Corporate media is once again promoting the narrative that consumer price inflation is down in this country.

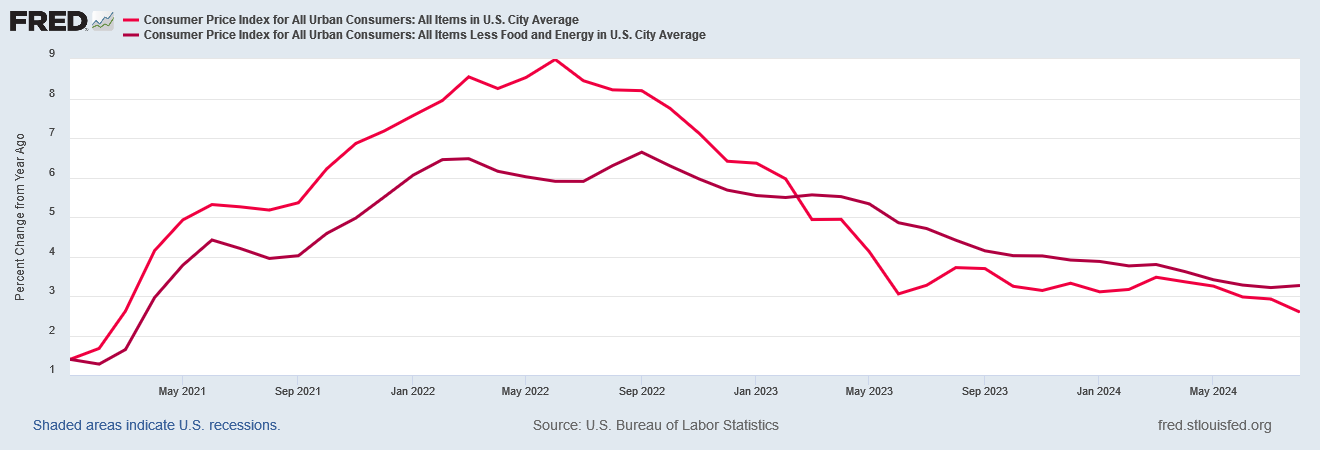

Inflation in August declined to its lowest level since February 2021, according to a Labor Department report Wednesday that also showed a key measure higher than expected, setting the stage for an expected quarter percentage point rate cut from the Federal Reserve.

The consumer price index, a broad measure of goods and services costs across the U.S. economy, increased 0.2% for the month, in line with the Dow Jones consensus, the Bureau of Labor Statistics reported.

By now readers are well aware that data from the Bureau of Labor Statistics should be taken with several doses of skepticism and at least three grains of salt.

Does the data behind the Consumer Price Index Summary reflect the media spin?

Not really.

To be sure, the Consumer Price Index Summary report itself presents inflation as trending down, using the anodyne language endemic in government press releases.

The all items index rose 2.5 percent for the 12 months ending August, the smallest 12-month increase since February 2021. The all items less food and energy index rose 3.2 percent over the last 12 months. The energy index decreased 4.0 percent for the 12 months ending August. The food index increased 2.1 percent over the last year.

However, it is important to note that this statement focuses on a point-in-time comparison to August of 2023. We should not interpret that as indicating a uniform downward trend throughout the past twelve months.

