The BEA Uncooked The Q4 2023 Books, But Only A Little Bit

Data Still Shows Major Weaknesses In US Economy

In the Bureau of Economic Analysis’ Second Estimate of 4th Quarter, 2024, GDP, the BEA trimmed its numbers somewhat, but still maintained its rosy outlook.

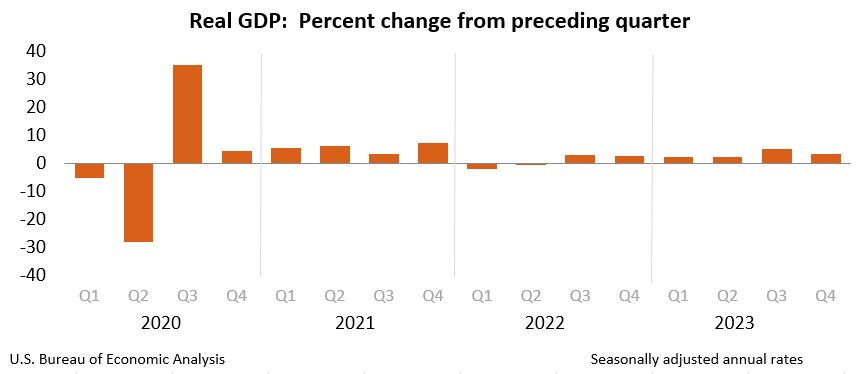

Real gross domestic product (GDP) increased at an annual rate of 3.2 percent in the fourth quarter of 2023 (table 1), according to the "second" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 4.9 percent.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 3.3 percent. The update primarily reflected a downward revision to private inventory investment that was partly offset by upward revisions to state and local government spending and consumer spending (refer to "Updates to GDP").

The increase in real GDP reflected increases in consumer spending, exports, state and local government spending, nonresidential fixed investment, federal government spending, and residential fixed investment that were partly offset by a decrease in private inventory investment. Imports, which are a subtraction in the calculation of GDP, increased (table 2).

The economy presumably is still growing at a healthy 3.2% for the quarter, although due more to government spending than private investment (which is itself a red flag that all is not right with the economy).

Certainly corporate media is willing to push that narrative.

The growth rate of the U.S. economy in the fourth quarter was downgraded slightly to a 3.2% annual pace, but the economy is still expanding at a rapid clip and showing few signs of slowing down.

Originally the government said gross domestic product had expanded at a 3.3% rate in the final three months of 2023. The figure is adjusted for inflation.

The increase in fourth-quarter GDP followed an even stronger 4.9% gain in the third quarter. The economy does not appear to have lost a step early in the new year, either.

According to that narrative, the US economy is not at all at risk of a recession, is healthy and robust and growing at a good pace.

The expansion in the nation’s gross domestic product — the economy’s total output of goods and services — slipped from a red-hot 4.9% from July through September. The fourth-quarter GDP numbers were revised down from the 3.3% pace Commerce initially reported last month. U.S. growth has now topped 2% for six straight quarters, defying fears that high interest rates would tip the world’s largest economy into a recession.

That is the narrative. As always, the data tells a different story, one that is decidedly less optimistic.

It is worth noting that Wall Street did not share corporate media’s optimistic take on the BEA data. Equities dropped dramatically out of the starting gate and spent all of yesterday in the red.

Clearly the stock markets did not share in corporate media’s optimism.

Bond markets were somewhat more forgiving, with yields jumping at first before trending down throughout the day.

Wall Street clearly has some reservations about what the BEA is saying about the state of the economy. Corporate media may be willing to gush about the BEA’s numbers, but Wall Street’s reaction is a good deal more uncertain, and even skeptical.

There is reason for skepticism, just within the BEA news release itself. While the BEA revised the GDP estimate down a tenth of a percentage point, it revised inflation—both the headline and core rates—up a tenth of a percentage point each.

Inflation is starting to rise again, and that rise is showing up even in the quarterly data. That is not a good sign for the economy. Wall Street’s reaction to such warning signals of future problems was for equities to drop right away at yesterday’s open—markets do not generally sell on good news, but on bad.

One reason to be less than enthused about the Q4 2023 GDP numbers is that they are substantially weaker than what has been reported previously. Before the “technical recession” that the “experts” refuse to acknowledge happened at the start of 2022, the BEA was reporting substantially stronger growth every quarter.

The BEA’s own data shows at every level of particularity that the economy “downshifted” in 2022, and it remains in that condition even now.

As a direct consequence, real economic growth is showing to be considerably less than nominal growth, and has been since Q1 2022. If we index real and nominal GDP to the beginning of 2021, we see that, from the start of Q1 2021 through the end of Q4 2023, real economic growth in the US has been just 8%, while nominal economic growth has been almost 24%.

The net effect of inflation on the US economy has been to diminish economic growth by two thirds. That’s not a healthy sign for any economy, and there is no sign that the effects of inflation are going to be reversed any time soon.

The data does not improve the further down we drill into it.

