Producer Prices Signal More Inflation...Or Do They?

Conflicting Signals In The Producer Price Index

While the world is understandably focused on Hamas’ horrific attack on Israel, the Bureau of Labor Statistics has released some bad news for the Federal Reserve: According to the September Producer Price Index Summary, factory gate inflation rose at the fastest pace since April.

The Producer Price Index for final demand increased 0.5 percent in September, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices rose 0.7 percent in August and 0.6 percent in July. (See table A.) On an unadjusted basis, the index for final demand advanced 2.2 percent for the 12 months ended in September, the largest increase since moving up 2.3 percent for the 12 months ended in April.

With producer prices generally considered the harbinger of consumer prices a month or two hence, rising producer price inflation is a signal that prices are going up again.

Or is it?

As is to be expected in a stagflationary scenario, the producer price indices are sending a bevy of mixed signals, and even the fresh outbreak of war in the Middle East is at this time not bringing any clarity.

At first glance, factory gate inflation does appear to be rising, as the year on year percent change has increased.

However, the delta in year on year inflation decreased in September, from a 0.81 percentage point increase in August to a .21 percentage point increase in September.

Right away, then we have cause to question once again the corporate media narrative, which is that factory gate inflation is heating up.

U.S. wholesale prices rose last month at the fastest pace since April, suggesting that inflationary pressures remain despite a year and a half of higher interest rates.

The Labor Department reported Wednesday that its producer price index — which measures inflation before it hits consumers — climbed 2.2 percent from a year earlier. That was up from a 2 percent uptick in August.

