The Producer Price Index is generally apprehended as a leading indicator for the Consumer Price Index. Where producer prices go today, consumer prices are likely to go a month or two down the road.

There is a touch of irony, therefore, in yesterday’s Producer Price Index Summary foreshadowing today’s Consumer Price Index Summary, with mixed and muddled signals galore.

Much like the PPI report, the September Consumer Price Index Summary presents consumer price inflation as printing at above expectations.

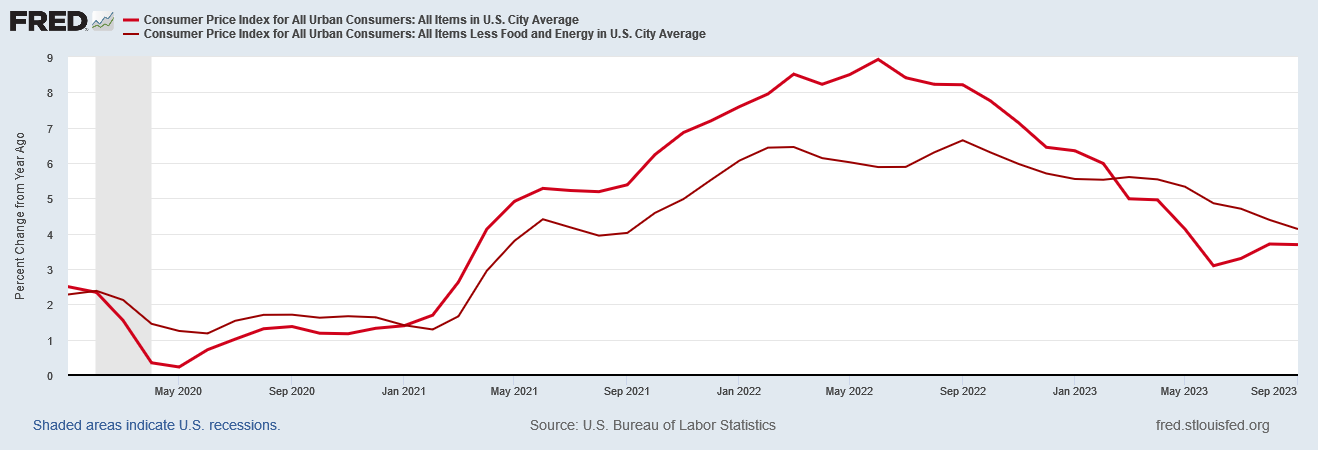

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4 percent in September on a seasonally adjusted basis, after increasing 0.6 percent in August, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.7 percent before seasonal adjustment.

This was a disappointment to the “experts” and to the corporate media, which had prognosticated further cooling of consumer price inflation.

On Thursday, investors will watch closely for one of the most important data points the Federal Reserve will consider in its next interest rate decision: September's Consumer Price Index (CPI).

The report, set for release at 8:30 a.m. ET, is expected to show headline inflation of 3.6%, a slight deceleration from August's 3.7% annual gain in prices, according to estimates from Bloomberg.

Over the prior month, consumer prices are expected to have risen 0.3% in September, a slower clip than August's 0.6% monthly increase.