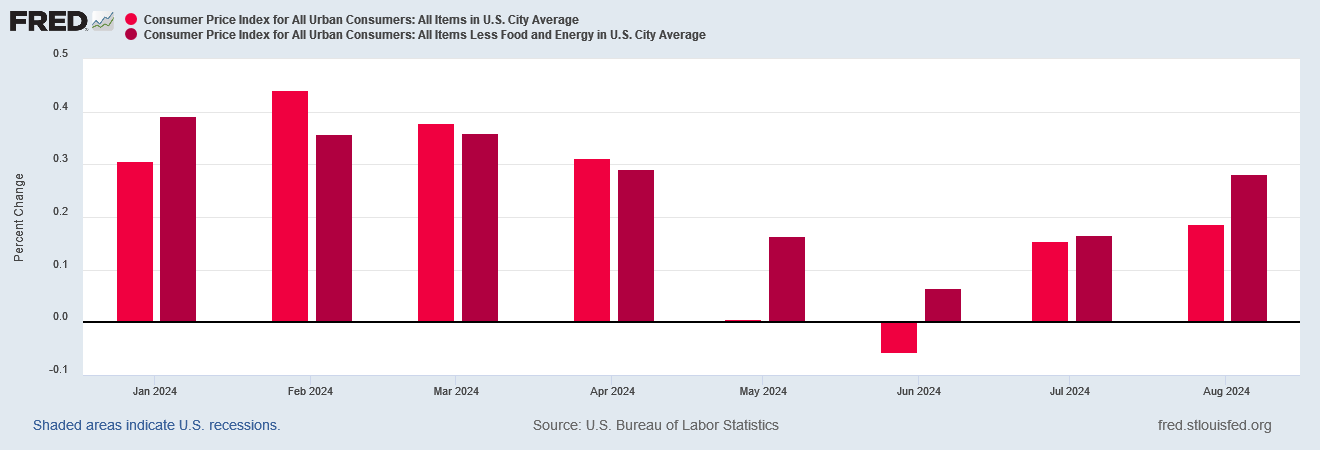

When we look at the headline and core consumer price indices, and their percent changes month on month for 2024, a somewhat different picture emerges.

While inflation may have slowed relative to last August, the CPI data shows inflation has been steadily heating up since June.

More crucially, however, is that “core” inflation appears to be heating up faster than headline inflation, as demonstrated by the greater month on month percentage increase for core inflation.

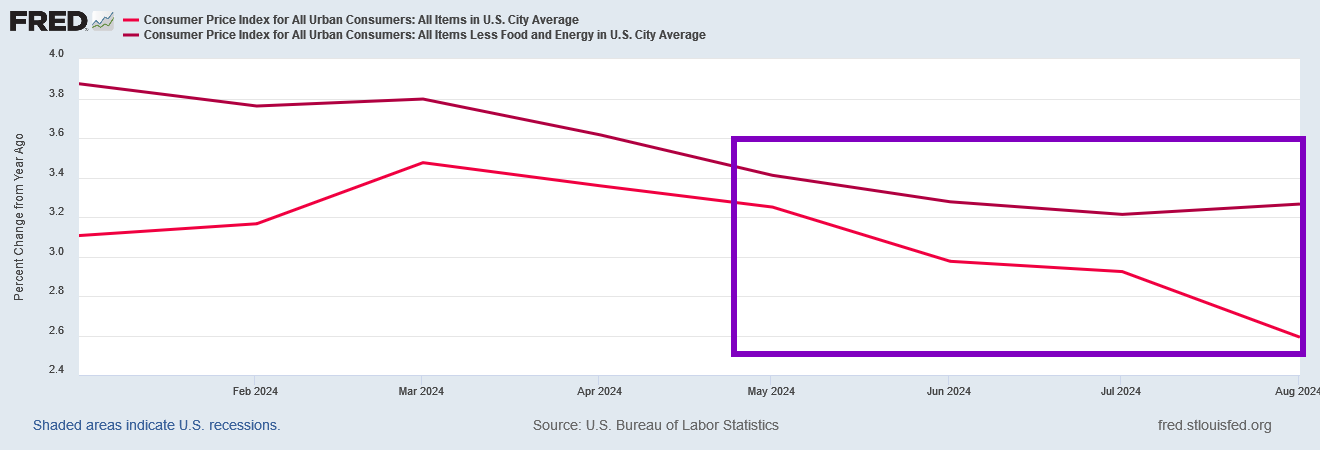

We see this presenting in the year on year data as well, with headline and core inflation diverging in the past few months even as the year on year changes are still showing declines.

When we focus on 2024, we see that core inflation has been trending down more slowly than headline inflation since May, and has even inched up during the two months.

