Russian Central Bank Enacts Yet Another Rate Increase

Resurgent Inflation A Daily Reminder Of the Cost Of War

To put it simply, Russia and Vladimir Putin have a problem on their hands: inflation is making a major comeback there, even more so than it has here.

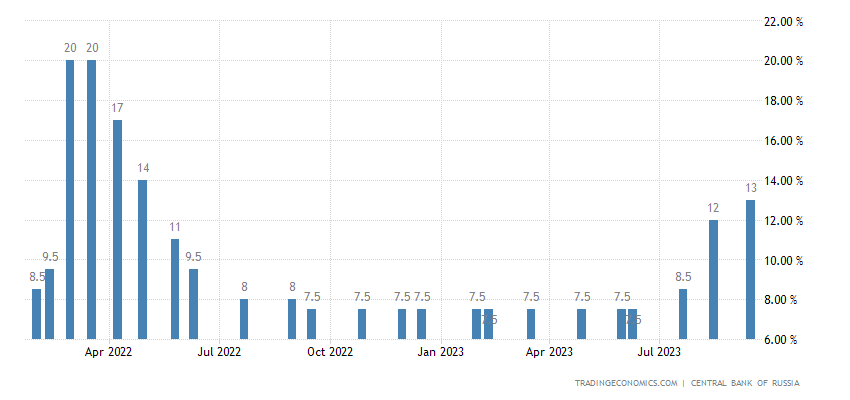

The seriousness of the problem for Russia is underscored by the Russian Central Bank’s decision to raise its key interest rate to 13%, just a few weeks after an emergency meeting in August to raise the rate to 12%.

“On September 15, 2023, the Board of Directors of the Bank of Russia decided to increase the key rate by 100 bp, to 13.00% per annum. Inflationary pressure in the Russian economy remains high. Significant pro-inflationary risks have materialized: growth in domestic demand, outpacing the possibility of expanding output, and the weakening of the ruble in the summer months,” the Central Bank notes, pointing out that in these conditions it is necessary to ensure additional tightening of monetary conditions to limit the scale of inflation’s upward deviation from the target and its return to 4% in 2024.

Resurgent inflation, and the somewhat panicked response of the Russian Central Bank, are ongoing reminders that wars are always a costly business.

With this latest rate hike, the Russian Central Bank has now raised its key interest rate 450bps within the space of about a month.

Russia's central bank raised its key interest rate by 100 basis points to 13% on Friday, jacking up the cost of borrowing for the third meeting in succession in response to a weak rouble and other persistent inflationary pressures.

A month ago, responding to the rouble tumbling past 100 to the dollar and a public call from the Kremlin for tighter monetary policy, the bank had hiked rates by 350 basis points to 12% at an emergency meeting.

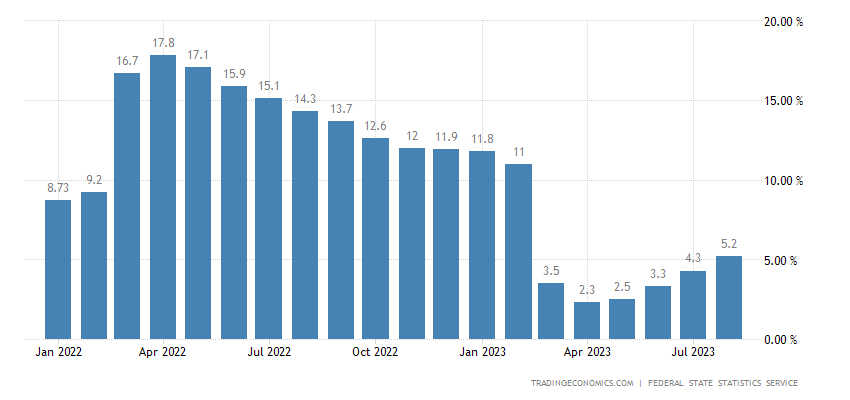

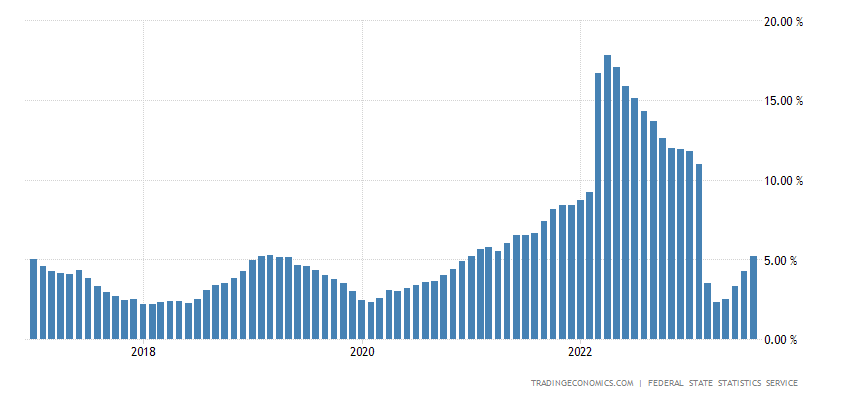

These rate hikes have come in response to consumer price inflation which has been climing steadily higher in recent months.

