There has been a decidedly upbeat trend in economic news of late, enough so that the “experts” are now convinced there won’t be a recession in 2023.

June consumer confidence data was the highest it's been in 18 months. Both April home prices and May new home sales surprised to the upside. And durable goods orders grew in May, too, even as economists had been expecting a decline.

Because of the good news, economists are deciding that a recession is clearly off the table for 2023. Why? Because optimism, mainly. Also because reasons.

What sort of good news has the economy been getting?

For starters, the Conference Board’s Consumer Confidence Index printed surprisingly high in June.

The Conference Board Consumer Confidence Index® increased in June to 109.7 (1985=100), up from 102.5 in May. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—rose to 155.3 (1985=100) from 148.9 last month. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—rose to 79.3 (1985=100) from 71.5 in May. Expectations have remained below 80—the level associated with a recession within the next year—every month since February 2022, with the exception of a brief uptick in December 2022. However, June’s reading was just a shade below 80 and up sharply from last month’s print.

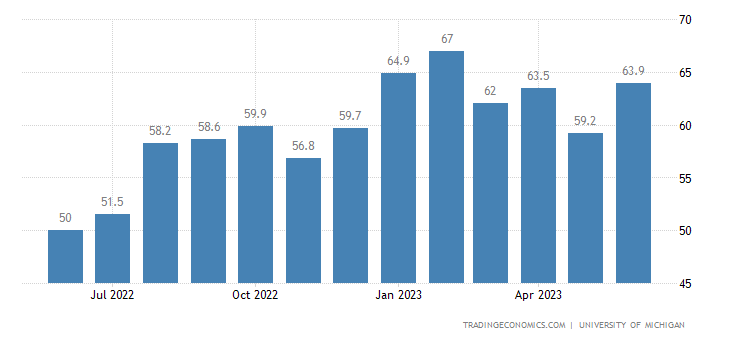

The Conference Board showed broadly the same rise in consumer confidence as University of Michigan Consumer Sentiment survey, which likewise posted a significant gain in its preliminary assessment for the month of May.

Overall, people are developing far more positive perceptions of the state of the US economy.

Those perceptions are not entirely without justification.

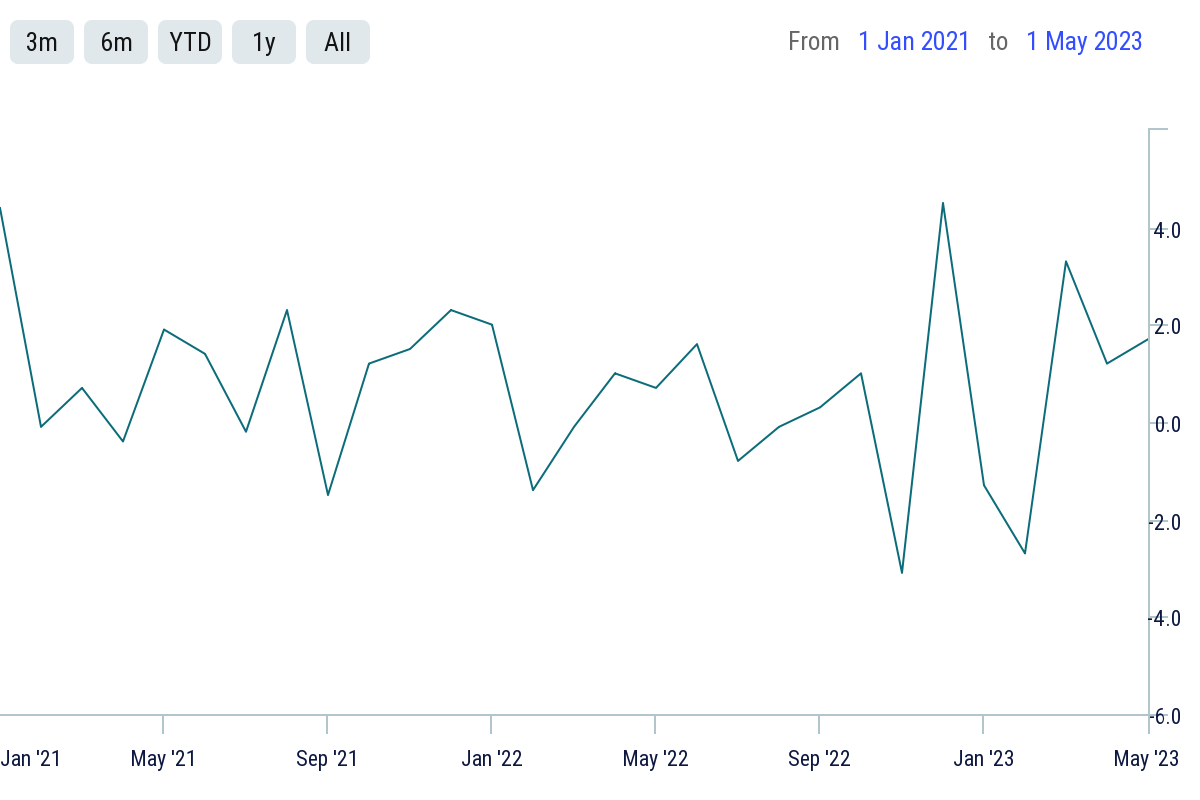

Wholesale inventories for the month of May came in 0.1% below April, and up 3.6% from May 2022.

