The Jobs Recession: Manufacturing Is Suffering

Job Loss, Reduced Wages, And Shrinking Hours Are Not Signs Of Prosperity

The prevailing narrative, from both corporate media and the “experts” both on Wall Street and in Washington, DC, is that the US economy is healthy and resilient.

The prevailing narrative is that, thanks to the superb leadership of the (Biden-)Harris Administration and the astute monetary policies of the Federal Reserve under the sober guidance of Fed Chairman Jerome Powell, the economy has weathered a hyperinflationary storm without a recession or severe economic dislocation.

The prevailing narrative is a load of hogwash and horse hockey.

In several sectors, manufacturing especially, we are seeing not only a lack of jobs growth but significant job losses.

Manufacturing is suffering and has been suffering under the economic stewardship of the (Biden-)Harris Administration.

Jobs have been lost.

Real wages have shrunk.

Hours have been diminished.

None of these are signs of prosperity in manufacturing, yet these are the hallmarks of US manufacturing job markets in the fall of 2024.

To hear economists tell the tale, the US economy has done remarkably well, and is on a glide path to a “soft landing” now that the Federal Reserve has begun to reduce the federal funds rate.

“It’s a shockingly smooth landing,” said Dean Croushore, who served as an economist at the Fed’s Philadelphia Reserve Bank for 14 years and participated in the survey. “Fundamentally, things are still pretty strong across the board.”

The more benign outlook in the survey, which polled 37 economists between September 11 and 13, found that a majority of respondents did not expect a contraction in the next several years.

This delusion, of course, is but the latest exhibit in support of the premise that “expert” is modern-day wokespeak for “blithering idiot.”

Nor is this an isolated case. Pullbacks in retail spending are attributed to “wallet shift”—the seemingly remarkable notion that when consumer prices rise faster than wages people have less money to spend.

The increasingly cautious approach to spending is likely more “wallet shift” versus fears of unemployment, he said, noting food prices as an example. In the decade leading up to the pandemic, food prices held relatively steady, with a 5-year growth rate below 1%, he said.

“Today, it’s a 27% increase versus what you were paying five years ago,” he said. “If you’re making 15% more money, but your grocery prices are up 27%, you have to buy less of something to be in the same place.”

The rationale is that, as the jobs market is still doing well, workers need not fear unemployment.

The (Biden-)Harris Administration, of course, is doing all it can to advance this narrative, with the Administration’s lamentable Press Secretary Karine Jean-Pierre talking up how the Administration has “created jobs”.

Perhaps no statement is more ludicrous than her regurtitating Joe Biden’s ludicrous claim to have presided over a “manufacturing boom.”

Without further adieu, let’s look at the data to understand why these statements are pure garbage.

Are we in a “manufacturing boom”?

No. Nor does the data even remotely suggest that we are.

There is no manufacturing boom when the Institute of Supply Management Manufacturing PMI metric shows manufacturing in the US either declining or contracting for most of the last 3-1/2 years.

Any time the PMI metric prints below fifty, a contraction is taking place. The ISM Manufacturing PMI has printed above 50 only once (March of this year) since November 2022. In other words, the ISM Manufacturing PMI is showing the manufacturing sector in the US economy to have been contracting more or less non-stop for very nearly two years.

Does a two-year contraction sound like an economic “boom”? Asking for a friend.

The S&P Global Manufacturing PMI shows a bit more strength than its ISM counterpart, with most of this year actually printing expansion, coming in just barely above 50 for most of the first part of the year.

However, given where the PMI was pringing in 20201 and the first half of 2022, to be just within a few tenths of a percentage point of outright contraction is hardly a glowing testimonial of ecnomic strength, especially since even the S&P Global Manufacturing PMI shows the manufacturing sector of the economy in contraction for most of 2023.

Does an extended contraction followed by weak growth sound like an economic “boom”? Asking for a friend.

Moreover, we have good reason to take the PMI metrics seriously. The Federal Reserve’s own metric of manufacturing production shows consistent year on year declines in production since December 2022.

Since January 2023, manufacturing production has been at likely to decline as has been to increase month on month.

Coming out of the Pandemic Panic Recession, manufacturing production did increase through 2021 up until October 2022, but the overall trend in the Fed’s manufacturing production index since then has been down.

Does declining manufacturing production sound like an economic “boom”? Asking for a friend.

Over that same time frame, since approximately September 2022, manufacturing capacity utilization in this country has been steadily declining.

Does declining manufacturing capacity utilization sound like an economic “boom”? Asking for a friend.

But manufacturing is not merely bad news at the sector level. The worker-level data is no better.

At the start of the Pandemic Panic Recession, the average workweek in manufacturing was 40.5 hours. In February and March of 2022, the average workweek had recovered and marginally surpassed that, reaching 40.6 hours. Since then the workweek has declined.

