The October Employment Situation Summary: An Economic Death Of A Thousand Cuts

Once Again, The Top Level Numbers Obscure Lots Of Troubles In The Details

To hear the corporate media tell the story, the October Employment Situation Summary beat expectations handily.

The U.S. economy added more jobs than expected in October even as the Federal Reserve pressed on with the central bank's most aggressive monetary tightening campaign in decades.

Certainly, looking at the top level numbers, the summary seems to be good news for employment in the US during October.

Total nonfarm payroll employment increased by 261,000 in October, and the unemployment rate rose to 3.7 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in health care, professional and technical services, and manufacturing.

These arguably good numbers were also above what Wall Street watchers anticipated.

Here are the highlights from the Labor Department's monthly jobs report released Friday, compared to consensus estimates from Bloomberg:

Non-farm payrolls: +261,000 vs. +195,000 expected

Unemployment rate: 3.7% vs. 3.6% expected

Average hourly earnings, month-over-month: +0.4% vs. +0.3% expected

Average hourly earnings, year-over-year: +4.7% vs. +4.7% expected

However, as has been the case for most of the year, beneath the top level numbers lurks a lot of troubling data that paints a far less glowing picture of US employment.

Despite Job “Growth”, Seasonally Adjusted Employment Declined

The first and biggest challenge in the Employment Situation Summary is that, on a seasonally adjusted basis, the number of employed people in the US actually declined during October.

While the unadjusted employment level shows jobs growth, that growth is less than it should have been, once seasonal factors are taken into account.

Civilian Labor Force Growth Slower Than Population Growth Again

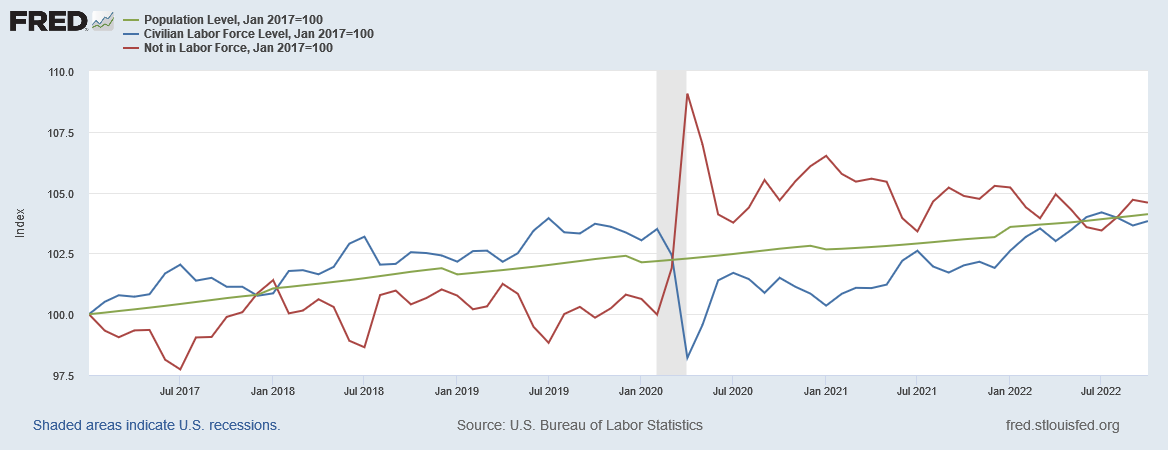

For the second month in a row, and in a continuation of a trend that extends back to the 2020 recession, the civilian labor force grew at a pace below that of the working-age population, while the cohort of those not in the labor force grew faster than the working-age population.

Put simply, the US is adding more non-workers to its working age population than it is adding workers.

This is not a healthy long term trend, as it prevents job recovery post pandemic of a magnitude to resolve steep decline in the labor force during the 2020 recession. Net labor force growth during October was less than net labor force decline during September.

