The February Personal Income and Outlays Report makes one point absolutely crystal clear: consumer price inflation is rising.

From the preceding month, the PCE price index for February increased 0.3 percent (table 5). Prices for goods increased 0.5 percent and prices for services increased 0.3 percent. Food prices increased 0.1 percent and energy prices increased 2.3 percent. Excluding food and energy, the PCE price index increased 0.3 percent. Detailed monthly PCE price indexes can be found on Table 2.4.4U.

From the same month one year ago, the PCE price index for February increased 2.5 percent (table 7). Prices for services increased 3.8 percent and prices for goods decreased 0.2 percent. Food prices increased 1.3 percent and energy prices decreased 2.3 percent. Excluding food and energy, the PCE price index increased 2.8 percent from one year ago.

Perhaps even more importantly, personal consumption expenditures increased, while real disposable personal income shrank.

Personal income increased $66.5 billion (0.3 percent at a monthly rate) in February, according to estimates released today by the Bureau of Economic Analysis (tables 2 and 3). Disposable personal income (DPI), personal income less personal current taxes, increased $50.3 billion (0.2 percent) and personal consumption expenditures (PCE) increased $145.5 billion (0.8 percent).

The PCE price index increased 0.3 percent. Excluding food and energy, the PCE price index increased 0.3 percent (table 5). Real DPI decreased 0.1 percent in February and real PCE increased 0.4 percent; goods increased 0.1 percent and services increased 0.6 percent (tables 3 and 4).

It comes as no surprise that the usual cadres of “experts” viewed these numbers as about what they expected, and saw no cause for concern.

Inflation rose in line with expectations in February, likely keeping the Federal Reserve on hold before it can start considering interest rate cuts, according to a measure the central bank considers its more important barometer.

The personal consumption expenditures price index excluding food and energy increased 2.8% on a 12-month basis and was up 0.3% from a month ago, the Commerce Department reported Friday. Both numbers matched the Dow Jones estimates.

Consumer price inflation is rising, and the “experts” see no problem with that. Seriously.

There are good reasons why I say “expert” is synonymous with “blithering idiot”, and this would be one of them.

Because the markets were closed for the Good Friday holiday, we will have to wait until Monday for the markets’ reaction to the report and the headline numbers. If Thursday’s GDP update is any guide however the markets are likely to be fairly blase about the data. Even market watchers tend to believe this will be the case.

“Nothing really super surprising. Obviously not the numbers the Fed wants to see, but I don’t think this is going to catch anybody off guard when they come back to work on Monday,” Victoria Greene, chief investment officer at G Squared Private Wealth, told CNBC. “I think everybody is going to pivot to labor pretty quickly and say well maybe if we see some weakness and cracks over here, this little stickiness in inflation and PCE isn’t going to matter as much.”

Whether Wall Street actually believes the data is, I suspect, immaterial. Far more relevant will be if Wall Street extends its attitudes from the GDP update of fundamentally not caring what the data says—they have their narrative and they mean to stick with it, trusting the Fed will bail them out if they are wrong.

What the markets have already begun to price in is that higher than anticipated inflation is going to delay the moment when the Fed decides to begin trimming the federal funds rate. What passes for ongoing commentary and analysis from corporate media on inflation and interest rates revolves around the presumption that the Federal Reserve is soon going to trim the federal funds rate and bring interest rates down at least a little bit.

With the Federal Reserve publicly committed to restoring a 2% inflation rate, a rising inflation rate particularly in the PCE means the Fed is not going to be able to credibly reduce the federal funds rate until at a minimum the inflation trend is down and not up. At present, the inflation trend is up, which pushes rate cuts off the table for now.

Jay Powell reiterated that theme on Friday while addressing a gathering at the San Francisco Federal Reserve.

“We don’t need to be in a hurry to cut,” Powell said Friday at an event at the San Francisco Fed.

Fresh inflation data released earlier is “pretty much in line with our expectations,” he said. But Powell reiterated it won’t be appropriate to lower rates until officials are confident inflation is on track toward their 2% goal.

“It’s good to see something coming in in line with expectations,” he said, adding that the latest readings aren’t as good as what policymakers saw last year.

Intriguingly, Powell might even be welcoming a slight uptick in the inflation rate, precisely because it undergirds his longstanding thesis of keeping interest rates “higher for longer”. That would certainly explain the non-plussed reactions by analysts and “experts” to the higher numbers—those higher numbers might not be good for the economy, but they are good for the Fed’s own agenda.

What is once again getting overlooked, however, is that consumer price inflation per the PCE is not merely shifting up or down, but is shifting in composition.