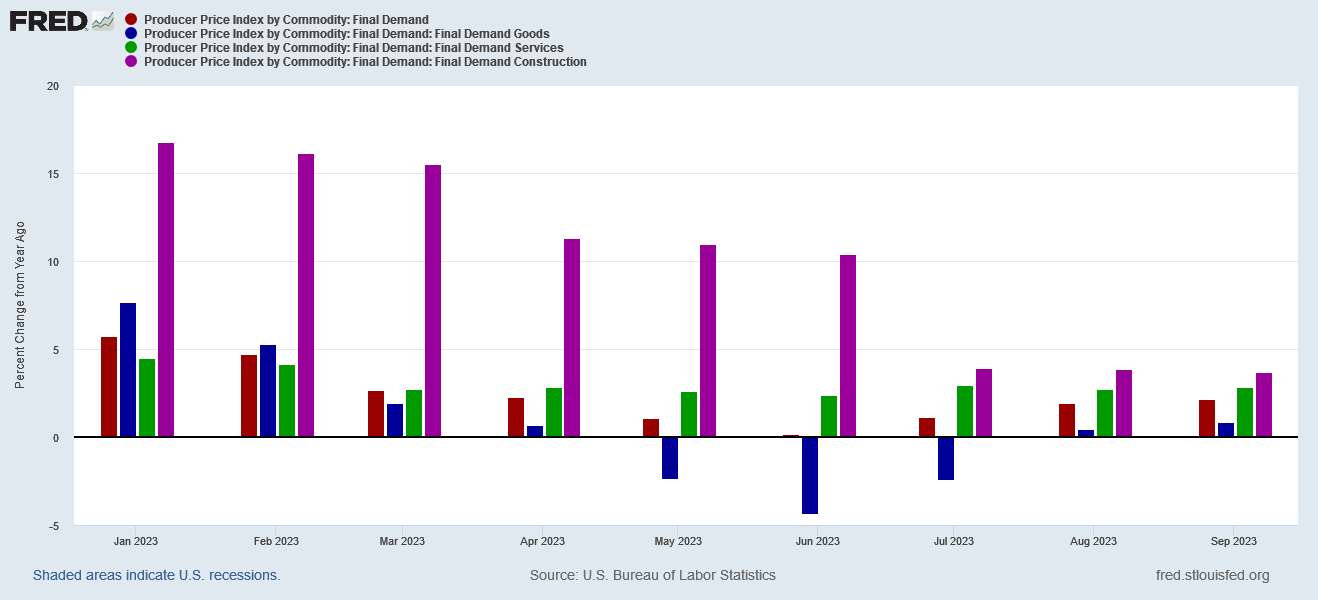

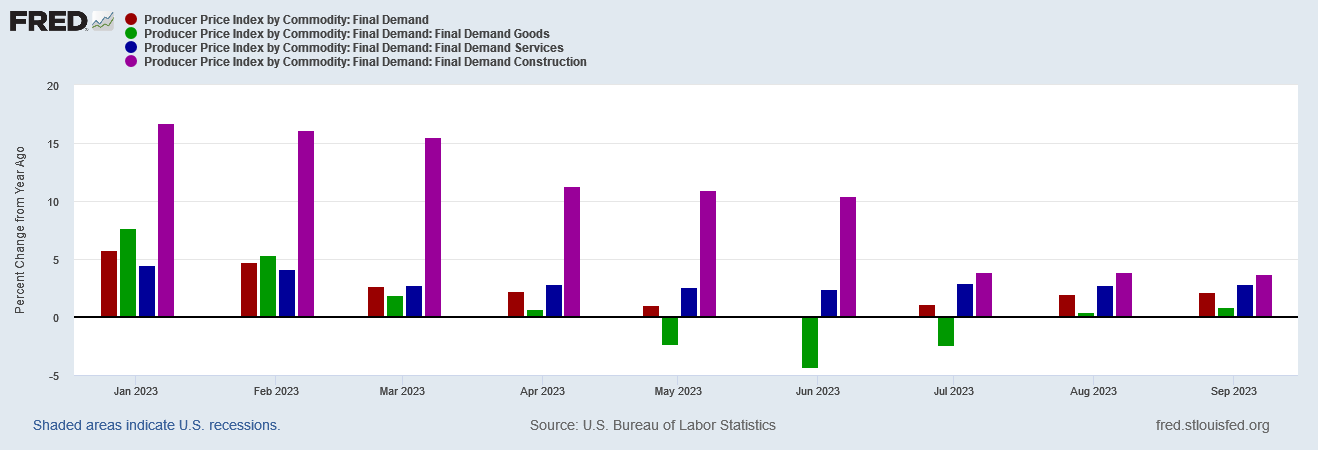

When we look at the major components of the Producer Price Index, we see that the inflation pressures appear to be cooling down from earlier in the year.

It is true that factory gate inflation rose in September, but the level of increase is not at all in proportion to the levels of decrease from earlier in the year. Construction price inflation in particular declined much more rapidly in the early part of 2023.

