Rising Energy Costs Wreck Fed's Inflation Strategy

Rate Hikes Are No Match For Rising Gasoline Prices

Despite the best efforts of the corporate media to put a positive spin on the August Consumer Price Index Summary, one unalterable fact remains clear: inflation is rising again, and gasoline prices are the primary reason why.

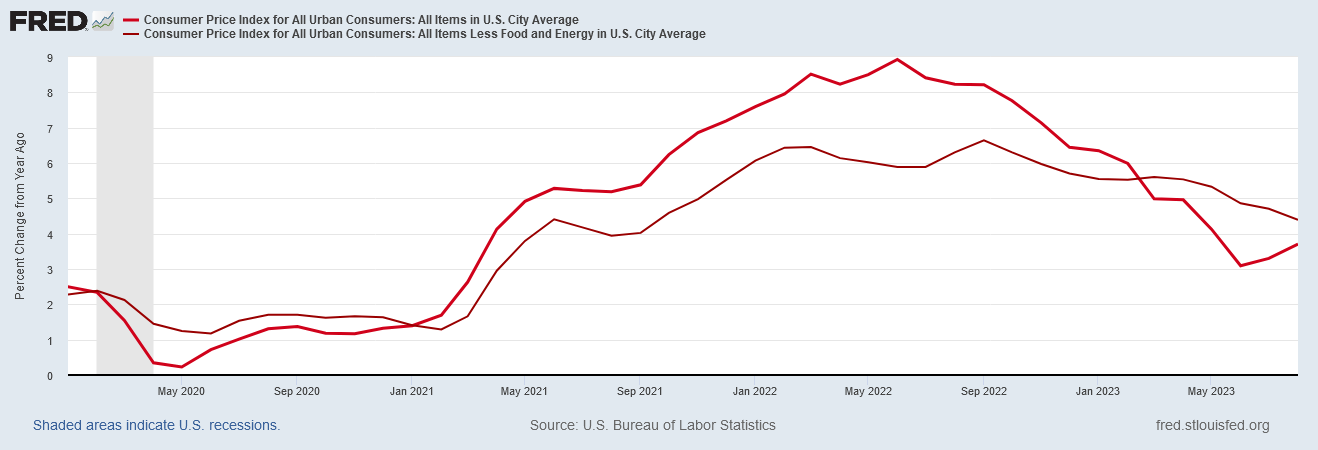

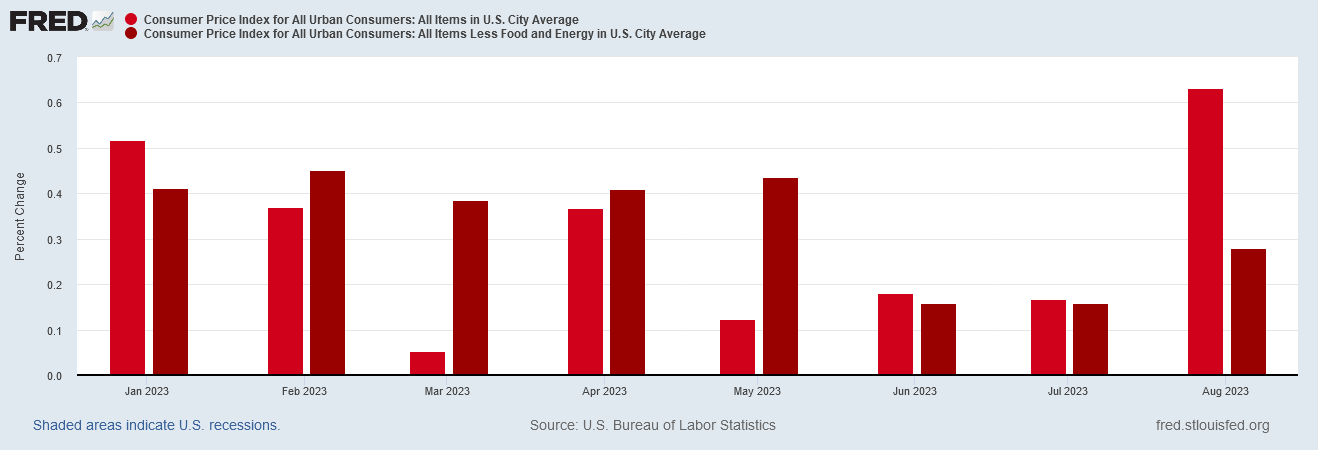

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.6 percent in August on a seasonally adjusted basis, after increasing 0.2 percent in July, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.7 percent before seasonal adjustment.

The index for gasoline was the largest contributor to the monthly all items increase, accounting for over half of the increase. Also contributing to the August monthly increase was continued advancement in the shelter index, which rose for the 40th consecutive month. The energy index rose 5.6 percent in August as all the major energy component indexes increased. The food index increased 0.2 percent in August, as it did in July. The index for food at home increased 0.2 percent over the month while the index for food away from home rose 0.3 percent in August.

Between the BS of Bidenomics and the economic futility of Powell’s federal funds rate hikes, this was not supposed to be happening. Yet it is.