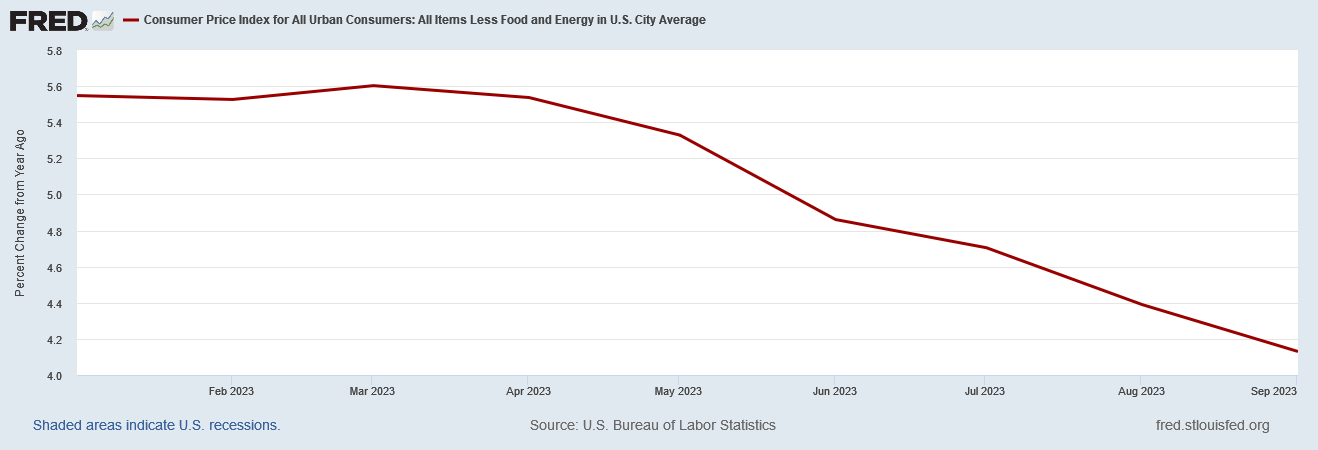

However, “core” inflation for September printed right where the experts predicted: 4.1% year on year and 0.3% month on month.

Is consumer price inflation heating up or cooling down? As with producer price inflation, the answer is a stagflationary “yes”.

When we look at headline consumer price inflation and “core” inflation together, we immediately see that a dichotomy has emerged in the past few months: headline inflation is increasing and core inflation is decreasing.

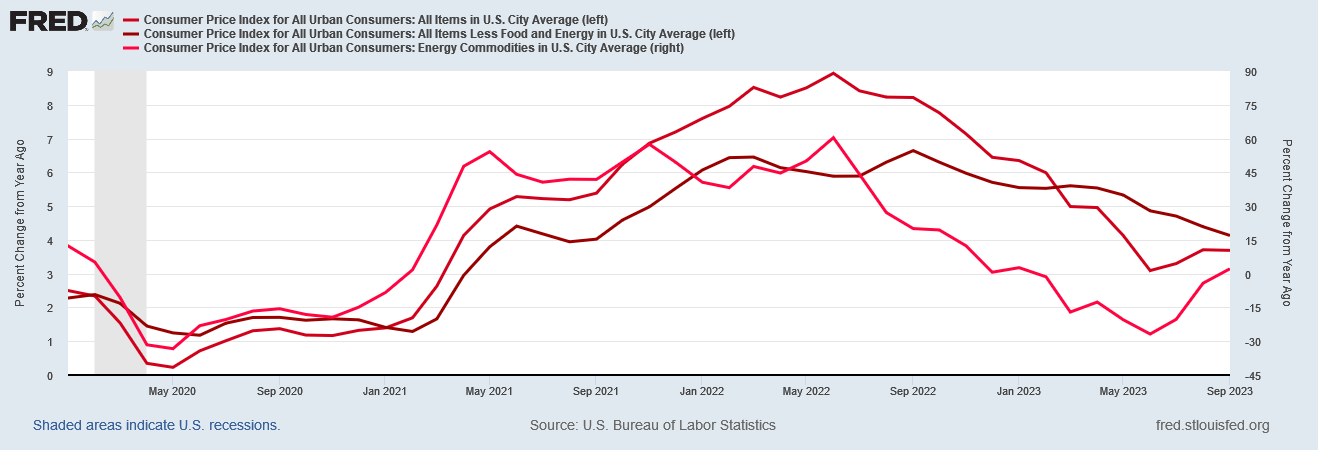

We do not need to look very far to find the source of the variance: once again, the culprit is energy price inflation, as is plain when we overlay the Consumer Price Index for Energy Commodities

The rise and fall of energy prices not only accounts for most of the excess of headline inflation over core inflation throughout 2022, but the decline of energy prices since June of last year is what has brought headline inflation down much more rapidly than core inflation, and—as noted last month—it is what is pushing headline inflation up now.

