OMG! Consumers Are Spending More Than They Earn!

Ummm....They've Been Doing That Since 2021

We must always remember one essential precept when digesting anything reported by corporate media: “Expert” is always wokespeak for “blithering idiot.”

Our latest data point to prove this proposition comes from Megan Leonhardt with the investor’s rag Barron’s, as she does a perfunctory bit of hand-wringing over the “alarming” fact that personal consumption expenditures rose more than disposable income last month.

Consumer spending rose 0.4% in July, adjusted for inflation, according to data released Friday by the Bureau of Economic Analysis. That’s in line with the solid spending gains notched in May and June. Robust spending helped to push second-quarter growth in gross domestic product up to 3% from an initial estimate of 2.8%.

But Americans’ outlays have outstripped disposable income for most of this year, even as consumer savings have dwindled. As a result, many economists now expect consumer spending to slow, particularly if employment conditions weaken, as expected.

What gets lost in this bit of financial fluff is the awkward reality that expenditures have been outpacing incomes since the start of the Biden-Harris Reign of Error.

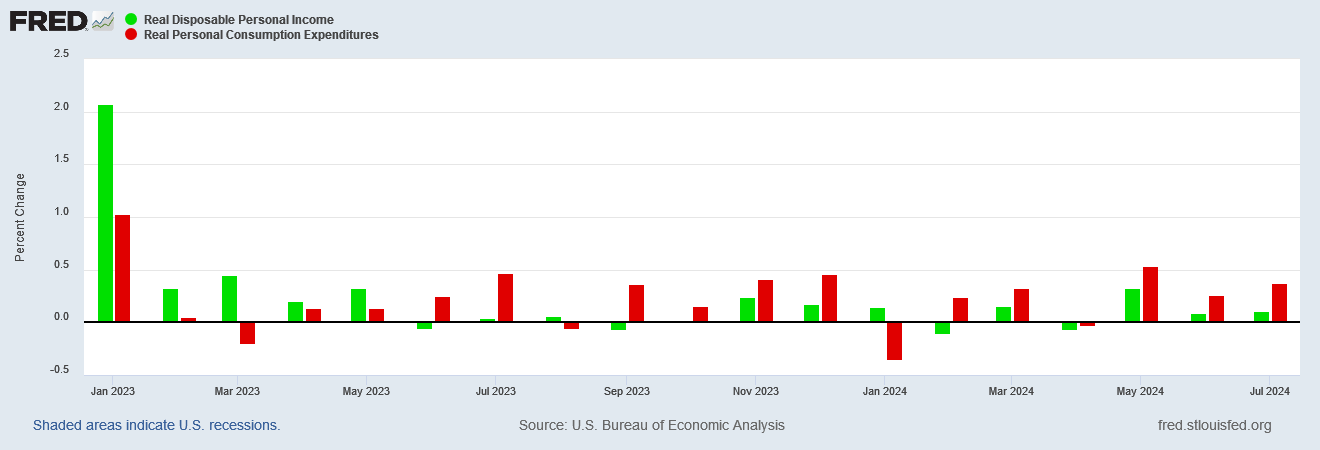

Specifically, what worries Ms. Leonhardt is the rise in real personal consumption expenditures over real disposable personal income since the start of 2024.

As the graph plainly shows, increases in real expenditures have risen more than increases in real incomes pretty much all year.

However, if we zoom out to the start of 2023, guess what we see for the exact same data sets?

You guessed it! Month on month, expenditures rose by a greater percentage than disposable income. What Barron’s deems newsworthy has been the status quo for months.

To be fair, Ms. Leonhardt is not alone in failing to check her data. The “experts” she quoted didn’t either.

“Consumers have proven themselves discerning, but not defeated,” says Diane Swonk, chief economist at KPMG. “There is only so long that can happen when rates are higher. We are starting to run on fumes.”

You would think the fact that the prevailing trend for months has been expenditures outpacing incomes would get a least a mention by an economist.

Over at Moody’s, however, they are apparently even less interested in looking at the actual data.

This year’s spending has been propelled largely by a solid labor market, coupled with wage gains that continue to outpace inflation. The wealth effect stemming from higher home values and investment portfolios also has helped, says Moody’s Analytics economist Matt Colyar. “There’s a tolerance there [for lower savings] that explains why you see the savings rate drop,” Colyar says.

That’s right—wages are doing well so all this extra spending is no big deal!

Let’s look at those wage “gains”. If we look at the personal income data since 2021, we are reminded yet again that real disposable income has fallen in this country.

With inflation having run amok particularly in 2022, the end result has been….wait for it…real expenditures outpacing real disposable incomes.

The data is actually worse than that, however, because the growth in nominal expenditures has also outpaced nominal disposable incomes.

Americans have been living beyond their means since the start of the Biden-Harris Administration.

But…but…Trump!

(Okay, that’s sarcasm.)

As it turned out, during the Trump Administration, incomes outpaced expenditures.

Even if we exclude 2020 as the year everyone went insane, incomes still outpaced expenditures during the Trump era.

Even in nominal terms, disposable income outpaced expenditures during the Trump Administration.

What the data shows yet again is that the supposed financial and economic “experts” both on Wall Street and in Washington are not paying the slightest bit of attention to any of the data, and are pushing along their preferred narratives of how wonderful things are, how great the economy is, and how clueless the ordinary consumer is for not realizing just how wonderful and great the economy is.

Because every consumer just loves watching their bills grow faster than their paycheck. Every consumer just loves spending more and more on groceries while their take home pay is less and less.

Memo to all the economic “experts” out there: In economics, “less” is not “more”. In economics, “more” is “more”, and, economically speaking, consumers are happier with “more” than they are with “less”.

If you understand that, you understand more than the average Wall Street economist.

Seriously.

Bingo! This is just the kind of analysis that I wish Trump’s campaign had, Peter. The MSM is clueless and spinning data to support their left-biased agenda. Grrr.

The average Joe needs to see that it’s not just him canceling the family’s vacation, canceling streaming services, paring back charitable donations, no longer going out for dinner, and other belt-tightening measures. It’s the majority of the country. I’m watching restaurants close, stores liquidate, and whole retail neighborhoods go dark. The MSM continues to blame everything on ‘Covid’, which is such a cop-out of a simplification. The bigger picture is that the ENTIRE result of the Biden administration has been decline!

Voters: it’s not just you! The economy, the culture, the prospects for our nation’s future are in peril. Vote for change. Vote Trump!

I'll respectfully stay out out of the political recommendations, not my country and all that.😉

But it is interesting to note- this phenomenon is occurring in lots of other countries as well.😐🤔

Now I've been pondering it almost as long as I've been reading your stack, and I can only surmise:

A) consumers and governments to are completely inept and oblivious to the situation and buying as normal.🤔

B) the consumers know we are in a global recession and are trying to put the brakes on their spending, but government are still spending like it's 2020, and denying it, so inflation😐.

C) the government is making every decision known to fiscal policy, economic science, and any joe/Jill who knows how to balance a checkbook/budget app, to purposely BREAK the financial system intentionally.🤨

In talking to people, I'm pretty sure b is occurring, but I personally think that c is the option.

As for media- they are towing the party line because they have been either a) told to from higher pay grades, or b) no one likes to be the bearer or bad news, so they are fingers crossed that the parents will step in an say the awful out loud for them😉🤨 given the level of maturity in media these days....🤔🤔🤦♀️🤦♀️