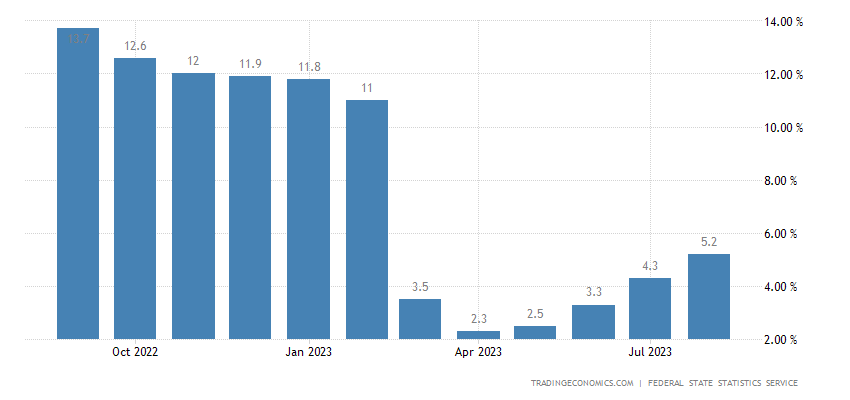

For August, Rosstat pegged consumer price inflation at 5.2% year on year.

This also marked the third month that the increase in year on year inflation was 0.8% or more. These are not small rises in inflation, particularly now, with inflation having dropped to a very nice 2.3% in April.

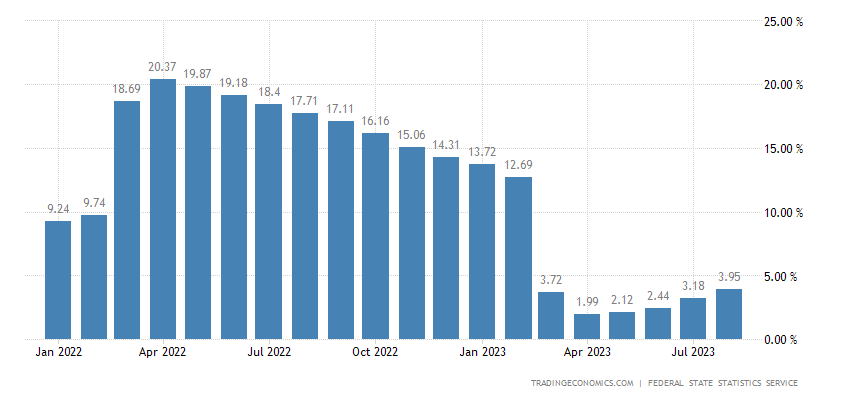

Moreover, core inflation has been rising almost as much.

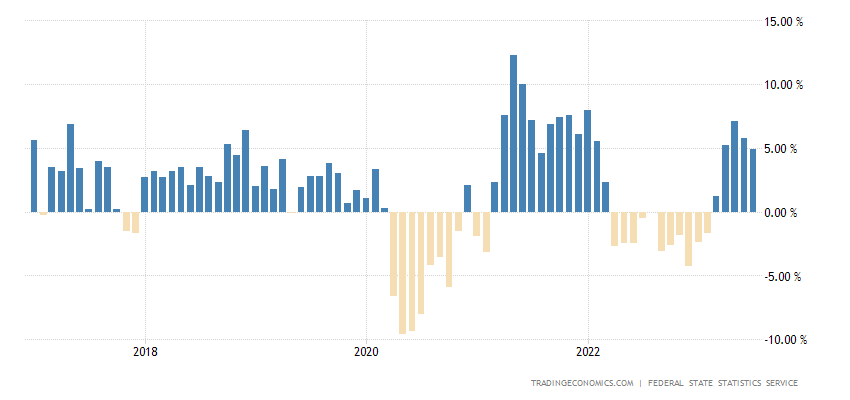

In some respects, Russia could see this surge in inflation coming, as their Producer Price Index rocketed to 4.1% year on year from zero in July alone.

Even that surge had some buildup behind it, as Russia’s factory gate inflation has been rising monthly almost all year thus far.

Despite having seen a bit of inflation within the Producer Price Index this past year, Russia’s inflation indicators are showing, much like those in the US, not just resurgent inflation but inflation that is going to last for a while.

In true parrot fashion, however, the Russian Central Bank has opted to pursue the same failed strategies that have been popular here in the US as well as Europe: they have raised interest rates.

Russia has gone through a period of major interest rate hikes before—right after the invasion of Ukraine, the Russian Central Bank pushed interest rates up to 20%.

Interestingly, Russian inflation peaked after the RCB began to taper off its interest rates.

While Russian inflation began 2022 already much higher than what was happening in the US, its peak of 17.8% year on year came in the same month (April) the RCB lowered its rate to 17%. One would expect if interest rates were having significant impacts on inflation that the peak would have been set earlier, when the interest rates themselves peaked. For an inflaton rate to rise after there has been some easing of interest rates is at the very least counterintuitive.

