PCE Index Will Show Inflation Easing, But Still Painfully High

"Peak" Inflation Just Means Inflation Has Paused From Getting Worse

With the Bureau of Economic Analysis set to release its Personal Consumption and Expenditures data for July, and Fed Chairman Jay Powell’s keynote address at the Federal Reserve’s annual Jackson Hole Economic Symposium later this morning, today should prove quite illuminating on the state of the US economy.

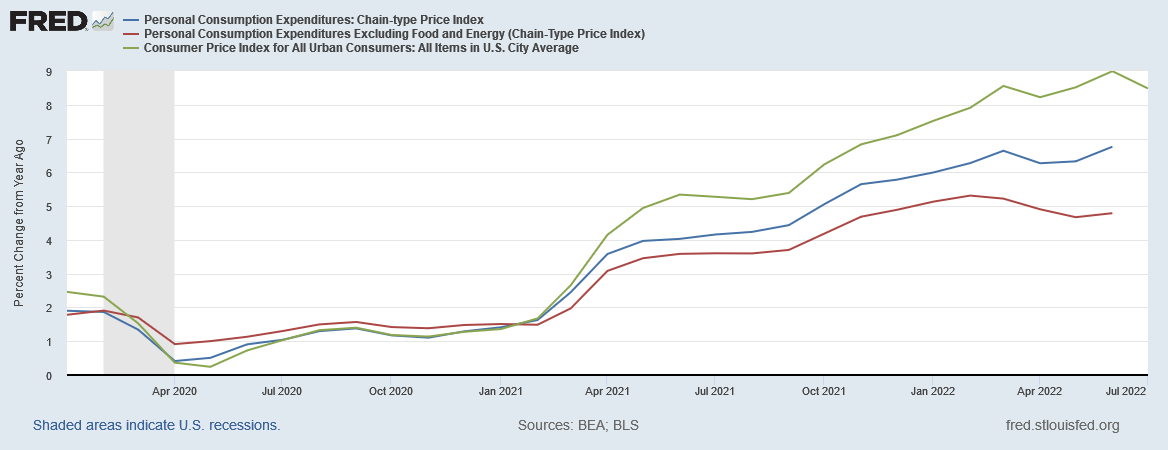

However, as the structural disparities between the BEA’s PCE Index and the Bureau of Labor Statistics' Consumer Price Index illustrate, the constant caveat must always be that neither the month-on-month nor the year-on-year inflation metrics conveyed by these indices should be viewed as the final word on consumer price inflation in the US. Not only has the PCE Index been charting consumer price inflation as much as two percentage points below the CPI, but, like the CPI, it is subject to the same internal distortions, as categories such as food and energy fluctuate to a far greater degree than the overall inflation figures.

Still, the aggregate inflation metrics from these price indices do serve to illuminate broader consumer price trends, which is an helpful framework for understanding the ongoing fluctuations and distortions within each index.

Look For PCE Inflation To Fall

Given the surprising decline in consumer price inflation within the July CPI Summary, we should reasonably expect a similar magnitude of decline in PCE inflation as well. Not only do the PCE and CPI inflation metrics follow broadly similar trajectories, there are a number of independent indicators to suggest the PCE index will show a drop in consumer price inflation.

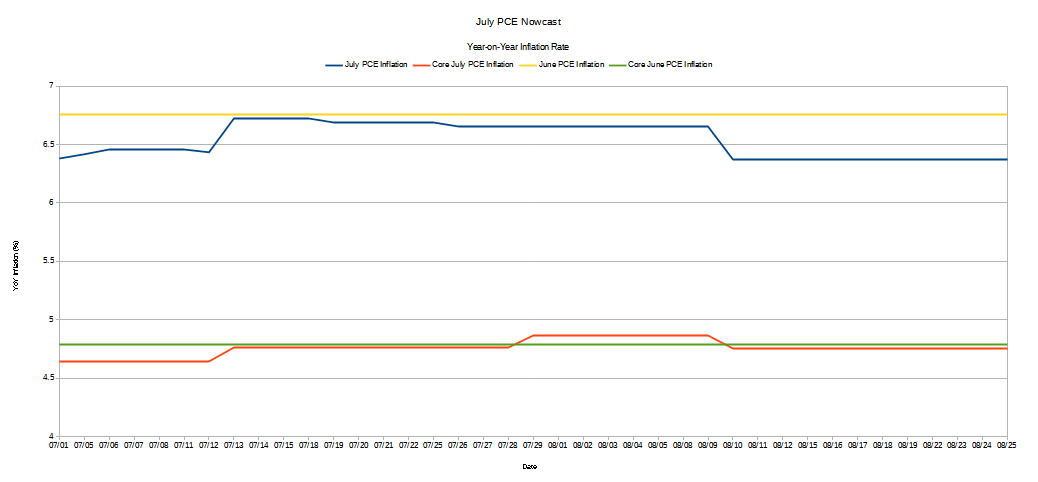

The Cleveland Federal Reserve’s Inflation Nowcast projects July PCE Inflation to be 6.38%, down from June’s 6.76%, with Core PCE Inflation posting a minimal decline from 4.79% to 4.75%

These shifts are in line with the reported CPI inflation figures for July, which saw a 0.6% decline in the headline inflation rate to 8.5% year-on-year, with the core CPI inflation rate holding steady at 5.9% year-on-year.

