Now that winter is well and truly here, it is worth taking a fresh look at Britain’s energy crisis, to see how well (or poorly) the UK is contending with winter cold.

However, while the corporate media is filled with news reports detailing the magnitude of the UK energy crisis, the data leaves a lingering question: “What energy crisis?”

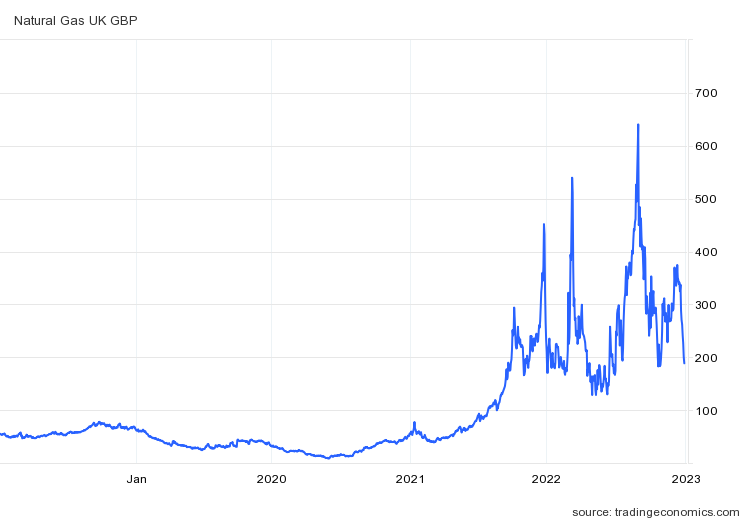

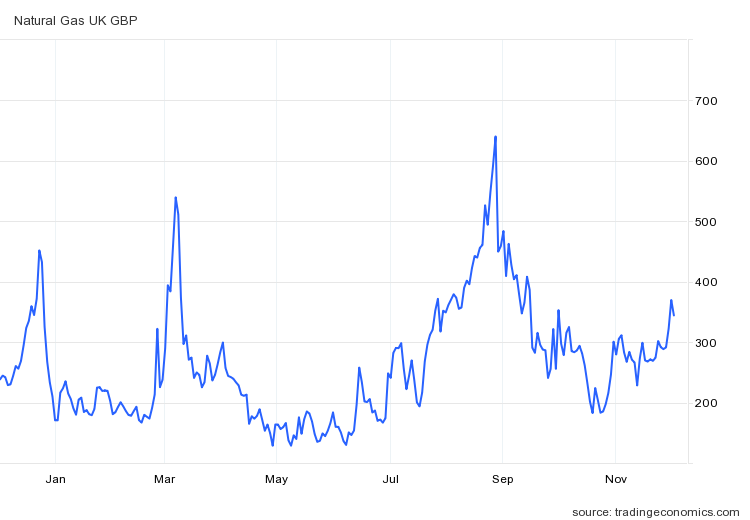

Winter temperatures have descended upon the British Isles, and across Europe and North America, yet natural gas futures have yet to show any enduring price rise consistent with an increase in energy demand. The UK’s gas storage volumes are not being depleted. December’s minimum temperatures were not the lowest of the past decade.

That does not sound like much of a crisis.

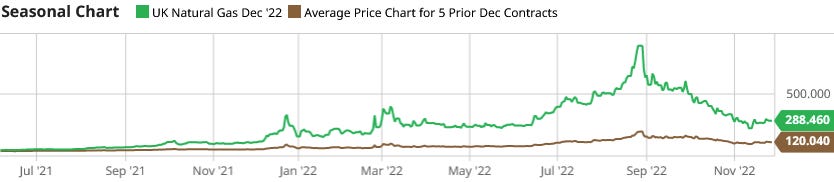

It is certainly true that the ICE natural gas futures contract for December delivery closed at 322.34 pence per therm as of the November 29 expiration date, nearly three times the five year average for the December contract.