Even the core rate peaked after interest rates were coming down.

However, it is not hard to understand Russia’s concern over inflation, as it has been fairly volatile for a number of years even pre-COVID. Consumer price inflation north of 5% is not that unusual in Russia, and in 2021, it was an indicator that inflation was not merely up but that it ws going to continue to rise.

Producer price inflation itself has in recent years been particularly volatile in Russia, surging above 30%, and that was before the invasion of Ukraine.

With the pace of the most recent rise in inflation, it is not hard to see why the RCB wishes to be proactive in the matter.

Yet the impact of inflation on the economy itself is not the only motivation for the RCB to do something regarding inflation’s rise. Practically from the beginning of the year, the Russian ruble has been deteriorating against the dollar.

A 40% drop in the ruble against the dollar is nothing if not extreme. Nor has the decline been just against the dollar. Perhaps more important has been the ruble’s decline against the yuan.

A 35% decrease against the yuan seriously imperils Russia’s ability to import goods from China, something which has taken on increased significance due to Russia’s economic isolation following the imposition of sanctions last year.

The ruble has even dropped 36% against the Japanese yen.

Given the depreciation of the yen against the dollar since the beginning of the year, the ruble’s decline against that currency is all the more striking.

The 4% decline of the yuan against the dollar since the start of 2023 likewise makes the ruble’s weakness against that currency appear particularly significant.

Despite Russia’s putting on the brave face to the economic media, the data is pretty unmistakable: the Russian economy is having a rough time right now.

It perhaps underscores Putin’s concern over inflation that he attempted to get ahead of some of it, speaking about the inflation situation and the interest rate rises in response while addressing the Eastern Economic Forum in Vladivostok.

Russian President Vladimir Putin on Tuesday said increasing inflation had forced the central bank to hike interest rates to 12% last month, warning that Russia’s economy would suffer if price rises were allowed to get out of control.

“In conditions of high inflation, it’s practically impossible to form business plans,” Putin said at the Eastern Economic Forum in Vladivostok.

It remains to be seen how committed Putin is to winning the inflation fight, as the single biggest source of inflation in Russia right now is the Russian government spending on the war in Ukraine.

Certainly the Russian Central Bank is taking a page from Jay Powell’s “hawkish” persona.

"We raised the rate due to the appearance of inflation risks and will keep it at high levels for quite a long time, until we are convinced of the sustainable nature of the inflation slowdown," the bank's governor, Elvira Nabiullina, told a press conference.

Perhaps of greater concern for the Russian economy, however, is the admission that consumer demand is not being met within Russia.

In a statement, the bank said: "Significant proinflationary risks have crystallised, namely domestic demand growth outpacing output expansion capacity and the depreciation of the rouble in the summer months," the bank said in a statement.

While this is not at all uncommon during times of war, it nevertheless underscores a significant political risk the ongoing war in Ukraine holds for Putin. The longer the war drags on, and the longer the Russian economy has to prioritize the Russian military over the civilian consumer, the higher consumer price inflation is going to move, regardless of how hawkish the Russian Central Bank decides to be.

Much like Putin’s off-the-cuff admission that high inflation disrupted business plans and strategies, the bank’s admission on the imbalance between demand and supply underscores the fragility of the Russian economy. For all Putin’s efforts to keep the war in Ukraine from directly impacting the Russian people, the war in Ukraine is hitting Russians directly in their wallet.

Which is not to say the Russian economy is teetering on the brink of collapse. However, just as the Russian economy was demonstrably off to a bad start at the beginning of the year, it appears that things have not completely resolved themselves.

To be clear, industrial production apparently has recovered at least somewhat in Russia, after having spent the bulk of 2022 in decline.

However, with the increases in industrial output lagging behind their 2021 peaks, it is not unreasonable to anticipate that most if not all of that output is going to the war in Ukraine, leaving very little for the domestic economy to enjoy.

Which is how inflation begins to rise again. Lengthy wars are generally bad for a nation’s economy, and the state of the Russian economy after over 18 months of war has not departed from that historical norm.

It is for that reason the Russian Central Bank’s rate hikes are unlikely to curtail domestic inflation that much. Interest rate hikes generally work on the demand side of the economy. However, the inflationary pressure Russia is experiencing comes from the relative scarcity of goods—from the suppliy side of the economy.

Raising interest rates is not going to improve the supply situation in Russia. At best it will constrain demand to ease pressure on supply. That tactic that might work in the short run, but, as the scarcity itself remains, the end result will still be a diminished Russian economy and a population that is prevented from consuming as much as it would like.

This is the cost of war.

The return of inflation is a stark reminder of an essential question about war that Putin must daily confront regarding Ukraine: how much Russian treasure is he prepared to expend to achieve the war’s objectives?

"In true parrot fashion, however, the Russian Central Bank has opted to pursue the same failed strategies that have been popular here in the US as well as Europe: they have raised interest rates."

All central banks are the same, even Russian.

We can't all be Vladimir Putin, at least not yet.