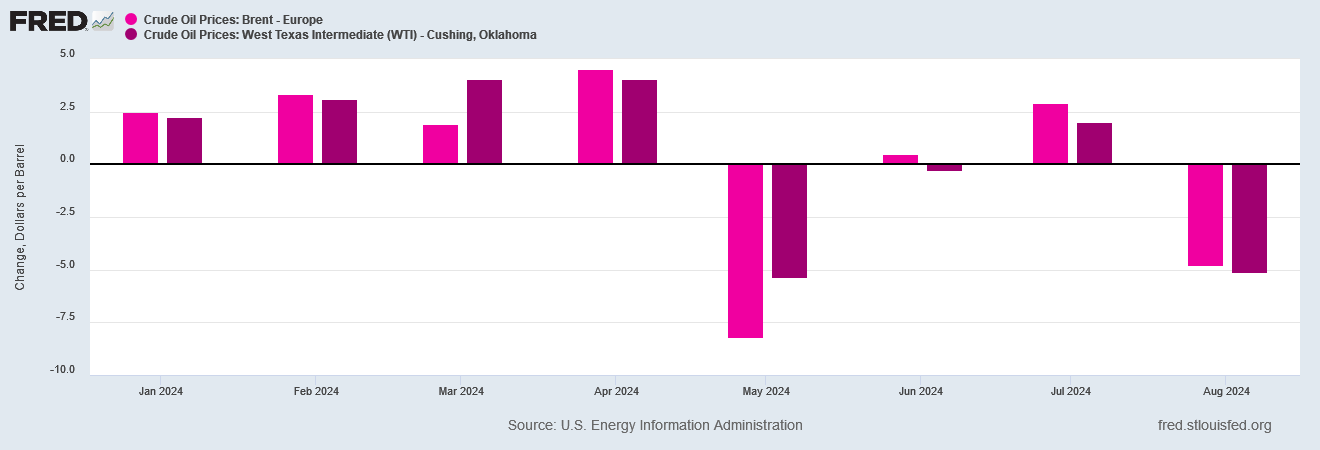

How is it that headline inflation is heading down while core inflation is heading up ?

In a word: energy.

When we look at the prices for Brent Crude and West Texas Intermediate oil throughout the year, we see that the past few months especially have had seen significant price declines.

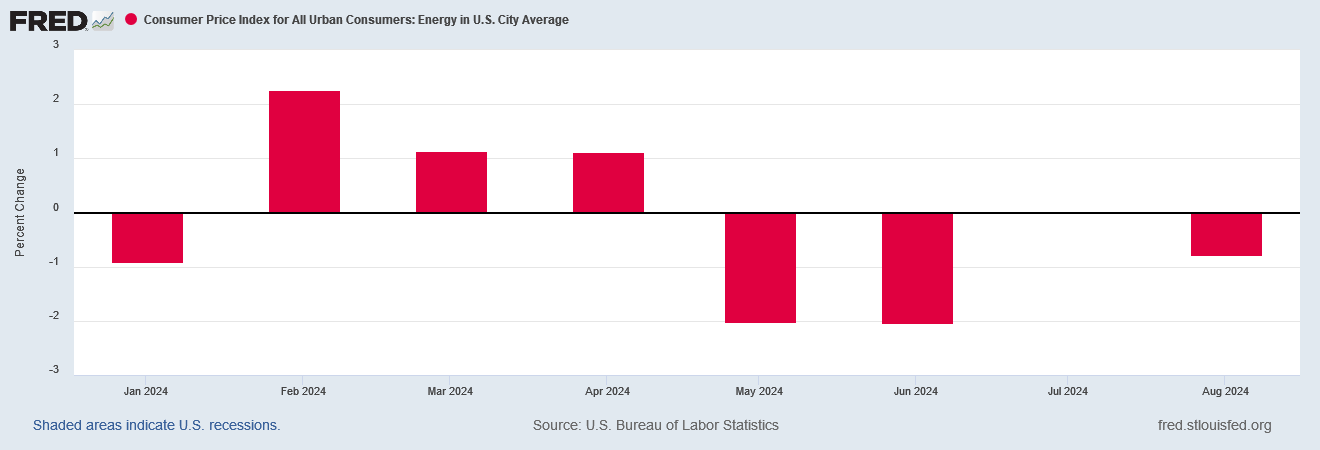

Declining energy prices naturally show up in the CPI Energy subindex, which likewise has been showing price deflation in recent months.

This deflation is reflected in the headline index but not the core index, which explicitly factors out food and energy prices, thus producing the divergent trends between headline and core inflation.

