PCE Index Shows Marginal Progress On Inflation

Food And Energy Price Inflation Declined, But Core Consumer Price Inflation Rose

`Coming one day after the Bureau of Economic Analysis released its advance estimate for 3rd Quarter GDP growth, the Personal Income and Outlays report for September 2022, like the GDP report, started off with some modestly good news—personal income increased during the month of September. Like the GDP report, it generally went downhill from there.

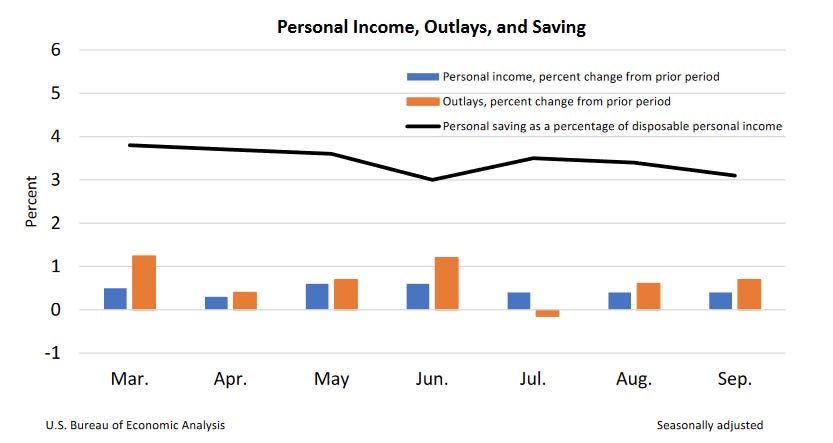

Personal income increased $78.9 billion (0.4 percent) in September, according to estimates released today by the Bureau of Economic Analysis (tables 3 and 5). Disposable personal income (DPI) increased $71.3 billion (0.4 percent) and personal consumption expenditures (PCE) increased $113.0 billion (0.6 percent).

When expenditures rise more than income, that’s not a good sign, either for the consumer or for the economy.

When inflation remains untamed, that is not good news for either Wall Street, Main Street, or the Federal Reserve. With the Federal Reserve committed to the Volcker playbook on inflation, each report which shows little or no progress on consumer price inflation is tantamount to another 75bps hike the Fed believes it must enact, never mind how deep a recession it catalyzes.