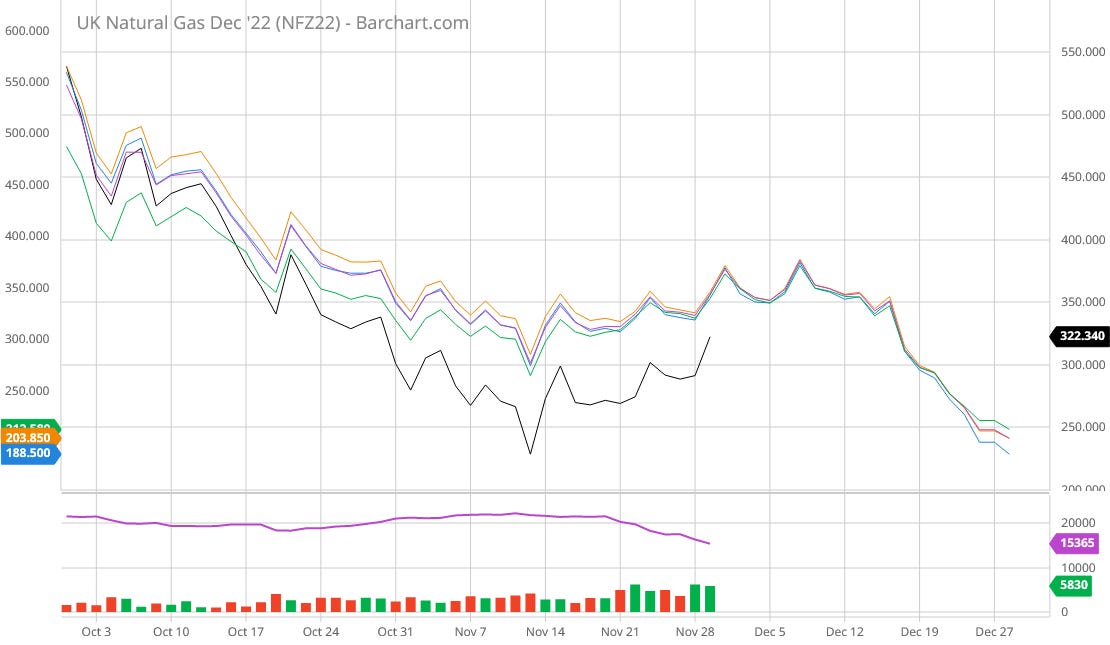

It is also true that the December contract surged somewhat on the last day before expiry, along with the January-March contracts.

Yet the January-April contracts still declined throughout December.

We should also note that the price for natural gas in the UK did rise during the first week of December, likely in response to the cold snap from the first part of the month.

However, that price rise was quickly reversed and the trend in natural gas prices ever since has been down, with the overall monthly trend being downward.

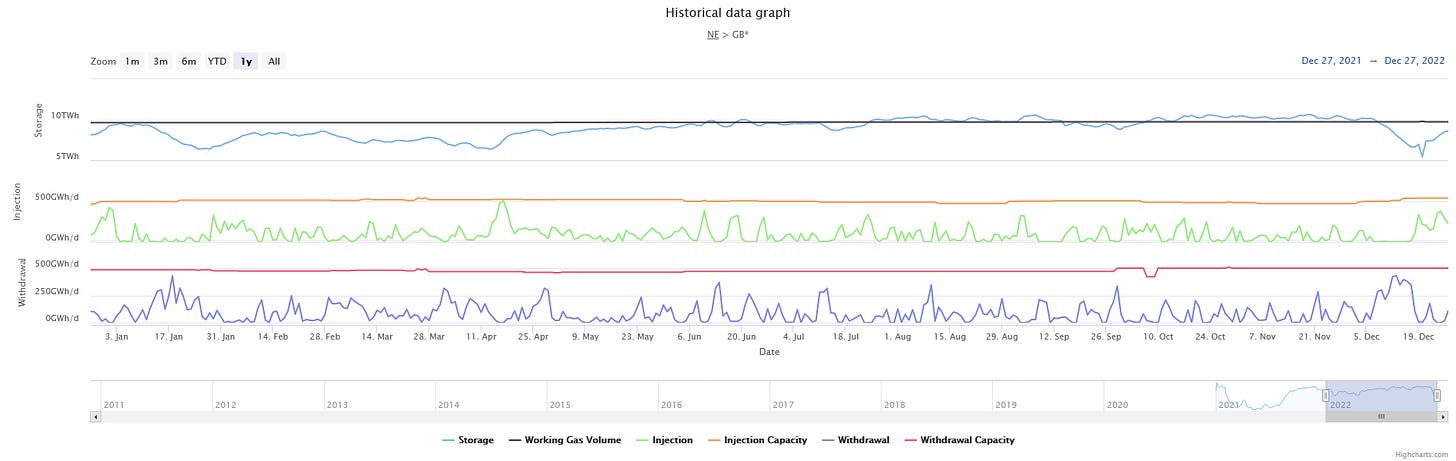

Not only did the natural gas price in commodity markets decline in December, but the UK actually managed to replenish its gas storage volumes over the past week, even with declining prices.

