Inflation Is Coming Down, So Naturally The Fed Will Keep Raising Rates

Because Reasons

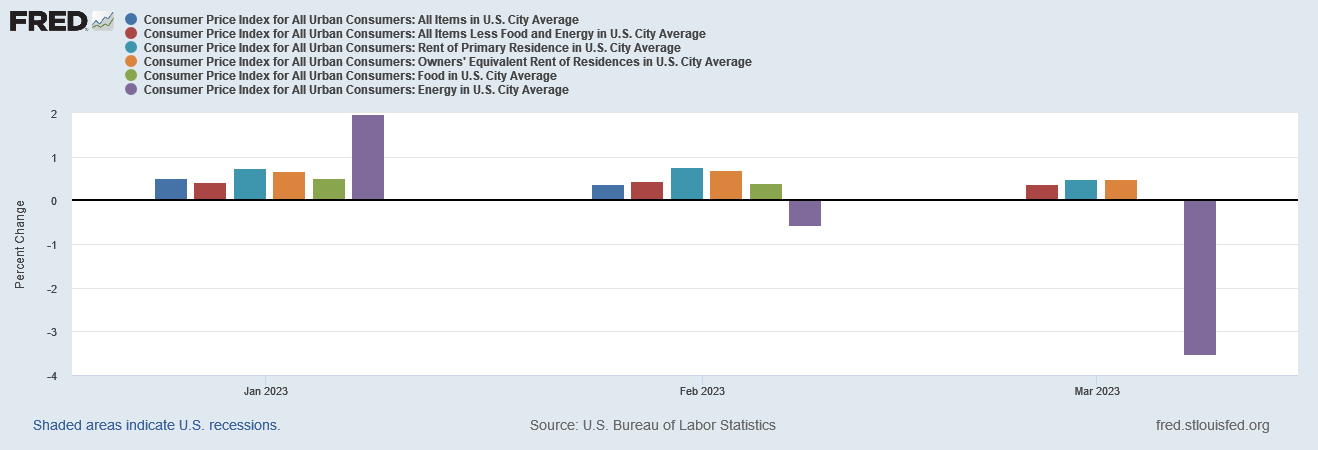

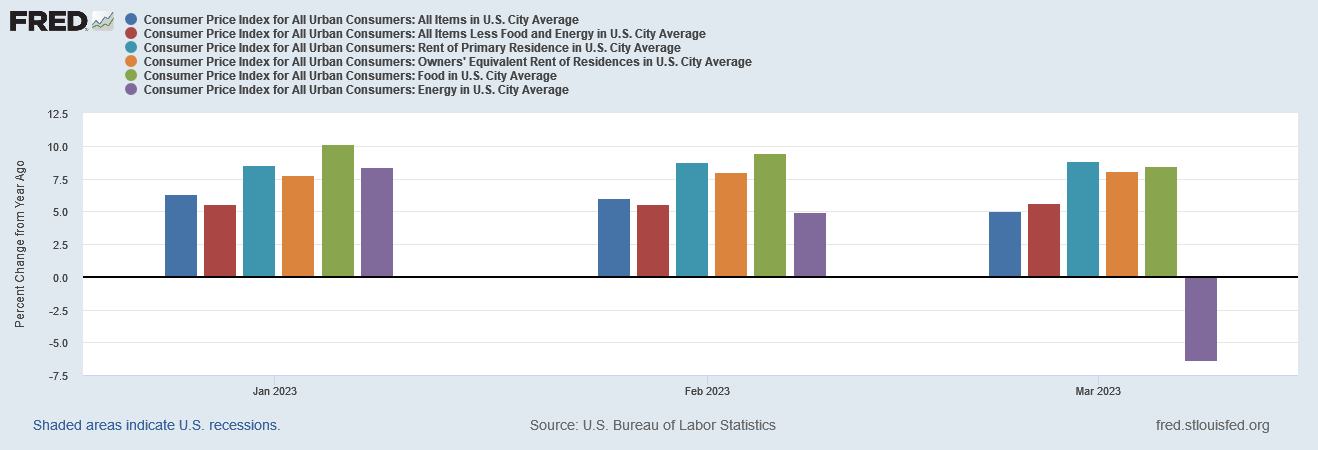

The March Consumer Price Index Summary contained some legitimately good news. Headline consumer price inflation dropped by a full percentage point from March, energy prices declined outright, dropping 3.5 percent on a seasonally adjusted basis, and even shelter price inflation eased somewhat.

