The Producer Price Index Summary generally gets far less attention than the Consumer Price Index Summary. Even I do not comment on the PPI all the time, in large part because it is released one day after the Consumer Price Index Summary, and so most of the major news bits on inflation are already addressed.

The PPI seems almost an afterthought when it confirms the inflationary trend appearing in the CPI, as it did for May:

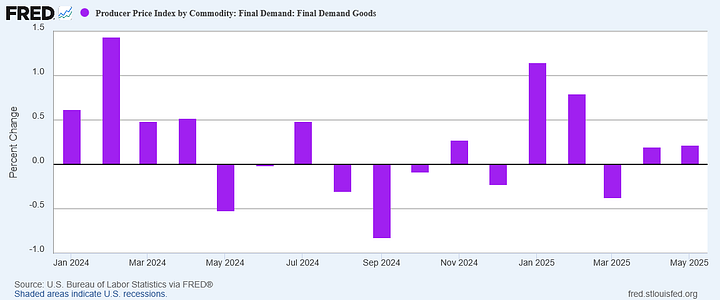

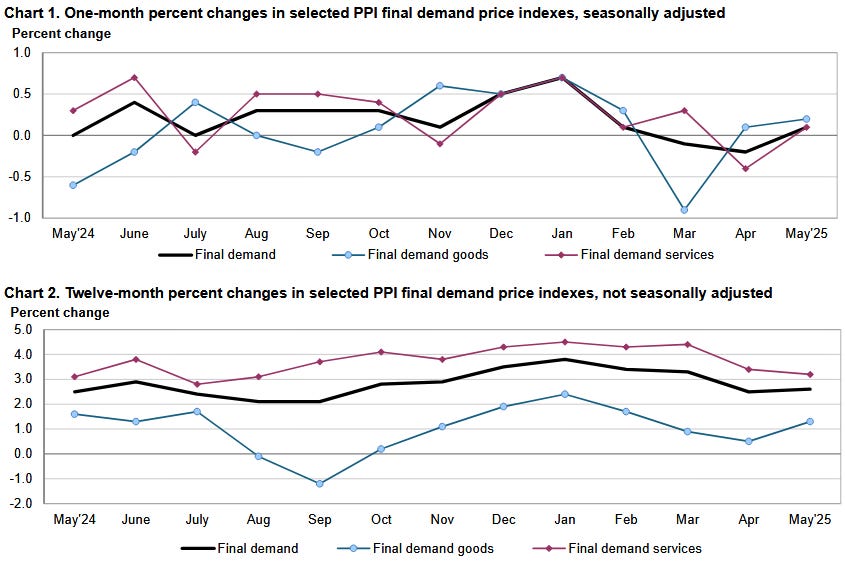

The Producer Price Index for final demand advanced 0.1 percent in May, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices declined 0.2 percent in April and 0.1 percent in March. (See table A.) On an unadjusted basis, the index for final demand rose 2.6 percent for the 12 months ended in May.

Factory gate inflation rose, but only incrementally.

Just as with the May Consumer Price Index Summary, inflation at the loading dock simply has not yet appeared.

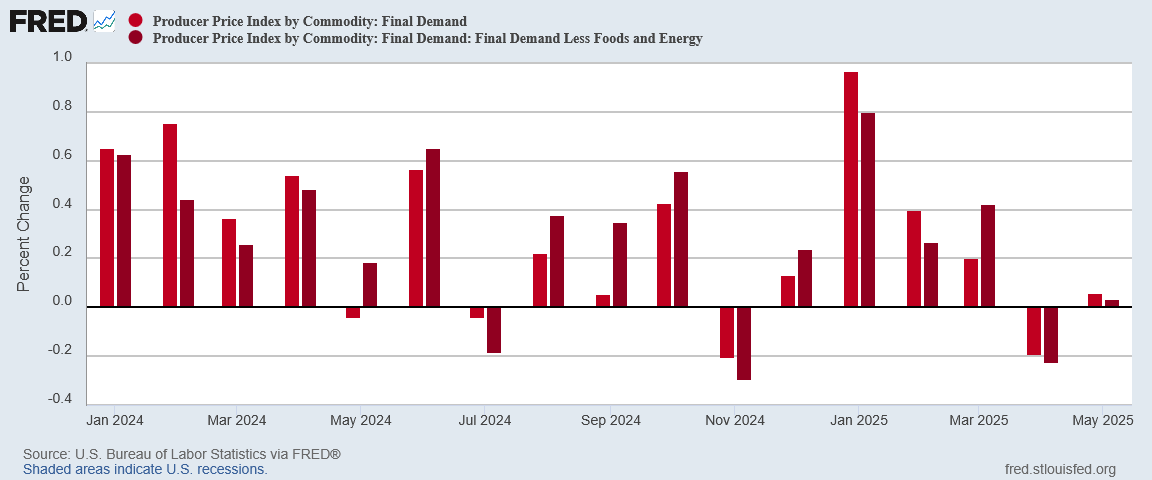

After trending up throughout 2024, both headline and core PPI have been trending down year on year since January.

