Producer Price Index Promises More Inflation To Come

Yet The Main Driver--Energy Costs--Does Not Add Up

With the release of the Bureau of Labor Statistics Producer Price Index Summary for June, two hopes effectively died: 1) the hope that June’s 9.1% consumer price inflation number represented “peak” inflation, and 2) the hope that the Fed might opt for a rate hike less than 100bps.

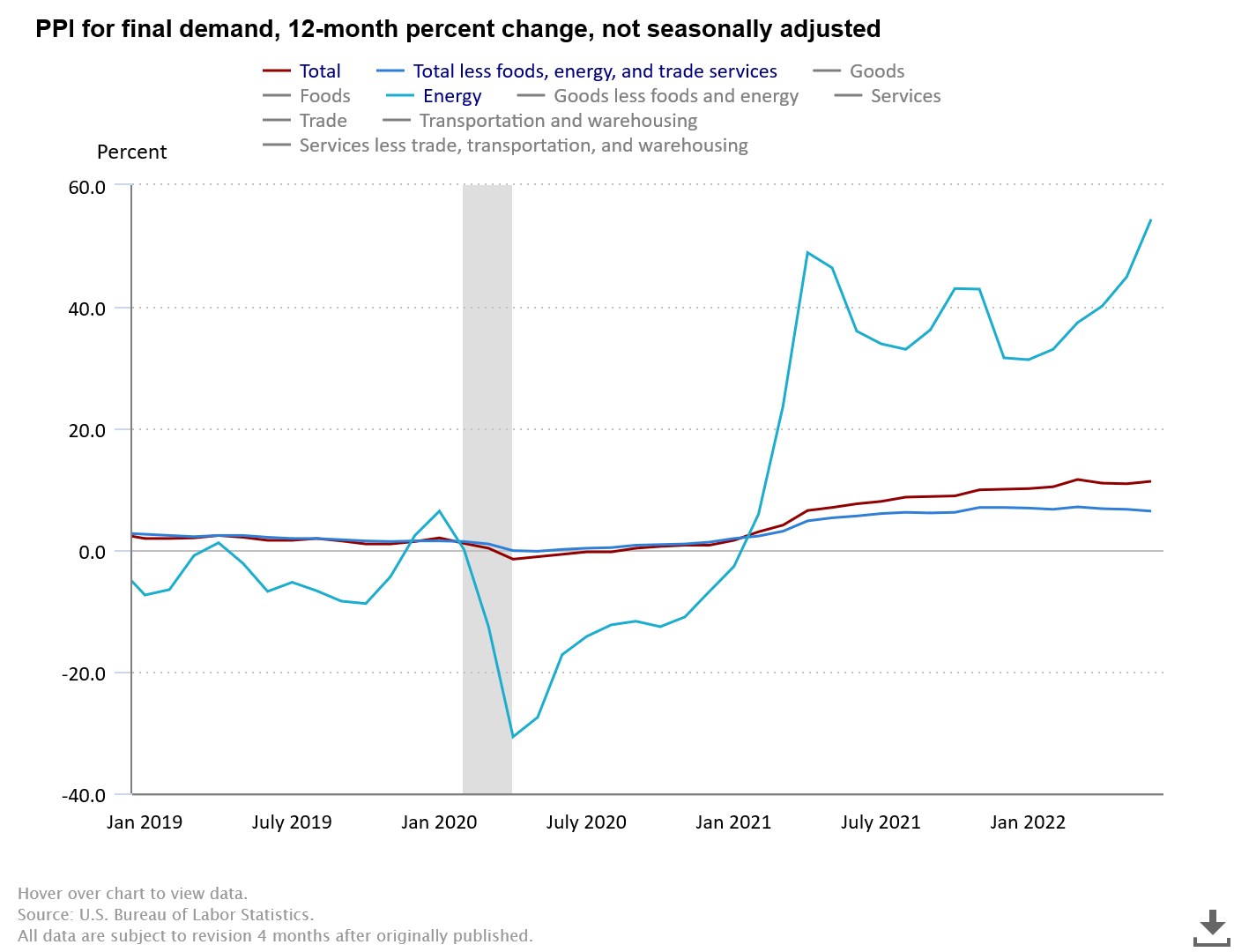

The Producer Price Index for final demand increased 1.1 percent in June, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. This rise followed advances of 0.9 percent in May and 0.4 percent in April. (See table A.) On an unadjusted basis, final demand prices moved up 11.3 percent for the 12 months ended in June, the largest increase since a record 11.6-percent jump in March 2022.

