The BEA's 3rd Quarter GDP Estimate: Expansion By Subtraction

It's Only Good News If You Don't Read The Fine Print

If you read just the opening paragraph of the news release accompanying the Bureau of Economic Analysis’ Advance Estimate on 3rd Quarter GDP growth, it is very good news.

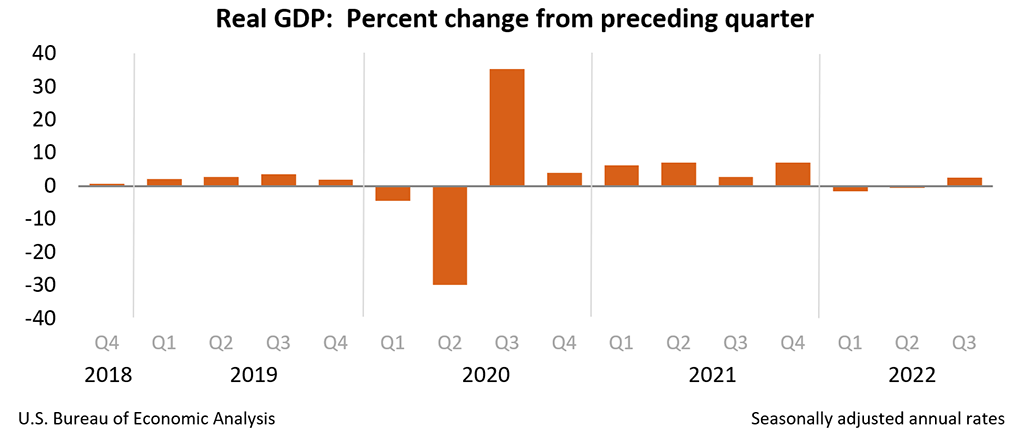

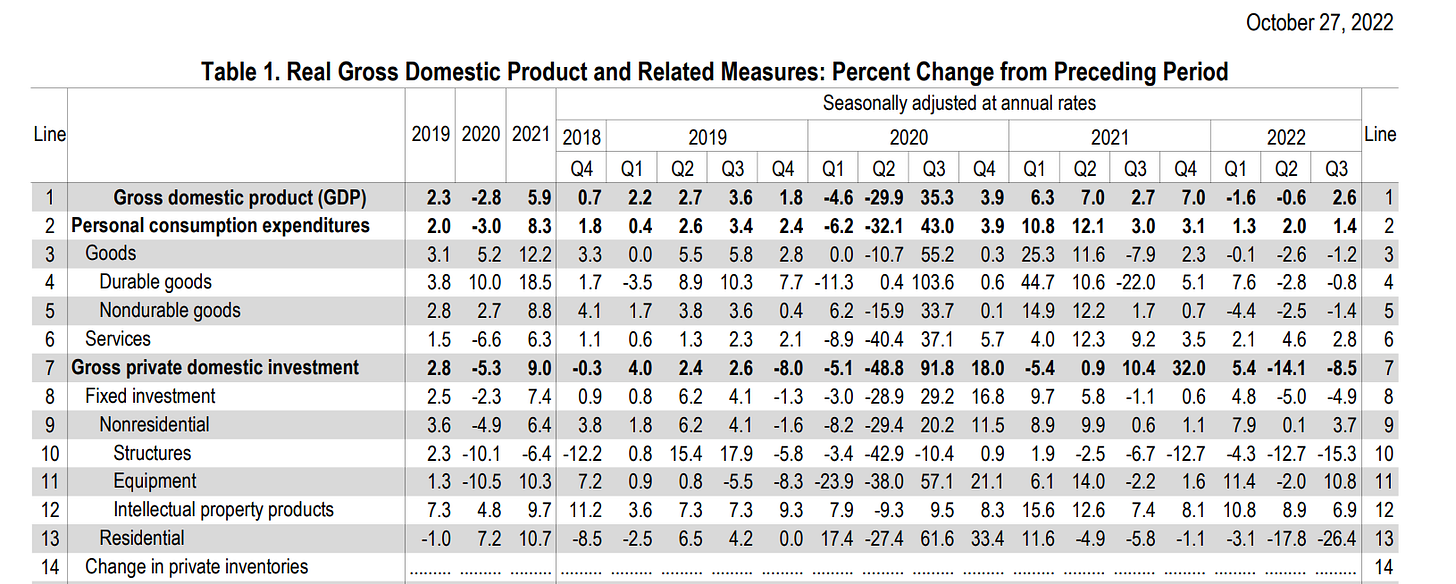

Real gross domestic product (GDP) increased at an annual rate of 2.6 percent in the third quarter of 2022 (table 1), according to the "advance" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP decreased 0.6 percent.

If you want a positive economic outlook, don’t read either the BEA release or this article any further. After that first paragraph the negative numbers far outnumber the positive ones—an ironic state of affairs for a “growing” economy.

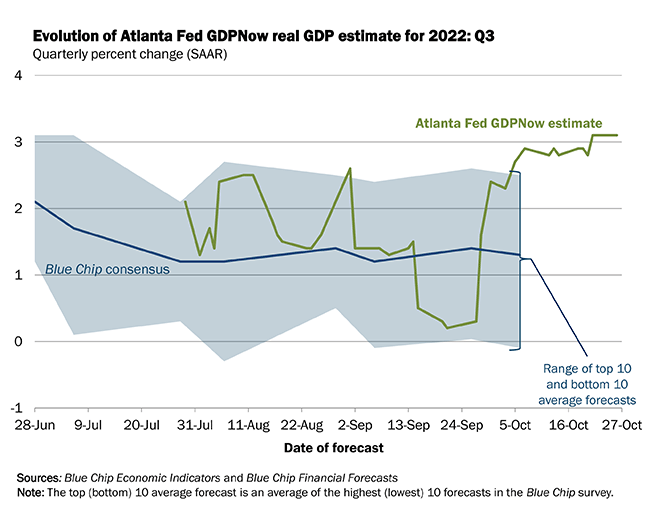

The Atlanta Fed Was Even More Optimistic