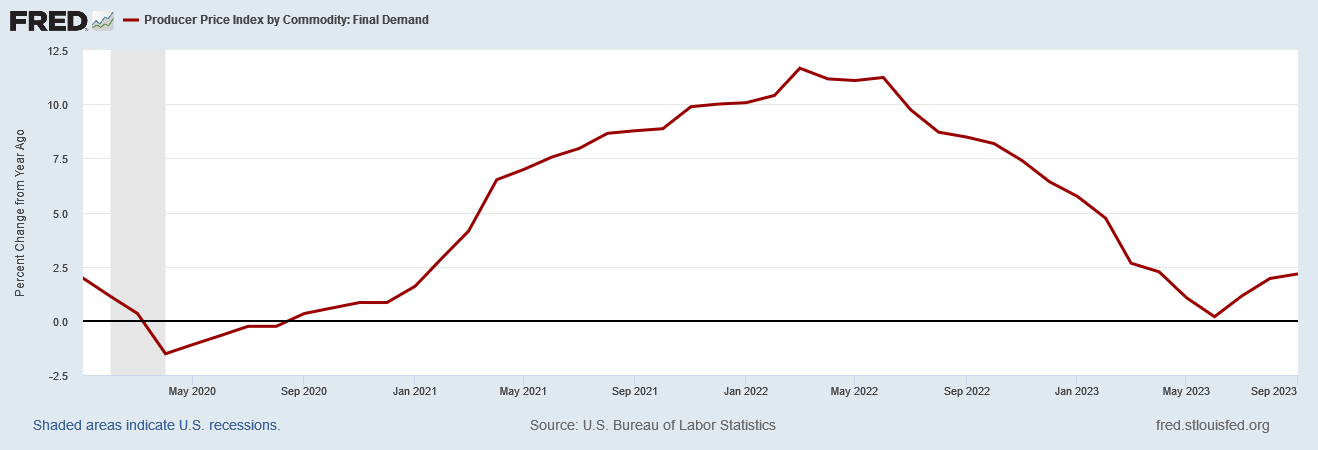

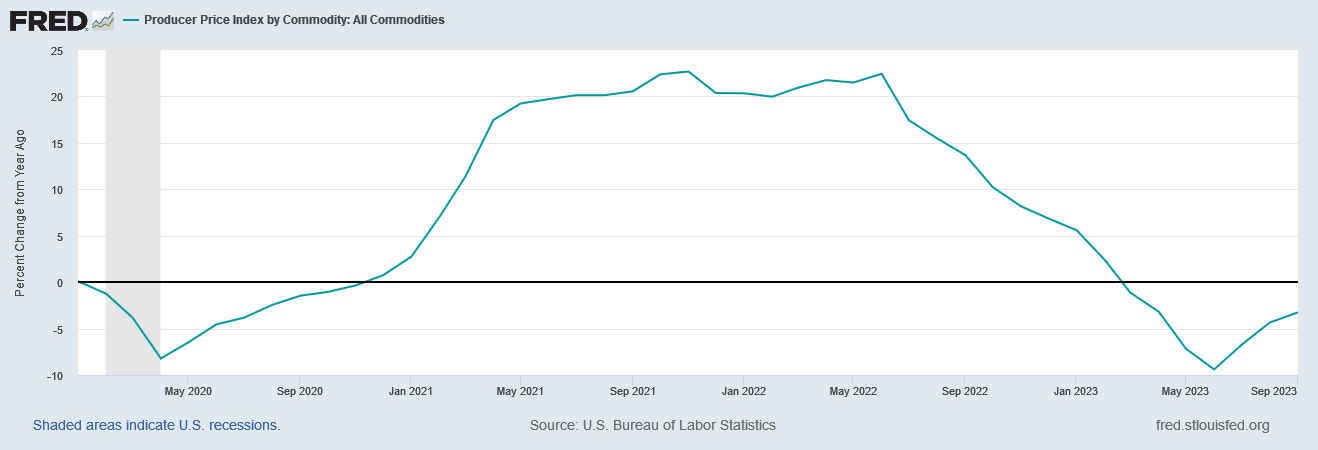

When we look at the trend in factory gate inflation since 2020, we can see that the upticks in September are truly minor.

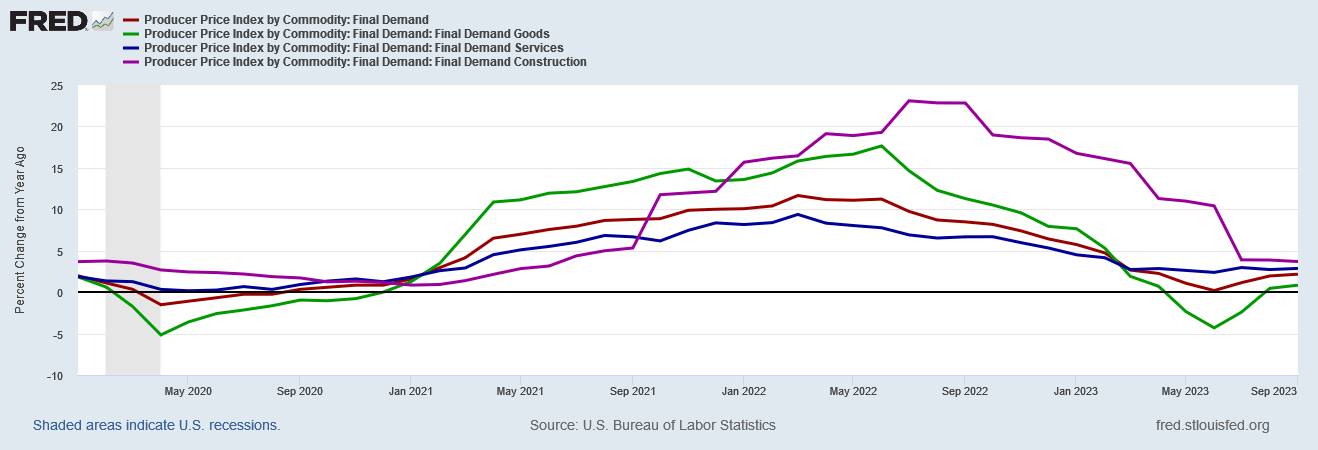

A far more significant trend is found in the horizontal movements in the sub-components of the Producer Price Index in recent months. Big shifts in inflation rates are not happening. Instead, inflation rates appear to becoming “baked in”. For goods prices that may actually mean an extended period of price deflation, but for services and construction that means elevated rates of inflation. Together they amount to stagflation.

Moreover, when we deconstruct the elements of the Producer Price Index, we find some interesting contrarian trends in the data. Most notably, commodity prices have been in outright deflation year on year since March.

