This coming Wednesday, December 14, the Federal Open Market Committee will meet for the last time this year, and enact its final rate hike for 2022.

We should consider, therefore, how well the Federal Reserve’s rate hikes to date have fared, and how well they have succeeded in squelching demand and bringing on economic recession—the Fed’s preferred method for reducing inflation.

According to the Bureau of Economic Analysis' Personal Income And Outlays Report for October, personal income rose in October, as did disposable income, in both nominal and real terms.

Personal income increased $155.3 billion (0.7 percent) in October, according to estimates released today by the Bureau of Economic Analysis (tables 3 and 5). Disposable personal income (DPI) increased $132.9 billion (0.7 percent) and personal consumption expenditures (PCE) increased $147.9 billion (0.8 percent).

The increase in expenditures is due in part to rising inflation, which the PCE index measured at 6% year on year for October, and 0.3% month on month.

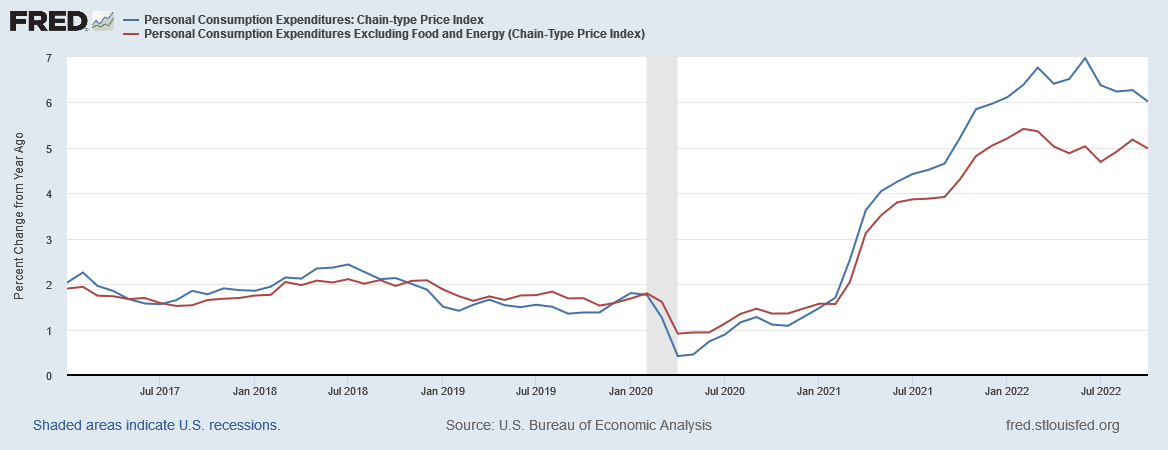

While the PCE index runs lower than the Consumer Price Index, within the index we see the same general inflation behaviors. In particular, we see energy price inflation show outsized volitality, thus causing it to play a major role in consumer price inflation per the PCE.

Still, both the headling PCE index and the “core” PCE index (the headline index less food and energy) show consumer price inflation having largely plateaued and even declined marginally in recent months.

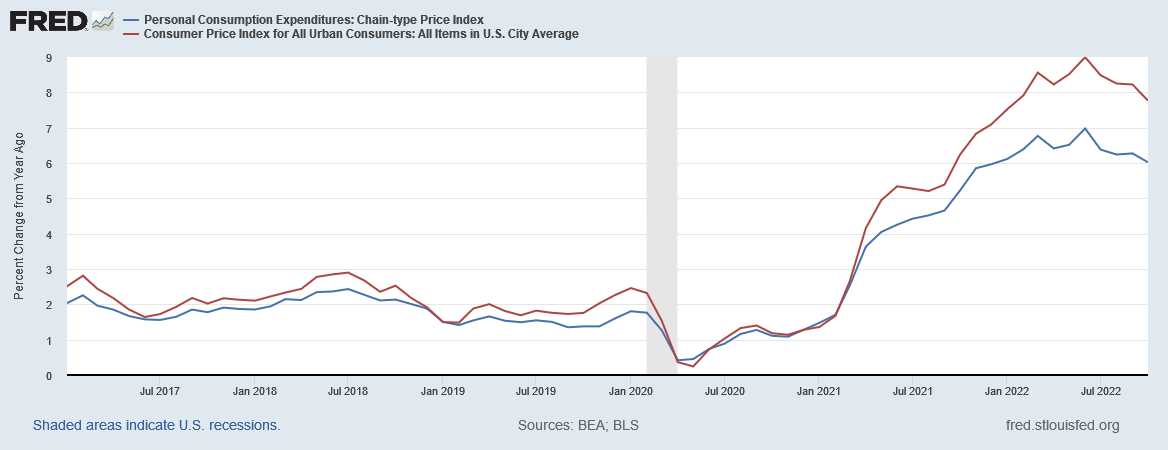

While the magnitudes differ, this aligns with what the Consumer Price Index shows for inflation over the same time frame.

