In War And In Peace, Always Follow The Money

Will China's Economy Be One Of The Unintended Casualties?

To say there will be huge economic fallout from Vladimir Putin's “special military operation” in Ukraine is both patently obvious and tendentiously trite.

Still, the economic impacts will be real, and must be considered, as not all of them are intuitively obvious. To appreciate them all, the hoary cliche of “follow the money” becomes good advice. When we do follow the money--in particular currency exchange rates--we see an unexpected potential casualty: China.

The Ruble Crashes

That the Russian ruble nosedived against the major currencies of the world is hardly surprising. Yet as I have already noted, the Russian ruble also nosedived against the Chinese yuan.

China is supposed to be Russia's counterweight to the West, and an avenue to lessen economic reliance on the West.

China-Russia bilateral trade in 2021 grew 35.9 percent year-on-year, reaching $146.8 billion, exceeding the threshold of $140 billion for the first time, an all-time high, official data showed. The two nations have set a goal of reaching $200 billion in bilateral trade by 2024.

A ruble collapsing in value against the yuan does not help Russia's efforts to encourage Chinese investment, efforts which some observers say are already struggling.

Russia is also failing to attract Chinese investors, according to Andrej Krickovic, an associate professor with the Moscow-based National Research University’s higher school of economics.

If Putin's plans include swapping trade with Europe for trade with China, the early currency movements after his Ukrainian adventure began suggest they may not pan out.

The Euro Ebbs

Yet the ruble is not the only currency to crater against the yuan immediately following Russia's attack on Ukraine. The euro also posted a precipitous decline.

The quick read of this drop is that currency markets are anticipating fairly global trade dislocations for Europe, ultimately impacting its trade with China.

The Dollar Dips

Perhaps the most surprising currency shift arising from events in Ukraine is the dollar's dramatic drop against the yuan.

As with the euro, the dollar drop on the surface appears to be a currency pricing in the potential for an extended war in Ukraine, with consequent trade dislocations.

The dollar drop against the yuan does not appear to be a “flight to safety” movement commonly seen in the early stages of a geopolitical crisis. That shift is still very much to the dollar, which has predictably surged against the euro.

Not What China Wanted

China's problem with these currency shifts is that they are the exact opposite of what Beijing wants. Referring back to each currency's movement against the yuan, one sees significant weakening of the yuan against the ruble, the euro, and the dollar in late January.

That shift was not accidental, but a deliberate weakening of the yuan as part of China's own efforts to manage its own economic problems.

The central parity rate of the Chinese currency renminbi, or the yuan, weakened 136 pips to 6.3382 against the U.S. dollar Thursday, according to the China Foreign Exchange Trade System.

In China's spot foreign exchange market, the yuan is allowed to rise or fall by 2 percent from the central parity rate each trading day.

Putin's Ukraine gambit has essentially erased all of the currency positioning by China over the past month. While there some rebound by the dollar in intraday currency trading, the yuan is still significantly stronger against the dollar. If Beijing intends a weaker yuan as part of its own economic safety net, it is now faced with having to execute an even greater currency manipulation than before.

Many Losers, Probably No Winners

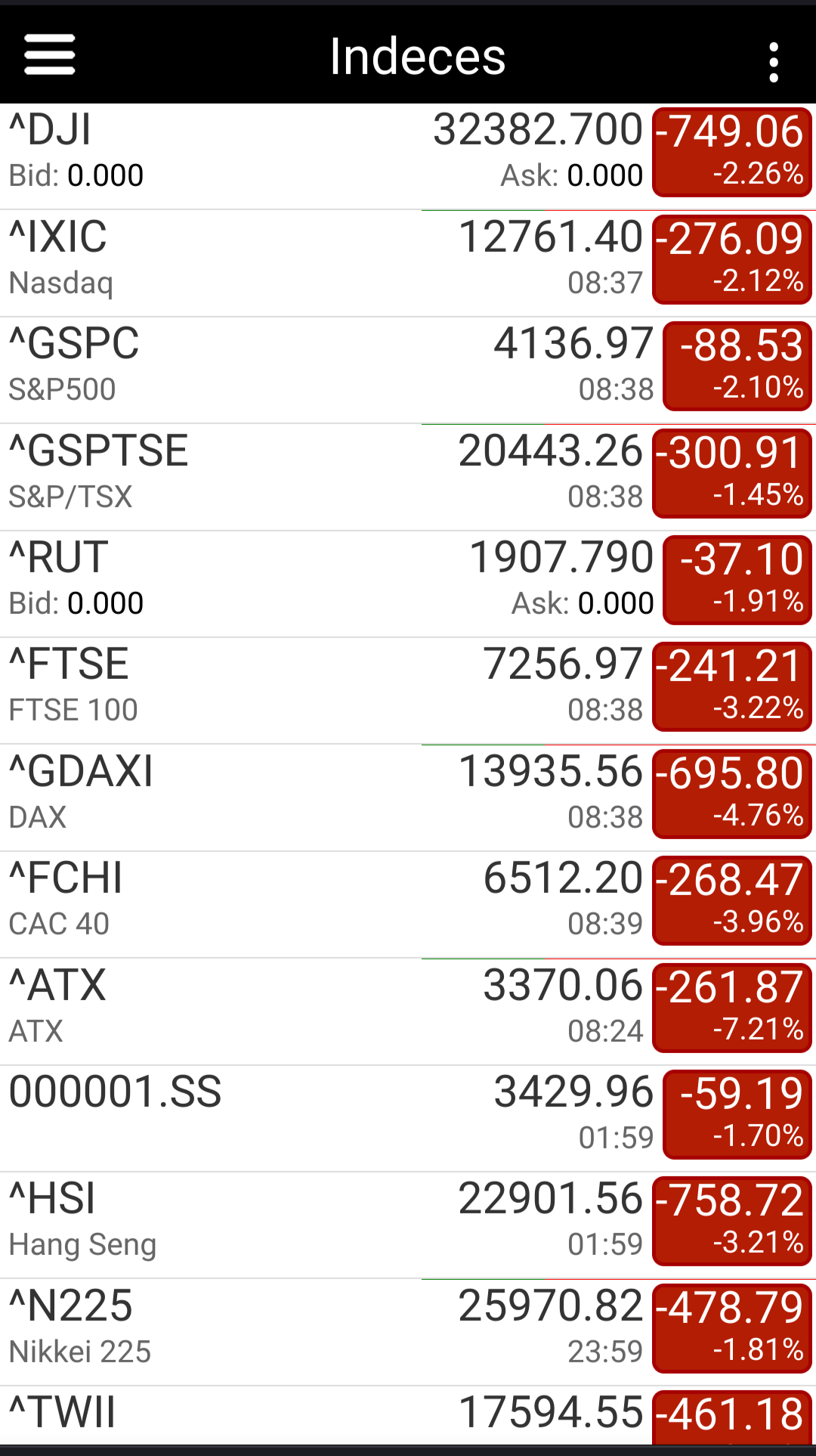

This outburst of war in Ukraine is already roiling global markets. As of this writing all major stock indices are in the red.

Whatever the political outcome of these events may be, the economic costs are already mounting around the globe. The price of this war is literally being paid by everyone.

In that sense, at least, this is already a “world war”.

Backed up the truck and loaded precious metal puts this morning (SLV & GDXJ). Am I crazy?