Wall Street is eagerly awaiting the Federal Reserve’s first reduction in the Federal Funds Rate since it begain its rate hike strategy against inflation more than two years ago. A few are hopeful, and many are fearful, that the Fed has waited too long to being trimming interest rates.

For investors, a key question may be whether the Fed will cut rates in time to avert a potential economic slowdown.

The S&P 500 (.SPX) has slumped an average of 4% in the six months following the first reduction of a rate-cutting cycle, if the economy was in a recession, data from Evercore ISI going back to 1970 showed. That compares to a 14% gain for the S&P 500 when the Fed cut in a non-recessionary period. The index is up 18% in 2024.

“If the economy is falling into recession, the rate cuts aren’t enough of a support to offset the move down in corporate profits and the high degree of uncertainty and lack of confidence,” said Keith Lerner, co-chief investment officer at Truist Advisory Services.

The bitter irony underlying the economic handwringing, however, is that the rate hike strategy has not been effective, and the rate cuts are likely to be just as impotent.

Wall Street and “experts” everywhere would be wise to simply say the quiet part out loud: “Powellnomics” is not working.

What do I mean by such an outrageously heretical statement?

I mean exactly that. Jerome Powell’s hiking of the federal funds rate has not had material impact on rates of consumer price inflation. For all the talk about the rate hikes being the largest in over a decade, the federal funds rate rises were too small and came too late to have any impact on inflation—and would not have been able to exert much influence even if they had come sooner because market-based rates have largely discounted the federal funds rate at this juncture.

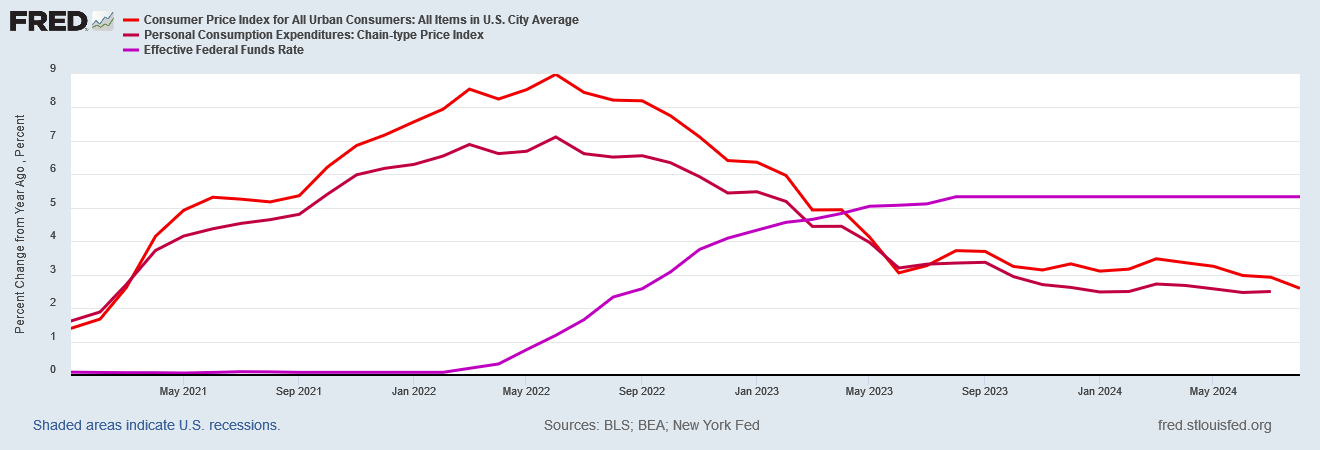

We can see that just by looking at the behavior of consumer price inflation in relation to the federal funds rate.

Inflation had already largely peaked by the time Jay Powell made his first rate hike in June of 2022, and it hit an apparent bottom roughly the following year, in June 2023. Inflation has inched down somewhat since then, but, as I’ve discussed before, those declines are due primarily to energy price deflation.