Personal Income Rose. Just Not By Enough

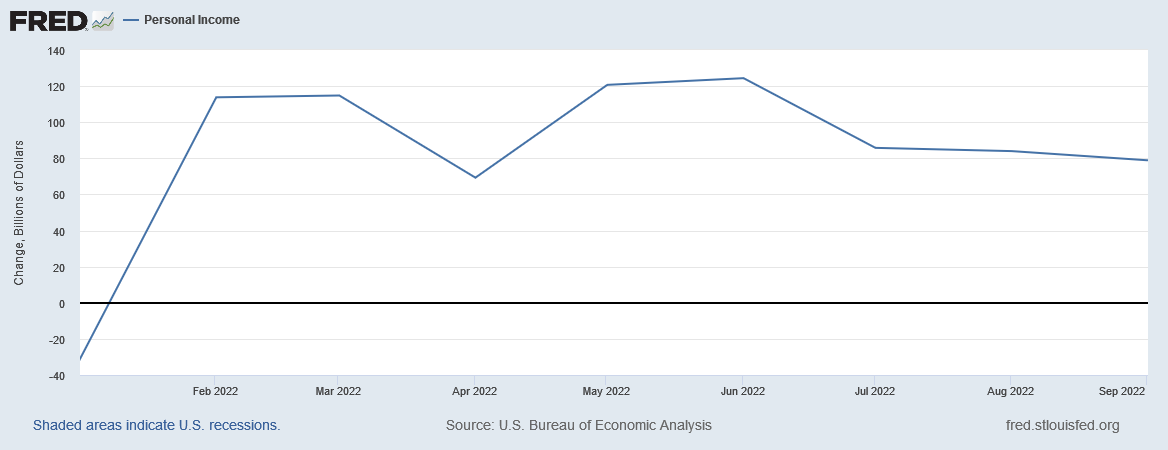

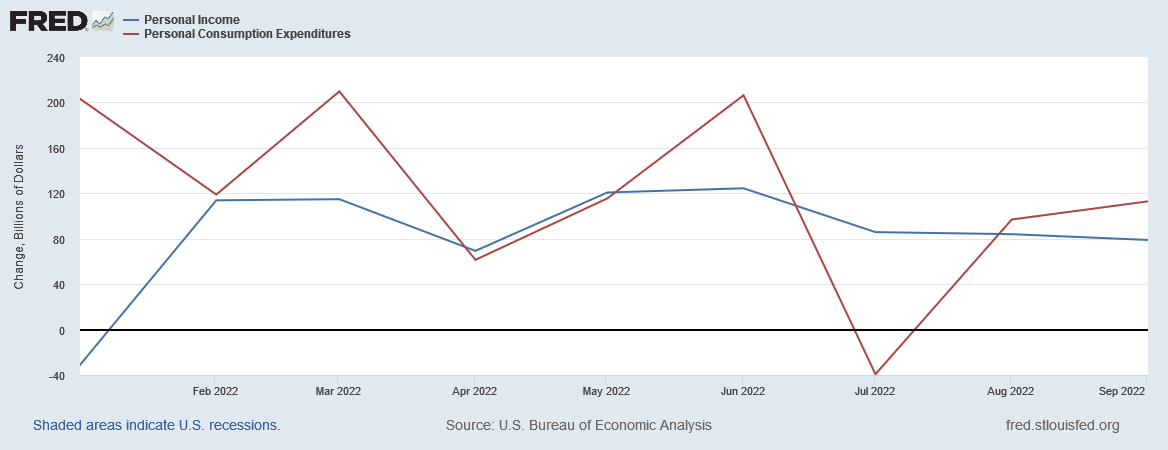

While personal income rose $78.9 billion in current dollar terms month-on-month, that number nevertheless represents a drop from August’s figure of $84 billion, which in turn represents a decline from July’s $85.8 billion. Throughout the third quarter, personal income growth has been on the decline.

While personal income growth has been declining, however, personal consumption expenditure growth has been on the rise, amounting to $113 billion month-on-month in September, greatly outpacing personal income.

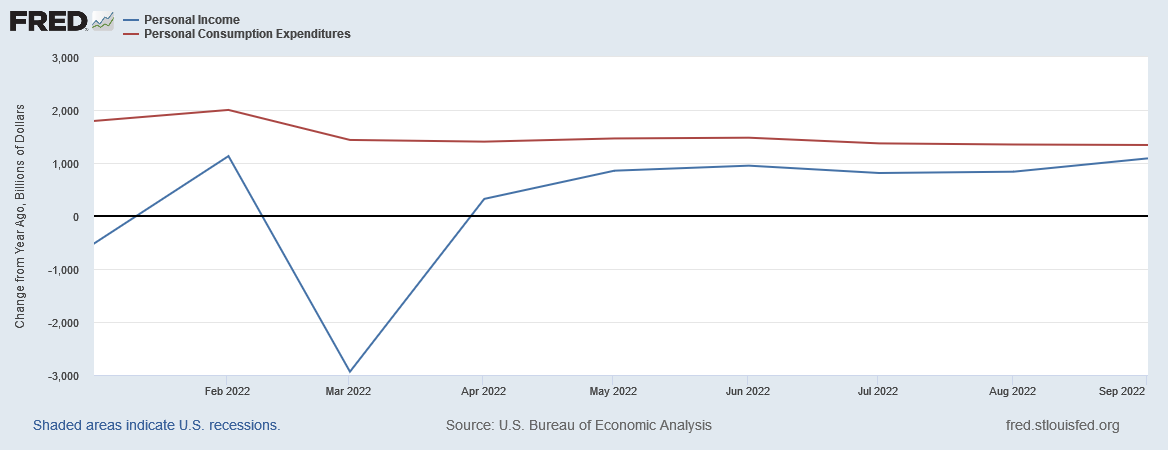

Year-on-year, personal income has consistently lagged behind personal consumption expenditures.