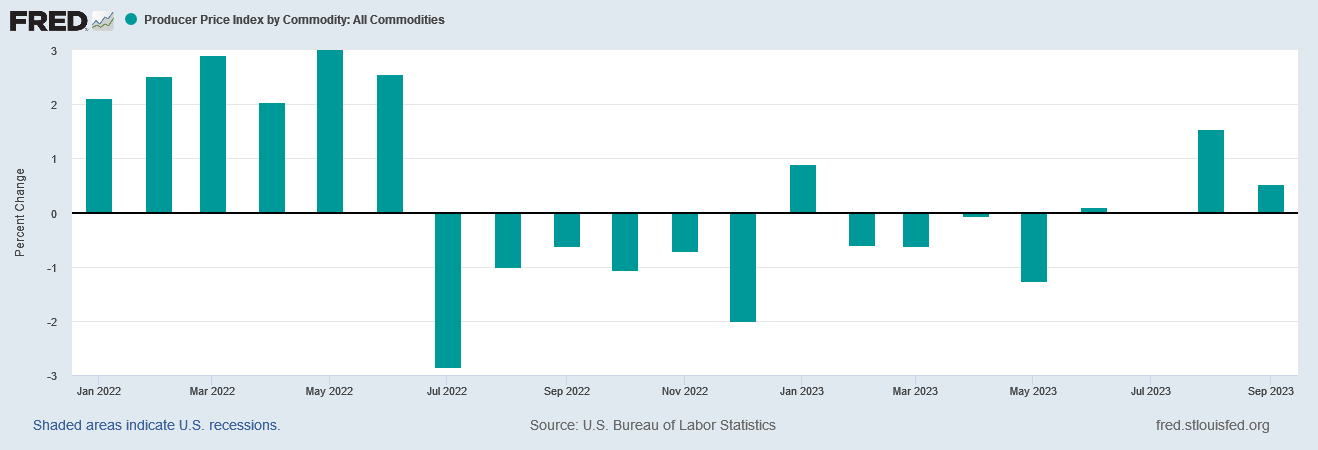

Even when we look at the month on month changes, we see commodity price inflation has cooled significantly since over a year ago.

Even from just August, commodity price inflation is down sharply. Commodities are among the key inputs for every manufacturing process. If commodity prices are down, that is a strong disinflationary force in the economy. If commodity prices are down, it is debatable how much factory gate inflation can be picking up steam of late.