As optimistic as the BEA news release starts out, the Atlanta Fed’s final GDPNow Nowcast for the third quarter was even more so, projecting economic growth of 3.1%.

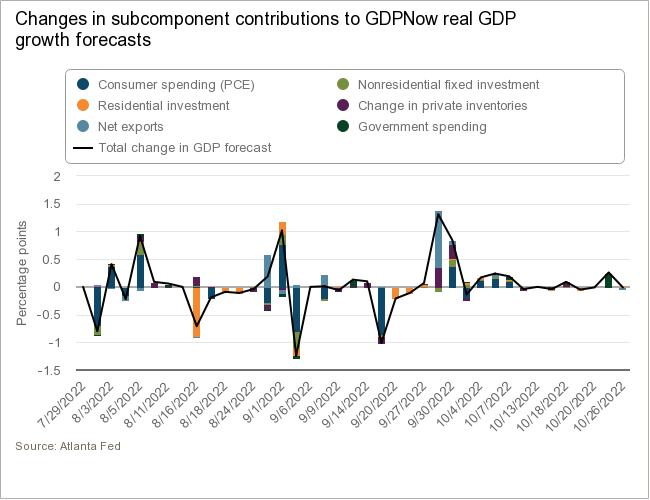

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2022 is 3.1 percent on October 26, up from 2.9 percent on October 19. After recent releases from the US Census Bureau, the US Department of the Treasury's Bureau of the Fiscal Service, and the National Association of Realtors, the nowcast of third-quarter real government spending growth increased from 2.4 percent to 3.8 percent, while the nowcast of the contribution of the change in real net exports to third-quarter real GDP growth decreased from 2.23 percentage points to 2.19 percentage points.

While the Atlanta Fed prediction overshot the BEA advance estimate, the Atlanta Fed still managed to find economic expansion amidst a number of negative data points and contraction signals.

