Stock Markets Are Still Denying Recession, Bond Markets Are Pricing In A Deeper One Than Expected

When Reality Hits The Markets, It Is So Going To Hurt

While the BLS Employment Situation Report overshot all expectations—mostly through contrived and unrealistic numbers (aka Lou Costello Labor Math)—Wall Street was mostly credulous and accepting of the numbers, with the broad stock indices moving mostly sideways after an initial and brief morning drop.

Stocks ended slightly down on the day, although the Nasdaq managed to eke out a small gain.

U.S. stocks ended a choppy trading session mostly lower after Friday’s jobs report showed more robust growth in the American labor market last month than had been expected.

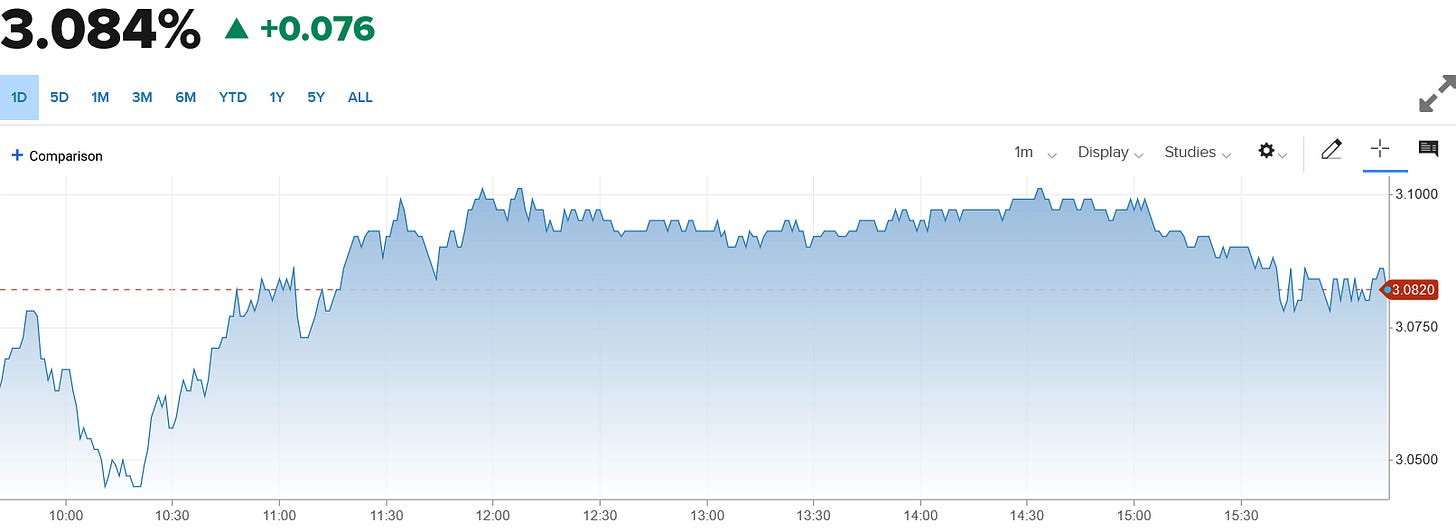

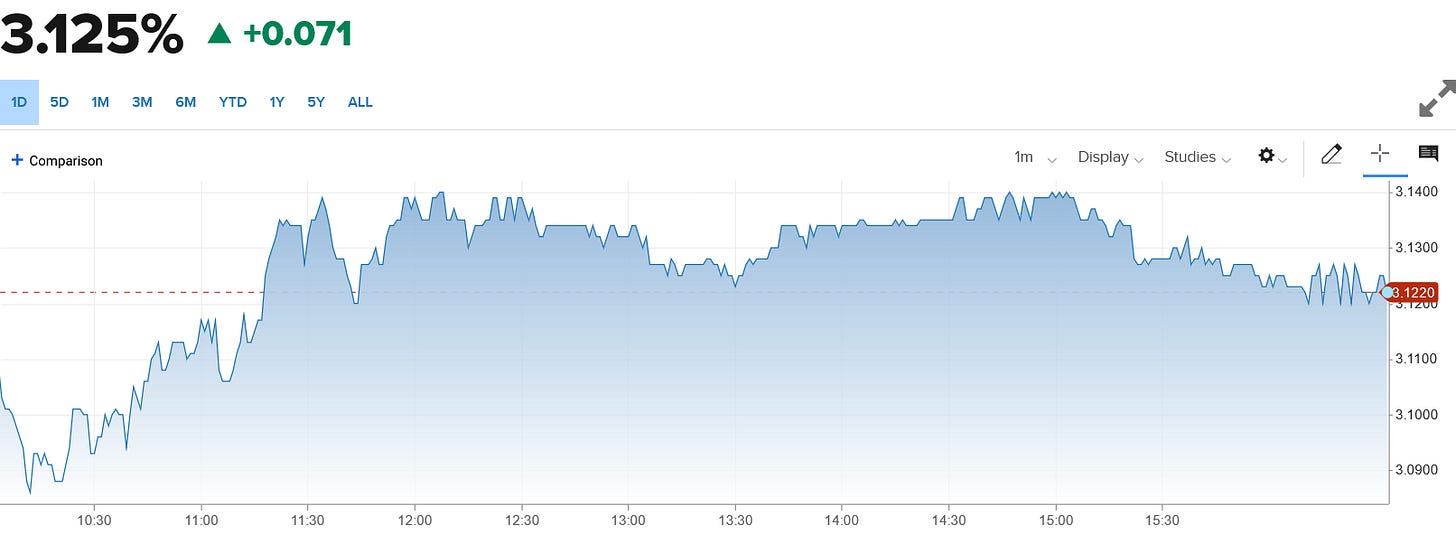

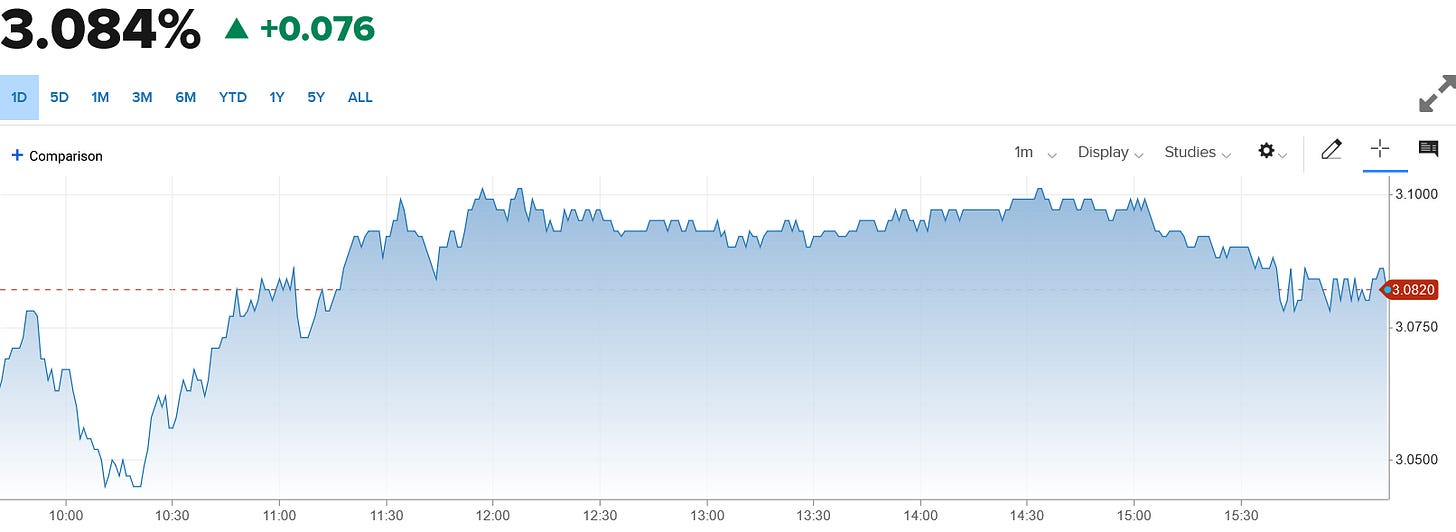

The bond markets, however, are grasping at least the basic reality: there is a recession, it is not going away soon, and it is going to get worse before it gets better. Yields rose across the curve, from 1-Year to 30-Year Treasuries. While the 10-Year yield gained some ground over the 2-Year and 5-Year yields, the shorter maturities remained inverted—posting higher yields than the 10-year—as they have been all this week.

