Jay Powell has a problem: inflation is not bending to his will.

That is the obvious—perhaps the only—conclusion to reach when the February Consumer Price Index Summary prints year on year inflation at 3.2%, a tenth of a percent higher than January’s figure.

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in February on a seasonally adjusted basis, after rising 0.3 percent in January, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.2 percent before seasonal adjustment.

That tenth of a percent also exceeded Wall Street guesstimates on what the inflation figure would be.

The inflation report, set for release at 8:30 a.m. ET, is expected to show headline inflation of 3.1%, matching January's annual gain in prices, according to estimates from Bloomberg.

It will be the last inflation print before the Fed's next policy decision on March 20. Investors are hopeful the central bank will cut interest rates this year.

Over the prior month, consumer prices are expected to rise 0.4%, a slight acceleration from January's 0.3% monthly increase.

The problem for Jay Powell is that he has positioned the Fed to be looking for an inflation trend moving in the other direction. Appearing before Congress last week, Powell set the expectation that inflation would be moving towards 2%.

In prepared remarks for congressionally mandated appearances on Capitol Hill Wednesday and Thursday, Powell said policymakers remain attentive to the risks that inflation poses and don’t want to ease up too quickly.

“In considering any adjustments to the target range for the policy rate, we will carefully assess the incoming data, the evolving outlook, and the balance of risks,” he said. “The Committee does not expect that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

What does inflation do? Instead of continuing to decline like a good little metric it rises again, in defiance of what Powell wants everyone to expect.

Readers of this Substack, of course, will not be surprised, as I have been pointing out how inflation has been heating up for the past several months.

The Federal Reserve is not “winning” its fight with consumer price inflation. “Bidenomics” is not making the US economy stronger. The US economy itself is not doing at all well.

All of which runs counter to the “official” narratives from both Wall Street and Washington—and yet which the sudden realization of which explains the dramatic one day drop in equity indices and the one day surge in Treasury yields.

The February inflation print is merely the next data point along that trend—one that does not have inflation “moving sustainably toward 2 percent.”

Surprisingly, Wall Street did not have an allergic reaction to the hotter-than-expected inflation number—suggesting that rising inflation was already priced in despite the pronostications of the “experts”. Equities had a particularly good day.

Wall Street apparently decided that the extra tenth of a percentage point was “close enough” and chose to focus on other bits of financial news.

Stocks jumped Tuesday after fresh U.S. inflation data was about in line with expectations, clearing the way for investors to resume buying high-flying tech names such as Nvidia and Meta Platforms.

The Dow Jones Industrial Average gained 235.83 points, or 0.61%, to close at 39,005.4. The S&P 500 ticked up 1.12% to finish the session at 5,175.27, surpassing the previous record high close from March 7. The Nasdaq Composite advanced 1.54% to 16,265.64.

Treasury yields behaved more predictably, with the yield on the 30-year Treasury rising to just over 4.3%.

Still, even corporate media could not avoid the reality that the inflation print was higher than projected.

"Inflation continues to churn above 3%, and once again shelter costs were the main villain. With home prices expected to rise this year and rents falling only slowly, the long-awaited fall in shelter prices isn’t coming to the rescue any time soon," said Robert Frick, corporate economist at the Navy Federal Credit Union. "The good news is food prices didn’t rise last month, but the bad news is one of the other main pain points for consumers, transportation costs, rose quite a bit."

With the Fed having pushed the federal funds rate to its highest level in decades, the specter of resurgent inflation was not supposed to be a part of the narrative—but it is.