The Atlanta Fed correctly captured that residential investment declined during the third quarter, resulting in broad economic output still trending towards zero.

Moreover, the nowcast skirted with reporting a third quarter of contraction right up until the end of September, when a slew of fresh data points suddenly pushed the nowcast up.

Where the Atlanta Fed and the BEA agree is that GDP rose solely because of exports and government spending.

Underneath The Rosy Top Level Number, A Lot Of Negatives

As with the Atlanta Fed nowcast, the BEA’s advance estimate shows a lot of negatives when you peak under the hood.

While personal consumption expenditures rose 1.4% overall, according to the estimate, expenditures on goods declined 1.2%. Expenditures on durable goods declined even more at -1.4%.

Gross private domestic investment was worse. The entire category saw a percentage decline of -8.5% from the second quarter. Investment in nonresidential structures declined -15.3%, and residential investment flat out collapsed, shrinking by -26.4%.

The slew of negative numbers in expenditures on goods and fixed investment aligns rather well with the recent contractonary signal in the S&P Global US Manufacturing PMI.

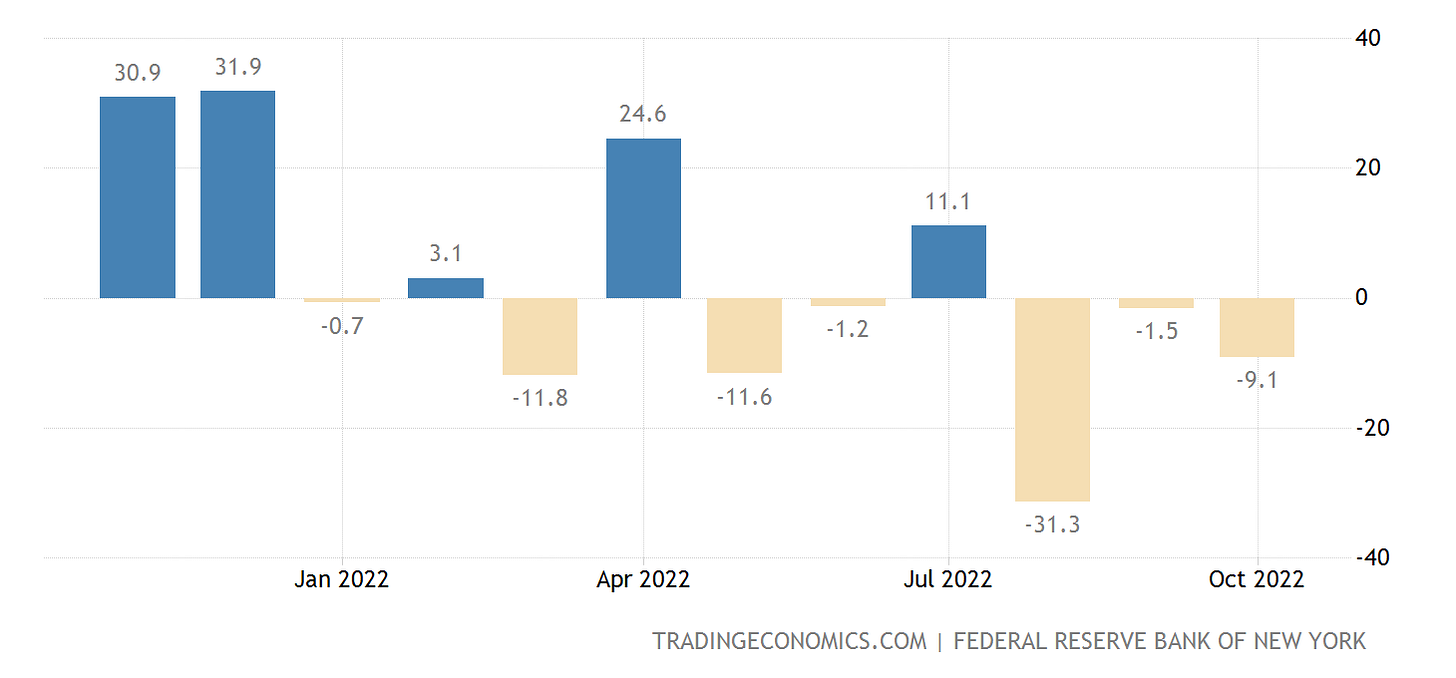

That goods production and consumption in this country also tracks with the New York Federal Reserve’s Empire State Manufacturing Index, which has reported contraction in manufacturing for five of the last six months, and six of the last eight.

Despite the rosy 2.6% growth reported by the BEA, the part of the US economy that produces actual “stuff” contracted—and contracted significantly—during the third quarter.

It’s All In Trade

What did expand in the third quarter were exports, and they expanded in a big way.