At the retail level, inventories rose month on month by 0.8%.

The improvement in inventories was also reflected by a narrowing of the trade deficit, which shrank to $91.1 Billion.

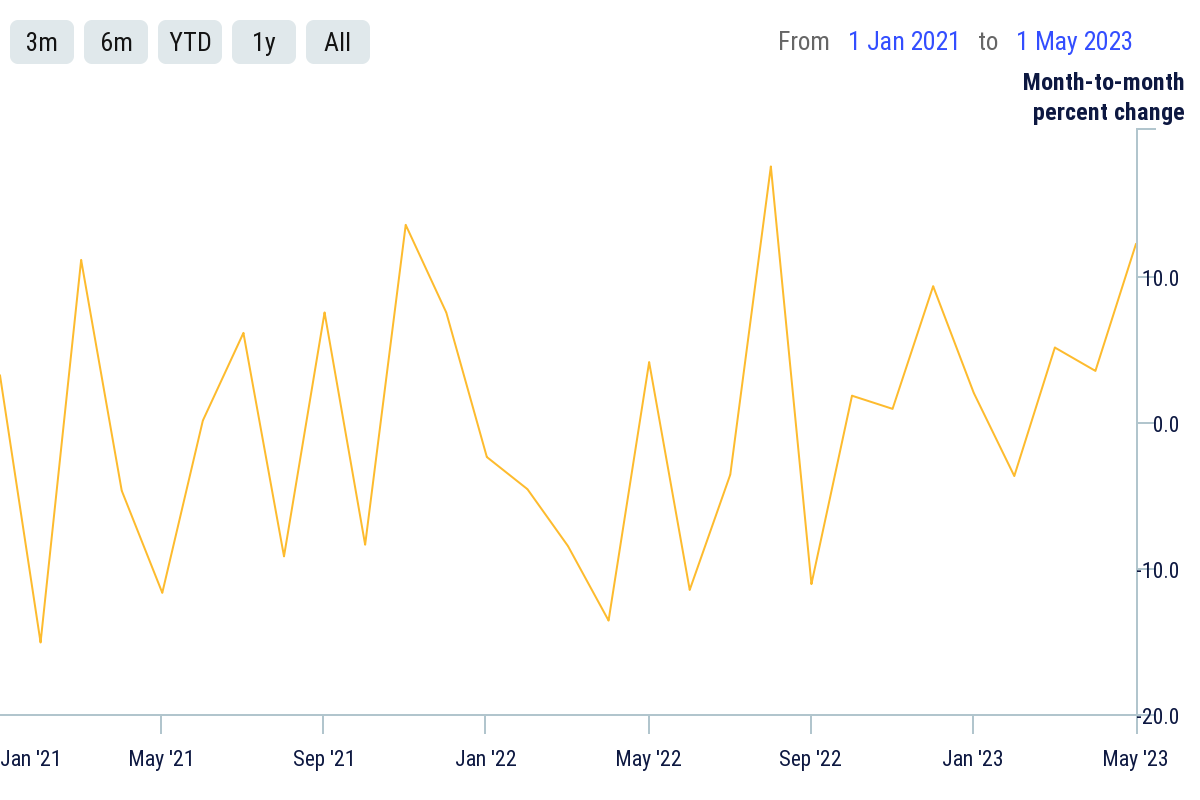

Meanwhile, residential home sales surged 12.2% in May.