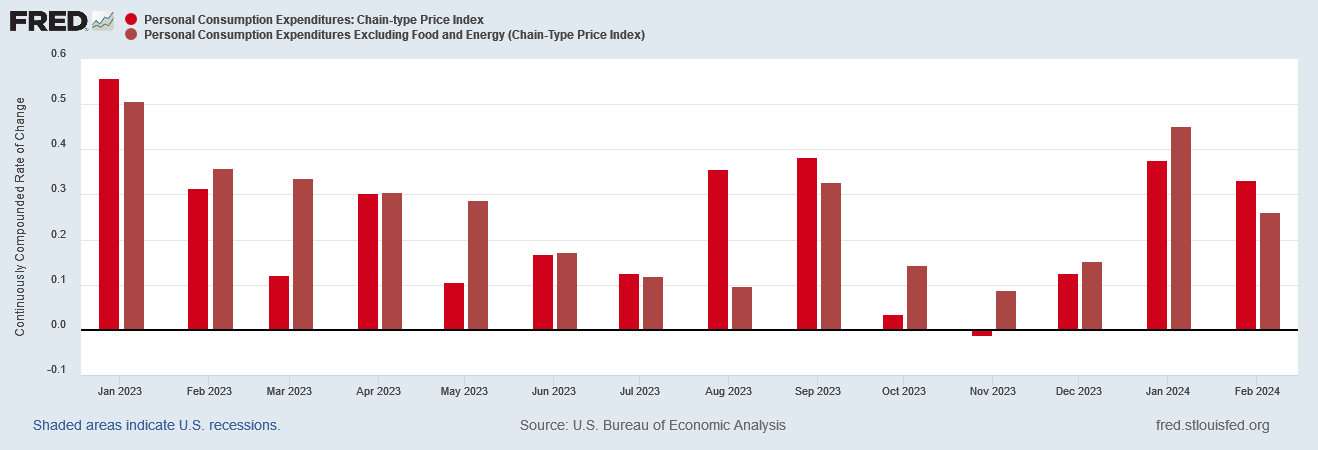

We should take careful note that while the headline PCE inflation metric is creeping up, the core PCE inflation metric—PCE inflation without food or energy pricing included—is still moving down.

When we look at the month on month inflation figures, we see that core inflation dropped noticeably, and even headline inflation dropped, just not by as much.

For there to be a small shift in the headline inflation rate month on month, and a large shift in the core inflation rate at the same time, we can safely conclude that energy prices are pushing the inflation rate up—and there is no denying that energy are in fact rising.

Throughout February both Brent Crude and West Texas Intermediate climbed steadily higher.

