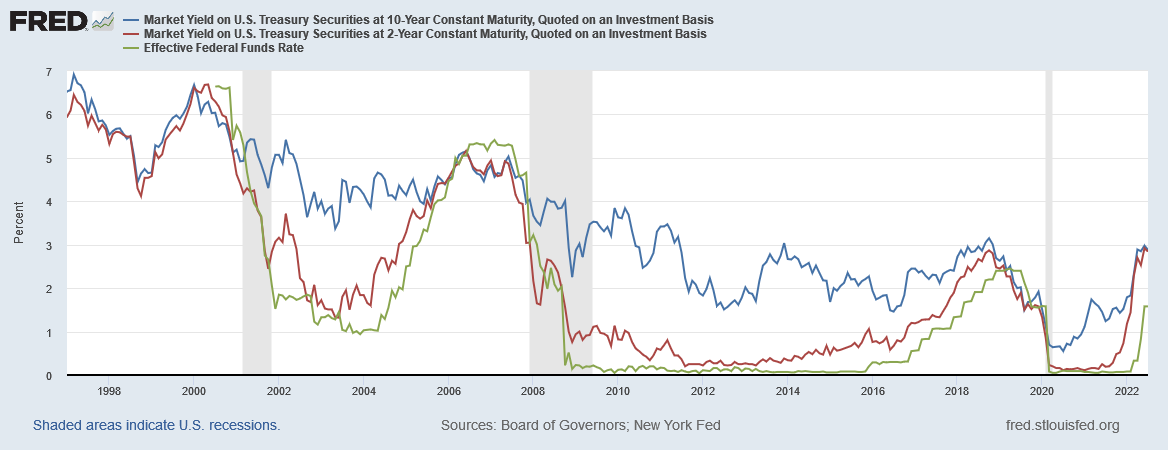

In bond markets, the benchmark yield on 10-Year Treasury Bonds continued to decline (meaning the price rose), although the yield followed the stock market pattern of early morning decline followed by a steady increase from mid-morning for the rest of the trading day.

Yields on the shorter-term 2-Year Treasury Bonds also fell, but to a lesser degree, and by late afternoon exceeded the 10-Year Treasury Yield.

As a general rule, shorter-term bonds have lower yields than the longer term ones, and when that relationship between the 10-Year Treasury and 2-Year Treasury Bond inverts, market prognosticators typically view that as a recession signal.

The market is fearful that the Federal Reserve's battle to suppress price gains -- by quickly raising interest rates and reducing its balance sheet -- may tip the world's biggest economy into recession.

The result is a flattening yield curve and inversion-- with the 2-year yield trading above the benchmark 10-year yield on Tuesday.

Even commodities markets had a bad day, with the benchmark price for West Texas Intermediate crude oil falling below $100 for the first time in two months, and gold prices reaching six month lows. The assessment of the financial media was that the decline was driven largely by fears there might actually be a recession.

Oil prices tumbled Tuesday with the U.S. benchmark falling below $100 as recession fears grow, sparking fears that an economic slowdown will cut demand for petroleum products.

Do The Markets Understand What A Recession Means?

If yesterday’s activity was dominated by fear of recession, what prompted the stock markets to reverse and largely eliminate early morning declines by the end of the trading day? Keep in mind that the expected response to expectation of economic contraction is market contraction, which means that recession fears should be sending stock markets lower.

Michael J. Wilson, a lead strategist at Morgan Stanley, said the Federal Reserve’s aggressive moves to curb inflation by raising interest rates could tip the economy into a recession.

Wilson’s team of researchers wrote in a note obtained by Bloomberg that a market contraction could send the S&P sliding even further to around 3,000 points — which is approximately 22% below its current value.

Not only is the stock market activity from mid-morning on contrary to what recession fears should trigger, but the bond markets are signalling an expectation that the Fed will back off its campaign of interest rate hikes to curb inflation—historically, yields move down when there is at least the expectation the Fed is likely to cut interest rates, and are pushed up when the Fed signals an intention to raise rates.

If one follows that logic, the bond markets are pricing in an expectation the Fed will respond to the reality of a recession by reversing its recent interest rate hikes and “restarting” Quantitative Easing policies. However, that logic runs aground on the fact that the Fed has yet to meaningfully reduce its balance sheet, which is still up significantly from the start of the year.

In other words, the Fed has yet to “tighten” the money supply, despite the recent interest rates hikes.

Yes, there is a recession going on, but to presume it was caused or catalyzed by the Federal Reserve’s interest rate manipulations is absurd. Rather, as I have argued before, the distortions and dislocations of persistent consumer price inflation have already produced the recession.