Falling prices and rising storage volumes are indicative of softer energy demand than anticipated—which would be the antithesis of an actual economic crisis.

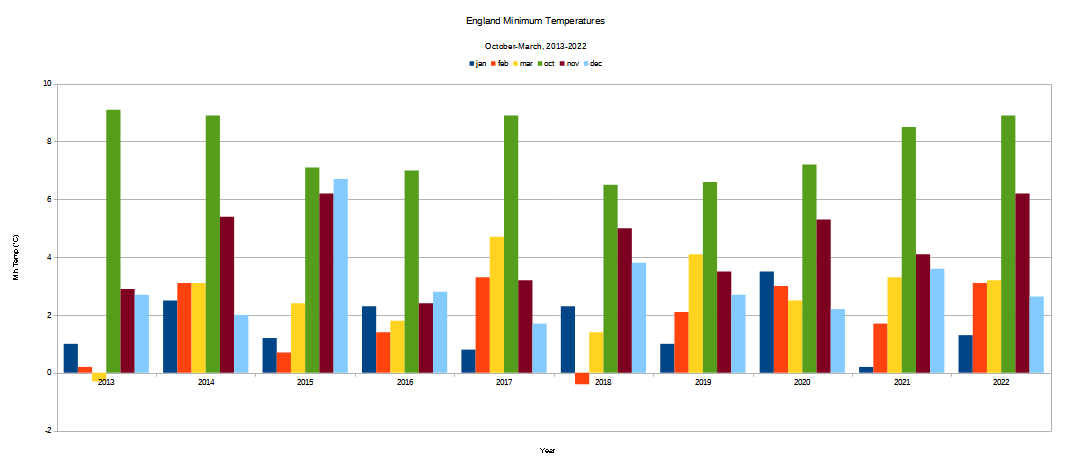

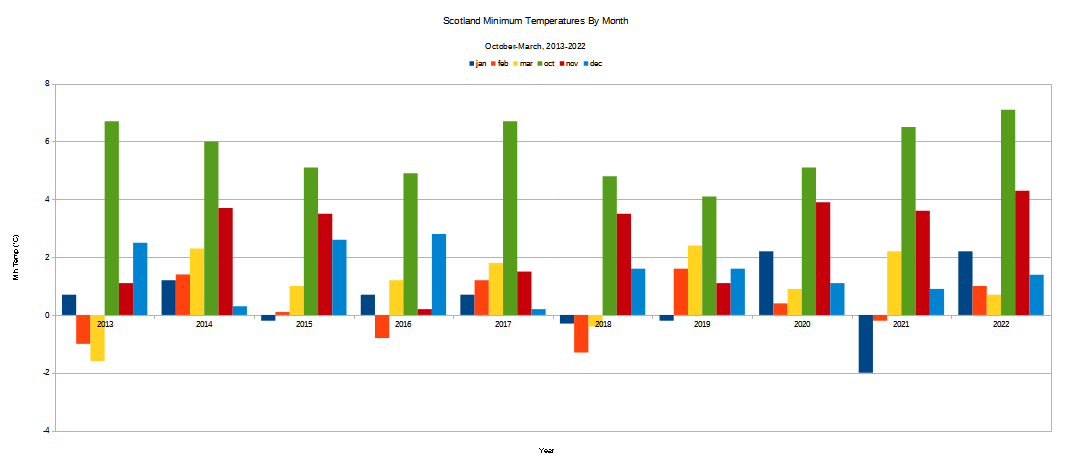

The energy crisis narrative is further undercut by the minimum temperature data for England and Scotland over the past ten years. Cold snaps not withstanding, the minimum temperatures for both Scotland and England were rather unremarkable for December.

In England, December’s temperatures were colder than October and November, of course, but in 2020 December’s minimum temperature was somewhat lower, while in 2021 it was somewhat higher.