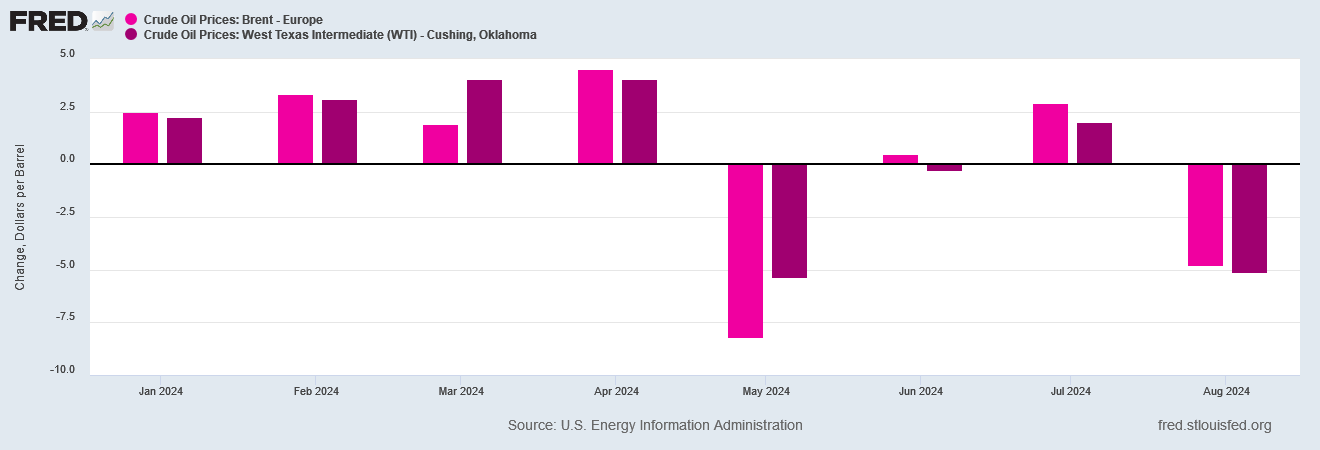

When we look at the prices for Brent Crude and West Texas Intermediate oil throughout the year, we see that the past few months especially have had seen significant price declines.

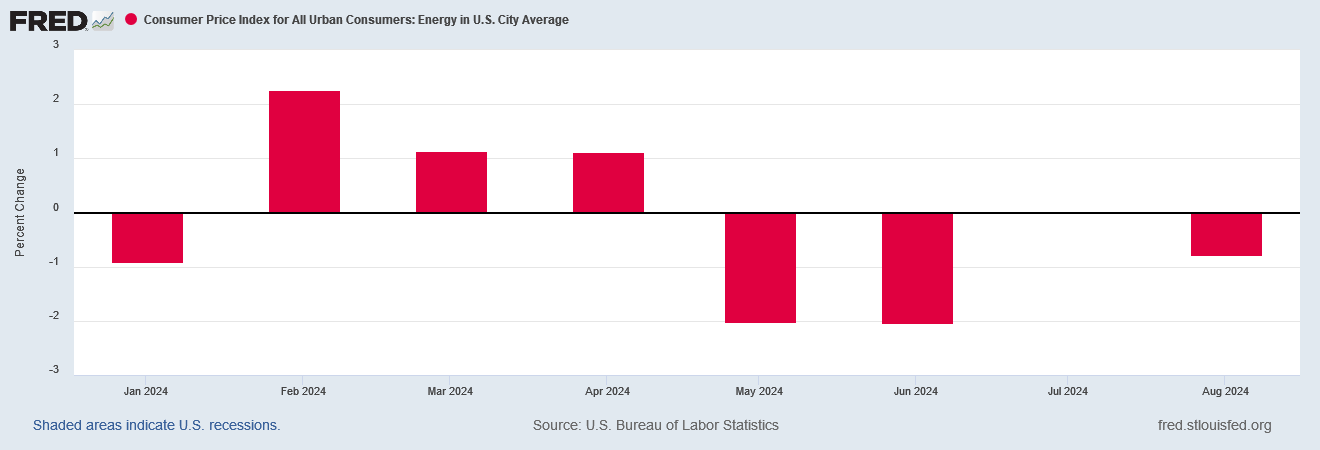

Declining energy prices naturally show up in the CPI Energy subindex, which likewise has been showing price deflation in recent months.

Energy prices pushed inflation up, and energy prices have brought inflation down, not Jay Powell.