We should also note that energy price deflation eased in August. Even though energy prices still declined overall, they declined less in August than they had in earlier months. Effectively, this mutes the impact of energy price deflation at least for the current month.

The net effect of the trends at the subindex level within the CPI is that headline inflation has actually been increasing month on month, and core inflation has been increasing even more.

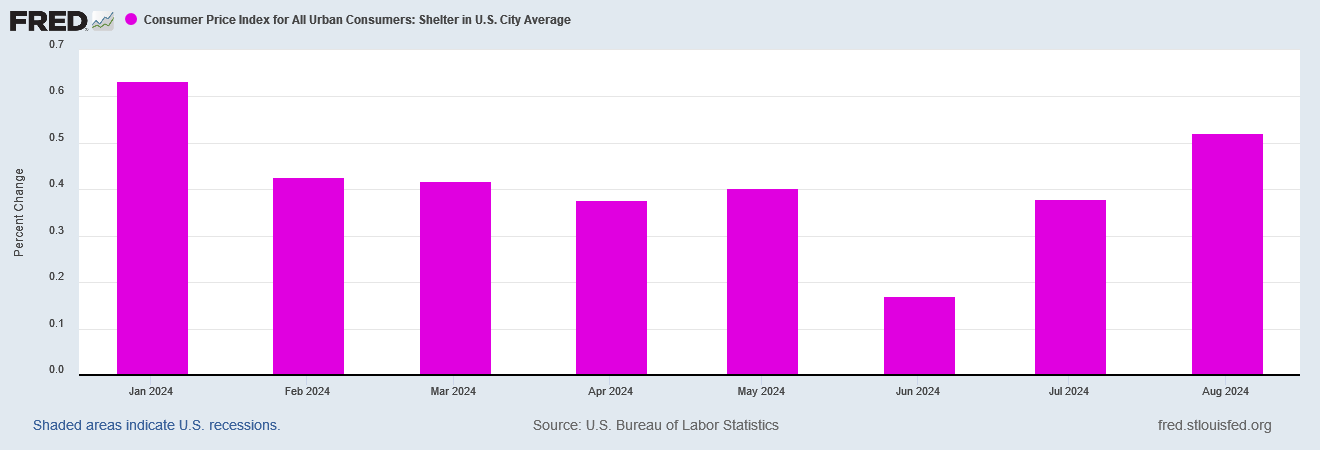

To their credit, the BLS does note that shelter price inflation has increased over the past few months, even though it has broadly eased throughout 2024.

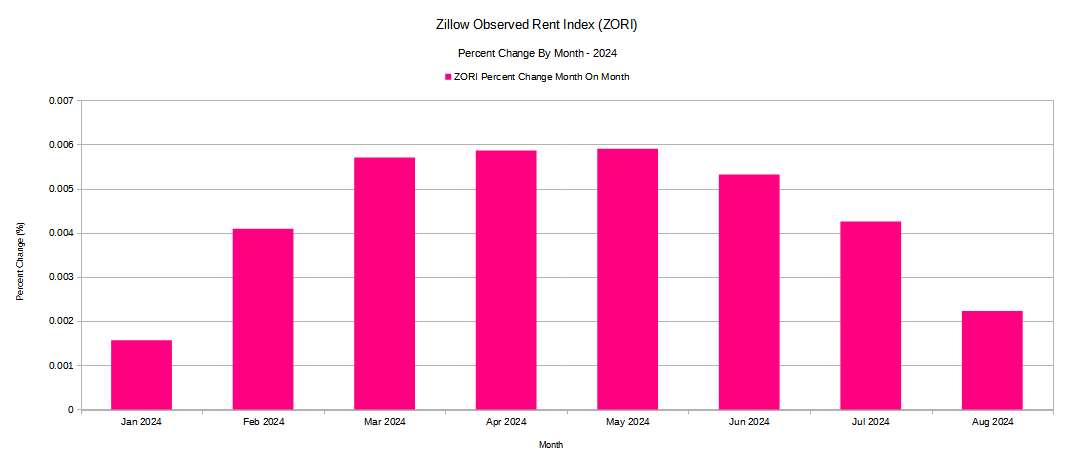

Because the CPI Shelter subindex tends to be a trailing indicator of shelter prices, the increases that the privately tracked Zillow Observed Rent Index charted earlier in the year are now showing up in the CPI Shelter subindex.