That the 10-Year yields are gaining somewhat on the inverted shorter maturities does not reflect an improving short-term outlook, however, but a worsening longer term one. The bond markets are not panicking, but they are digesting the reality that the Fed is pretty much locked into another large interest hike later this month—possibly as high as 100bps, with 75bps now being seen as the most likely increase.

“After this report, you can pretty much count on 75 basis points in July,” said Jim Caron, chief fixed income strategist with Morgan Stanley Investment Management. “The job market is strong and it’s not giving up any growth.”

The Media Still Is Not Paying Attention

Strangely enough, the media still has not grasped what close inspection of the BLS Employment Situation Report makes abundantly clear: the numbers do not hang together internally. The Establishment and Household surveys diverge fairly significantly almost from the get go.

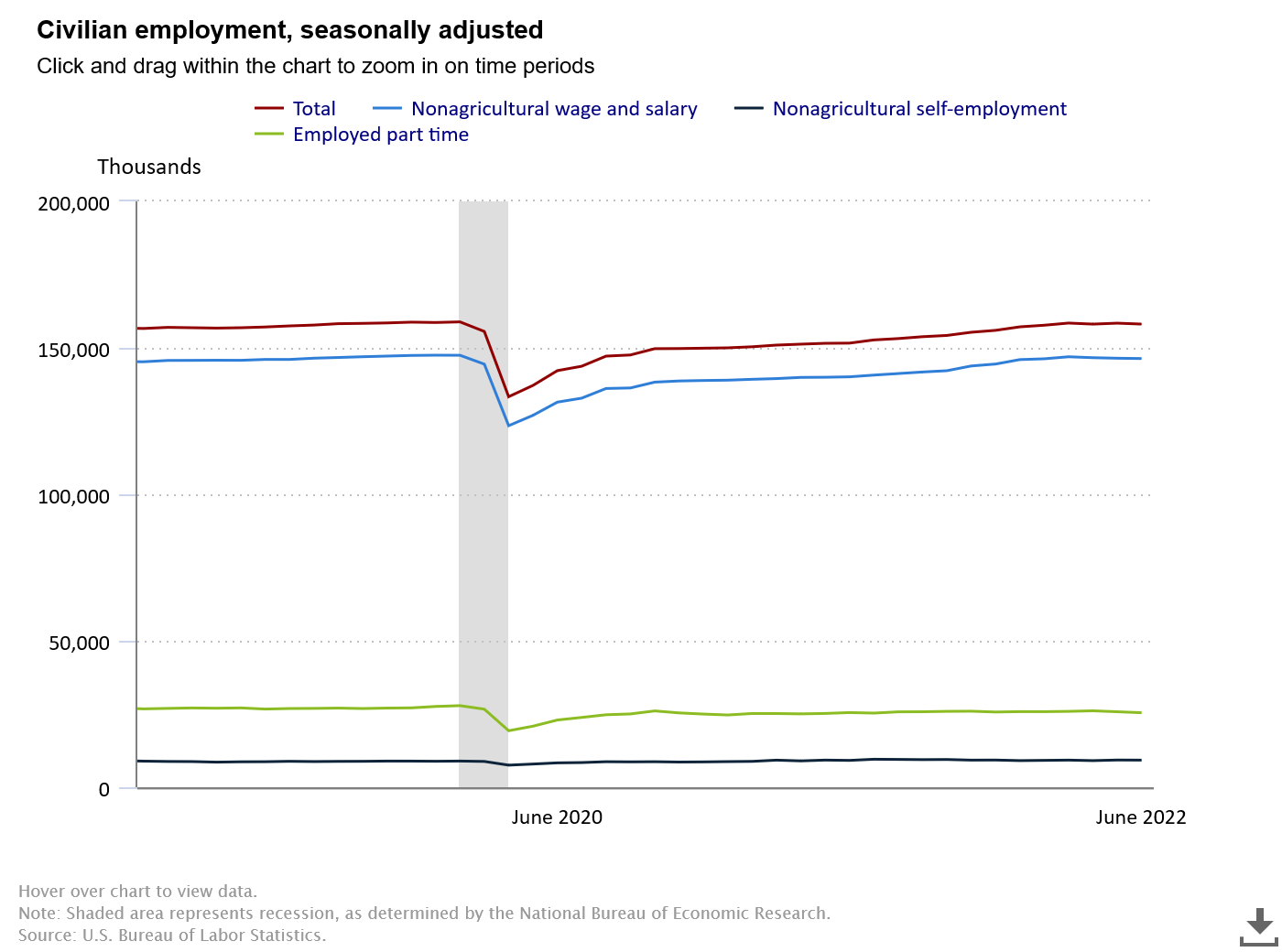

While the Establishment survey speaks of 372K jobs being added to payrolls, the Household data shows loss of workers and declining employment across the board. Even self-employment is down.

Despite this dichotomy, which at the very least should grab every finanacial journalist’s attention, the corporate media is still playing along with the government canard of strong and tight labor markets, when the reality is a labor force that shrunk on the month across the board—total employment, non-agricultural wage and salary jobs, and non-agricultural self-employment all dropped, along with part-time work

When the labor force is shedding workers that is not a job market that is “tight”, but that is “dysfunctional.”

Why The Fed Will Continue To Raise Rates

While the corporate media is focused on the nonexistent “strength” of the labor market—and the supposed health of the economy as the inevitable byproduct—they are ignoring the global reactions to the jobs report.

In the wake of the jobs report, the dollar has declined against both the euro and the yuan, and has only strengthened marginally against the yen.

In a macro environment where all the major economies of the world are either in recession or headed there, the stability of fiat currencies becomes a global race to the bottom, with the strongest currency being whichever one comes in last. Think of it as the currency equivalent of that old joke about two men being chased by a bear, and when one stops to put on running shoes, the other asks “What are you doing? You can’t outrun a bear!”—to which the first calmly replies “I don’t have to outrun the bear.”