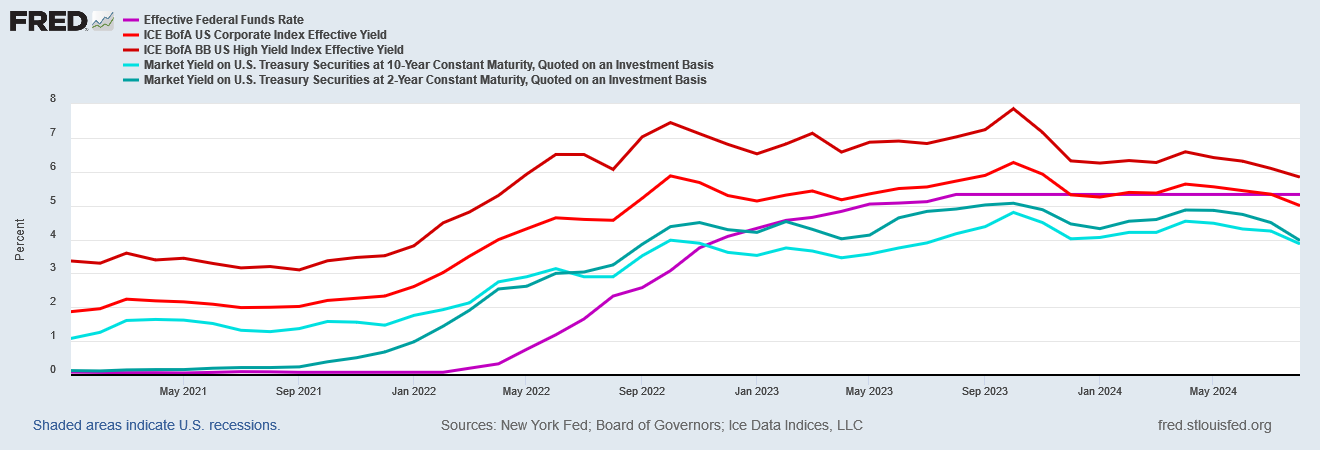

Moreover, the purpose of the rate hike strategy was to push market rates higher, and that it has never done.

Neither treasuries nor corporate debt waited for the Fed to bid interest rates up, nor have they waited on the Fed to bid them back down again.

When markets do not wait for Powell to raise the federal funds rate or to lower it again, it is a safe bet that Powell lowering the federal funds rate tomorrow will not make much difference.

One likely reason the Fed’s rate hikes have proven less than impactful especially on market rates is that markets make so much use of any “forward guidance” that comes their way that any impact the federal funds rate changes might have had gets fully priced in before the Federal Reserve can actually enact a rate change.

The biggest hint that the Fed’s largesse will disappoint investors, though, is the extent to which it is already expected by the market. Already, traders’ central expectation is for 1.25 percentage points’ worth of cuts before the year is out, followed by another 1.25 next year. Such rapid moves have only occurred in the past amid recessions or crises. There is plenty of room, in other words, for Mr Powell to surprise on the hawkish side even as he slashes rates, which would raise bond yields and make stocks less attractive. Rate cuts ought to be good for the stockmarket. But not if investors have already pocketed their benefits

