With the holiday shopping season about to begin in earnest, it is almost reflexive to ponder how much prices are likely to go up for the month of November.

Consumer price inflation has been heating up of late. Should we expect that trend to continue? Or are deflationary forces likely to push the inflation rate down for us?

As has been the norm all along, we are almost sure to see a mixture of both inflation and deflation, when looking at the various components of the Consumer Price Index.

Given that corporate media does a perfectly craptacular job of dissecting the inflation numbers when they get released each month, it’s worth exploring how different components feed into the consumer price index, and tell us if the economy is experiencing consumer price inflation, consumer price deflation, or a combination of the two, which at significant levels becomes on flavor of stagflation or another.

Let us see what the data has to say.

I will begin by looking at the InflationNow “nowcast” maintained by the Cleveland Federal Reserve. The nowcast is a running estimate of current inflation that is updated daily by the Cleveland Fed as economic data is generated throughout the month and the quarter.

Currently, the InflationNow estimate is that headline consumer price inflation will rise year on year by a little more than a tenth of a percentage point, with core consumer price inflation rising by about half that much. The nowcast projection is that inflation overall is continuing to heat up in this country.

Month on month, the InflationNow nowcast projects that headline consumer price inflation will also rise, but that core consumer price inflation is actually going to come down incrementally—a welcome cooling trend given that core consumer prices is where the most persistent inflation has been in the economy.

Core consumer prices are consumer prices with food and energy prices—typically the most volatile—removed. With headline inflation moving up month on month and core inflation moving down, we can safely presume that either food or energy prices (or both) are going to show inflation in November.

Currently, there are very few indicators that we are going to see any measure of energy price inflation in November. Quite the opposite—energy prices are down on the month across the board.