With the PPI showing producer price inflation jumping to 11.3% year-on-year, there is clearly more inflation yet to work through to the CPI, and that near certainty of future inflation only amplifies the Fed’s stated logic on rate hikes.

Yet the producer price inflation itself rests on an assertion that is difficult to interrogate empirically: that producer inflation was driven up by increases in gasoline and energy costs.

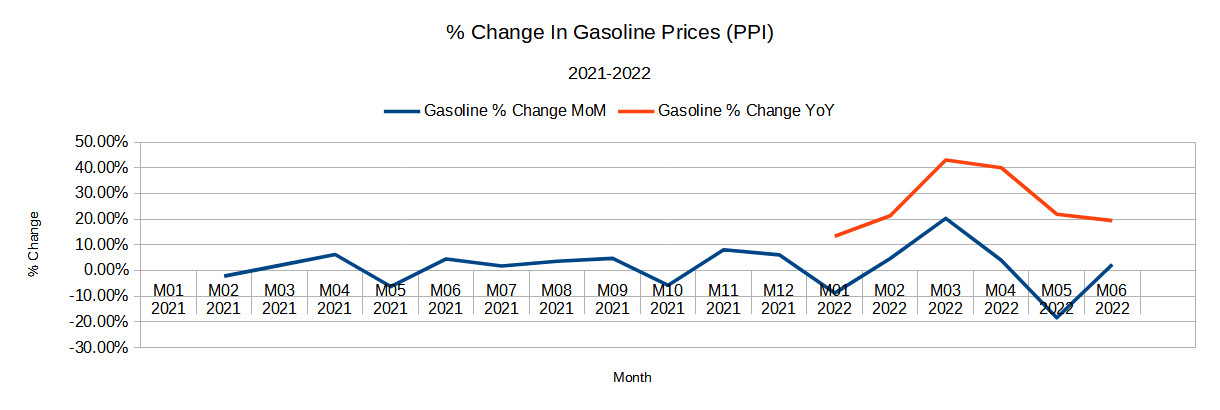

Product detail: Over half of the June increase in the index for final demand goods is attributable to gasoline prices, which jumped 18.5 percent. The indexes for diesel fuel, electric power, residential natural gas, motor vehicles and equipment, and processed young chickens also moved higher. In contrast, prices for chicken eggs dropped 30.2 percent. The indexes for iron and steel scrap and for jet fuel also decreased.

Energy Costs Presumably Rising?

The PPI Summary is unambiguous on this point: energy costs rose significantly in June—so much so that if one strips energy costs out of the PPI, producer price inflation actually declined for the month.

That the impact of reported energy price inflation within the PPI was by far the dominant influence on the June numbers is plain for all to see.

However, there is one small problem with that assertion. It is difficult to find the cost increases described in the indices, particularly at the magnitudes that are being claimed.

According to the PPI report (Table 1), final demand energy prices rose an unadjusted 54.4% Year-On-Year and a seasonally adjusted 10.0% Month-On-Month.

Looking at the data for Intermediate Demand (prices paid by distributors and wholesalers, Table 2), gasoline prices jumped 86.7% Year-On-Year and 18.5% Month-On-Month.

If that data is correct, the President’s artless tweet about gasoline prices yesterday was not merely inaccurate, but positively delusional.

If gasoline prices in the PPI rose 18.5% for the month of June, in July look for a ginormous spike at the pump. Remember, producer price inflation is a general leading indicator for consumer price inflation—what shows up in the PPI today shows up in the CPI tomorrow, as it were.

But…did gasoline prices actually increase? There is data to suggest otherwise.

Producer Price Gasoline Data

While the numbers are still preliminary and subject to revision, producer prices for the primary products of gasoline stations (which presumably would be…well…gasoline) rose from an index value in March of 165.130 to an April surge of 171.720 before declining in May to 140.234. In June that index value rose to 143.580.