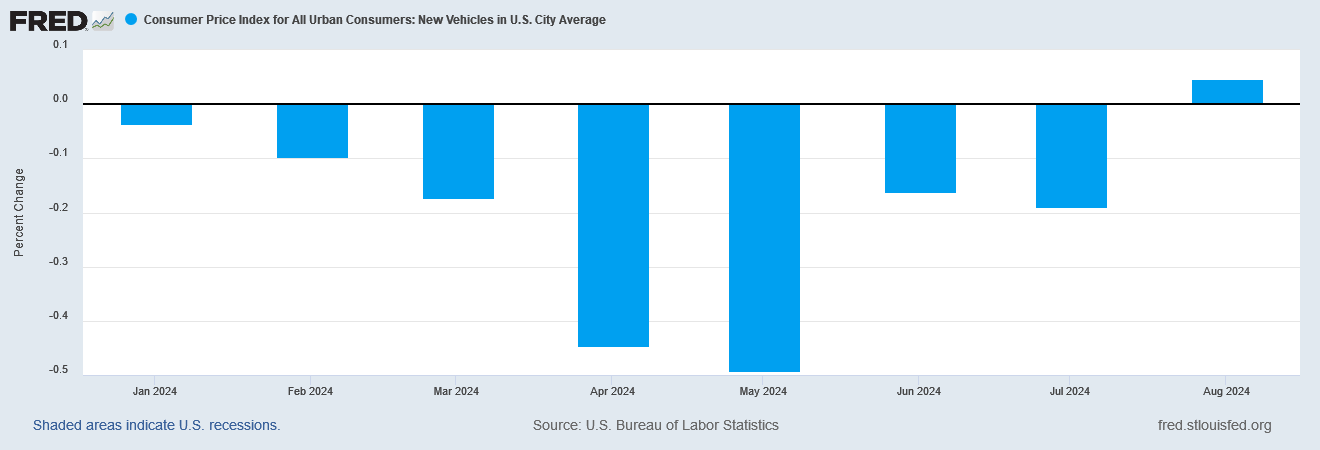

At the same time, prices for goods such as new cars during August went from outright price deflation to moderate price inflation month on month.

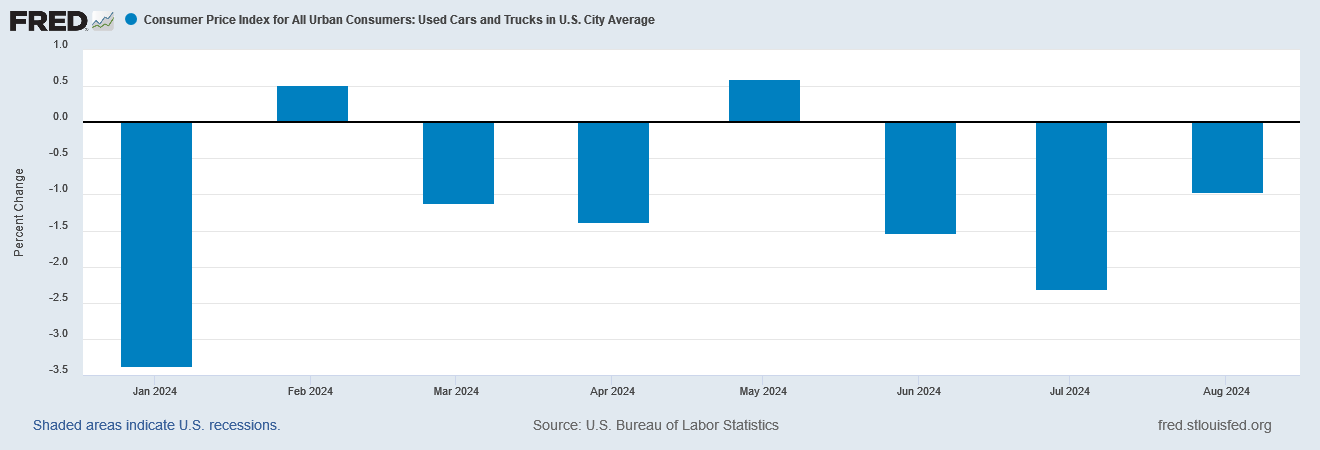

Even used car prices, which are continuing a broad deflationary trend, declined less in August than in earlier months.