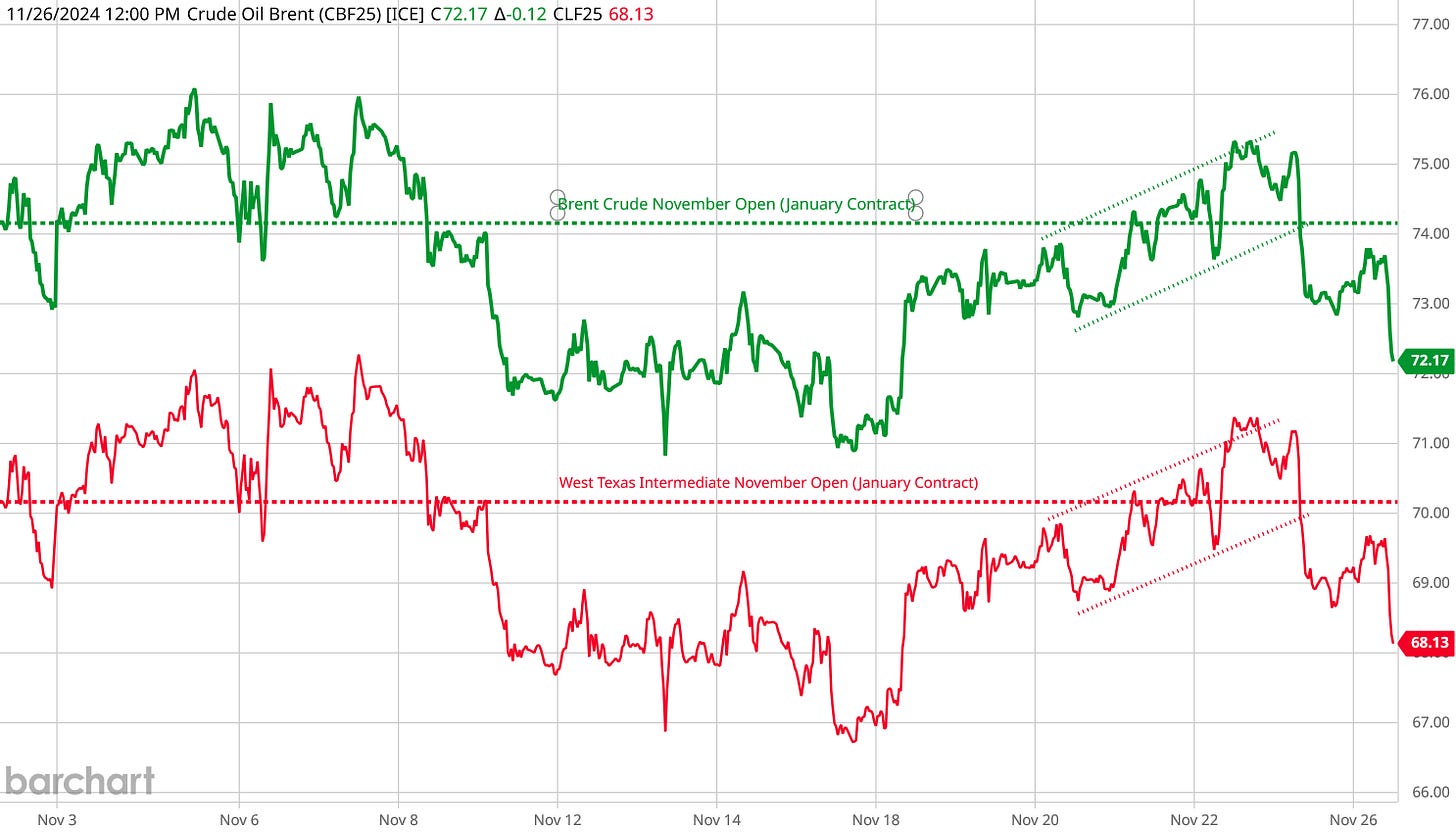

Crude oil prices lead the way in this decline after posting significant declines to begin Thanksgiving week.

Crude oil prices have been flirting with a bit of an increase on the month, having established a brief upward trend at the end of the previous week, but abruptly reversed that trend, moving significantly below the opening prices for November.

Refined products also followed the same trend, with reforumulated gasoline (RBOB) prices moving significantly lower as well.

We can safely assume, based on these price movements, that there will not be any inflation in energy prices happening during the month of November.

However, when we dig further into energy prices, we see that retail gasoline prices are trending down across the board as well.

AAA, which tracks the prices people pay at the pump for gasoline, is currently showing gas prices having dropped around 7 cents per gallon of gas over the past month.

The government’s Energy Information Administration data is also showing retail gas prices declining in November.

The gasoline price-tracking webiste Gasbuddy.com also shows gasoline prices coming down in November.

With all the pricing forces pushing energy prices down, we should expect energy price deflation to be larger than it was last month, when it all but disappeared.

If we are anticipating noticeable energy price deflation, however, that means we are likely to see noticeable food price inflation. If headline inflation is moving up, incrementally, core inflation is moving down incrementally, and energy prices are moving down more than incrementally, food prices—the other element in headline inflation removed before examining core inflation—must be going up.

We cannot say with certainty what the November food price inflation rate will be, but September’s month on month food price inflation rate was 0.4%. Depending on how significant November’s energy price deflation turns out to be, we may be seeing similar food price inflation rates in November.

When we look at the factors which drive consumer prices for goods, such as commodities prices, we are seeing again a slight deflationary signal, with commodity indices all moving incrementally lower on the month.

Prices for the raw materials which go into the manufacture of various physical goods are moving slightly lower on the month, and so we have yet another downward price pressure in for consumer goods.

The deflationary signal in commodities is amplified by the November Flash Purchasing Manager’s Index for Manufacturing, which is showing manufacturing to be in its fifth consecutive month of contraction.

With overall manufacturing output declining, prices are going to decline as well. If prices were rising that would be putting pressure on suppliers to expand manufacturing output. As that is not happening, we can safely assume that in November we will see more goods price deflation.

