How Much Lou Costello Labor Math Did The BLS Use This Time?

Can We Separate Fact From Fiction In The August Employment Situation Summary?

At first glance, the August Employment Situation Summary reads like a nice bit of relatively good news:

Total nonfarm payroll employment increased by 315,000 in August, and the unemployment rate rose to 3.7 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in professional and business services, health care, and retail trade.

Certainly Wall Street’s first reaction to the report this morning was to treat it as good news, as stocks opened generally higher.

While the headline number was in-line with expectations, the unemployment rate surprised economists by climbing to 3.7%, from 3.5% in July. To be sure, this increase was largely driven by an uptick in the labor-force participation rate which rose to 62.4% from 62.1%.

U.S. stocks advanced after the data, which created a “goldilocks scenario” for markets, according to Naeem Aslam, chief market analyst at Avatrade.

By mid-afternoon, however, reality seemed to be setting in for stocks, and they soon surrendered the morning’s gains and headed south for a third straight losing week.

It was “a goldilocks report” as it was not “too hot” while showing the labor market remains “pretty strong” as the Federal Reserve aims to fight inflation by cooling the economy through interest rate hikes, according to Anthony Saglimbene, chief market strategist at Ameriprise Financial.

“From a market perspective, it keeps the debate of a 50 or 75 basis points move by the Fed at the end of the month on the table,” Saglimbene said by phone Friday, referring to the potential size of the central bank’s next rate hike at its Sept. 20-21 meeting. “Market odds are suggesting they move 75 basis points, but with today’s labor report, I think the inflation data later this month is going to be the key data.”

(On a side note, the two quotes above also illustrate why I archive news stories as much as I do: both quotes are from the “same” article at the same URL, with the negative story line coming in the afternoon and the positive one coming in the morning. MarketWatch didn’t put out a new URL and article for the updates, they just repurposed the old link without warning or attribution.)

By The Numbers

The reported jobs gains were roughly where the “experts” anticipated they would be.

The economy added 315,000 nonfarm payrolls last month, the Bureau of Labor Statistics said Friday. The median forecast from economists surveyed by Bloomberg was for a gain of 300,000 payrolls. The reading reflected a moderation from July's growth rate largely due to waning consumer demand and signs of economic softening.

However, the uptick on unemployment was a clear miss.

The unemployment rate edged higher to 3.7%, according to the report. That came in above the median forecast of a 3.5% rate. The uptick was largely powered by a rise in labor force participation, which tracks the share of Americans either working or actively seeking work. That measure rose to 62.4% from 62.1% in August. Since the unemployment rate counts workers seeking employment, higher participation means there were more Americans counted as unemployed last month.

Wages were a bigger miss:

Pay growth similarly eased up. Average hourly earnings rose by $0.10, or 0.3%, to $32.36 in August, according to the report. Economists expected wages to rise by 0.4%. The uptick marks the weakest one-month increase since February and another sign that the booming price and wage gains seen through 2022 are slowing down.

Overall, the jobs report came in close to where analysts and economists expected it to be. While this was treated as good news initially, as the day wore on the reality sank in that this report would not dissuade the Fed from another large rate hike later this month—the “good news” that was expected once again became the “bad news” that the Fed will not be dissuaded from its rate hike policies by this report. A 75bps rate hike is quite definitively still a possibility, and August jobs report did nothing to reduce its likelihood.

Does The Data Match The Headline?

As I covered for paying subscribers earlier, one of the recurring anomalies in the Employment Situation Summary has been an odd decoupling between the raw data and the seasonally adjusted data for the Civilian Labor Force, which led to the July report claiming over half a million jobs created even as the seasonally adjusted Civilian Labor Force metric declined month over month.

August brought that trend to a close, as both the raw data and the seasonally adjusted data on the Civilian Labor Force started to converge once again.

However, when we index each year’s data1 on the labor force to the January number, we quickly see that the slowdown in the growth of the labor force, while ameliorated to some degree, is still present.