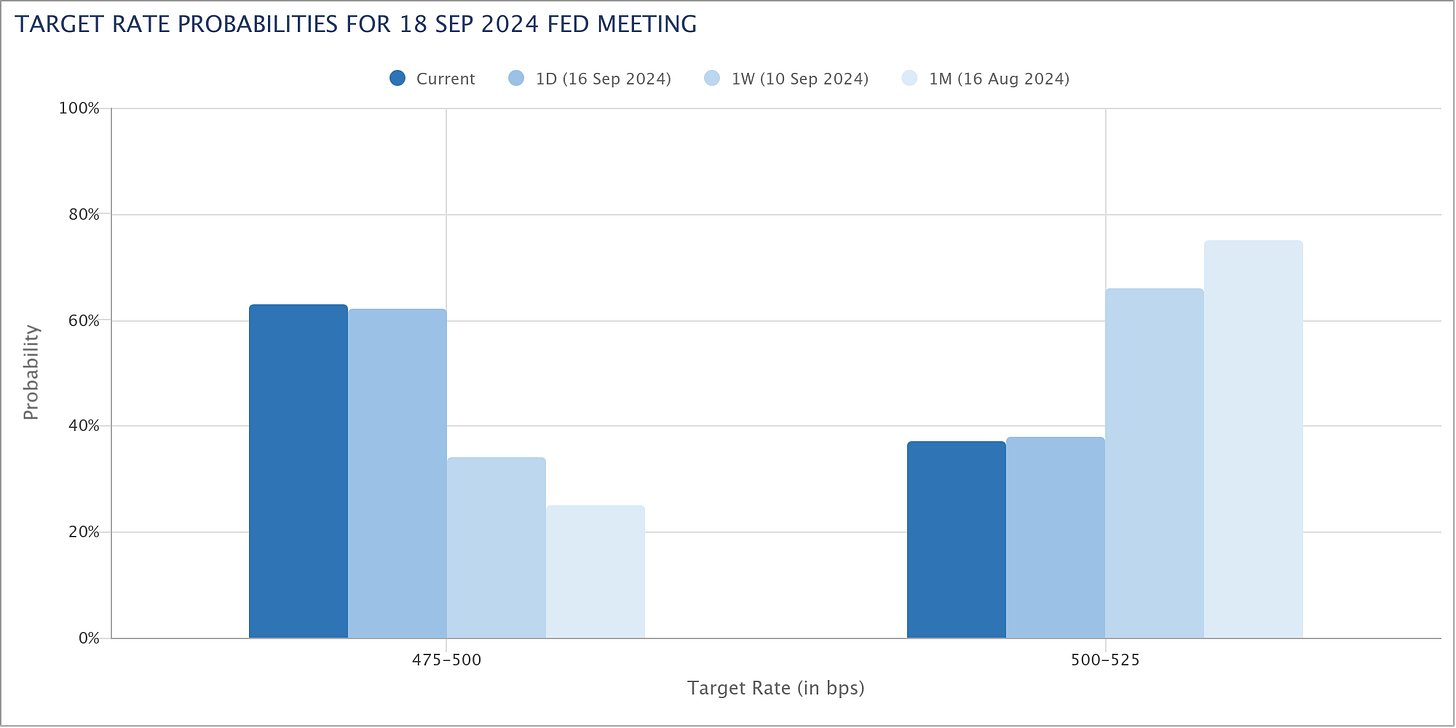

It’s not hard to see how, with the CME Group’s "FedWatch” tool giving investors an organized view of expectations for the Federal Reserve’s FOMC meetings.

For the past month, Wall Street has been talking up tomorrow’s anticipated rate cut. For the past month Wall Street traders have been bidding up or down that lower interest rate environment.

Virtually Wall Street interest rate watcher is expecting at least at a cut of 25 basis points to the federal funds rate.

The survey shows 84% of the 27 respondents, including economists, fund managers and strategists, see the Fed cutting by a quarter percentage point, with 16% seeing a half-point decrease. That compares with 65% probability of a half-point cut now priced into fed futures markets.

Wall Street has already sold itself on the inevitability of a rate cut.

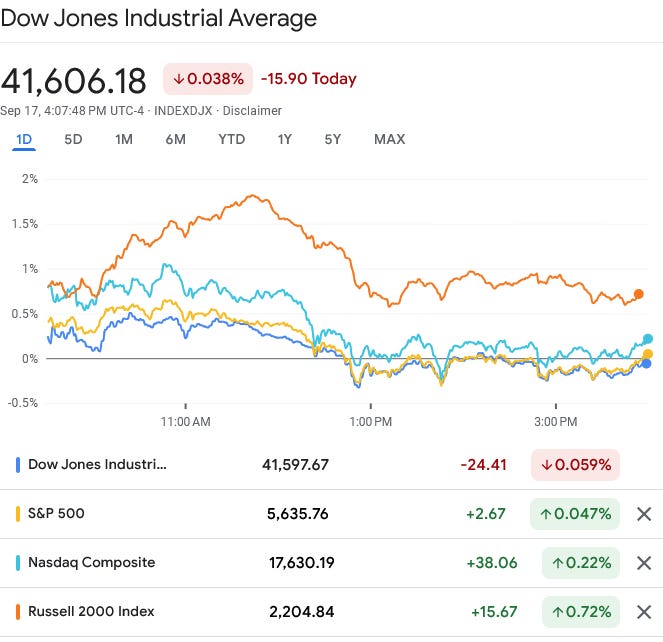

That certainty goes a long way to explain why stocks have varied today from mixed to slightly optimistic.