The dollar does not have to be “strong” or even “sound” to survive as a financial hegemon. It merely has to be the “strongest” and the “soundest”, and even at that only for a time. The dollar only has to outrun the euro and the yuan (and possibly also the yen) against the looming bear market (i.e., recession) just long enough for the others to bottom out first.

Oil Seals The Deal On Rate Hikes

Despite the possibility of detectable demand destruction showing up earlier this week, with the spot price for West Texas Intermediate crude slipping below $100/Barrel, oil jumped back up above $104 earlier today before settling in at $104.80/Barrel.

Gasoline futures followed oil higher on the day.

Demand destruction is coming, but it has not arrived yet. The recent reversal in the spot price for gasoline suggests that next week’s inflation numbers will again print high—and the Fed has already all but promised a 75bps or 100bps rate hike if inflation remains red-hot.

The Fed Is Not In Control. Neither Is Wall Street

Any market hopes the Fed will eventually be persuaded to ease up on rate hikes presumes the Fed actually has a choice in the matter. At this juncture, it has no choice. The Fed has already laid out how it will respond to market dynamics—and now it will have to make good. A major rate hike is now all but certain.

The Fed speculating how a recession might still be averted is either pure ignorance on the part of the Fed (possible) or the Fed throwing Wall Street some fleeting—and false—hope to prevent a market meltdown and general panic (also possible).

Yet neither the Fed nor Wall Street can postpone the day of reckoning much longer. The rate hikes that now must come will spark further angst and volatility on Wall Street when they do come if not sooner—not “may”, not “might”, not “could”, but “will”.

The markets moved sideways today, but the future is all downhill. The Dow, the S&P 500, the Nasdaq, are all going to decline significantly in the near future. They will decline because the same rate hike the Fed is using to suppress demand is also causing asset price disinflation—and the Fed has no way to separate the two. Stocks are going to go down, yields are going to go up, and neither the Fed nor Wall Street can prevent it.

For years, the Fed and Wall Street impudently ignored Main Street. Now that the Fed is obligated to respond to inflation on Main Street, Wall Street is unhappily being dragged along for the ride.

When the reality of that ride finally hits Wall Street, it is so going to hurt. Wealth destruction on that scale always does.

This article will become freely available on August 1.