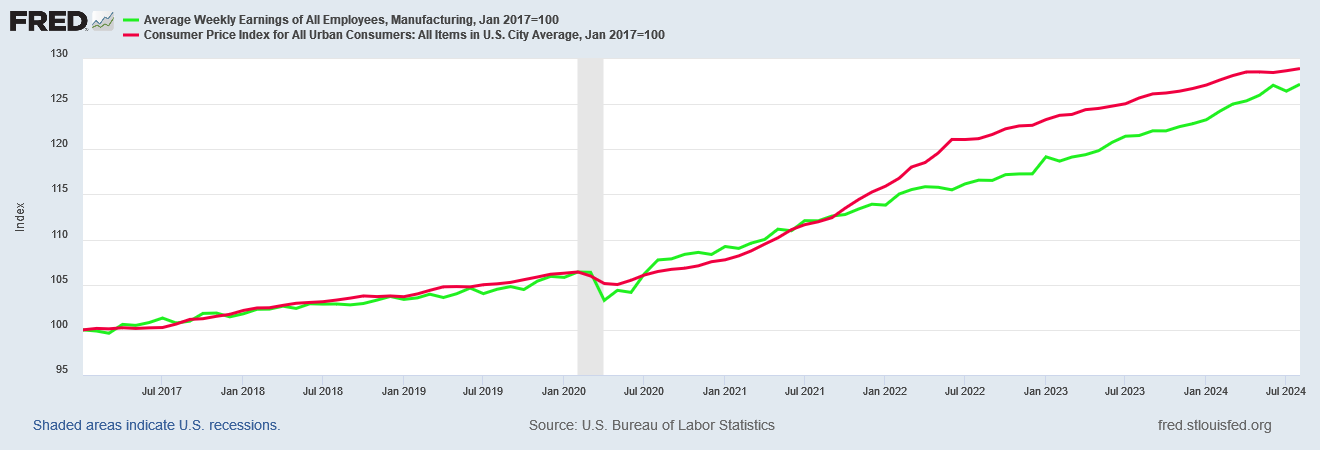

Manufacturing wages have hardly fared better, as they have not even remotely kept pace with inflation the past couple of years.

In real terms, if we use the Consumer Price Index as a deflator to ascertain what “real” wages look like, we see that, in real terms, manufacturing wages have fallen.

Do declining workweeks in manufacturing and declining real wages in manufacturing sound like an economic “boom”? Asking for a friend.

Nor can it be said that job growth in manufacturing has been all that great.

We do well to remember that much of the job “growth” claimed by Joe Biden is little more than employment recovering to where it was at pre-COVID. As regards manufacturing employment, if we account for recovery to pre-COVID levels, during the (Biden-)Harris Administration there have been approximately 150,000 jobs added.

Moreover, those 150,000 new manufacturing jobs were accomplished by October 2022. Since then, there has been little movement in manufacturing employment, either in absolute terms or relative to overall private employment.

Since October 2022, there has been no manufacturing job growth of any kind.

Does a stagnant level of manufacturing employment sound like an economic “boom”? Asking for a friend.

By virtually ever metric imaginable, since the fall of 2022, manufacturing in this country has been in decline.

Manufacturing production has declined.

Capacity utilization has declined.

Manufacturing PMI has printed contraction rather than expansion more often than not.

The average manufacturing hours worked per week has declined.

Real wages have declined, especially when calculated using the Consumer Price Index as a deflator.

Even the number of employees in manufacturing jobs has either been stagnant or has declined since the fall of 2022.

These metrics come from a variety of sources, but they all show the same reality: stagnation and decline. Even more damning is that they all broadly show the manufacturing sector having a marked slowdown in the fall of 2022.

None of these diverse metrics shows a “boom” in manufacturing, certainly not since the fall of 2022, and arguably not even before then.

If manufacturing in this country is either stagnating or declining, and manufacturing is a mainstay of economic production, on what basis can anyone claim this country’s economy is healthy?

I will say it again: this country’s economy is mired in a jobs recession.

We are not seeing major job growth, and it is far from certain we are seeing any job growth. In manufacturing we certainly are not seeing any job growth.

We are not seeing expanding workweeks.

We are not seeing rising real wages — inflation has been taking bigger and bigger bites out of worker paychecks since the hyperinflationary cycle began in 2021.

When anyone from Wall Street or Washington talks about how well this economy is doing, understand one thing: they are spouting nothing but hogwash and horse hockey.

“expert” is modern-day wokespeak for “blithering idiot.” Heh heh heh. You’re on fire today, Peter.

The good news is that a great many people can sense that all is not well, and they will vote accordingly. They see the grocery prices, the restaurants closing, and the homeless camps. Even young people are miffed that they never got the Magical Fairy’s promise of extensively canceled student debt. Consequently, the MSM may once again be astonished when Trump ‘somehow’ wins - assuming voter fraud is reigned in sufficiently.

I’m trying to stay optimistic. I have high confidence that Harris and Walz will trip themselves up with their idiocy before the election (Walz saying, “We can’t afford another four years of this!” - wow, is he incompetent at everything!) We seriously NEED to get our country’s manufacturing jobs situation improved. Get out the vote, everyone!

"Job Loss, Reduced Wages, And Shrinking Hours Are Not Signs Of Prosperity". I would have added the caveat "Unless you're the Biden/Harris administration and the Fed" to your title. Linking as usual @https://nothingnewunderthesun2016.com/