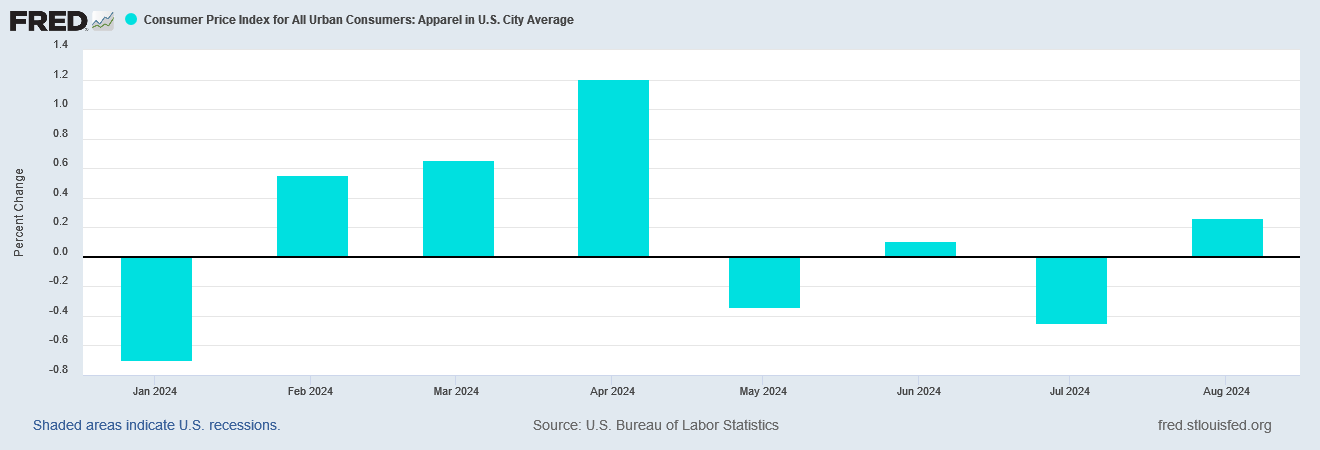

Apparel prices also inched up in August, after having been in outright deflation during previous months.

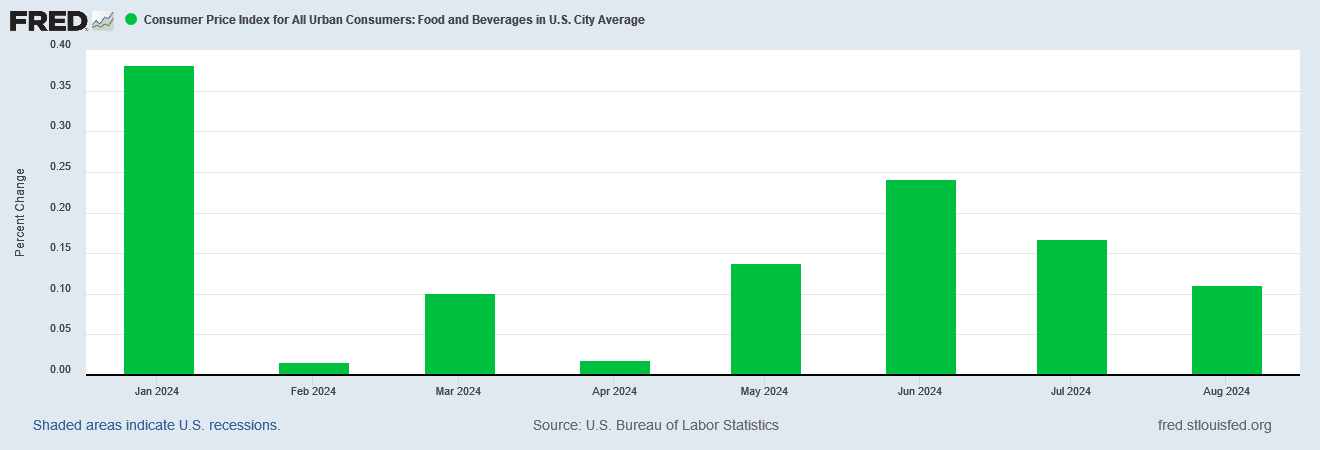

Rounding out this brief overview of pricing behaviors at the CPI subindex level, we should note—and the BLS did note—that food price disinflation increased in August.