Having already sold themselves on the rate cut, Wall Street is left to tussle with the fundamentals of the economy—and that is a far from pleasing picture.

As Notes follwer Stacy Cole observed earlier, one’s wallet tells the tale on the economy.

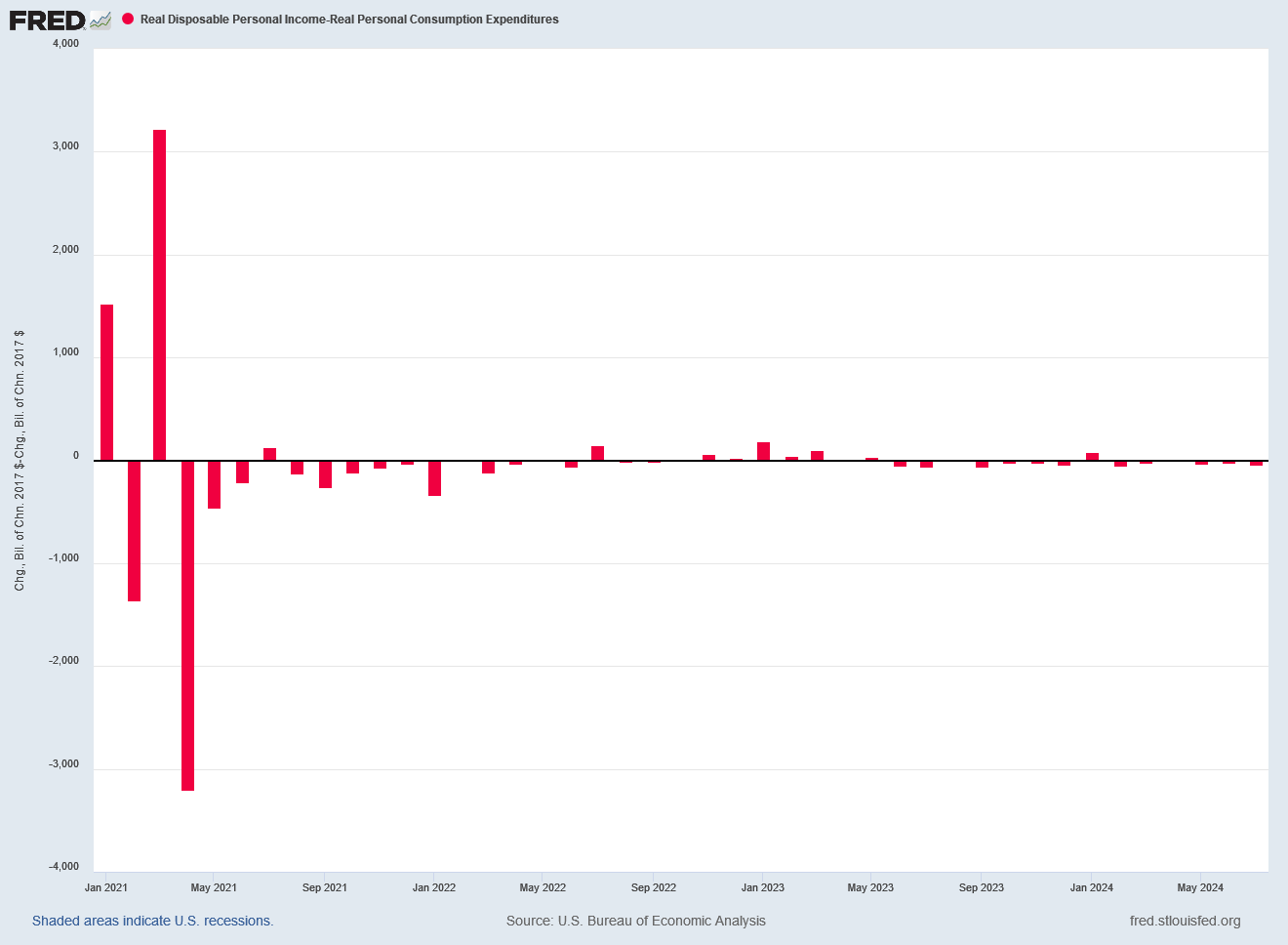

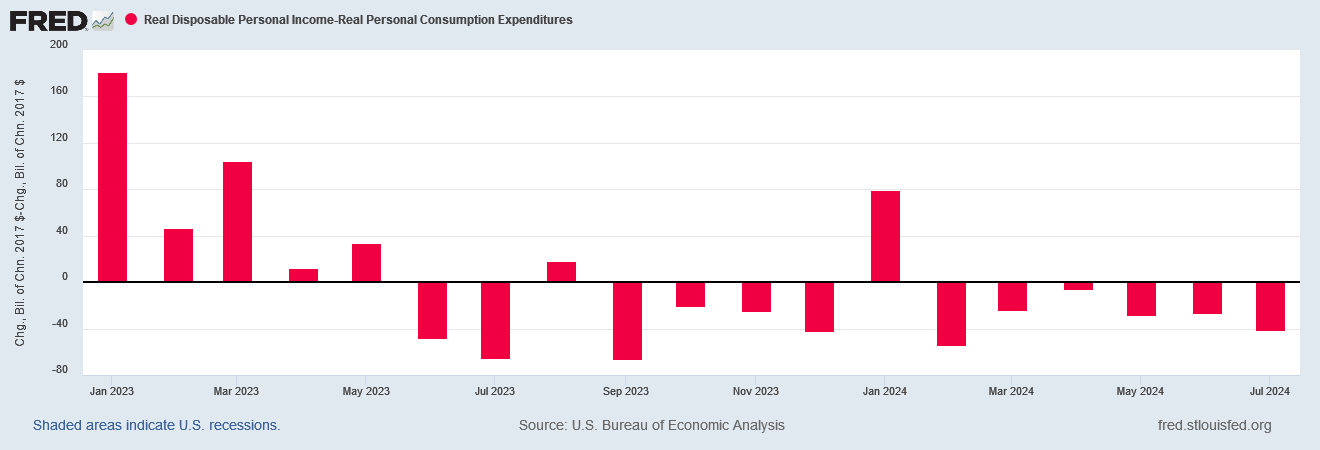

The data is very much in line with that anecdotal assessment. It is a fact that growth in Real Personal Consumption Expenditures has outpaced growth in Real Disposable Personal Income for most of the (Biden-)Harris Administration’s tenure in the Oval Office.

The extreme volatility of the early months of Kamala Harris’ Reign of Error tends to visually overwhelm the remainder of the data, but if we zoom in on just the past two years—from January 2023 forward—we see the same trend prevails even at the smaller scale.

When the change in Real DPI is consistently less than the change in Real PCE, that means real incomes are effectively shrinking, and people are spending more and more relative to their take-home pay.