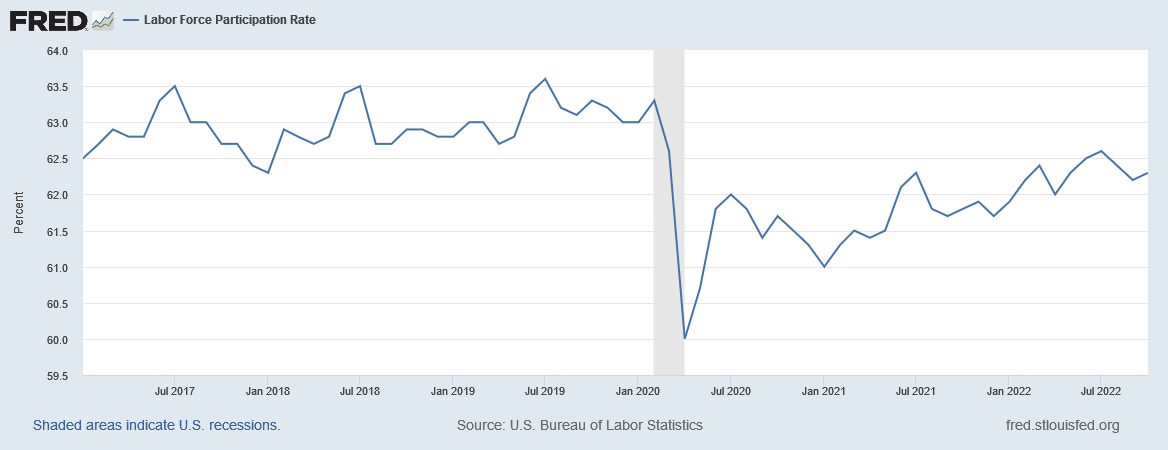

Viewed another way, the marginal increase in the labor force participation rate in October was less than the marginal decline in September.

Not only is the labor force participation rate apparently leveling out well below pre-pandemic levels, it is completely failing to reverse a decade long trend in declining participation.

Without robust labor force participation the labor aspect of the economy is inherently suspect.

Unemployment Rate Points To Growing Job Destruction

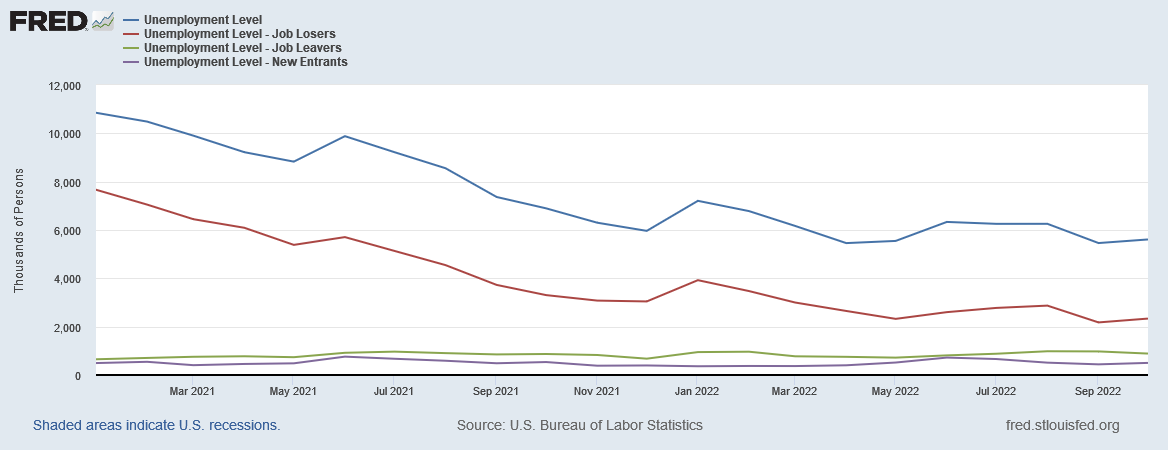

While the rise in the unemployment rate from 3.5% to 3.7% was about the only negative in the Summary’s top level numbers, the reality underneath is that in October people who lost their job through layoff or termination rose, while those who left a job voluntarily declined.