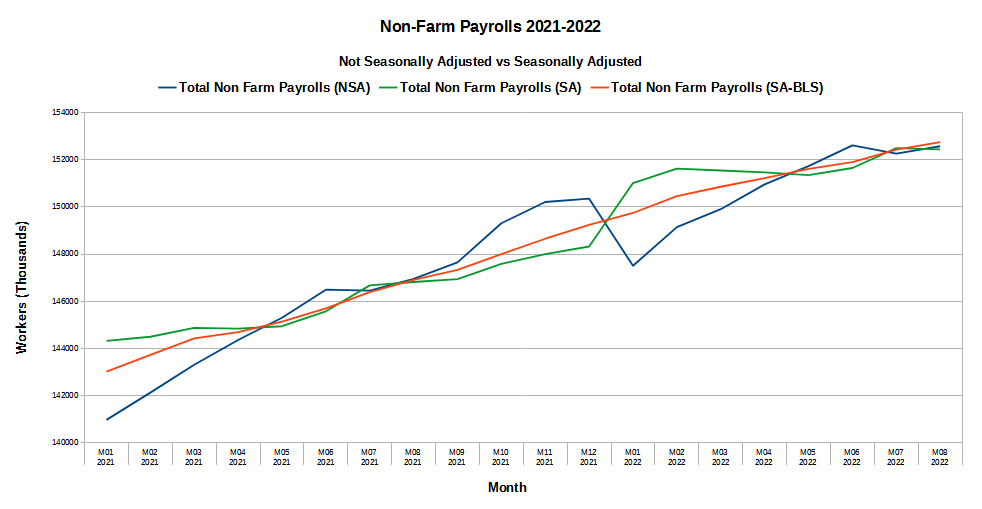

When we look at the raw data year by year, we see that the “increase” in jobs is in fact merely less of a decline in employment than is the historical norm for August.

Thus the application of the seasonal factor for August is less impactful on the data than it would be otherwise.

Were 315,000 jobs created? Apparently close to that number were created (assuming no falsifying of the data itself), as the raw data showed an increase of 309,000 jobs, and the unadjusted and the seasonally adjusted data are in fairly close agreement with each other.

So it would appear that Lou Costello Labor Math might not be a mainstay of this month’s report after all, although there are still some rather generous interpretations of what the data actually means.

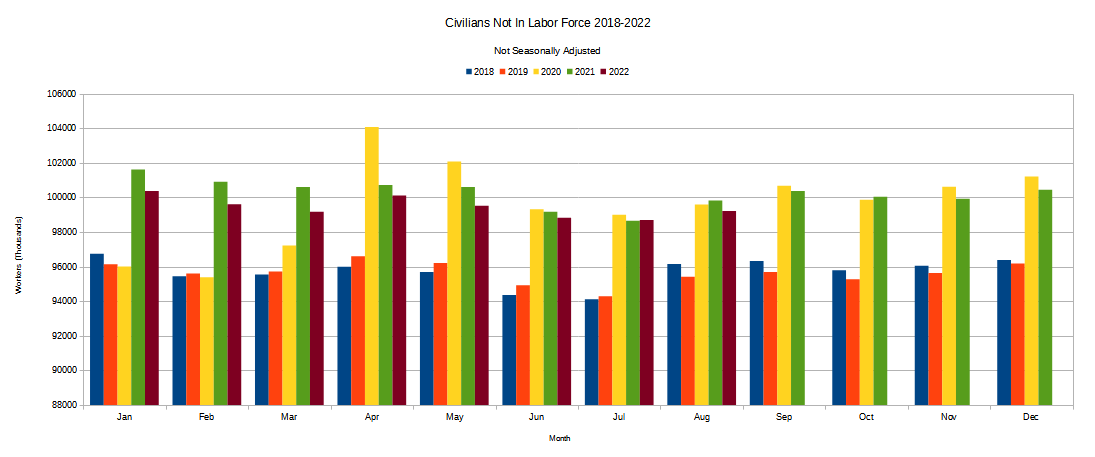

For example, while the labor force participation rate did increase during August, so did the number of civilians not in the labor force.