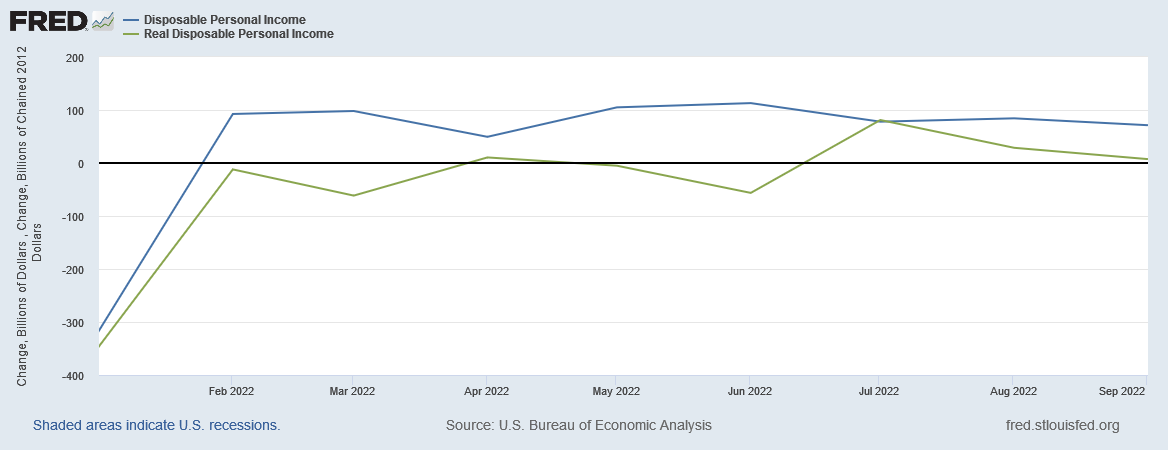

While disposable income was $71.3 billion month-on-month in current dollar terms, in real terms, the month-on-month figure dropped to $7.2 billion month-on-month.

In real terms, there was almost no disposable income growth in September. That’s never a good sign.

Incremental Declines In Consumer Price Inflation

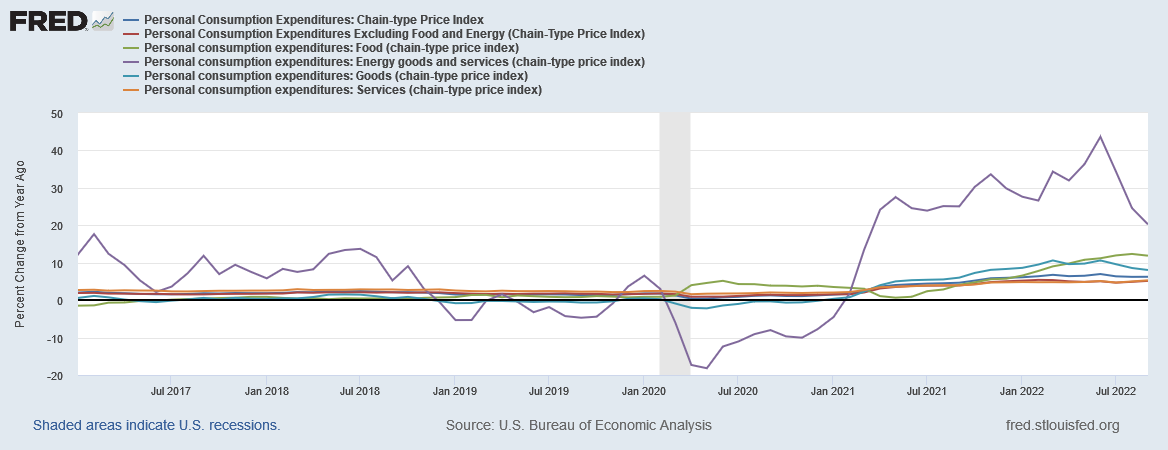

The best news on the inflation front was the PCE Index for energy dropped significantly, registering a 2.4% drop in actual prices from August—outright deflation as opposed to a disinflationary deceleration of price increases. Year-on-year energy price inflation in the PCE Index declined from 24.6% in August to 20.3% in September.

Food price inflation eased from 12.3% year-on-year in August to 11.9% year-on-year in September. While that is still progress, albeit of the incremental variety, Food price inflation in the PCE Index is still running well above the top-level consumer price inflation metric of 6.2% year-on-year for September.

Consumer price inflation for goods overall also remains well above the top-level number, easing from 8.6% year-on-year in August to 8.1% year-on-year in September, while inflation for services rose from 5% year-on-year for August to 5.3% year-on-year for September.

These were no doubt contributing factors to the rise of “core” consumer price inflation in the PCE Index from 4.9% year-on-year to 5.1% year-on-year.

While the inflation trends are largely downward, which is a very good sign, there still has not been the sort of significant easing of inflation to match the pace with which inflation rose. With this level of decline it will take years for the Federal Reserve to get even close to a 2% core inflation target.

Inflation Numbers All But Guarantee Another 75bps Hike

While the PCE inflation numbers are mostly trending down at the moment, the incremental pace makes another 75bps hike next Wednesday by the Federal Reserve a virtual certainty. While there is as of yet no solid indication the rate hikes by the Fed are having any significant impact on inflation, Federal Reserve Chairman Jerome Powell has so far remained committed to a replay of the “Volcker playbook” on inflation, which means the Fed will keep hiking rates until consumer price inflation comes down to a significant degree—or until something breaks on Wall Street in a major way the Federal Reserve is unable to ignore.