While gasoline producer prices did rise in June, that rise is nowhere near 18.5% Month-on-Month. Nor is the Year-on-Year price increase 86.5%. In actuality, the Year-on-Year increase is just above the monthly reported rise of 18.5%

This is dramatically different from the changes reported at the index level, which show dramatic increases for both Month-On-Month and Year-On-Year.

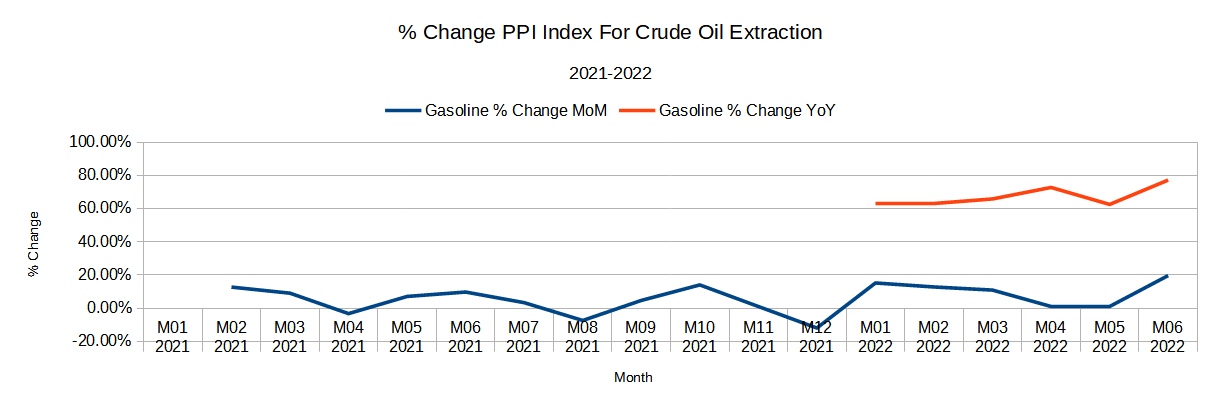

The PPI index for crude oil extraction—the precursor to gasoline—also shows dramatic increases for both the Month-On-Month and Year-One Year changes.

However….

The commodities futures data for gasoline and crude oil do not reflect such increases during the month of June.

Futures on West Texas Intermediate crude oil declined dramatically during June. They did not rise.

Gasoline futures also declined during June:

Keep in mind that, although the average price at the pump for gas rose during June, according to the Energy Information Association data, weekly gas prices did decline during the final weeks of the month.

Price indices nominally should track at least somewhat to real world prices—and must if they are to be useful information. Low accuracy is one thing, but being completely wrong is another. The PPI indices for gasoline and crude oil appear to be at odds with prevailing commodities prices (futures) for both commodities. The indices are reporting pricing pressures that are not showing up in commodities markets, a reality which is at the very least counterintuitive.

“Core Inflation” Overwhelmed By Energy

The accuracy of the energy price inflation data is crucial because that one subcomponent completely overwhelms the declines both in food price inflation and core producer price inflation. But for the energy factor, the PPI would show a moderate decline for June, in keeping with prior months trends.

Stepping back to take the PPI report at face value, whether accurate or inaccurate it is sending a strong signal of future inflation—a signal it seems highly unlikely the Fed can or will ignore. Too much rhetoric has been issued about the need to tamp down such inflation, and, as the bond market yields reveal, the markets are taking that rhetoric seriously. Jay Powell can’t back off of rate hikes at this juncture without both the markets and the media concluding he is completely insane (an assessment which may not be entirely inaccurate as things stand).

This PPI report is troubling, because there are anomalies under the surface that do not easily resolve themselves upon scrutiny. The degree to which energy costs are or are not rising within the economy shapes the entire inflation discussion—energy price inflation alone makes Brian Deese’ artless spin attempts to talk about “core inflation” absolutely absurd.

However, the report is clear on one point: there will be more inflation to come. “Peak” inflation is still not yet here.

I thought the recent price drop at the pump was due to Biden dipping into our strategic oil reserve. I read 20million gallons a week. This is really scary because that’s supposed to be used in dire emergencies and we may need it down the road if Putin decides to cut us off?

Yes, the war on our energy hasn't even reached "the end of the beginning."