While the aggregated headline Consumer Price Index shows inflation coming down year on year, when we peel the data apart and look at various subindices, we are once again reminded of that the damage of inflation is the relative price shifts among various goods people buy.

Readers will recall that price distortion is a point I have articulated repeatedly when discussing inflation. The economic harm from rising prices is not simply that prices rise. Prices rises are a natural economic phenomenon and are going to happen even without fretting about inflation.

Where the price rises become problematic is always in that some goods become more expensive relative to other goods, which has direct impact on consumer buying patterns.

Price rises are also problematic when they exceed earnings increases over the long term—something that corporate media is only just now coming to acknowledge.

What the data shows yet again is that the supposed financial and economic “experts” both on Wall Street and in Washington are not paying the slightest bit of attention to any of the data, and are pushing along their preferred narratives of how wonderful things are, how great the economy is, and how clueless the ordinary consumer is for not realizing just how wonderful and great the economy is.

Because every consumer just loves watching their bills grow faster than their paycheck. Every consumer just loves spending more and more on groceries while their take home pay is less and less.

The preferred narrative might be that inflation is coming down, and so consumers have nothing to fear going forward.

The reality is that some prices are trending down, other prices are trending up more slowly, and still more prices are rising faster than before.

The reality is that the trends among these subindices—and thus between headline and core inflation—are diverging over time.

The reality is that these divergent trends mean people will continue to be concerned about inflation for the near term, and with good reason.

We have to remember that people do not buy monolithic abstract “consumer goods”. People buy food. They buy cars. They buy gasoline for their cars. They buy clothes. They buy or rent shelter. The Consumer Price Index always seeks to present these atomic purchases in an aggregate context to show what the overall trend in conumer prices is.

The constant caveat with all price indices is “Your Mileage Will Vary”. Depending on the particular mixture of various goods one purchases, the pricing trends in the CPI will correlate to one’s actual experience or it will deviate from it. Not only is that normal behavior, but the nature of indexed data bakes a certain amount of variance into the equation. Distortion is an essential element of the right perspective on consumer price inflation data.

Corporate media will not present the inflation data with the right perspective. More often than not, corporate media will simply focus on the headline and maybe core inflation numbers, and in particular on the year on year numbers, and somewhat foolishly use those aggregate numbers to discuss all price movements. In the process—and just as we can see with current media reporting on the Consumer Price Index for August—they overlook all the areas where inflation is actually rising and has been for the past few months.

Yes, consumer price inflation is down in this country, except for those areas where consumer price inflation is up.

It is more complex than than "the preferred narrative", thank you. Shopping at Walmart and Aldi sure do show high inflation which is cognitive dissonance from the headlines. I also think the labor/hourly wage pressure is increasing prices in the arena where most people shop - convenience food, Aldi, etc. I used to think transportation costs were a factor in increasing food costs, but with energy costs lower, labor costs are probably exerting more pressure?

Peter, you are just the BEST! We consistently get the most complete and accurate picture of the economy from your data and analysis, so thank you once again!

I am also usually left with minor questions evoked from the data. For example, why should new car prices start going up after months of deflating? Is it because the big car companies have been losing billions from making EVs that nobody wants, and so they are desperately trying to make profits elsewhere? Do they figure that for the declining sector of the populace that can still afford a new car a few extra bucks on the price tag won’t matter? I don’t expect you to know; the data just raises speculation in me.

And I see this more accurate picture of the economy as being helpful to Trump’s election chances. Nobody likes to be lied to, right? People can sense when a candidate like Harris is feeding them massaged data and, well, bullfeathers. It’s annoying to feel like someone is trying to con you. Annoyed people don’t feel inclined to vote for the con artist. Trump wins!