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in March on a seasonally adjusted basis, after increasing 0.4 percent in February, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 5.0 percent before seasonal adjustment.

The index for shelter was by far the largest contributor to the monthly all items increase. This more than offset a decline in the energy index, which decreased 3.5 percent over the month as all major energy component indexes declined. The food index was unchanged in March with the food at home index falling 0.3 percent.

On its face, the March inflation report was one of the best since the Fed began its rate hike campaign in an effort to corral consumer price inflation.

So why was Wall Street not happy?

By every expected measure, Wall Street was not happy with the March CPI report.

Stocks declined throughout the day yesterday, after an initial jump at the starting bell.

Treasury yields were up and down yesterday, with the 2-Year Treasury and the 10-Year Treasury closing below Tuesday’s close.

Even the dollar dropped on forex markets, posting declines against the euro, the pound, and the yuan.

How could a good inflation report make markets unhappy everywhere?

One piece of bad news is that “core” consumer price inflation (CPI inflation less food and energy), actually rose a tenth of a percentage point year on year. The primary driver of the decline in the headline inflation metric was the significant drop in energy prices—6.9% year on year.

All of March’s improvement on inflation came from declines in energy prices. For every other metric year on year and even month on month inflation gained ground in March.

Yet it was not merely that core inflation actually rose in March. Part of Wall Street’s angst over inflation was precisely that core inflation was expected to rise—and may very well keep rising over the near term.

The Cleveland Fed is publishing the Inflation Nowcast on a daily basis, and the latest update is generally consistent with the market consensus expectations for March, although there is the risk that the core CPI comes at the higher than expected 5.7% reading (if you round up the 5.66% Nowcast expectation).

However, the Nowcast core CPI forecast for April is still at 5.6%, which suggests that the disinflationary trend in the core CPI has really plateaued at a very high level at around 5.5%.

Inflation, despite posting significant improvement in March, is poised to tick upwards again. Certainly energy prices are going to put upward pressure on prices in April, given the recent price appreciation for West Texas Intermediate crude, which broke out of its previous plateau to the upside.

Oil prices yesterday showed the results of a positive feedback effect—given that the inflation report produced a drop in the dollar against other leading currencies, that sudden weakness in the greenback forced oil prices upwards, with even Brent prices moving higher.

Because disinflation has arguably “bottomed out”, forex traders moved out of the dollar, which pushed oil prices higher, which is setting the stage for more energy price inflation in April and perhaps beyond, proving that disinflation has bottomed out.

The good news in the inflation report was that inflation had come down. The bad news in the inflation report was that there likely would be no more good news going forward.