Rising gasoline prices are causing consumer price inflation to rise once more, and a further federal funds rate hike will not stop it.

Despite the rising energy prices, corporate media insists the inflation report is mostly good news, enough to give the Federal Reserve cover to avoid raising interest rates at the next FOMC meeting.

U.S. consumer prices increased by the most in 14 months in August as the cost of gasoline surged, but the annual rise in underlying inflation was the smallest in nearly two years, likely giving the Federal Reserve cover to leave interest rates unchanged next Wednesday.

The mixed report from the Labor Department on Wednesday was published a week before the Fed's policy meeting and followed data this month showing an easing in labor market conditions in August. Economists, however, believe officials at the U.S. central bank will continue to signal an additional rate hike this year given the stickiness in services inflation.

Even Dementia Joe’s handlers tweeted out their usual unwarranted victory lap, filled with bogus and fact free claims about inflation.

Fact Check: Inflation printed at 3.7% Year on Year in August, and core inlation printed at 4.3% Month on Month. Core inflation did decline from July, but that is the extent of the good news.

August was also the second month in a row year on year consumer price inflation rose from the prior month. That is not a good trend for inflation; it is the trend we are likely to see for the next few months at least.

Not only is inflation up year on year, but the August month on month increase in consumer prices was the worst all year, with the increase in core prices being the most in the past four months.

Perhaps more worrisome, however, is the fact that a 0.63% increase in consumer prices month on month is the largest such increase in over a year, and is on par with some of the worst consumer price increases since this current inflationary cycle began.

Rising energy costs are by far the single biggest reason behind this spike in monthly inflation.

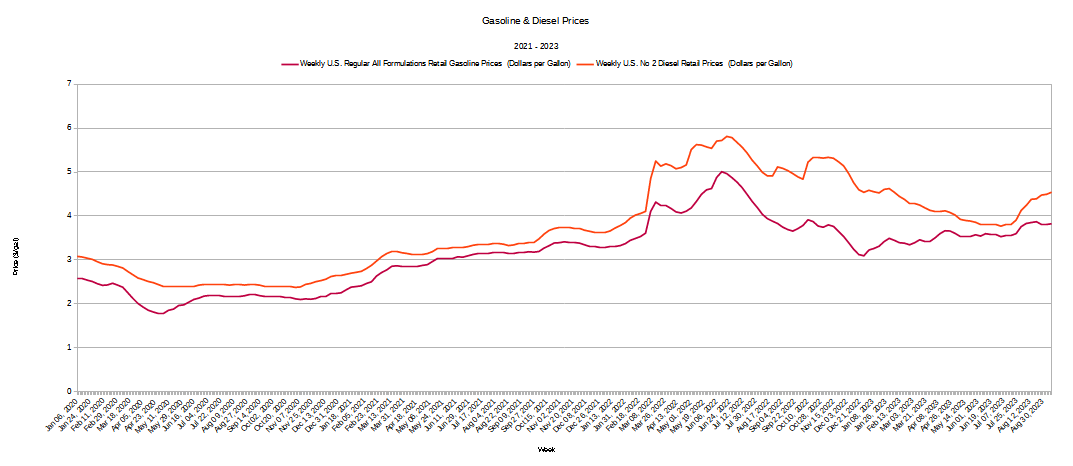

When we look at weekly gasoline and diesel prices as recorded by the Energy Information Administration, it is immediately clear just how much these prices have risen during this cycle.

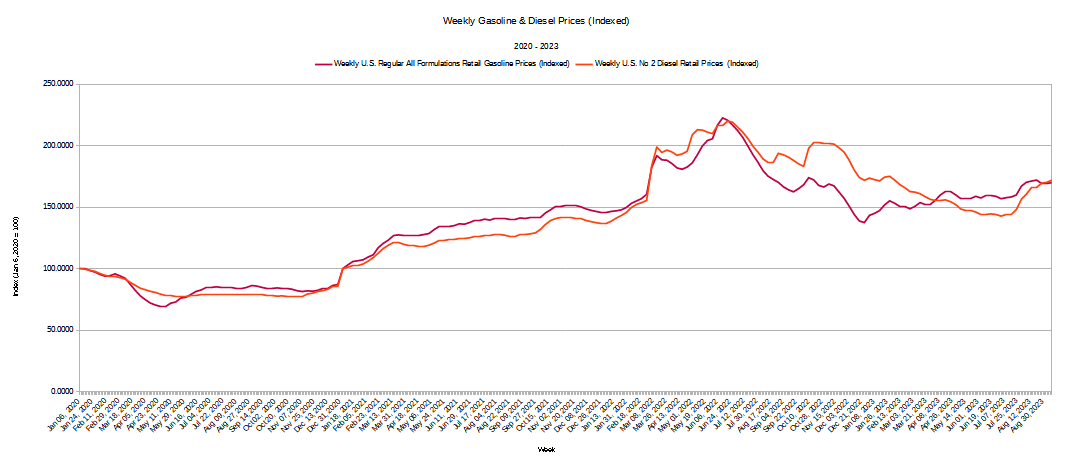

Even with the extended decline in prices at the pump for both gasoline and diesel in the twelve months between June, 2022 and June of this year, when we index those prices to the first week of 2020, we see that gasoline and diesel prices have risen by nearly 50%.