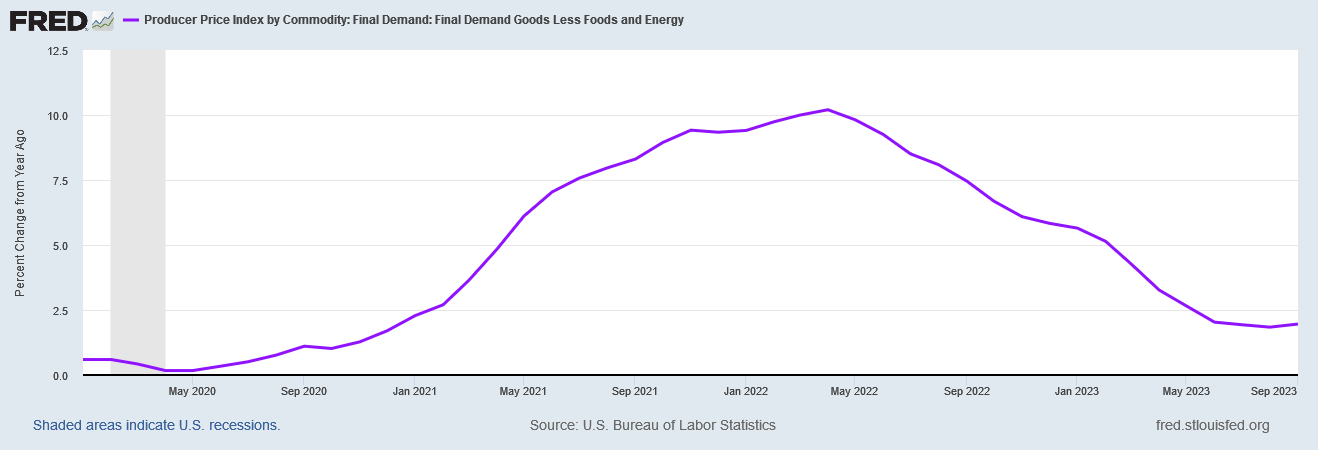

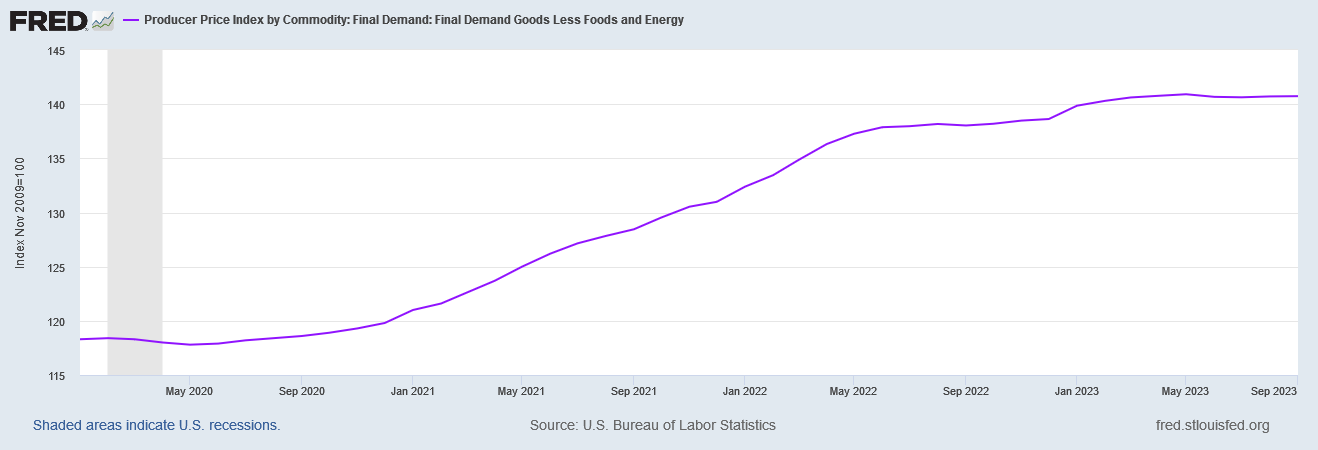

When we look at “core” factory gate inflation year on year, we see a marginal uptick compared to the large price movements in 2022.

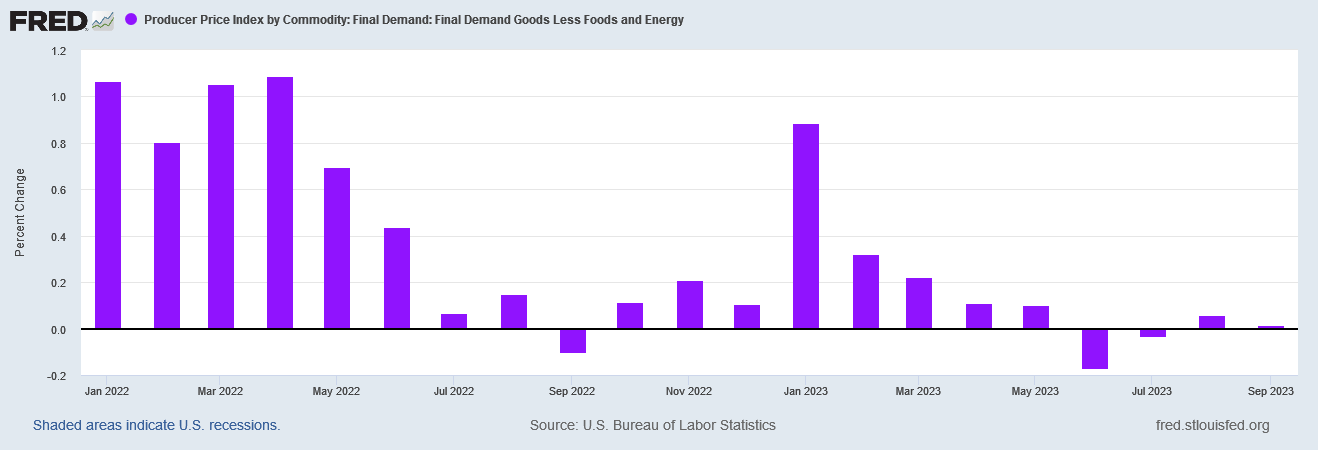

Month on month, core factory gate inflation has actually cooled since August.

In fact, when we look at the core Producer Price Index itself since 2020, we see that core factory gate inflation has been minimal for most of the year.