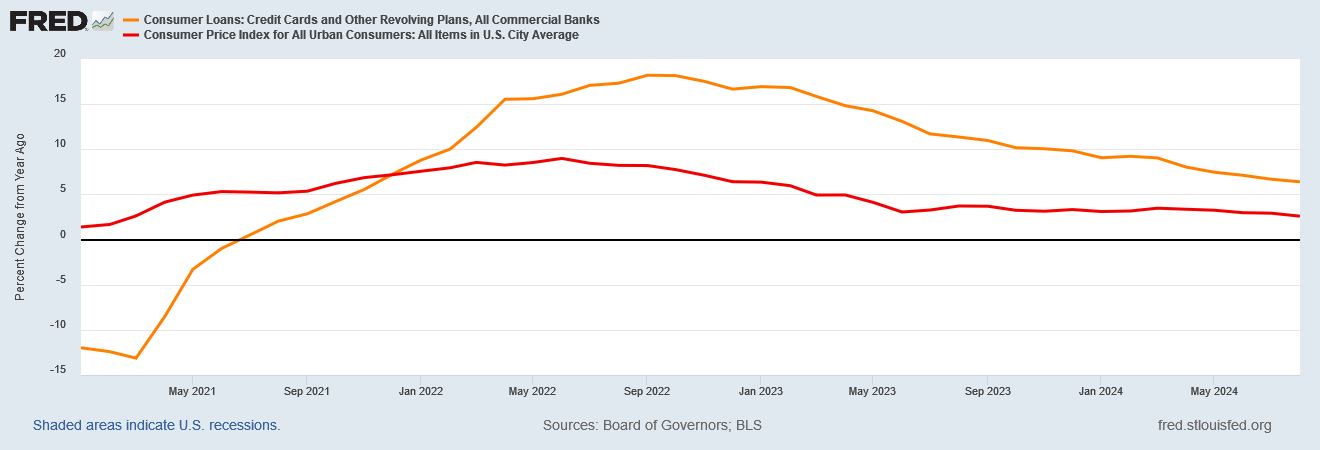

This reality does not make rising consumer debt levels anywhere near a token of economic health—and rising consumer credit card debt in particular very much has been a consequence of the recent inflation cycle.

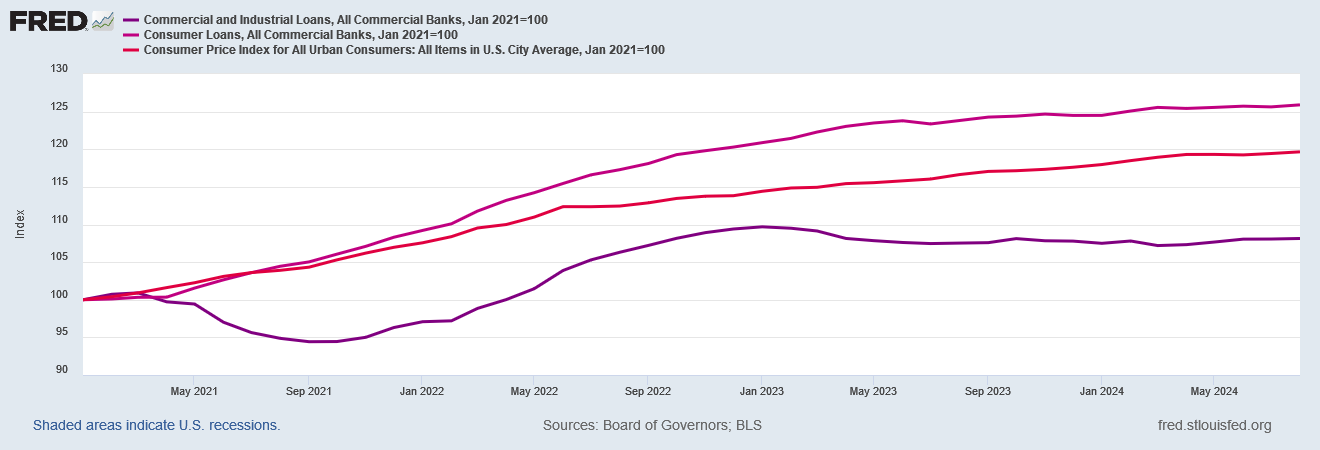

We do well to note at this juncture that consumer debt has risen more than inflation, while corporate debt has risen less.

Since January 2021, consumer debt has risen 25.9%, consumer prices have risen 19.7%, and corporate debt has risen 8.1%.