If we index those same prices to the first week of 2021, we see that prices at the pump have risen nearly 70% since the beginning of 2021.

In other words, all of the price increase and then some occurred during Dementia Joe’s administration. So much for worrying about Bidenomics being good for prices at the pump.

Had the price declines which began in June of last year continued, the overall increase might not have been that significant. However, when diesel prices began rising in July, they were still 42% higher than at the start of 2021, and when gasoline prices began rising last December they were 37% higher.

Fuel prices have been rising because, as we’ve discussed previously, crude oil prices have been rising as well, surpassing previous year to date highs in early August.

These increases align with the trends in the price index for energy commodities.

While the percentage shifts for the real world prices and the price index might differ, the timing of the price trends in both align fairly well, which is confirmation that energy prices have been the prime contributor to consumer price inflation, both in the disinflationary trend between June of 2022 and June of 2023 as well as the resurgent inflationary trend during the past couple of months.

Outside of energy prices, core consumer price inflation has shifted much less dramatically—it simply has not fallen the way headline consumer price inflation has fallen, pulled down by energy price deflation.

Core inflation moved above 4% year on year at the same time headline inflation moved above 5%, in June of 2021.

However, while the energy price deflation that had prevailed until the past few months succeeded in pulling headline inflation below 4%, core inflation remains above 4%.

When we look at the breakdown of core consumer prices, we see that the reason there has been far less improvement in core inflation has been the stagflationary nature of the economy: the disinflationary trends in some price categories are largely negated by the inflationary trends in other categories.

Thus, while motor vehicle prices have risen dramatically since January 2021, items such as communication and education have remained much more stable.

Since the start of the year, categories such as medical care have dropped by 0.8%, while motor vehicle prices peaked in May, rising 2% above January 2023 levels. Yet while motor vehicle prices have trended down, other categories such as apparel and recreation either continued trending up or began trending up around the time that motor vehicle prices began trending down.

The net effect is to keep overall core consumer prices trending up at roughly the same pace.

Not only does this keep core inflation higher and allows for a much slower disinflationary trend than has been observed in headling inflation, it also makes energy prices particularly likely to have major impact on inflation, resulting in the trends we have been seeing regarding inflation. Not only has headline inflation been pulled down because of declining energy prices, it is now being pushed up because of rising energy prices.

Ironically, these relatively muted movements in core inflation are what are lulling Wall Street and the corporate media into thinking that a fresh increase in the federal funds rate is not in the cards.

"There is nothing here to seriously put a Fed rate hike on the table next week, but there is enough to keep the debate about the need for one more hike in 2023 alive," said Conrad DeQuadros, senior economic advisor at Brean Capital in New York.

Indeed, Wall Street is absolutely convinced that the Fed will not raise rates at next week’s FOMC meeting, and the August inflation report has only served to increase that conviction, which is now 97% certain the Fed will hold the line on rates.

In fact, Wall Street is overall convinced that the Fed will not raise the federal funds rate higher at all, with standing pat being the favored outcome of FOMC meetings through next September.

However, Jay Powell himself reminded everyone at Jackson Hole that the Fed was still prepared to raise rates, and some watchers believe that the marginal progress on core inflation means that the Fed will raise rates in either November or December, if they do not raise them next week.

“The core CPI is a bit disappointing,” said Kathy Bostjancic, chief economist at Nationwide Life Insurance Co. “This will keep the Fed on a hawkish alert and suggests a rate hike is possible in November and December.”

Fed Chair Jerome Powell said in late August at the Kansas City Fed’s conference in Jackson Hole, Wyoming, that inflation remained too high, and central bankers were prepared to tighten more if necessary. The Federal Open Market Committee raised its benchmark rate in July to a range of 5.25% to 5.5%, a 22-year high, and its most recent projections had one more rate increase penciled in for 2023.

Yet that marginal progress on core inflation, as well as resurgent energy price inflation, also prove the impotence of rate hikes on core and energy price inflation.

Energy prices, being driven by supply constraints rather than consumer demand, are not going to respond to rate hikes at all no matter what.

For all of Jay Powell’s jawboning, interest rates simply have not been all that impactful on core inflation, which has remained high throughout the Fed’s rate hike campaign.

While the Fed may opt to stand pat next week, Powell’s insistence on keeping to the rate hike strategy on inflation is likely to force his hand eventually, if not next week than in November or December. Ironically, when that next rate hike does come, it will be as effective as the other rate hikes (i.e., not at all).

Regardless of what the Federal Reserve does, however, the present economic reality is that inflation is increasing once again. With crude oil prices continuing to advance, inflation is likely to continue to increase through the remainder of this year. With or without a rate hike, consumer price inflation is going to remain on an upward trend.

In other words, future rate hikes will not do a damn thing about consumer price inflation, because previous rate have not done a damn thing about consumer price inflation.

Good think Dementia Joe just cancelled all those oil leases.

No matter. Mindless leftists would vote for him even as they are processed for Covid concentration camps of Gov .Hochul