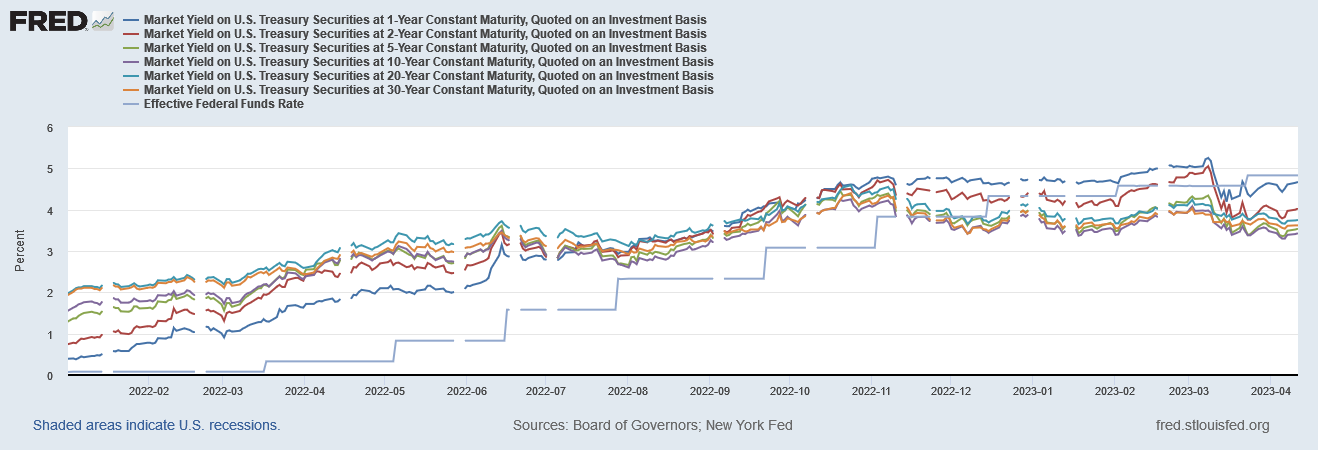

The likelihood that inflation has “bottomed out” is in truth very bad news for Wall Street, as it means the Fed will continue with its rate-hike strategy even though it has failed to bring consumer price inflation below the holy grail number of 2% year on year. Certainly Wall Street continues to price in a 25bps hike in the federal funds rate at the next FOMC meeting in May.

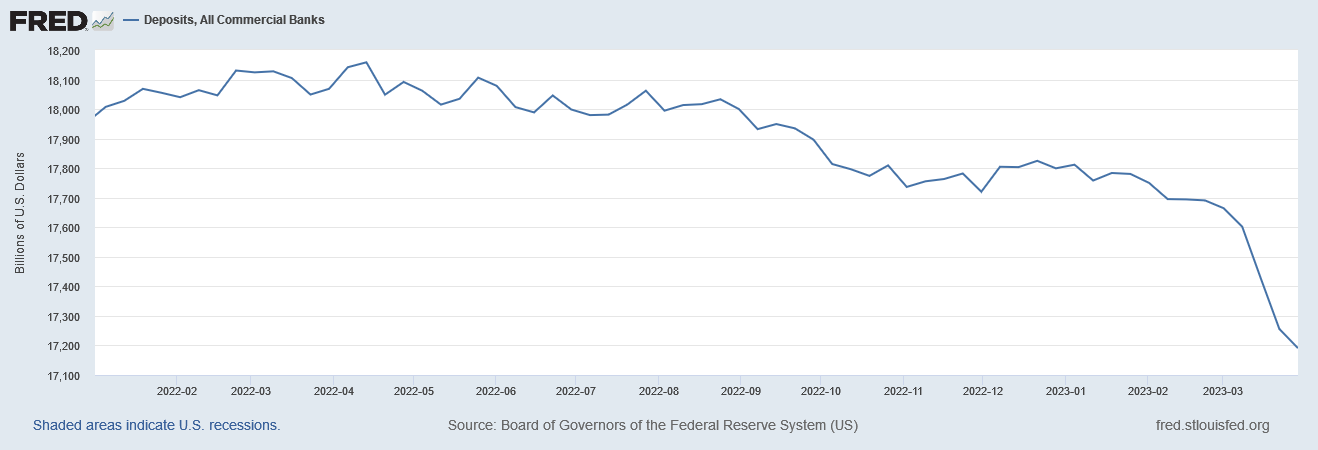

If the Fed follows through with a rate hike to the federal funds rate in May—as it certainly has given every indication that it will—it will move closer to an unstoppable banking crisis.

Remember, as I have pointed out innumerable times before, the Fed’s increases to the federal funds rate has not produced any real growth in interest rates since November of last year.

Regardless, banks are still hemorrhaging deposits—a trend which accelerated in recent weeks.

At the same time, commercial loan delinquencies, which had been declining, are showing signs of bottoming out and even starting to rise.