When we index the data to January of each year, we quickly see that the growth of this population cohort not in the labor force is still higher than last year’s pace for August.

If the number of people not in the labor force actually grew in August, how does the labor force participation rate increase? The answer is, once again, “seasonal adjustments.” If you examine the raw data, the labor force participation actually decreased in August.

However, while the seasonally adjusted increase is not quite as strong a data point as the corporate media might make it out to be, the difference between the seasonally adjusted data and the raw data is not altogether facetious and arbitrary. If we expand the timeline on the data back to 2011, we can quickly see that there are regular movements up and down on the raw data graph, movements which are simply seasonally-derived fluctuations that have no real bearing on the state of the economy. The seasonal adjustment process merely smooths out those recurring bumps.

The increase in labor force participation in the face of an increase in the number of people not in the labor force merely means that many more people joined the labor force than stayed out of it. That is very much a good thing, although better still would be if the number of people not in the labor force declined in the raw data and not just in the seasonally adjusted data.

Overall, the data underneath the headline numbers is at least consistent with the headline numbers, which could not be said of last month’s report.

However, there is one fine print item in the report that deserves special mention here (emphasis mine):

The change in total nonfarm payroll employment for June was revised down by 105,000, from +398,000 to +293,000, and the change for July was revised down by 2,000, from +528,000 to +526,000. With these revisions, employment in June and July combined is 107,000 lower than previously reported. (Monthly revisions result from additional reports received from businesses and government agencies since the last published estimates and from the recalculation of seasonal factors.)

While the BLS is reporting 315K new jobs for the month of August, they are also taking away 107K jobs from June and July. Just like that, one-third of the August jobs tally simply disappeared from June and July.

The Real Bad News

Where the Employment Situation Summary really struggles to turn a negative into a positive is where it discusses growth in wages for the US. It doesn’t do a very good job of it.

In August, average hourly earnings for all employees on private nonfarm payrolls rose by 10 cents, or 0.3 percent, to $32.36. Over the past 12 months, average hourly earnings have increased by 5.2 percent. In August, average hourly earnings of private-sector production and nonsupervisory employees rose by 10 cents, or 0.4 percent, to $27.68. (See tables B-3 and B-8.)

For each hour worked in August, workers made an additional $0.10. Over a 40-hour work week that is a whopping $4.00. (Try not to spend it all in one place!)

What the Employment Summary does not mention is that inflation long ago gobbled up that extra dime, and then some. An increase in earnings of 5.2% when inflation is running above 8.5% is a loss of real income, not a gain.

The fact that the raw data on earnings showed earnings declining month-on-month as well merely underscores the reality that, in the present environment, workers are losing their income to inflation at a pretty good clip, and have been since last summer.

Something For Everyone

Ultimately, the August Employment Situation Summary had a little something for everyone. Those who were looking for signs of economic health and vitality got an increase in jobs. Those who want to see a softening of labor markets can point to rising unemployment . Those looking to justify Powell’s interest rate hikes as the best medicine for a toxic economy can point to anemic earnings growth in the face of inflation as an argument for the Powell’s continued interest rate hikes.

What the Employment Situation Summary does not show—and has never shown at all this year—is a labor market that meets the typical notions of “strong.”

Wages are not rising to keep pace with inflation, and workers are losing a significant chunk of their paycheck each and every month to inflation.

There is job growth, although not as much as previous reports have claimed, nor as much as is likely to withstand future revisions.

Workers are moving into the labor force, although an increasing number of erstwhile workers are remaining out of it.

Powell will no doubt be pleased with the August jobs report, as there is just “enough” good news for him to be able to rationalize continuing his rate hikes. Unfortunately, he will likely still not look at the internals of the report to realize just how thin that “good” news really is.

The bar charts were made using LibreOffice Calc 7.3.2.2, with data downloaded directly from the BLS at https://www.bls.gov/data/#employment