Mis-Reading The Tea Leaves

The markets do appear to be hopeful the Fed is going to moderate its stance on future interest rate hikes. The expectation that a recession will at last be confirmed by the Fed and will force the Fed to ease up on its notionally “aggressive” stance on rate hikes is a cogent explanation for how expectation of recession (or, rather, expectation the Fed is finally going to admit there is a recession) could push stock markets up.

However, given the Fed’s rhetoric on interest rates, the only plausible scenario where they can moderate their stance on future interest rate hikes is to see a significant decline in consumer price inflation. The one clear signal today that such a decline might be getting closer is the drop in oil prices. Depending on how long benchmark oil prices remain below $100, that price decline could indicate sufficient demand destruction in energy markets to collapse the price of energy, with the benchmark price for West Texas Intermediate serving as leading indicator.

Unfortunately for the markets, a leading indicator is just that—an advance warning of what is to come, not what is happening. The Fed has based its stance on interest rates on what the consumer price inflation metrics (CPI and PCE) are doing—and those indices are trailing indicators.

While a persistent decline in the price of oil will produce an inflation decline—as oil prices percolate through to gasoline prices for consumers—that decline is not going to happen in the next update (June) to either the PCE or CPI. For both benchmarks, their June levels are already set (and are merely awaiting publication), which means any moderation on interest rates can’t come until August or September at the earliest. For the Fed to reverse on interest rates now would be an extreme reversal of their stated policy position and require them to simply abandon targeting inflation.

The markets are misreading the economic tea leaves in several significant aspects.

First, they are failing to appreciate that the Fed has committed itself to squelching inflation, even if recession momentarily ensues.

Second, they are failing to grasp that the Fed’s policy driver on interest rates is not future recession expectations, but past inflation performance.

Third—and most importantly—they have missed the signal that oil and gold prices sent: Demand destruction is reaching the tipping point where disinflation begins.

The Fed may ultimately rein in its interest rate hikes, but only because demand destruction and disinflation will have removed the foundational logic for future interest rate hikes.

Scrambled Thinking

Where the financial media has lost touch with economic reality is that markets are not the economy itself, but are instead the amalgamation of broad investor expectations of the future state of the economy. Thus, declining bond yields are the reflection of investor expectations of what the Fed will do with the Federal Funds Rate, as well as its balance sheet. Plowing still more money into stock markets—as rising stock market indices suggest is happening—is an expectation the Fed will loosen its monetary policy to produce still more asset price inflation.

However, falling yields are no more a recession than steep stock market declines. A recession, however it is defined, is a loss of economic output. It is a contraction of the economy, not of financial markets. Markets give us indicators of whether a recession either will happen or is happening, but they are not the recession itself.

Moreover, the Fed’s objective by hiking interest rates is demand destruction. Not only have they said so—explicitly and repeatedly—but that is the only way the Fed can influence consumer behavior to reverse inflation into disinflation.

Yet the financial media is completely ignoring the Fed’s own stated logic behind its rate hikes. The implicit presumption behind all the media commentary about whether or not a recession is “looming” (it’s not looming, it’s here) is that market contractions alone will compel the Fed to alter course on interest rates. That presumption completely ignores the Fed’s own need for some semblance of credibility.

The Fed can’t simply abandon its position on interest rates and inflation in order to appease various players on Wall Street without being soundly punished by other players for doing so. The Fed’s credibility is inextricably linked to the credibility of the dollar in currency markets; if the Fed were to be seen as unserious about at least following through on what it has said it would do on inflation, currency speculators will almost certainly take that loss of credibility out on the dollar—which in turn could have even more profound impacts on interest rates and inflation than what the Fed itself does or does not do (while Treasury Yields are positively correlated to the Federal Funds Rate they are also influenced by a number of other market forces beyond the Fed’s direct control).

As I have said before, the Fed has lost control. Having committed themselves to raising interest rates as a means of squelching consumer demand in order to stop consumer price inflation from rising further, they have at this point little choice but to do so until there is a plausible indication that inflation has been checked. That point may yet come later this year, but it is not going to come in the next month or two.

The financial markets and the financial media have had their brains scrambled by the return of stagflation to the economy after being absent for decades. They have grown accustomed to a pliant Fed servicing their every whim on money and interest rates and have forgotten the potential for other forces to exert even greater control over the Fed.

We are seeing that potential becoming reality. The Fed cannot stop raising interest rates at this point. They are committed to a policy of demand destruction in order to bring down inflation—the economic contraction they seek will happen. While the Fed can and eventually will be influenced to alter that policy, it will take more than a turbulent day or even a turbulent week on Wall Street to make that happen.

Thank you for helping me understand and tune out the noise...esp "However, falling yields are no more a recession than steep stock market declines. A recession, however it is defined, is a loss of economic output. It is a contraction of the economy, not of financial markets. Markets give us indicators of whether a recession either will happen or is happening, but they are not the recession itself"