Rising layoffs and terminations can only mean there is an increasing pace of job destruction taking place in the US—something only the Federal Reserve is eager to see.

Part Time Jobs Grew, While Full Time Jobs Shrunk

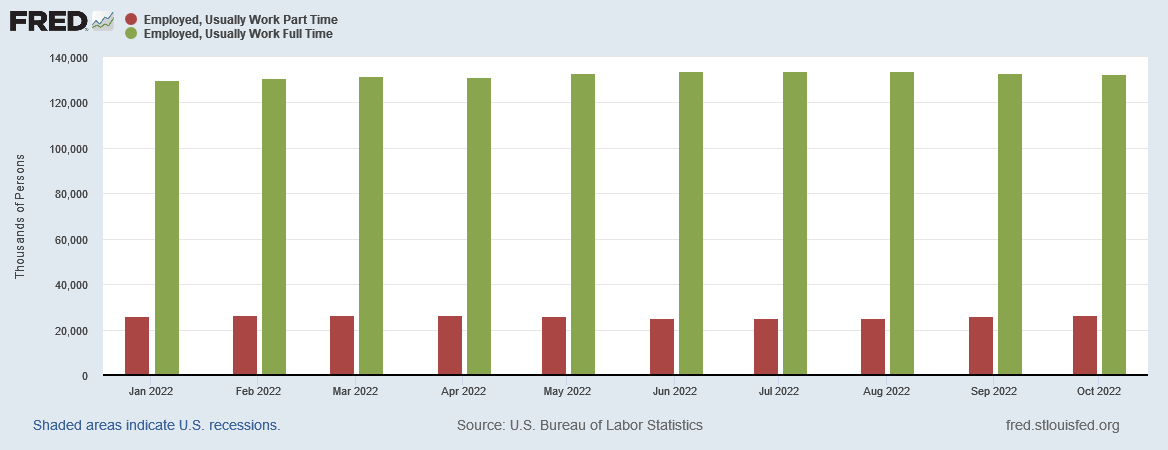

The top level jobs numbers make no distinction between part-time and full-time work—one of many reasons it is important to look beneath the top-level numbers to have a complete understanding of the jobs picture.

In October, the top level jobs growth was the result of an increase in part time positions, while full time positions declined.

The significance of this should be intuitively obvious: an healthy economy provides full time employment rather than part time employment.