Certainly both inflation metrics make the case that “peak” inflation has largely passed, although we have yet to see a substantial retreat from that peak.

Yet in the month on month inflation metrics, we also see the return of energy price inflation as a substantial driver of consumer price inflation.

For the first six months of the year, energy price inflation outpaced headling consumer price inflation by several orders of magnitude. During July, August, and September, we had on a month by month basis energy price deflation. In October, however, energy price inflation returned, and once again outpaced consumer price inflation by severl orders of magnitude.

While recent trends show that peak inflation has passed, if energy price inflation continues to outpace headling consumer price inflation, not only will inflation start to rise again, but the previous inflation peak will quickly be surpassed.

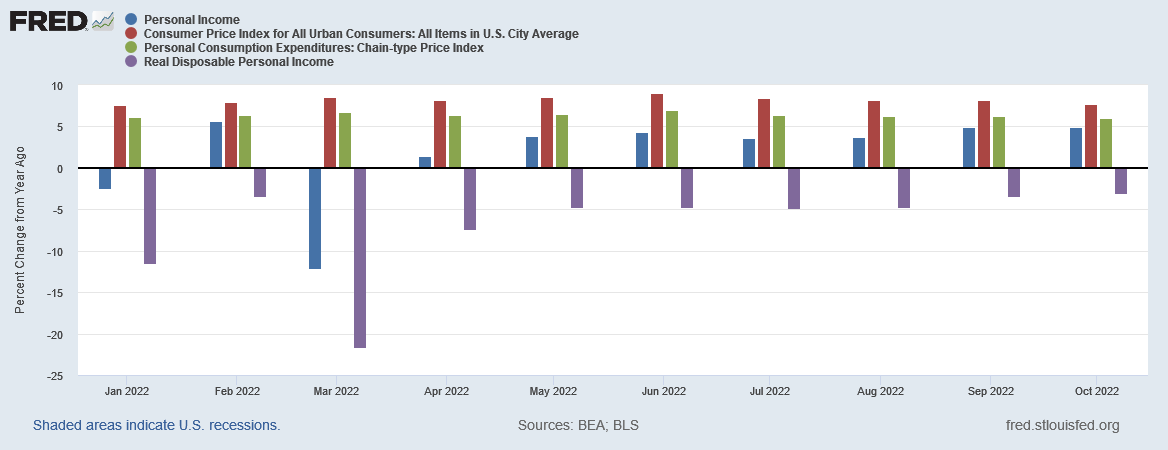

Given that the Fed’s recipe for curing inflation is recession, with the Fed deliberately targeting consumer demand and jobs for destruction as the vehicle by which inflation is to be brought back down, October is a big disappointment for the Fed. Viewed month on month, not only did personal income rise, but real disposable personal income rose as well.

During the first half of the year, inflation as measured by both the CPI and the PCE outpaced personal income growth, resulting in shrinking real disposable personal income. However, beginning in July, monthly personal income growth has managed to say ahead of month on month inflation percentages, allowing real incomes to grow—exactly what the Fed has openly opposed since they began hiking interest rates.

Far more in line with the Fed’s intentions and expectations are the yearly personal income numbers, which still show real incomes having shrunk from twelve months earlier.

From one perspective, the recent monthly rises in real disposable personal income merely mean that the yearly declines in real disposable personal income are simply less than they have been. Monthly income growth will need to be a lot more for the yearly income figures to flip from decrease to increase.

Arguably, the real disposable income figures from earlier in the year confirm that the economy was in recession for the first six months of the year—something the White House and the media have strenuously denied.

The month on month growth in real disposable income from July onwards, on the other hand, certainly plays into the BEA estimate of GDP growth for the third quarter.

While the overall economic picture is far more problematic, a simplistic focus on headline numbers such as GDP sustain the narrative that a recession has not yet occurred, and the Fed may yet pull off a “soft landing” where inflation is brought down without triggering a recession—a foolish hope, given that recession is the Fed’s stated and immediate objective as part of their strategy to tame inflation.

With the economy showing unacceptable signs of growth, the Fed is almost certain to raise rates again come Wednesday’s FOMC meeting. Cooling inflation has the market anticipating a 50bps rate hike as opposed to a 75bps rate hike, but the expectation is that the Fed will hike rates yet again.

Yet aside from growth in personal consumption and personal income, the details underneath the top level GDP growth estimates show multiple aspects of the US economy still contracting and the US economy therefore still in recession.

Not only has the Fed not achieved a “soft landing” for the US economy, the Fed’s further rate hikes will ensure that the landing engineered by the Federal Reserve will be a hard one, and will get harder as we move from 2022 into 2023.

Because personal incomes are showing signs of growth, because personal consumption is still powering GDP expansion, the Fed will feel obligated to continue hiking rates. The only way the Fed knows how to reduce inflation is to eliminate personal consumption and halt personal income growth.

Expect the Fed to keep hiking rates so long as workers in this country have disposable income to spare. That the economy is already in recession on several fronts simply does not matter to them.