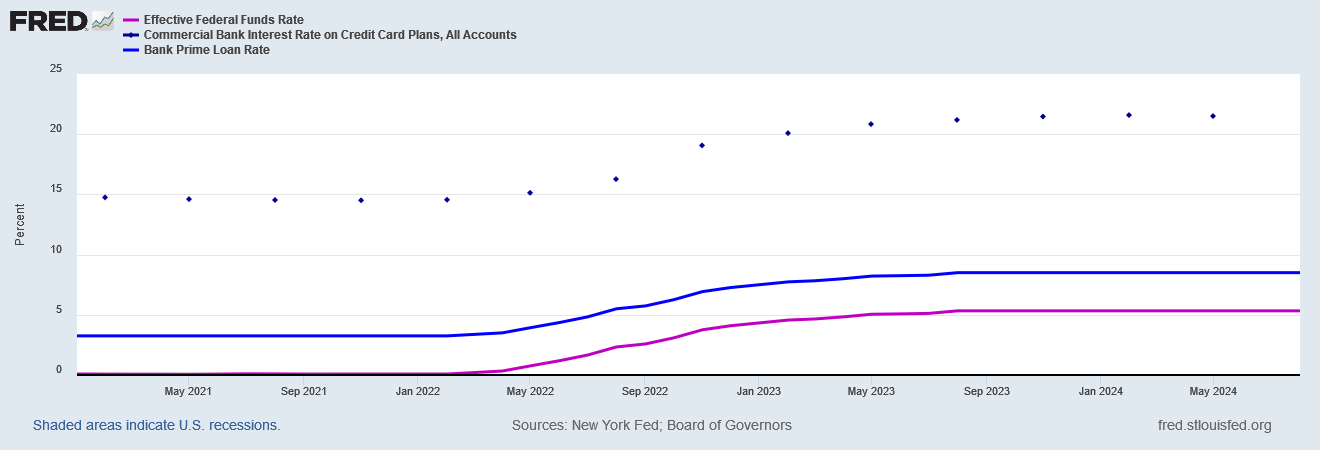

This rise in consumer debt underscores the one impact the Federal Reserve’s rate hike strategy has had: it has put the cost of consumer inflation squarely on the backs of the consumer, for consumer interest rates are the one category of interest rates the federal funds rate impacts directly.

Interest rates accessible to the typical consumer for regular loans—i.e., the Bank Prime Rate and bank credit card rates—vary directly with the federal funds rate (by design in the case of the Bank Prime Rate). Powell’s interest rate hikes had negligible impact on market-based rates, but they have had a major impact on consumer interest rates.

The irony of Wall Street watchers fretting about how much the Federal Reserve will trim the federal funds rate tomorrow is that they are the ones least impacted by the federal funds rate. Corporate media is, as per usual, completely silent about the impact of the Powell’s rate hike strategy on the consumer—and that impact has not been at all benign.

However, this should come as no surprise. Powell made it quite clear in his 2022 Jackson Hole speech that he wanted consumer demand to shoulder the burden of containing inflation.

The last part of that sentence, about the Fed’s “tools” (read, “rate hikes”) working “principally on aggregate demand”, should send chills down every consumer’s spine. Powell sees inflation as too much demand and too little supply (notionally correct, by the way), and sees the solution to too much demand as a simple matter of eliminating the demand.

For the unpardonable sin of consumers wanting to buy things, Jay Powell intends to raise interest rates until consumers are no longer able to buy things. “Demand destruction” is what will save the economy…although it won’t do much for consumers in the short run.

The irony is that while consumers have paid for Powell’s rate hikes with more debt and less income, the impact of those rate hikes on core inflation metrics has been at best problematic.

Powell has been coasting on energy price deflation, which has allowed him to conveniently ignore the degree to which other pricing metrics have not responded to his rate hikes much if at all.

Powell’s rate hikes have done little if anything to resolve intractable core consumer price inflation, while adding greatly to consumer debt. That debt load is made even more burdensome by the trend of declining income that has been a fixture of the economy under the (Biden-)Harris Administration.

Small wonder that for many consumers like Stacy Cole above, the current state of the economy “feels” like a recssion. For most consumers, the current state of the economy is recession.

This is the result of Powellnomics. And this is the result also of Kamalanomics. A failure to the consumer of both presumed stewards of the American economy.

When the Federal Reserve trims the federal funds rate tomorrow, the corporate media will no doubt tout it as testament to the great success of Powell’s rate hike strategy. Which also means we can also look forward to another Kamala Harris cackle of how “Bidenomics is working!”

Sadly, we cannot look forward to anything from Kamala Harris or Jay Powell resembling productive policy to address an American economy that is categorically not working for anyone outside of Wall Street or Washington DC.

Once again, great accumulation of facts. Well worth the read. PS. Thanks for including the note. I feel validated! 😁

Can any one really say what Kamalanomics is? As she doesn't seem to have a clue and who is actually advising her anyway??????