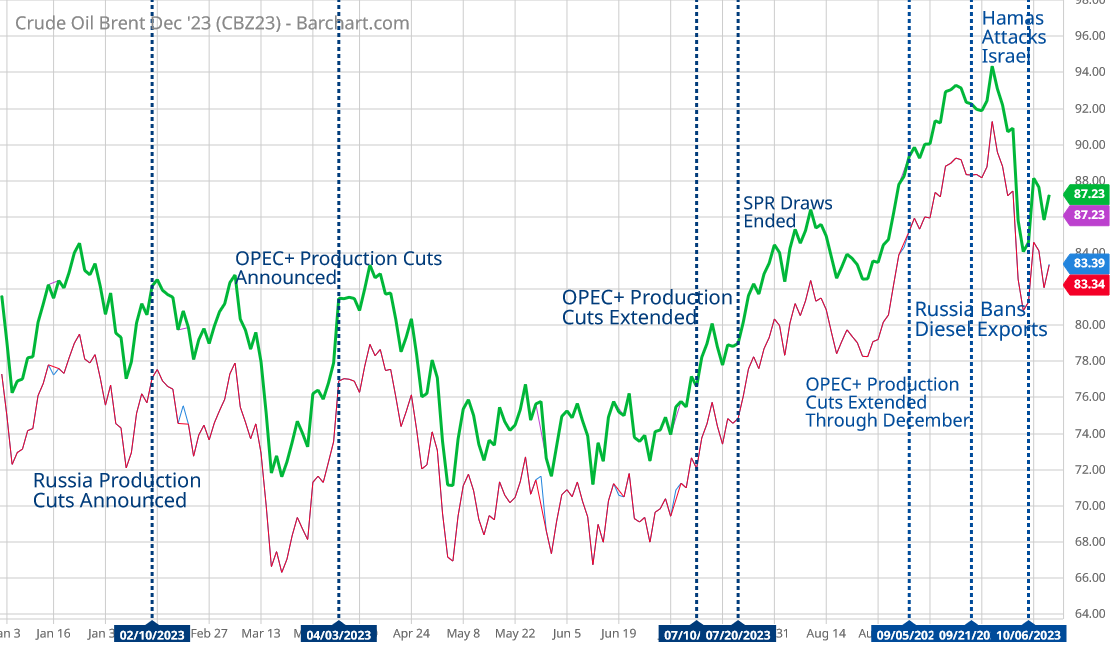

The energy index signals, readers may recall, are confirmed by the benchmark market prices for crude oil.

If we look at the energy index year-to-date, we see it tracks crude oil prices fairly closely.

(I want to digress for a moment to highlight the excellent summation byHolly MathNerd on the importance of context and examining data in multiple dimension; a critical failure of the corporate media in presenting inflation and other data has been a lack of contextualization. One reason my articles grow lengthy is because I strive to provide context and suitable framing for digesting the data.)

Yet we also are seeing something besides rising energy prices in the energy index. As the inflection point in August shows, and as benchmark prices for crude oil confirm, energy price rises are easing, and market prices indicate they peaked mid-month.

Diesel and gasoline prices also confirm these trends.

For headline inflation at least, while energy prices have been pushing the overall price level up, there are more than a few signals suggesting that upward push has abated for the time being, depending on whether or not we see further escalation between Israel and Hamas.

This is encouraging news on inflation, because if we look back at the core inflation chart we see that inflation among other elements in the consumer price index has been easing in recent months—between March and May year on year core inflation began to decrease more rapidly than before.

Much of that has been due to deflation within various goods and commodities.