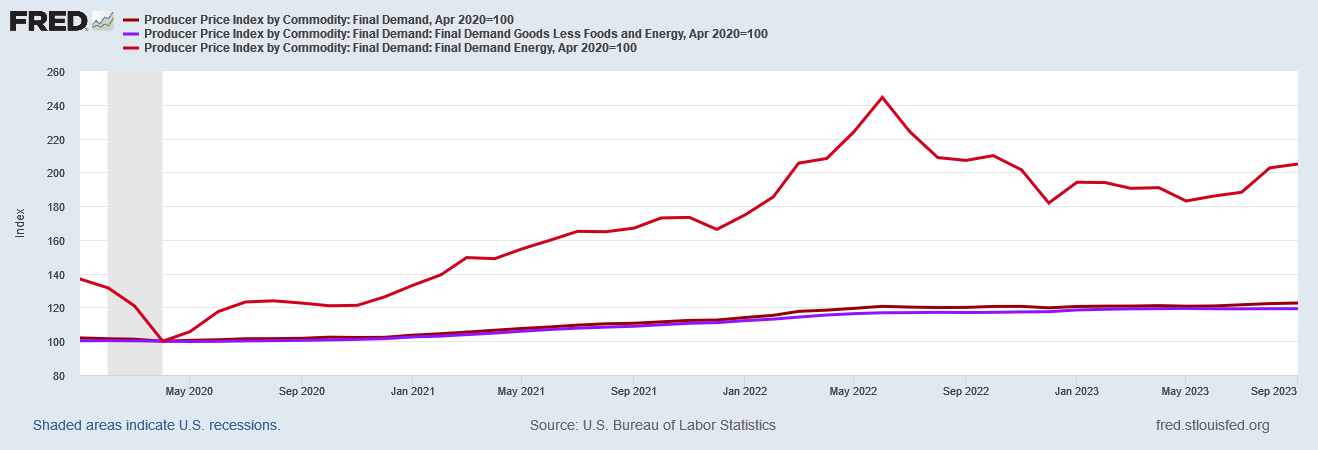

So what is driving headline factory gate inflation? The same thing that has been driving headline consumer price inflation—energy prices.

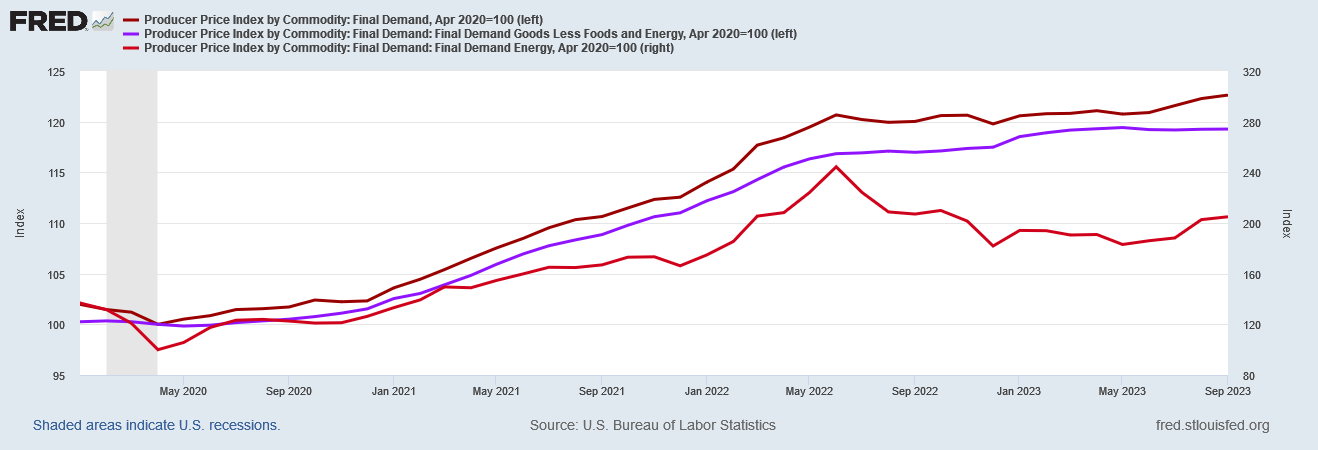

If we move energy prices to an independent axis, we can see the impact of energy price inflation more clearly.

Energy prices have been a major contributing factor in headline inflation since the current inflation cycle began at the end of the 2020 Pandemic Panic Recession. Energy prices have powered inflation up to its June 2022 peak, and it has accounted for the bulk of inflation’s retreat since then. It has also been the cause for headline factory gate inflation moving back up since about June of 2023.