Even month on month, the PPI trend since January has been down.

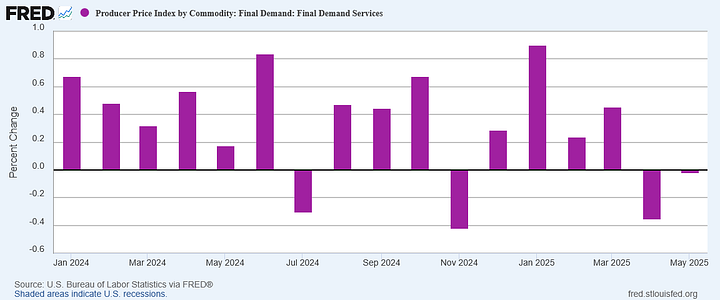

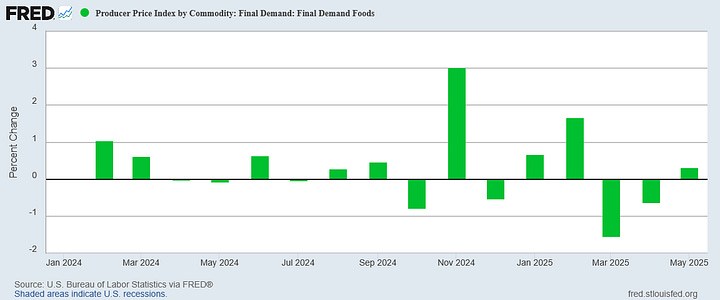

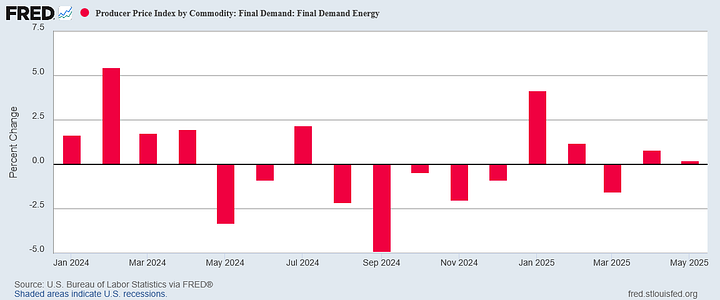

Across the major PPI subindices, there was either outright deflation (services) or only incremental inflation upticks month on month (food, energy, goods).

Even

Intermediate Demand PPI is not charting a significant inflation uptick in any of the four stages.

These weak inflation signals from the PPI suggest that consumer price inflation may drift upward in coming months, but only slightly.

This tends to confirm that, with oil prices and commodities sending the only clear inflation signal, any prices rises will be fairly minor1.

While events in the Middle East could easily render all inflation prognostications moot, there are simply no other likely forces which are acting to push prices up. Nor is it certain how permanent the impact of Israel’s ongoing attack on Iran will be on oil prices, and thus on inflation.

Is the lack of clear inflationary signals in the US economy the result of Donald Trump’s economic policies within Agenda 47?

The Trump Administration is naturally claiming that it is.

Naysayers will argue that the key to lack of inflation has been Trump’s “unwillingness” to enforce the punitive tariffs, and the cynical doubt on Wall Street that President Trump will ever follow through with actual imposition of the higher tariff rates.

Following weeks of shifting trade policy, early deals and winding court challenges, some retail executives are starting to feel more optimistic about President Donald Trump's so-called reciprocal tariffs, a new survey from consulting firm AlixPartners shows.

The survey, which polled executives from brands, retailers and other consumer companies on June 1, found most respondents expect the president will walk back those steep duties on the European Union, Vietnam, India and Mexico after a 90-day pause lapses in July. Mexico wasn't part of Trump's reciprocal tariffs but has faced new levies from the administration, which respondents also expect will stay the same.

Yet even that narrative suggests Donald Trump is making specifically impactful economic decisions on tariffs, and is being rewarded for it.

At present the only clear inflation signal is the spike in oil prices and commodity price indices happening as of this writing after Israel attacked Iran.

Trump has either been very shrewd or very lucky, but the inflation data has so far been quite kind to his administration. Barring a major change in the economic outlook the inflation data is likely to continue to be kind for the next few months at least.

How kind has inflation been to you recently? Leave a comment below or drop one in chat and let me know!

This assessment does not factor in price spikes in Brent Crude and West Texas Intermediate following Israel’s attack on Iran yesterday afternoon.

Trump has been both shrewd and lucky. Let’s hope that this holds, as we are likely in for a wild weekend!

And Happy Birthday, Mr. President!