Additionally, the Energy Information Administration’s data on retail gasoline prices shows a sustained downward pricing trend from mid-June onward, which was a primary contributor to energy price inflation within the CPI data declining year-on-year by almost 9% in July.

Finally, while food price inflation has remained persistently higher than headline inflation, Datasembly’s Grocery Price Index suggests a general moderating of food price increases from June through July.

Food price inflation might not be declining (it increased in the CPI data), but any increase within July’s PCE data looks to be marginal.

Taken altogether, these data points suggest that the Cleveland Fed’s inflation nowcast will come fairly close to the actual reported inflation values for July, which would put PCE inflation between 6.2% and 6.4%, and Core PCE inflation between 4.7% and 4.8%.

PCE Not The Whole Story

Regardless of what the PCE figures show, they will not tell the whole story on inflation.

While gasoline prices are on the decline, natural gas prices have been heading into the stratosphere, and are currently at 10-year highs.

Coal has been on a similar rocket ride to record prices.

These two fossil fuels combined generate approximately 60% of all electricity in the United States. One does not need a degree in economics to understand the impact the price of natural gas and coal has on consumers’ electricity bills—which have also been going ballistic over the past year.

Electricity rates have risen so much in the United States that some 20 million houesholds are behind in their utility payments, with total past due balances amounting to billions of dollars.

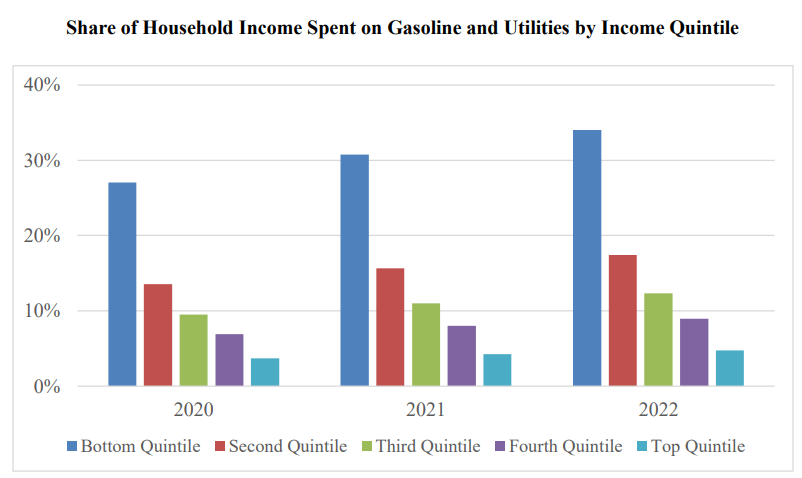

Nor is this a new trend. Energy consumption has been taking a larger and larger share of household budgets for at least the past two years, especially among the lower income brackets.

Within the realm of food price inflation, while the inflationary trends may have moderated somewhat in recent weeks, that does not change the reality that dairy products and eggs were 15% more expensive in Datasembly’s Grocery Price Index at the end of July than at the beginning of the year, meat was 10% more expensive, produce was 9% more expensive, and baked goods 14% more expensive since the start of 2022.

Such realities are the reason why food price inflation for July—the month the President bizarrely crowed about there being “zero inflation”—was 11.2%, and actually rose from June even as the headline CPI inflation rate fell.

Unbalanced, Distorted, Disordered Economy

Whenever one delves into the current inflation data, regardless of which metric one uses, the picture revealed is always the same: consumer price inflation is distorting the economy, reducing overall consumption and diminishing the overall economy. It surely is no coincidence that, as inflation has risen throughout the first half of 2022, overall GDP has declined.

These are the economic realities to which Jay Powell needs to speak in his Jackson Hole address. These are the signs of a broken and dysfunctional economy spiraling further and further into recession, and potentially outright depression.

We should expect this morning’s PCE inflation data to show consumer price inflation easing in this country. We should also understand that, even so, inflation is pushing the economy farther and farther out of balance while causing the economy to contract.

We should not expect Jay Powell to comprehend any of this, nor to propose doing much that is helpful about it.