In Scotland, December was slightly warmer than in either 2020 or 2021.

That hardly is the stuff of which winter energy crises are made.

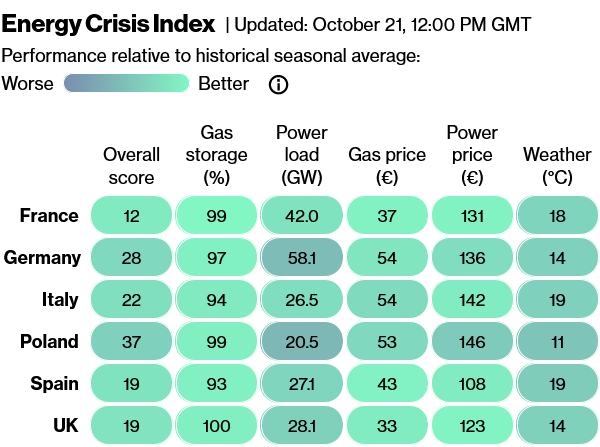

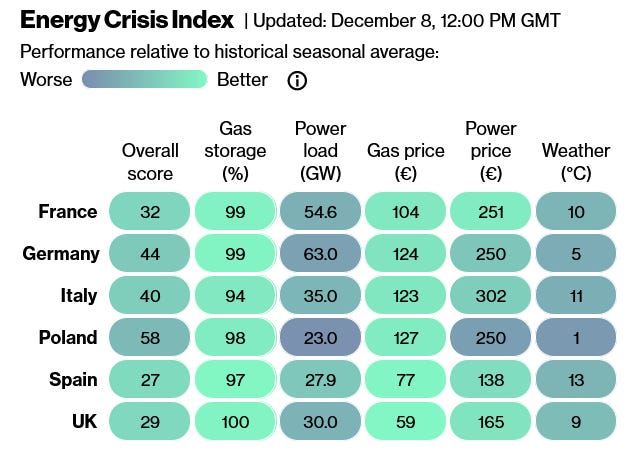

Yet Bloomberg’s Energy Crisis Index certainly seems to show the UK in an energy crisis. While the index scored Britain at 19 on October 21, by December 8 Britain’s score had risen to 29.

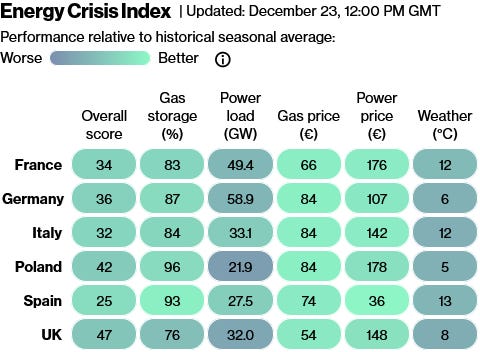

By December 23, Britain’s crisis score was 47.

The score was chiefly the result of the reported gas storage percentage at 76, rather than the 100 percent of two weeks’ prior. Since December 23, however, the UK has increased its gas storage to 88%. That is not the image of an ongoing crisis, but of a resolved crisis.

I will pause to note here that, compared to pre-pandemic energy prices, the price for UK natural gas has been highly volatile and considerably higher since 2020 than prior to 2020.

Viewed against the historical norms, current UK natural gas prices are several multiples of pre-pandemic averages, and that is certainly going to put a crimp in the average British household budget.

Yet the steep rise in natural gas prices from historical norms does not alter the current downward trend in those same prices, which arguably should result in the price charged to British households declining as well.

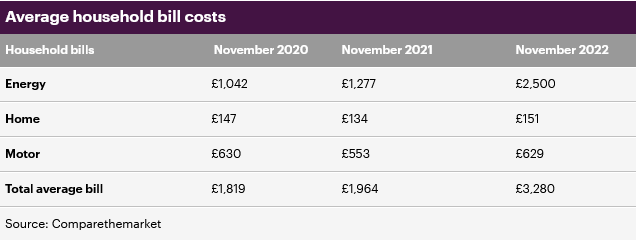

Yet even though natural gas prices are only somewhat higher than this time in 2021, UK energy bills are tremendously higher from this same period.

Energy costs have risen the most as the average bill has surged by £1,223 over the past year, according to comparison site Comparethemarket.

