The past two weeks has served up an uneven spate of economic reports, as both the jobs and inflation reports produced mostly mixed messages.

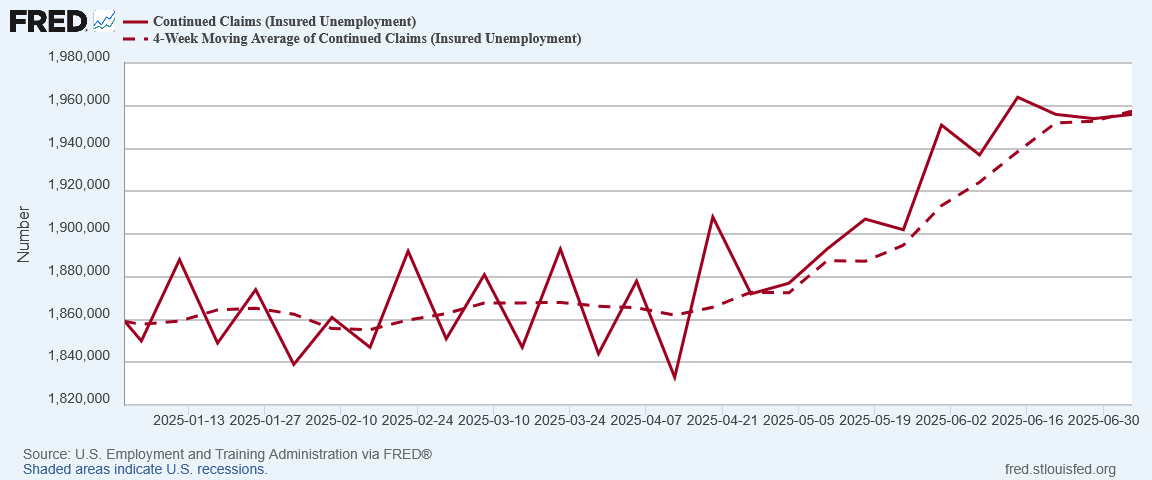

Yesterday’s unemployment insurance weekly claims report was no exception, showing initial claims dropping for the fifth week in a row even as continuing claims maintained their rising trend.

In the week ending July 12, the advance figure for seasonally adjusted initial claims was 221,000, a decrease of 7,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 227,000 to 228,000. The 4-week moving average was 229,500, a decrease of 6,250 from the previous week's revised average. The previous week's average was revised up by 250 from 235,500 to 235,750.

The advance seasonally adjusted insured unemployment rate was 1.3 percent for the week ending July 5, unchanged from the previous week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending July 5 was 1,956,000, an increase of 2,000 from the previous week's revised level. The previous week's level was revised down by 11,000 from 1,965,000 to 1,954,000. The 4-week moving average was 1,957,500, an increase of 4,750 from the previous week's revised average. This is the highest level for this average since November 20, 2021 when it was 2,004,250. The previous week's average was revised down by 2,500 from 1,955,250 to 1,952,750.

There is no denying that the initial claims data is extremely positive, posting the lowest weekly total since mid-April.

At the same time, continuing claims are at their highest level since November of 2021.

As I have noted previously, the drop in initial claims makes the weekly report a small win for Donald Trump, even with the continuing claims charting rising long-term joblessness. This report is no different.

Yet we should not overlook the rise in continuing claims. The duration of unemployment is increasing, which means job markets are not as robust as some narratives claim. Companies might not be laying off workers at elevated levels, but neither are they hiring at even normal levels.

The rise in continued claims shows hiring is still a major weak spot in US labor markets—companies are simply not doing enough of it. The negative trends from last month’s JOLTS report do not appear to have abated much, if at all.

Like the June Employment Situation Summary, this week’s unemployment claims data is arguably a political win for the Trump Administration, but is not really good news, economically speaking.

The drop in initial claims is a plus, as it indicates labor markets are mostly stable—workers are not being laid off en masse in most companies.

Continued claims, on the other hand, show that once one is out of work, it is increasingly difficult to get back into work. The unemployed can look forward to longer periods without a paycheck—and there is no political spin which can cover up an empty wallet.

For those hoping to see an end to the jobs recession this country has endured for close to two years now, the weekly unemployment claims data is yet another disappointment.

The jobs recession is not going away, and possibly got even worse this past week.

You’ve long known that there are underlying fundamentals to the U.S. jobs market that are unhealthy, such as too few manufacturing jobs, and too many unproductive government workers. It will be interesting to watch some shifts over the next year. If Trump is successful, tens of thousands of government employees will lose their cushy jobs, and many of them are too useless to obtain productive work elsewhere. Many will be unemployed for as long as they can milk the unemployment insurance system. Also, the rapid rise of AI is supposed to eliminate a great many jobs, especially entry-level jobs, and where will those kids end up?

Peter, I would love to see your data analysis of these jobs shifts, if anyone is presenting the raw data in ways that you can analyze. We’d like to see to what extent Trump’s grand economic plan works, and in which ways. Some basic Keynsian principles could be disproved (again), or some of Navarro’s economic ideas could be strengthened. We know that the corporate media will not likely admit Trump’s ideas actually succeeded, so we rely on your objective genius mind, Peter! Thanks in advance, as always.

The lies of the past lies may be catching up to the US economy: “The BLS just said the number of jobs reported for the 9 months ending December 2024 was likely overstated by ~800,000.”

https://x.com/kobeissiletter/status/1946728097866269181?s=46