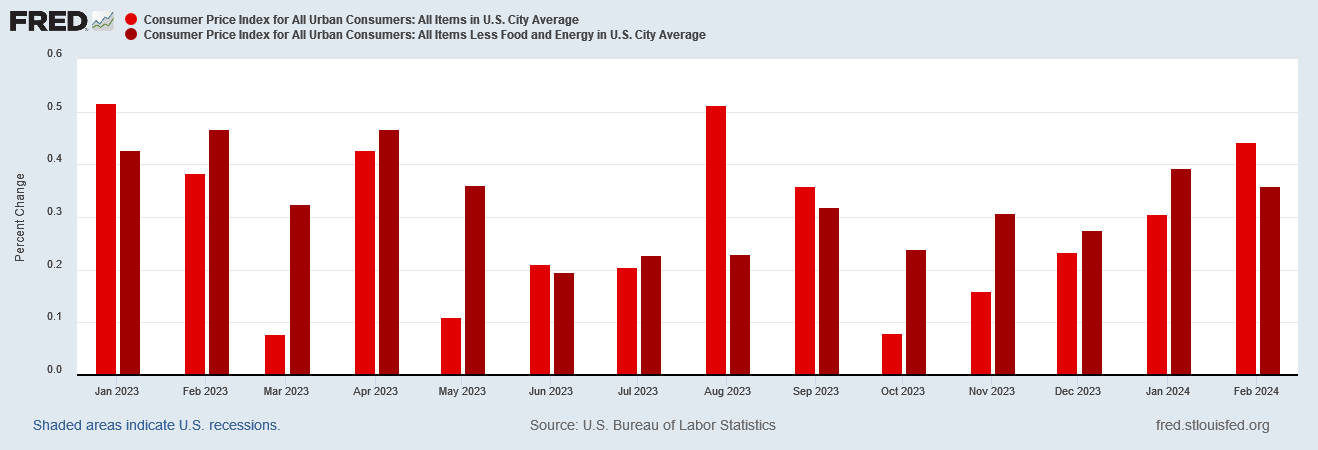

When we look at the month on month inflation numbers, we should not be surprised that headline consumer price inflation printed higher than expected. The month on month trend has been moving steadily higher since last October.

With month on month inflation rising over the past five months, it was only a matter of time before the monthly increase spilled over into a year on year increase.

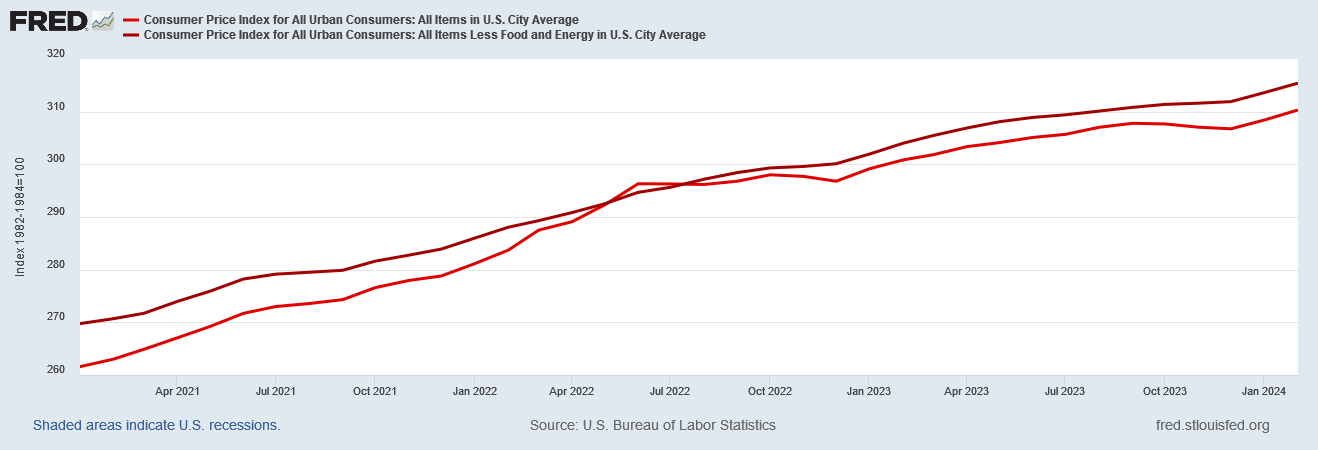

Moreover, the unadjusted raw data shows substantially the same overall trends.

Even the raw index data shows an inflection point occurring in December, after which both headline and core inflation rates are moving demonstrably higher.