Overall, exports increased from the second quarter by 14.4%, and exports of goods increased by 17.2%.

Imports—which normally are a net reduction in GDP—decreased -6.9% (and imports of goods decreased -8.7%), which thus adds to the overall improvement in trade.

The US bought less things and sold considerably more things abroad.

What sort of things did the US sell abroad? The BEA analysis does not explicitly say, but given that Federal spending on national defense rose 4.7% during the third quarter, it seems fair to presume that a big portion of that export volume involved weapons transfers to Ukraine (It is worth noting here that the US has for decades been the largest exporter of weapons and munitions in the world, and by a healthy margin).

Strictly speaking, the role arming Ukraine plays in the 3rd quarter GDP numbers is an educated guess on my part, but the export and national defense spending numbers certainly seem to suggest arming Ukraine has been good for the US economy. Where that leaves various justifications and condemnations of US policy towards Ukraine I leave for readers to reason out for themselves.

Yet the export numbers are important for one subtle bit of mathematics the BEA news release itself did not mention: Exports contributed 2.77% to real GDP growth.

Chew on that number a bit. Exports contributed 2.77% to a real GDP growth figure the BEA puts at 2.6%.

In other words, exports amounted to 107% of real GDP growth during the third quarter, which means every other part of the US economy contracted during the third quarter.

Domestic manufacturing contracted.

Housing contracted.

Retail contracted.

Everything contracted.

Personal Incomes Rose—Barely

The one other bright spot in the BEA advance estimate was in personal incomes.