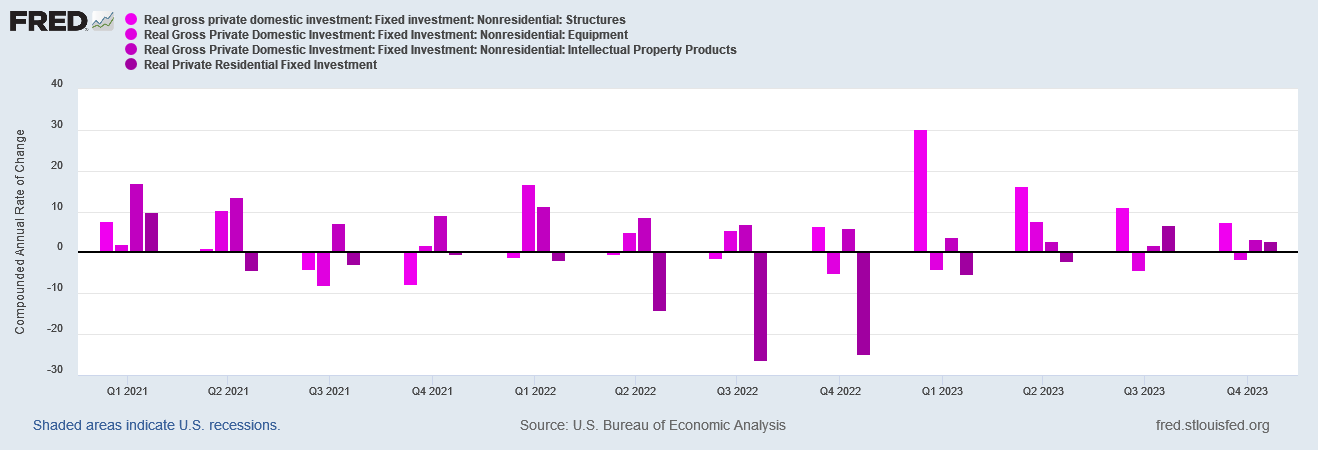

When we look at investment—residential and business spending outside of consumption—we see ongoing (and potentially structural) weakness across multiple categories.

Residential investment growth turned positive in Q3 2023 for the first time since Q1 of 2021. Even that, residential investment growth tapered off significantly between Q3 and Q4 of last year.

While nonresidential investment growth in structures had surged in the first quarter of 2023, that investment growth has been steadily diminishing ever since, and that after several quarters of uneven and problematic growth.

Nonresidential investment growth in equipment has simply been weak since Q1 2022.

Nonresidential investment growth in intellectual property has been positive since Q1 2021, but that growth has been steadily diminishing.

These are not trends which augur well for the future of the economy.

The consumption picture over the long term does not look much better.

Once again, 2022 is where growth either diminished drastically or stopped altogether. While consumption growth has picked up in Q3 and Q4 of 2023 (although Q4 saw much less consumption growth than Q3), the rates are still weaker than was being reported in 2021. The tapering off in consumption growth between Q3 and Q4 undercut any thesis of ongoing structural expansion in consumption—the very sort of consumption growth that an economy needs to have sustained growth.

This is another trend that does not augur well for the economy.

However, where the economic data released by the BEA really displays weakness is in personal income—in particular real disposable income.

The BEA’s own data shows that nominal personal income dropped between Q1 and Q2 of 2021, and did not recover until Q4 of 2022—over a year and a half later.

Disposable income dropped even more, and did not recover until Q1 of 2023.

Real disposable income dropped and has yet to recover.

People have less money to spend now than in 2021. That is never a sign of economic health and is by definition the antithesis of economic prosperity.

While the other economic data shows the start of 2022 as being the inflection point, the income data shows the shift coming much sooner, with the dramatic Q1-Q2 drop in nominal and real incomes in 2021.

If we index the personal income data to the start of 2021, we see just how destructive inflation has been on the average pocketbook.

Not only did real disposable income start to trend significantly lower than nominal disposable income in 2022, but the nascent “recovery” in real disposable income growth at the end of 2022 did not extend into 2023, where real disposable income growth flattened relative to disposable income once again.

This is another sign that inflation is continuing to drag down the US economy, by pinching the average paycheck. That the gap between disposable income and real disposable income has not narrowed throughout 2022 and 2023, but gotten wider, is a grim testimony to the utter failure of both monetary and fiscal policy in the US, and that inflation is continuing to eat away at the economy.

With such signs of economic weakness, how is it that the BEA can see economic growth? The most likely source of paradox is the growth in public debt.

Public debt as a percentage of GDP had been declining until 2023, when it began rising again. The government is literally attempting to borrow its way to prosperity—a strategy that has been tried before, and failed.

This is the problem with the BEA data, and why it can never be said too much that we must look past the headline numbers in any economic report. The BEA looks at a select series of matrices to develop its economic assessments, but it ignores altogether important related trends such as government debt. The BEA assessment fails to articulate the influence of government policy and government spending on economic “growth”.

The result of such omissions is that, once again, we are looking at economic data that is fundamentally fictional. If we remove the increases in government debt over the past several quarters, we would also remove the economic “growth”—which is to say that there was no actual economic growth.

Inflation is growing—again.

Nominal incomes are growing, although at a much slower pace than before.

Real incomes are not growing. They have shrunk, and as inflation continues to reignite they are likely to shrink again.

The BEA took a very small step towards acknowledging the “weak and getting weaker” state of the US economy by trimming its GDP growth estimate every so slightly. Unfortunately, such half steps towards reality still leave the BEA assessment itself in the realm of fantasy and fiction, which is what the BEA headline numbers ultimately are.

Nominal incomes: (gross income) are growing

Real incomes: (after inflation) are not growing.

It is so important to look at and understand details and not look at the headline and say “okay got it”. You likely don’t.

As I read PNKs article about inflation, I think on the impact this has on people/families living paycheck to paycheck and how it is getting worse. I listen to Bloomberg news and they love to say inflation / economy is getting better. The working poor and middle class is saying “the cost of non-discretionary goods has gone up so much, I can’t understand why they say another 3%ish rise is good. I can’t afford to live now”. I can’t help but think it creates anger or tears when they hear it.

Doesn't appear there are any books that they don't cook or revise anymore, in order to juggle things to show the picture that they want to show. But then again, we are talking about the government!!

Linking as usual @https://nothingnewunderthesun2016.com/