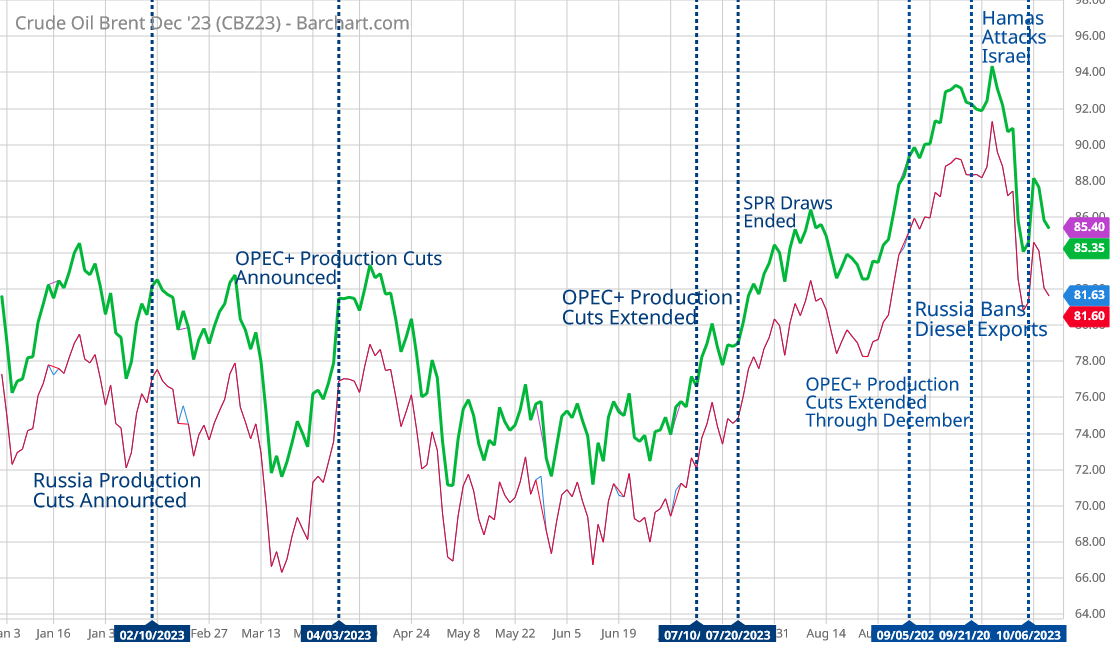

Yet if energy prices are once again the primary determinant of inflation, the narrative of inflation heating up again runs into another problem: energy prices peaked in late September, and even with the “fear trade” in the aftermath of the Hamas’ attack on Israel, Brent Crude is still at a price below all of September’s prices.

Depending on what happens next in the Middle East, the “fear trade” is fading, and with it the trend for rising energy prices.

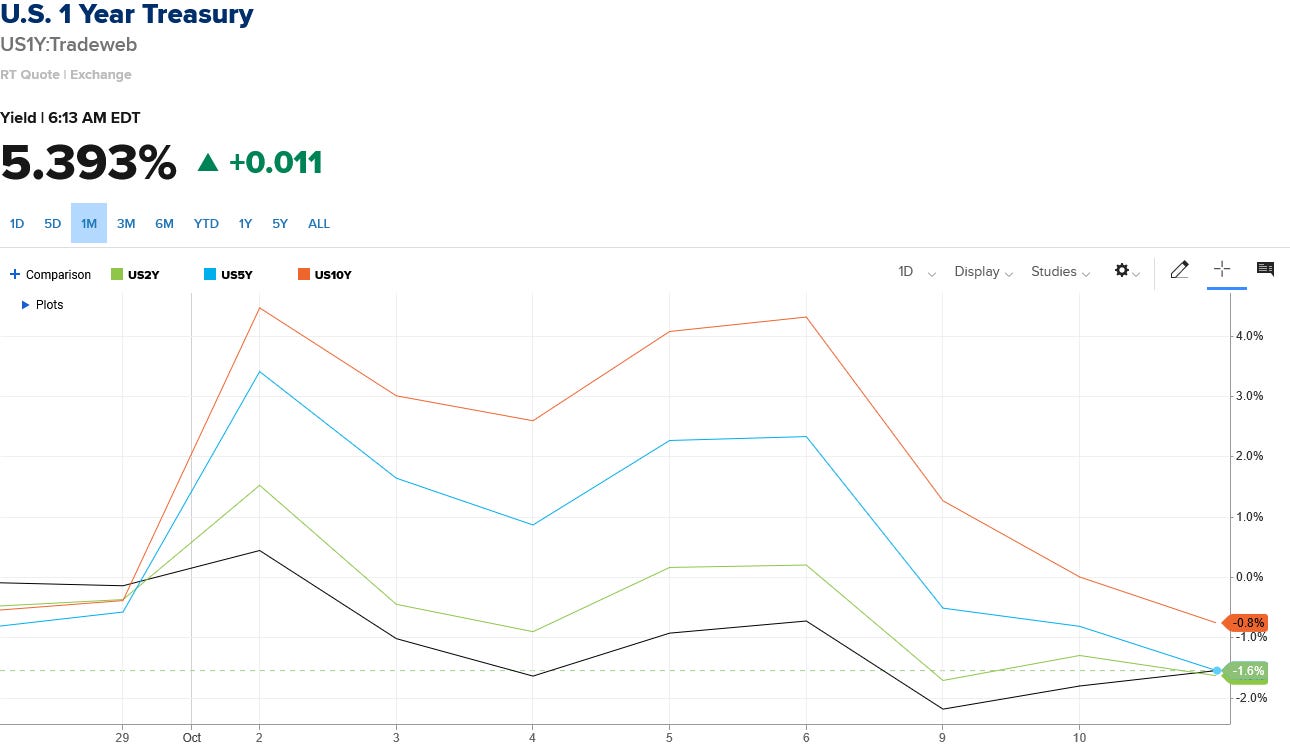

Without a significant new event in the Middle East, the market’s assessment of Hamas’ attack on Israel and the rather predictable Israeli response is fairly non-plussed. Treasury yields have declined since October 6 (the day before the attack began).