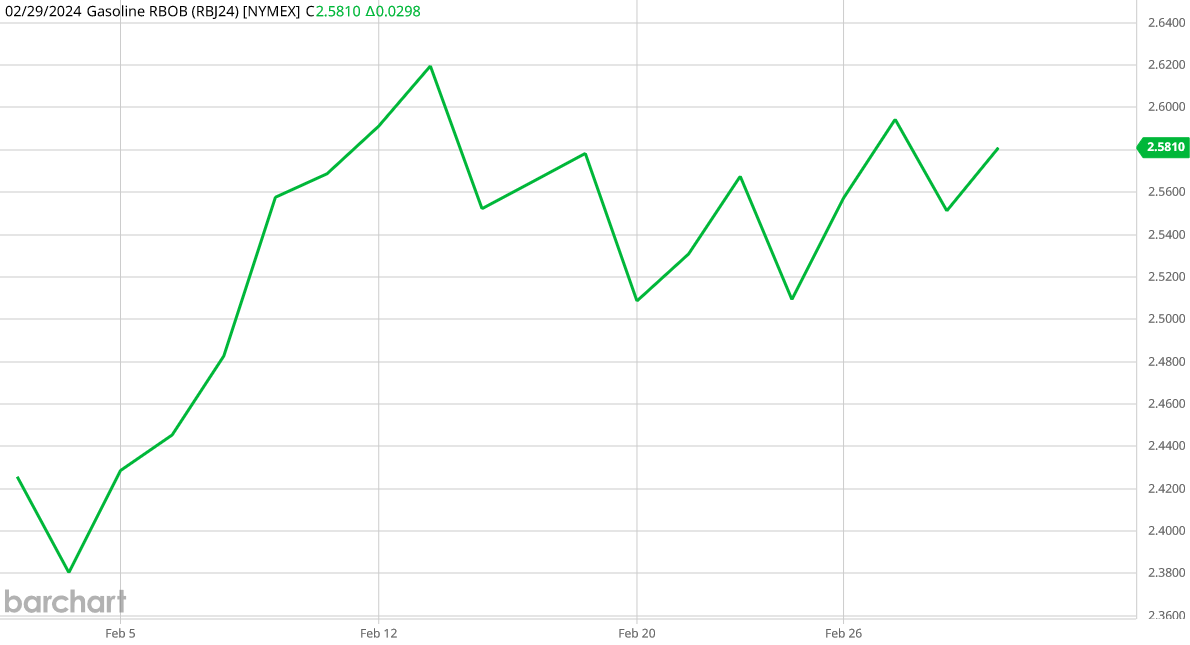

The spot prices for gasoline also moved higher throughout February.

Retail gasoline prices also moved higher throughout February.

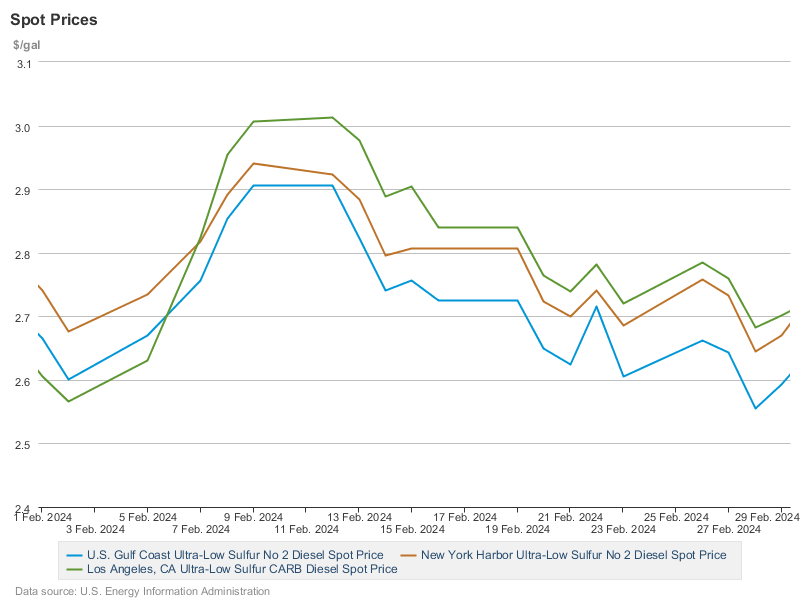

Only diesel prices ended February slightly lower, and that was after a significant uptick in early February.

Unsurprisingly, these price movements reversed the energy price deflation that had been the trend since October of last year, giving the PCE Energy goods and services subindex a healthy burst of inflation month on month for February.

Small wonder, then, that headline inflation within the PCE Price Index ticked up while core inflation ticked down.

Regular readers here will recall that we observed the same phenomenon of rising energy prices driving inflation in the Consumer Price Index as well.

Energy prices are moving up, energy price inflation is moving up, and now headline inflation is moving up.

The February factory gate inflation figures also showed the impact of rising energy prices.

Nor is there any great mystery as to why factory gate inflation is moving up: Energy prices are moving up, and especially moving up since the start of 2024.

To its credit, corporate media did note the influence of energy prices on the PCE inflation numbers—if one read far enough down.

Rising energy costs helped push up the headline reading, with a 2.3% increase. The food index edged up 0.1%. Inflation pressures came more from the goods side, which rose 0.5%, compared to the 0.3% increase for services. That countered the trend over the past year, during which services rose 3.8% while goods actually fell by 0.2%.

Given that energy price rises were the predominant driving force behind the headline inflation metric moving higher, corporate media did an excellent job of burying the lede.