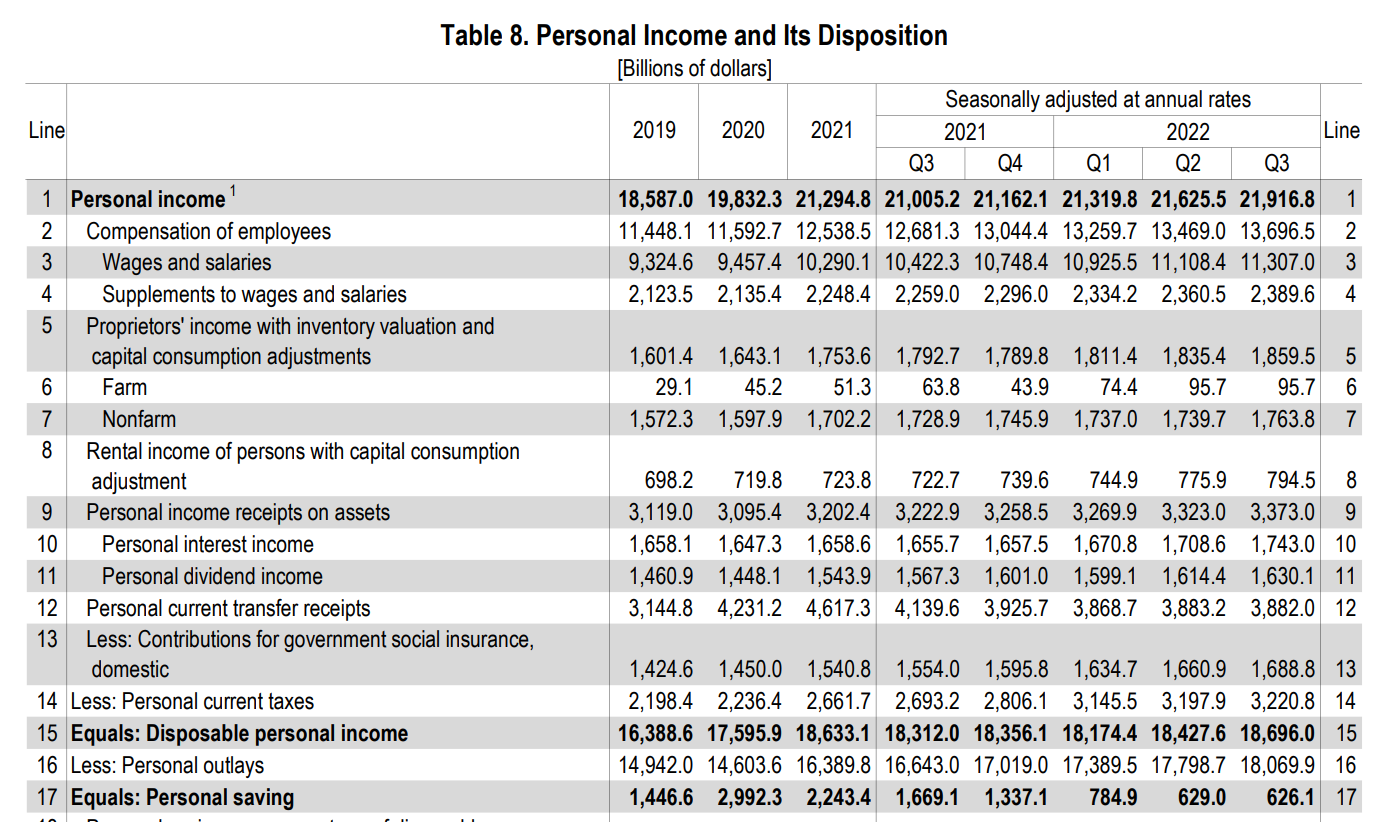

Despite the underwhelming performance of most sectors of the economy, wages and salaries still managed to eke out some gains, allowing for aggregate personal incomes to rise $291.2 billion during the third quarter.

Current-dollar personal income increased $291.2 billion in the third quarter, compared with an increase of $305.7 billion in the second quarter. The increase primarily reflected increases in compensation (led by private wages and salaries) and personal income receipts on assets (table 8).

Disposable personal income increased $268.3 billion, or 6.0 percent, in the third quarter, compared with an increase of $253.3 billion, or 5.7 percent, in the second quarter. Real disposable personal income increased 1.7 percent, in contrast to a decrease of 1.5 percent.

Workers are still losing ground to inflation, only after the third quarter results they are not losing quite so much as they were.

Did The Economy Expand Or Contract?

With all the negatives buried in the details behind the BEA’s top-level number, the natural question is to wonder if the US economy actually expanded during the third quarter or if it contracted.

Overall, the assessment has to be that the economy continued to contract in the third quarter, even though export volumes gave a sugar rush to the top-level number. Manufacturing and construction clearly contracted, and the decline in import volumes means consumer demand is on the wane as well (that part will be music to Jay “job killer” Powell’s ears no doubt).

The long-standing reality of the the US economy is that it is powered primarily by domestic consumption, and not by exports. If consumption is not happening then the US economy is in recession, and according to the BEA advance estimate, for the third quarter, consumption is not happening.

While the BEA numbers do not have the shady “two plus two equals five” aspect that we have seen repeatedly in the government jobs data, the advance estimate is yet another reminder one must pay attention to the details to get a true picture of the US economy.

Overall, the BEA pulled off a neat economic trick: Economic expansion from a data set littered with contractions.