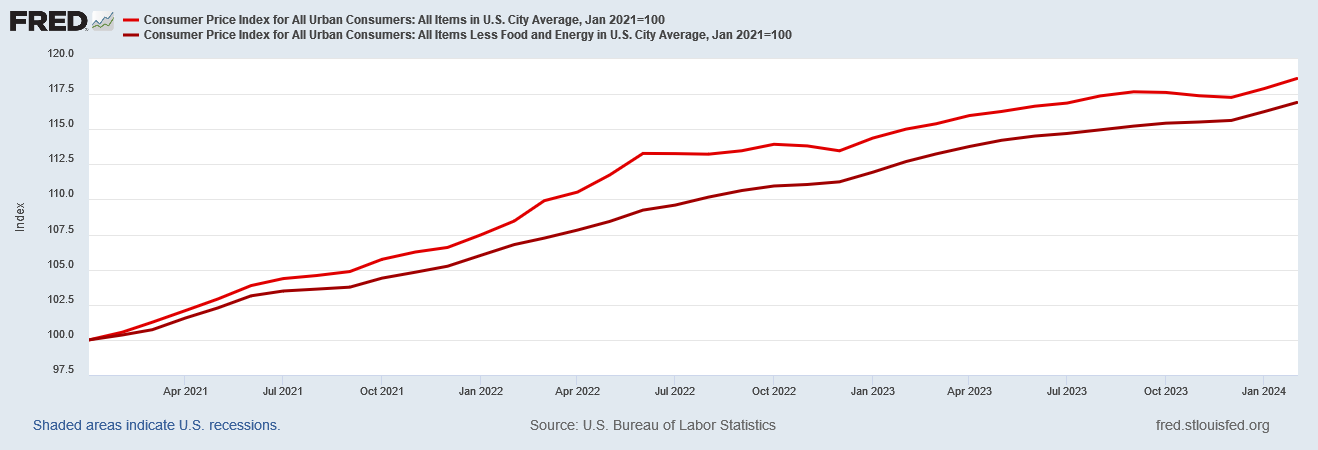

If we index the CPI to January of 2021 and the start of the Biden Regime, the inflection point in December remains.

The data leaves no doubt that inflation is heating up again.

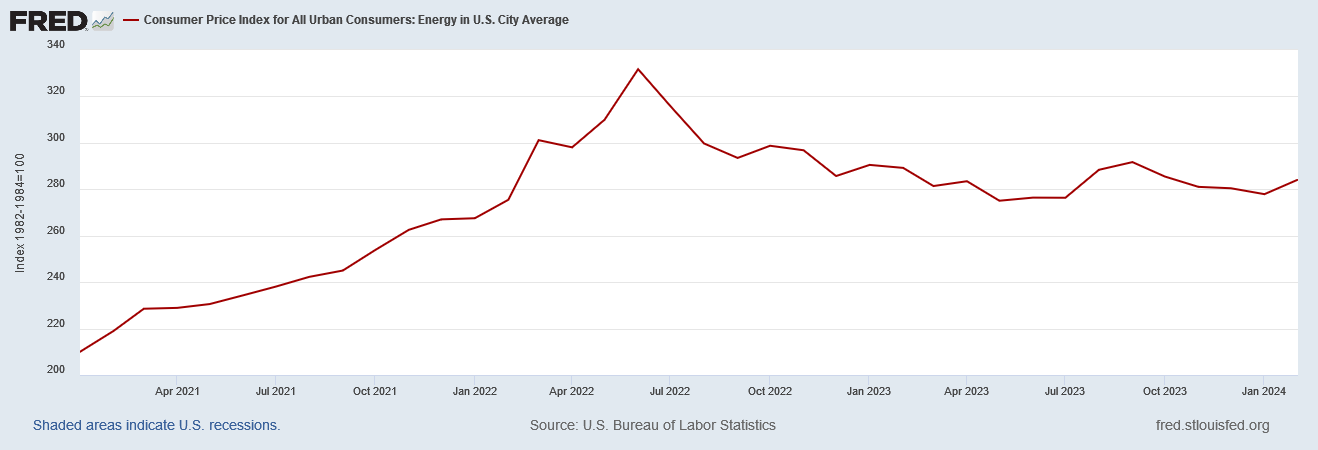

Nor is there any great mystery as to why inflation rates are moving higher: so are energy prices.

Even the raw energy price subindex shows the December inflection point.

This was to be expected, however, as a look at benchmark oil prices reminds us that oil prices bottomed out last summer, trended up until early fall, moved down again until November before trending up.

Energy is, of course, the primary differentiator between headline consumer price inflation, and “core” inflation with food and energy inflation removed.

Nor are crude oil prices the only indicator of rising energy prices and rising energy price inflation. Gasoline futures are also showing similar upward price pressures, and over the same time frames.

Energy prices are moving up, energy price inflation is moving up, and now headline inflation is moving up.