Yet we are also seeing disinflation now among services, and especially if we exclude housing costs (“rent of shelter”) from the mix.

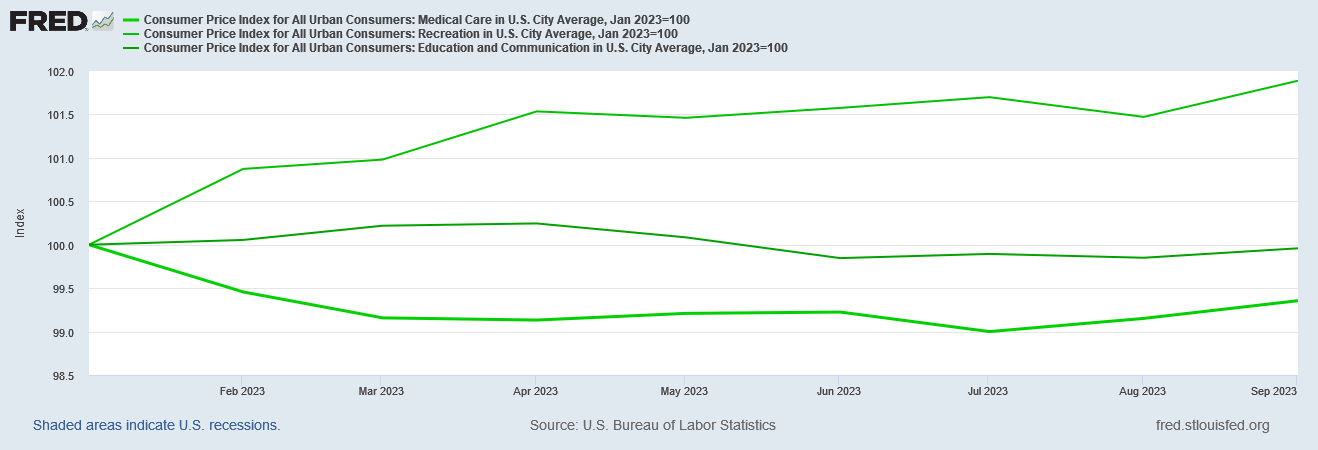

Not all services are currently seeing easing inflation, however. Prices for recreational activities are up 1.9% on the year, and while medical care prices are down 0.6% on the year, they have been rising steadily since July.

Among goods prices, new and used car prices have been in broad retreat since the spring, while apparel costs turned downward in August.

These movements within the Consumer Price Index make Wall Street’s reaction to the overall report a bit irrational—by mid-morning yesterday corporate media was reporting the Dow Jones Industrial Average down by 100 points because of the CPI report.

U.S. stocks declined Thursday as investors looked toward new consumer inflation data for greater insight on the economy, putting the major averages on track to snap their 4-day winning streak.

The Dow Jones Industrial Average dropped about 120 points, or 0.4%. The S&P 500 edged lower by 0.1% and the Nasdaq Composite added 0.1%.

Wall Street had a reflexive “oh crap!” moment at the opening bell on the headline inflation data before attempting a recovery throughout the morning.