The typical annual household energy bill now stands at around £2,500 due to the Government's Energy Price Guarantee. This is a £1,223 increase from levels seen in 2021 and is £1,458 higher than in the year to November 2020.

Natural gas prices are higher than in 2021, but they are not double 2021 prices—yet UK energy bills are double what they were this time last year.

What appears to be happening in UK energy markets is energy suppliers are taking advantage of the volatility in natural gas prices to pass along the cost increases to consumers, but are somewhat reticent in passing the cost decreases along as well.

Certainly, that is the conclusion to be drawn from an investigation by the End Fuel Poverty Coalition which found that gas and electricity companies had accumulated a cash reserve of some £2 billion from customer billings.

A fuel poverty charity has echoed calls from a Conservative MP urging the UK's energy watchdog Ofgem to crack down on companies accused of "stockpiling our money" and ramping up bills amid the cost of living crisis. It comes after an investigation found that gas and electricity companies are sitting on an eye-watering £2billion or thereabouts of users’ cash, the Telegraph reported. The publication also found that firms are increasing direct debit payments for customers that have thousands of pounds in credit.

Even more perplexing is that Britain’s National Grid has prepared a plan for rolling blackouts this winter to “conserve gas.”

The UK government has plans in place which reveal the exact times your house could suffer an electricity blackout this winter. This comes as a result of National Grid warnings of a potential energy crisis that could cripple the country

£2 billion in cash reserves, gas storage at 88%, the price of natural gas is down on the month, yet Britain’s utility companies are preparing to inflict blackouts on the country.

That is hardly rational market behavior.

Yet while Britain’s energy companies may not be behaving entirely rational with regards to energy costs, the impact steep energy bills is having on both consumers and business is both rational and predictable.

Britain’s Office of National Statistics reports widespread efforts to use less gas and electricity, with nearly all households simply heating their homes less.

The survey of 4,962 households also found that 63 percent of adults reported using less gas and electricity because of increases in the cost of living, with more than 96 percent of these adults saying they were using the heating less.

At the same time, entire industries—such as Britain’s ceramic industry centered in the city of Stoke-on-Trent—are being squeezed potentially out of existence by energy bills that are 10 times what they have been.

Britain’s iconic ceramics industry are slashing production and cutting jobs as surging energy bills push the sector in a key English town to the brink of collapse.

Some companies have seen a 10-fold surge in energy bills, crippling a major UK industry that produces goods from sought-after teacups to bricks, aerospace parts and artificial hip joints. The crisis is hitting British businesses from hospitality to entertainment, leaving Prime Minister Rishi Sunak in a tricky political position in industrial heartlands ahead of the next general election that’s due latest by January 2025.

Natural gas prices are up, but they are hardly 10 times what they were this time last year. As of November 30, UK natural gas prices were approximately 44% higher than in 2021, despite significant price spikes in the interim.

While a 44% year on year rise in price is an indisputably extreme amount of energy price inflation, it is neither the 100% price increase being visited upon UK households nor the 1,000% price increase being visited upon UK businesses. The energy price inflation as experienced by energy providers in the UK is, at present, merely a fraction of the energy price inflation being charged by those same providers to their customers. The increases in natural gas prices have been transmitted through to customers, but not the decreases.

In theory, Britain’s energy regulatory structures exist to prevent this exact sort of price dislocation and imbalance. Yet, as we have seen previously, the volatile shifts in the price of energy commodities, as well as their availability from various sources, are pushing that regulatory structure beyond its limits, distorting the pricing mechanism for energy in the UK.

Continued natural gas price volatility, even with relatively milder winter weather, has at this juncture all but destroyed any semblance of rational energy pricing in the UK. There is no correlation to be had between natural gas prices in commodity markets and the prices charged by Britain’s energy companies. Britain has a reserve of natural gas, and market dynamics are easing cost concerns to Britain’s energy producers, yet none of that is being transmitted through to British consumers—their energy bills are going up, and never down, despite natural gas prices moving both up and down.

The energy crisis in the UK has mutated from one of high energy price inflation to one of complete breakdown of the energy market itself.

We need more of that in a World of one propaganda narrative after another. Thank you.

That was a really good article. I love articles that turn the conventional wisdom on its head.