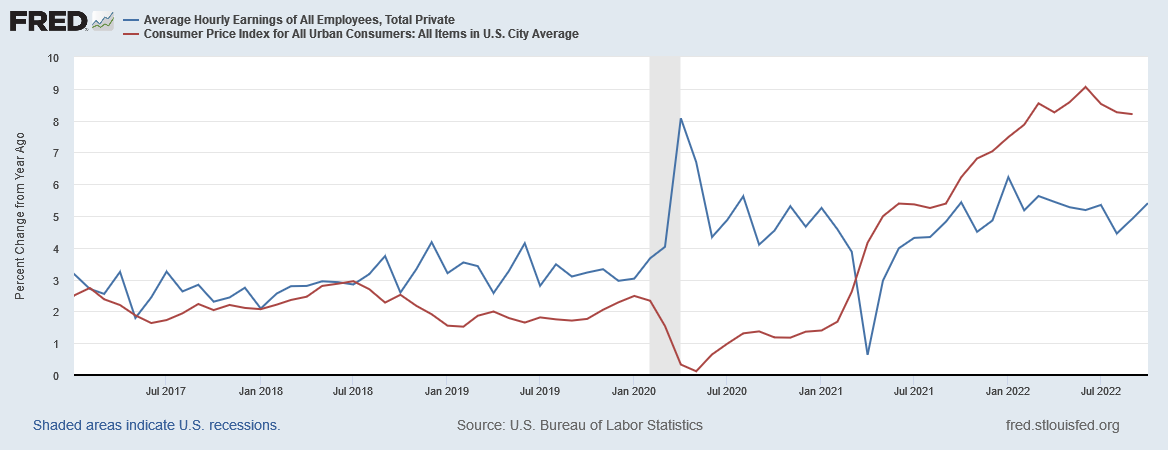

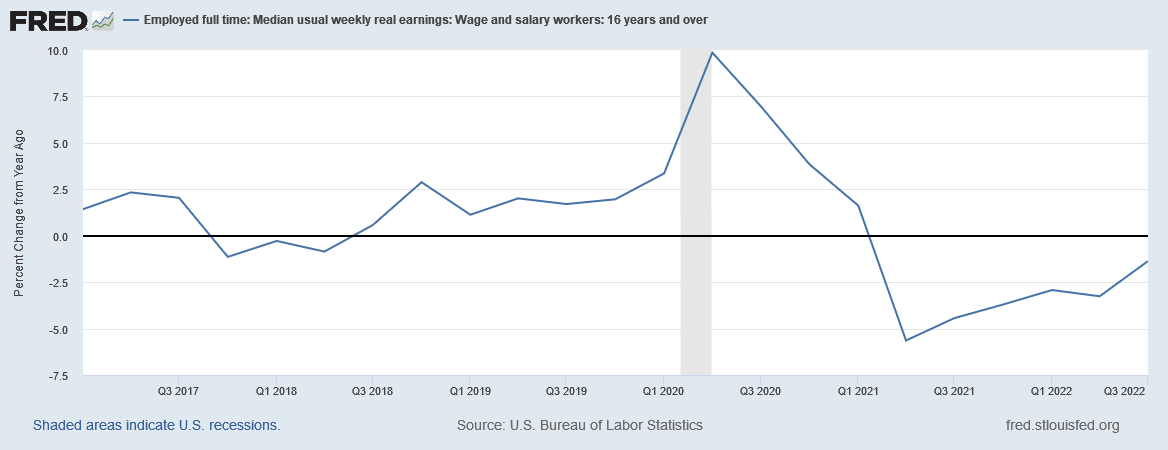

Inflation Means Real Wages Declined Yet Again

While any increase in average hourly earnings appears welcome, when wage growth is overwhelmed by inflation, the net effect is a decline in real wages.

This has been the state of the American worker since the spring of 2021—steadily losing income to inflation.

The Data Death Of A Thousand Cuts

While the October Employment Situation Summary is not one of the BLS’ more egregious examples of Lou Costello Labor Math, the detail underneat the top level numbers still shows there are numerous areas of concern, and numerous areas of outright weakness in US labor markets.

Even if the jobs growth of 261,000 jobs is taken at face value, the seasonal decline in overall employment means that the US economy needed to add considerably more jobs than it did, in order to keep pace with the overall population and the overall labor force. The failure of the economy to generate that level of jobs growth means that more and more workers are being left sidelined and out of the labor force—a reality which makes the notion of a “tight” jobs market extraordinarily absurd.

A shift from jobs involving full time work to jobs involving part time work undermines US productivity as well as US wages (which are already languishing far behind inflation).

The increase in job terminations and layoffs among the unemployed means that job destruction is taking place in the US economy, although at the moment not at a rapid enough pace to make the Federal Reserve happy.

Declining employment, lack of labor force participation, declining wages….by themselves these details are relatively small and would not, on their own, trigger any great concern. Taken all together they paint a jobs picture that is far weaker and far less robust than the corporate media narrative wants you to believe.

The October Employment Situation Summary starts off with what sound like good top level numbers and portrays an healthy jobs market in the US. Unfortunately, within the details the Summary and US jobs markets suffer a death of a thousand cuts, and what at first suggests economic health in fact portrays economic weakness.