Stocks are up in the US.

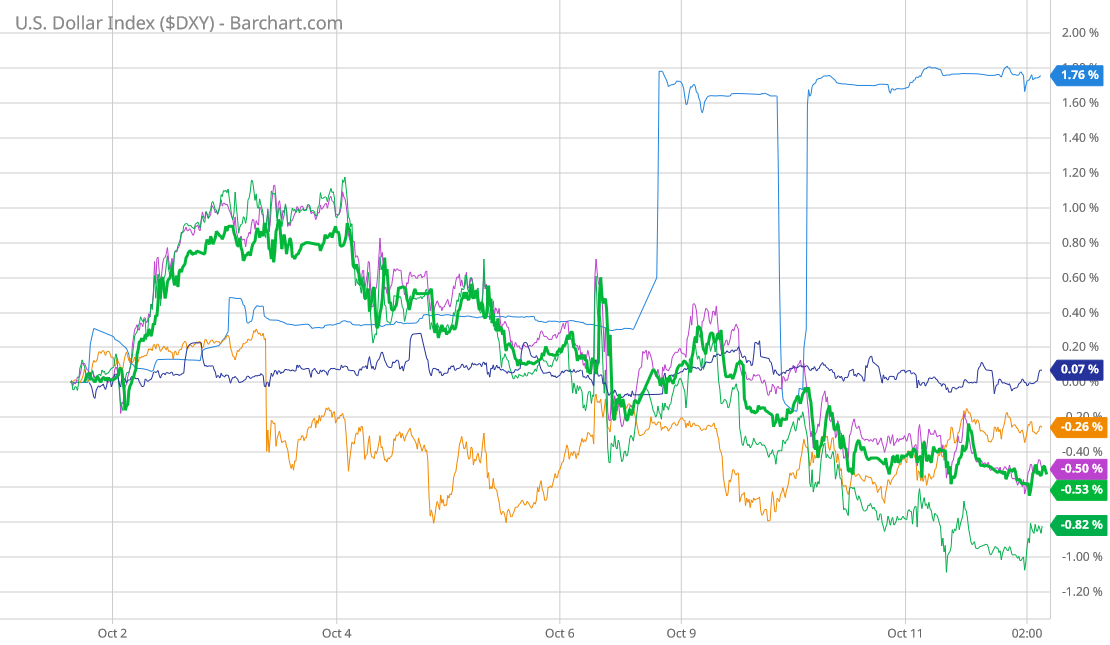

The dollar, which has been declining against most major currencies, continued to do so. The fear trade in forex markets faded almost as soon as it emerged.

Intriguingly, the dollar strengthened considerably against the Chinese yuan right after Hamas’ attack on Israel, and has held that new level ever since. Given China’s ongoing economic woes, however, it is quite likely that is merely coincidental timing. At present there is no reason besides timing to connect that currency shift to events in the Middle East.

As gripping as the images and video footage from Israel and Gaza have been, the events unfolding there have not had major economic or financial impact as of yet. While some view the violence in Israel and Gaza as either the onset or perhaps the escalation of World War 3, Wall Street is taking everything in stride.

Such equanimity is important to understanding reports such as the Producer Price Index Summary, and to understanding why we do well pay attention to such data even as dramatic war stories unfold before our very eyes. We can begin to fathom how these events will ultimately impact our own lives by assessing such mundane data. By seeking a context for this data we begin to see what impact the dramatic war stories are likely to have on our own lives.

The context for the Producer Price Index Summary is that energy prices have been rising for the past few months and that is being reflected in headline inflation, both factory gate inflation and consumer price inflation. We see that throughout the inflation data. We also see that, based on last week’s dramatic reversals in oil prices, energy prices are done rising, which means an abatement of energy price inflation and thus a moderation of inflation overall—which in turn means factory gate inflation is not “heating up”, despite what corporate media and the “experts” want to believe.

With factory gate prices for goods either stagnant or in decline, and with factory gate inflation for services seemingly intractable, what the PPI is showing when all the data is examined is not rising inflation across the board but a continuation of the stagflationary trends we have been seeing for some time.

As it was last month, we have inflation, and we have deflation, which added together means we have stagflation.