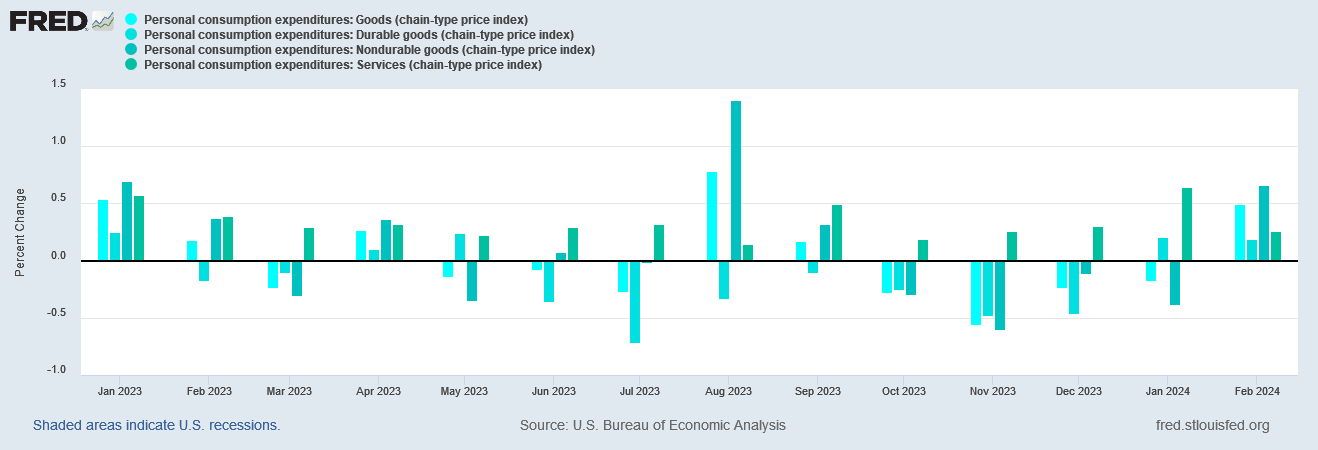

Energy prices also explain why nondurable goods were the biggest component of month on month consumer price inflation for February.

After several months of goods price deflation, rising energy prices flipped the script, and pushed overall goods prices back into inflation

While the “experts” may congratulate themselves for having guesstimated inflation rates correctly for February, in their haste to pat themselves on the back they have overlooked a major point—energy prices rose in February.

Gasoline got more expensive in February.

Crude oil got more expensive in February.

Even diesel prices started off February moving up before trending back down again.

As we saw with factory gate inflation, when energy prices move up they tend to take a whole host of other prices with them. Even within the Consumer Price Index data, rising energy prices invariably mean there will be more inflation, as energy prices tend to impact every good that is produced.

That energy prices drive up the various price indices—CPI, PCEPI, and PPI—is easy enough to understand, but there is an important corollary to that impact: if the price indices are moving up and down because of energy prices, they are not moving up or down because of the Federal Reserve’s interest rate manipulations.

Alternatively, to the extent that energy prices are the driving force behind inflation trends, interest rates are not the driving force behind inflation trends.

The corporate media narrative acknowledges the impact of energy prices on inflation, but never connects the dots to acknowledge how fundamentally little impact the Fed’s interest rate manipulations over the past two years have had on inflation.

The “experts” might think a little uptick in consumer price inflation is no big deal, but the reality of that uptick happening because of rising energy prices means the Fed is not influencing inflation trends. Rather than the Fed’s rate hike strategy controlling inflation, inflation is now controlling the Federal Reserve—which means the much anticipated rate cuts could be a long time in coming.

The “experts” might think a little inflation is okay, but Wall Street is likely to be a good deal less sanguine about it when it is apparent that little bit of inflation is likely to cause the Fed to postpone cutting the federal funds rate indefinitely.

Somehow, I doubt even Wall Street will be okay with that.

“‘Expert’ is synonymous with ‘blithering idiot’” - love it!

Oddly enough, I was just having lunch with a friend who said essentially the same thing about the Bidenomics ‘experts’, except he put it more colorfully than just ‘blithering idiot’. My friend is a local guitar legend, so we were talking about the economic health of the regional clubs, bars, and music venues (there was an era in my life when I was managing blues bands). He was ranting about how expensive everything had become on the music scene - cover charges, parking, drink prices,and just everything. The costs are killing live music. Young people who are struggling to come up with food and rent can’t go out, on any kind of regular basis, and drop $200 on $18 drinks and $40 cover charges. As the nightlife dies and city vibrancy dies, the downtowns die.

And the ‘blithering idiots’ seem to be CLUELESS about it! It’s all connected, you morons! You create trillions of dollars out of thin air, the dollar loses purchasing power, people can’t afford anything, and quality of life evaporates. Grrrr.

Hey, Peter, off-topic but significant.

In yesterday’s Courageous Discourse Substack, Dr. Peter McCollough is being interviewed, and about 24 minutes in he talks about Trump’s awareness of the Covid mismanagement and coverup. He explicitly states that he discussed it with Lara Trump and ‘she is FULLY AWARE’ of everything. He figures that if Lara Trump knows, Donald Trump most likely knows. Hmmm. Will Trump denounce the jabs soon, or hold his cards until just after the Election?

https://open.substack.com/pub/petermcculloughmd/p/reality-with-bruce-de-torres?r=z3pgv&utm_medium=ios&utm_campaign=post