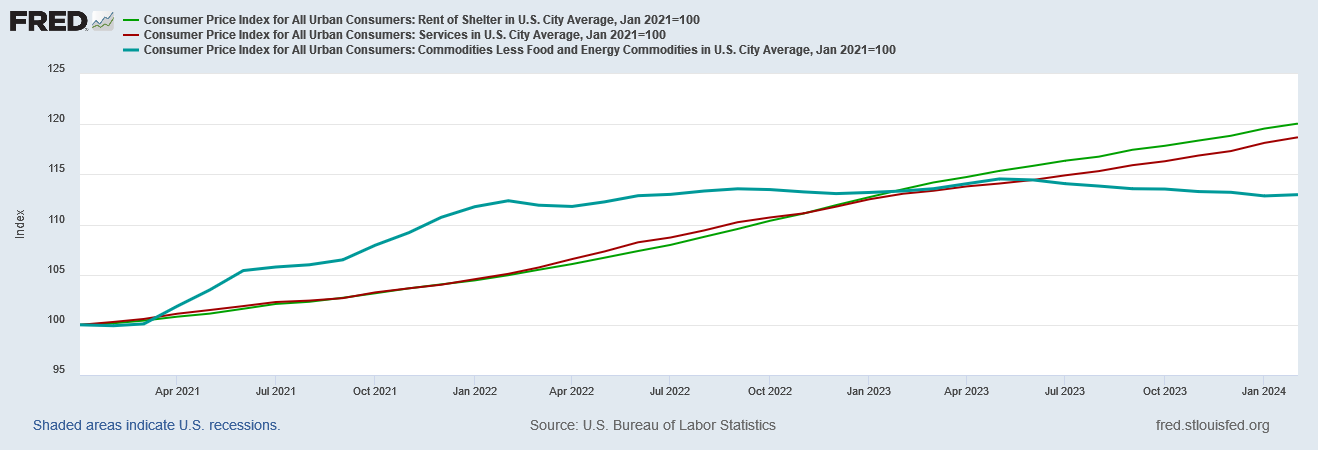

Yet it is also not merely energy prices that are bringing about resurgent inflationary pressures. Service pricing, and shelter pricing, are also proving to be tough inflation nuts to crack.

Despite the deflationary trend in physical commodities sans food and energy commodities, shelter and service pricing have not altered their respective trajectories since 2021. The stubborn refusal of service and shelter pricing to ameliorate the way physical goods pricing has leaves overall price levels particularly sensitive to energy price shifts—and we have been seeing that play out in the CPI data

How much is inflation likely to heat up? Because the inflation trend is almost entirely dependent on the energy price trend, the ultimate answer is “it depends”.

While energy prices have moved higher overall since last summer, over the past several weeks crude oil prices in particular have largely plateaued.

If energy prices are neither rising nor falling overall, but instead are trending largely horizontally, future upward price pressures within the CPI are likely to be reduced. Headline inflation numbers would not move much higher under that scenario.

Yet that scenario also confirms that Jay Powell’s manipulations of the federal funds rate has not been the primary driver of disinflation in recent months. Rather, inflation rates have largely risen and fallen according to what energy prices are doing.

As the federal funds rate has not been what has brought overall inflation rates down, it comes as no surprise that energy prices are what are pushing inflation rates back up again.

However, that also means that overall consumer price inflation is not “moving sustainably toward 2%”, which means the Fed’s criteria for eventually reducing the federal funds rate are also not about to come to pass. If current trends continue, it will be impossible for the Fed to lower the federal funds rate at all, based on the Fed’s criteria.

Far from controlling consumer price inflation, the Fed is in the unenviable position of being controlled by consumer price inflation. The price pressures from energy pricing have existed with or without the Fed’s rate hikes, and they are driven by events wholly outside the Fed’s ambit, in particular the ongoing wars in Ukraine and the Middle East.

The result? Structurally higher inflation even as the federal funds rate remains high.

That is exactly what is going to happen unless there is a radical shift in overall strategy for contending with a dysfunctional and underperforming economy. That radical shift is not likely to happen during an election year, and may not even happen after the election in November.

Unless and until the DC swamp decides to tackle their spending and debt habits, inflation is going to get worse before it gets any better. That is not the outcome the Fed and Jay Powell want to see, but it is the outcome they are on track to receive.

"Unless and until the DC swamp decides to tackle their spending and debt habits"

I'm pretty sure that won't happen until the whole mess blows up in their faces, something that will likely happen in the foreseeable future. We're in the coffin corner now (aviation analogy) and it's been entirely predicable for a decade and a half that this is where we'd end up if we kept climbing.

“Far from controlling consumer price inflation, the Fed is in the unenviable position of being controlled by consumer price inflation. The price pressures from energy pricing have existed with or without the Fed’s rate hikes, and they are driven by events wholly outside the Fed’s ambit, in particular the ongoing wars in Ukraine and the Middle East.

The result? Structurally higher inflation even as the federal funds rate remains high.”

That says it all. But, the Biden administration will do whatever they must in order to win the Election, including manipulating energy prices (via tax cuts, draining the Strategic Energy Reserve, ending the Middle East conflict -whatever). They know that a few days before the Election everyone will be asking themselves, “Am I better off from Biden’s reign, or do I want a change?” The answer better be - at any cost - “yeah, I’m good with Biden”.

Because I want to get rid of Biden’s administration, my preferred trajectory for the economy is for inflation to continue to rise for 7.5 months, so that everyone is ticked off at their polling places. After the Election, I’m hoping that deflationary contagion from China, or possibly new policies, will kick in enough to reverse inflation. Peter, you have studied all of the ‘good little metrics’ (giggle) for years, and have a wisdom now about lag times, lead times, likelihood of stable rates, etc. Juggling all the factors and extrapolating at the rates and prevalences you’ve historically seen, can you give us a ‘likelihood’ of my preferred trajectory occurring? Maybe 50% chance? Or are the pertinent factors, and the future situation in 7.5 months, just too unpredictable to even venture a guess?