Wall Street is anticipating an extremely bad year for commercial real estate. The market value of real estate income trusts (REITs), have dropped some 20% since peaking in late December of 2021.

Commercial mortgage backed securities, as an asset class, have also shed some 13% in market value since the start of 2022.

None of this bodes well for the $450 Billion in commercial real estate loans coming due in 2023, loans which will have to be either repaid, refinanced, or defaulted. If the Fed continues to apply upward pressure on interest rates, it will only increase the level of defaults among the maturing loan portfolios and make the resulting credit crisis that much worse.

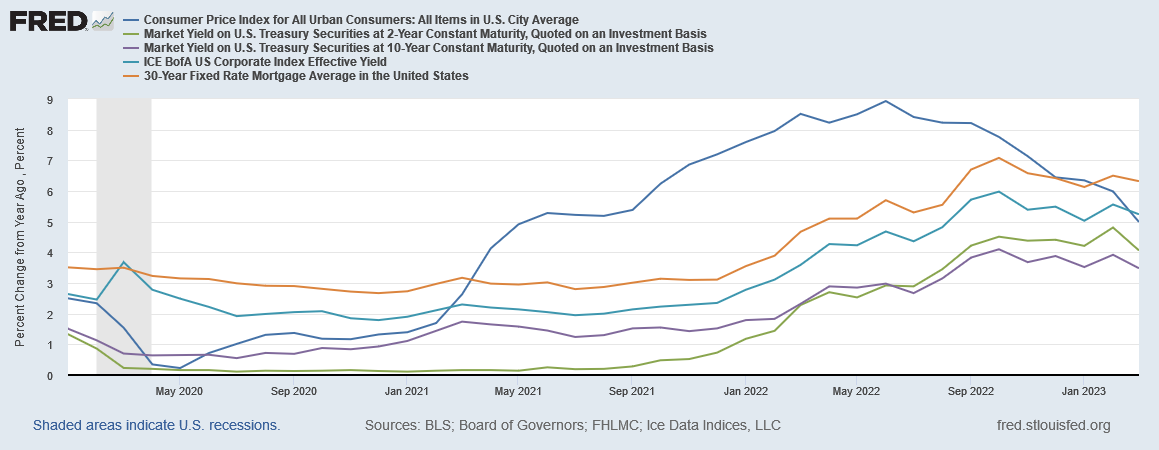

The perverse irony here is that, with headline consumer price inflation having come down to 5%, it is now coming in below market interest rates. Year on year inflation is now less than a 30-year mortgage interest rate as well as the effective yield on investment-grade corporate debt.

While consumer price inflation is still well above the Fed’s 2% year on year inflation target, it has come down far enough while interest rates have risen far enough that the Fed can claim success with their rate hike strategy and at least declare a pause on future rate hikes. Such a claim would, of course, be complete nonsense, as the data does not bolster any argument that hiking the federal funds rate has brought down inflation, but it could prove to be beneficial nonsense, if it allowed the Fed enough breathing room to not continue to apply upward pressure on interest rates in a market environment that has little appetite for rising interest rates.

The March Consumer Price Index Summary does not leave much room for optimism about future declines in consumer price inflation, but it contains enough good news about declines in inflation thus far that the Fed could use it as the departure point to exit its failed and economically damaging rate hike strategy. Wall Street does not see the Fed doing that, however, and neither do I.

Regardless of what the underlying data indicates the Fed is likely to persist in its simplistic thinking that “inflation is above 2%, so interest rates must go up”. For all the Fed’s insistence that it is “data driven”, the Fed has consistently ignored most of the data, and nearly all of the most relevant data, doubling down at every turn on a rate hike narrative and strategy that is doing far more harm than good.

Why is Jay Powell doing this? Because reasons.

Any guess as to how much of an interest rate hike it would take to cause a severe banking crisis? For example, a quarter-point increase this year could be weathered, but anything greater would be disastrous?

Meanwhile, back at the fed . . . https://fortune.com/2023/04/14/will-fed-hike-interest-rates-inflation-christopher-waller