We should not forget that Wall Street is betting the farm on a Fed “pivot” when that break occurs, if not before.

Given that nothing has “broken” yet, the Fed is unlikely to see any reason not to enact another 75bps rate hike at the next meeting of the Federal Open Market Committee meeting next week. Whether there will be sufficient progress on inflation by December for the Federal Reserve to take a lighter touch on interest rates remains very much an open question.

Certainly there are plenty of warning signs of more supply shocks yet to come, all of which will push consumer price inflation back up again.

If labor negotiations between railroad unions and the railroads continue to be stymied, a nationwide rail strike could come as early as December.

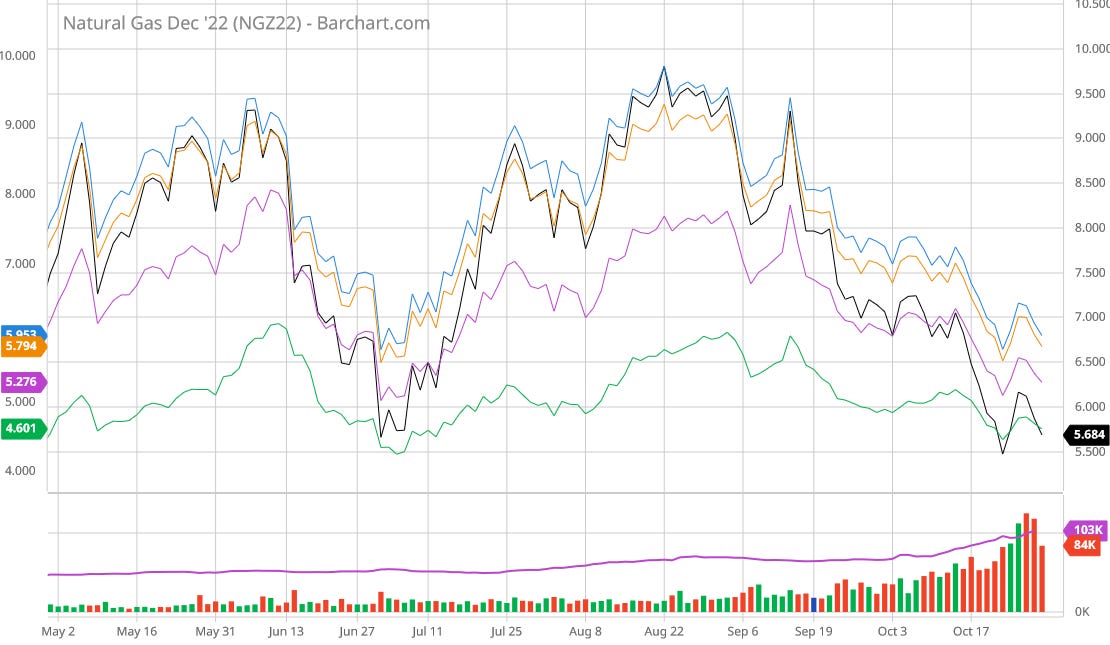

While energy prices have not been quite the consumer challenge here in the US that they have been in Europe, the differences between Europe and the US on energy price inflation are at present largely a matter of degree, and as winter weather settles in over much of the US, there is likely to be some upward movement on natural gas prices and thus on energy price inflation.

These are not inflation dynamics that can ever respond to interest rate hikes. Interest rate hikes tackle inflation from the demand side, and the likely sources of renewed inflation are all on the supply side, just as most of the drivers of inflation thus far have been on the supply side.

If these supply shocks do not materialize—if the rail unions do not strike and the winter is mild in the US—there is an outside chance the Federal Reserve may find logic to justify easing off jumbo rate increases in December, and perhaps into the first quarter of next year.

For the present, however, this latest round of government data on inflation leaves everyone stuck with the same intransigent Fed policy that has not worked yet, meaning at least one more jumbo rate hike, with the possibility of more to come.

Energy prices (specifically gasoline and diesel) did indeed decrease in September, but they have been rising again this month. The high price of those fuels isn't due to the price of crude either, it's limited refinery capacity, and nobody is willing to invest in more capacity when the administration has said they want to "end fossil fuels".

I'm confident that continued interest rate increases will eventually reach the point where something on Wall Street breaks. Cry me a river. There is much there that should have been allowed to break naturally back in 2008/2009. The fact that we managed to patch it up with QE and ZIRP just means the collateral damage this time will be worse than it would have been 14 years ago. And if we somehow manage to kick the can down the road again, it will be even worse the next time.