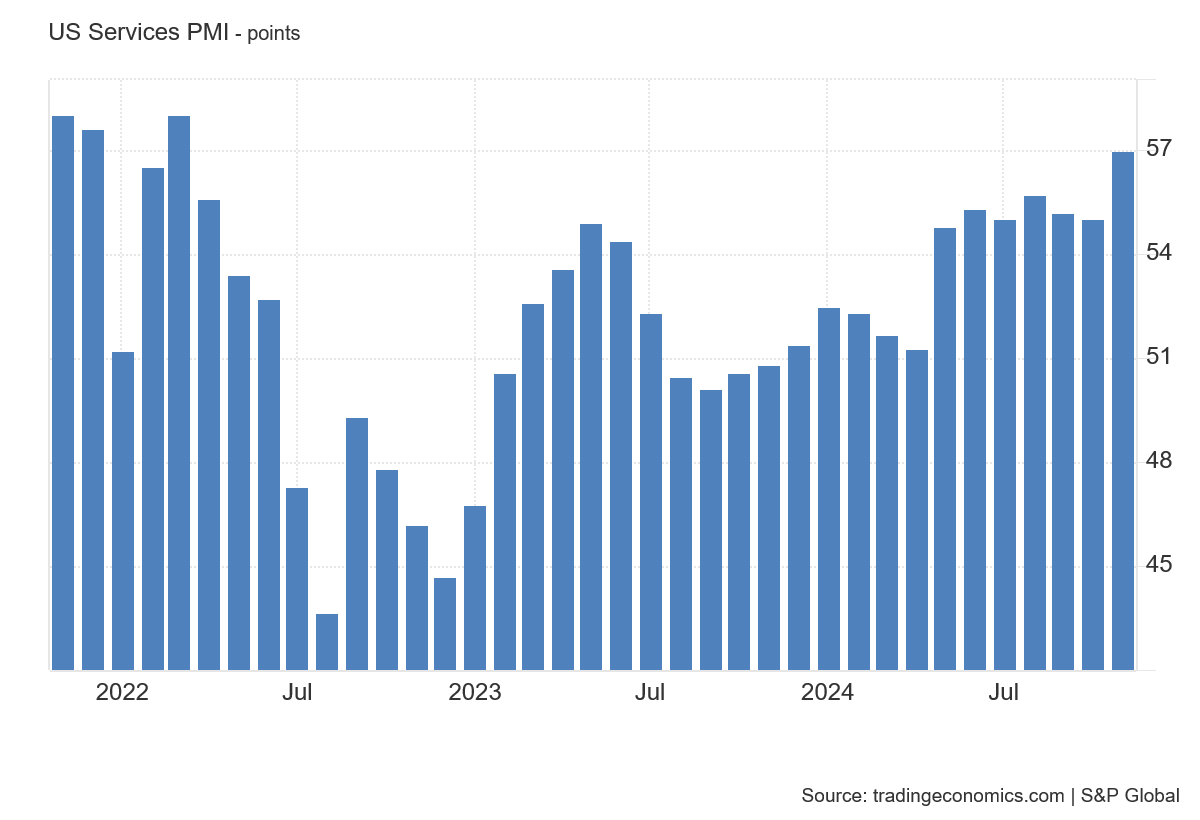

Where the PMI data continues to show strong expansion is in services.

Services, readers will recall from my earlier articles on inflation, is where we have seen sustained inflation even after the end of 2022’s hyperinflation cycle. Based on the extant data, that trend is continuing. Just as with manufacturing, sustained high and expanding levels of output indicate strong demand which in turn indicates upward pressures on prices—i.e., inflation.

How will all these various forces and factors resolve into the consumer price index measurement for November?

Most likely, we will see an incremental uptick in year on year consumer price inflation, just as the InflationNow nowcast suggests (InflationNow has a pretty good track record for accuracy, and is rarely off by more than a couple tenths of a percentage point).

Yet it bears repeating that we are seeing a combination of prices which are trending down and prices which are trending up. We are seeing both consumer price inflation and consumer price deflation, within the same overall index and in the same month.

Energy prices are trending down, and are in deflation.

Food prices are likely to be trending up, and are in inflation.

Goods prices appear to be trending down, and are in deflation.

Services remain trending up and are absolutely in inflation.

These components of the Consumer Price Index will get amalgamated together, and the combination of inflation and deflation they represent will be resolved into a single figure showing either consumer price inflation or consumer price deflation.

However, we should never make the mistake of assuming that the overall CPI metric is anything more than a broadbrush trend. The price movements among the various components of the CPI are in almost every regard more meaningful than movement in the overall CPI itself. Certainly rising food prices and falling gasoline prices are going to have more resonance with people than a rise or fall in an abstract index value.

Rising food prices and falling gasoline prices are indeed what we are likely to see when the November Consumer Price Index data is published. Inflation and deflation will be present, just as they ultimately have been present for quite some time within the data.

That consumer price data frequently shows such bipolar behavior is a reminder that there are many layers within that data, and to properly understand the data we have to peel back all of those layers. We have to look at the individual details to truly understand the data overall.

Stagflation on the way?

You would think that with all the talk about WW3 looming, energy prices would be trending upward. Peter, do you think that the markets are showing confidence in Trump being able to end the Ukrainian war? Or are other factors more significant?