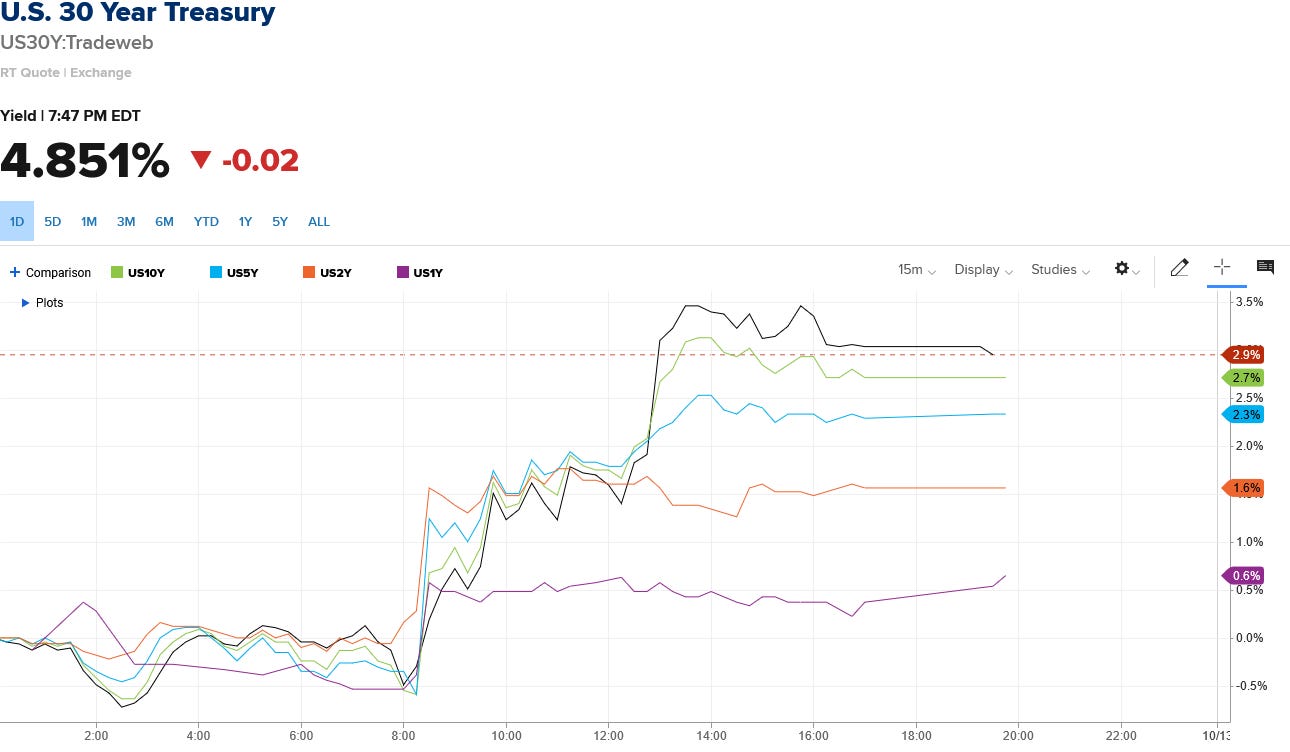

However, by mid-day Treasury yields jumped, rising nearly 20bps on the day for the 30-Year Treasury.

At the same time, stocks surrendered their recovery efforts and headed south again, with all major indices closing down on the day.

What is worrisome about the Consumer Price Index Summary, however, is that it echoes yesterday’s Producer Price Index Summary, and even last month’s Producer Price Index Summary: we have inflation here, deflation (and disinflation there), and, consequently, stagflation everywhere. When the numbers are amalgamated to yield either the “core” inflation metric or the headline inflation metric, the net effect is a slower than desired decline in consumer price inflation. For the headline number, the net effect has been an increase in consumer price inflation.

What is also cause for concern is the continuing outsized influence of energy prices upon the consumer price index. With continuing media speculation about Iran’s possible direct involvement in last weekend’s attacks by Hamas on Israel, there is ample geopolitical risk that oil prices may move sharply upwards quite literally at any time.

Absent any new supply-side shocks, particularly shocks to oil, consumer price inflation appears to be moderating and even receding. That much is good news.

What is not good news is that, for a number of consumer price elements such as rent of shelter, inflation is receding only very little and for others receding not at all. Consumer price inflation is not increasing by multiple percentage points for the moment at least, but neither is it coming down with anywhere near the speed with which it rose. Some prices are coming down, but others are proving intractable and downright stubborn.

Is inflation rising? Ultimately, no, it is not. Unfortunately it is also not coming down half as much nor half as fast as anyone would like.