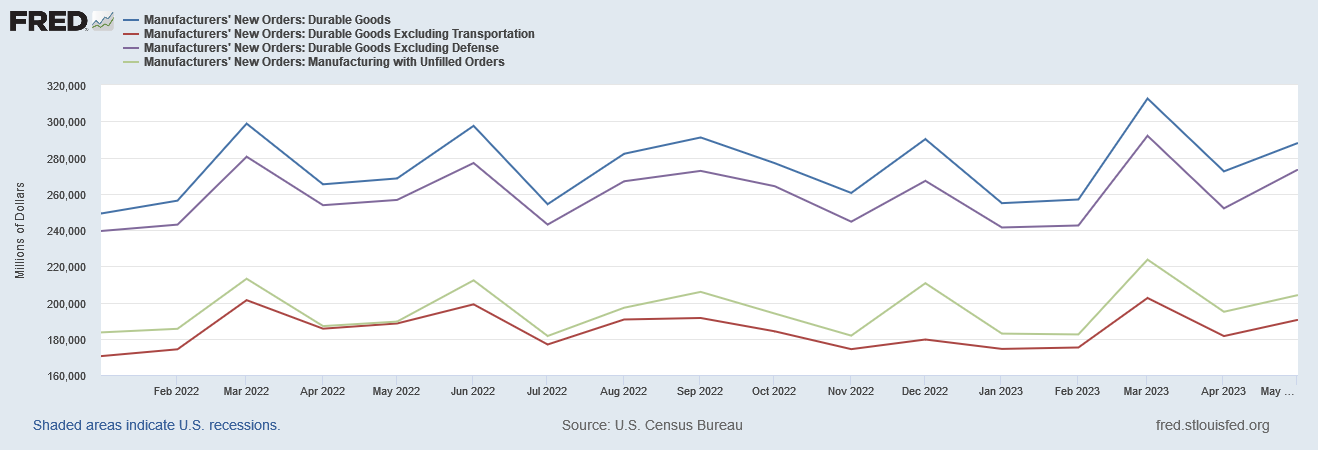

New orders for durable manufactured goods rose for the third month in a row, climbing by 1.7%.

With inarguably positive data in inventories, home sales, and new orders, the US Census Bureau’s Index of Economic Activity improved to 0.61.

There is no doubt that these are positive economic numbers and they suggest the US economy is improving at the margins.

Naturally, Wall Street does not expect the Federal Reserve to allow such good news to go unpunished. In response to this outrageous burst of optimism, Wall Street expects the Federal Reserve will move to choke off any economic improvement by raising the federal funds rate another 25bps at their July meeting.

After all, the Federal Reserve has been committed to pushing the US economy further into recession ever since last year’s Jackson Hole symposium, where Jay Powell promised to crush inflation and whatever else got in his way.

The tragic irony of Powell’s interest rate fixation is that it will come at a time when the banking sector is inching back from the crisis cliff.

Bank deposits continue to show signs of stability and even a slight increase.

The weekly improvement is more easily seen if we index deposits to the beginning of the year.

Banking deposits in domestically chartered banks rose by ~0.2% of their January 1 level. Deposit outflows effectively ceased in May and have been largely holding in the same range, with incremental improvements in the past couple of weeks.

This improvement in bank deposits is met by continued declines in the funds placed in the Fed’s reverse repo market.

In extending the decline that began on April 12, reverse repo market funding reached its lowest level since February 15.

The net effect of these two trends is to move the banking sector away from the liquidity crisis Powell has been pushing it towards with the Fed’s rate hike strategy. The one thing the recent spate of good economic news cannot change is that continued increases in the federal funds rate—and, ultimately, in market interest rates—is that somewhere the financial system will run out of dollars.

This strengthening of banking conditions was reflected in the Fed’s recent announcement that the country’s largest banks had all “passed” the Fed’s annual “stress tests”, which subjected bank balance sheets to various levels of debt default arising out of a number of recession scenarios.

The banks were able to maintain minimum capital levels, despite $541 billion in projected losses for the group, while continuing to provide credit to the economy in the hypothetical recession, the Fed said in a release.

The improving situation has also been recognized on Wall Street, which has been kinder to bank stocks recently, particularly former leading candidates for failure PacWest and Western Alliance.

Even ETFs have been showing increased confidence in mortgage backed securities as well as Treasuries, after having been in retreat since April.

While it is far too soon to declare the banking sector out of danger of renewed crisis, the positive trend within banking in recent weeks is unmistakable.

Would the banking sector have begun to strengthen had Powell pushed through a 25bps hike in the federal funds rate in June? There is, of course, no way to know for certain, but pushing the federal funds rate up invariably makes the reverse repo market an attractive place to park “excess” cash, as it can achieve better returns than in most bank-managed accounts. A rate hike that incents funding inflows to the reverse repo market invariably pulls funds out of bank deposits, away from the banks that need them.

Powell did not push for a rate hike at the last FOMC meeting, and the net consequence thus far has been declining funds in the reverse repo market, which in turn has meant rising deposits at a time when banks large and small need them.

Meanwhile, improvements in inventories and home sales means people are buying stuff—and Powell simply cannot abide that while inflation remains high. He will keep pushing the federal funds rate higher, keep draining liquidity away from banks, keep using interest rate manipulations to discourage consumers from consuming. Whatever economic gains have been happening recently Powell is almost sure to want to end when the FOMC meets again in July.

What Powell is almost sure to overlook, however, is that while these latest metrics are undeniably positive, they are also very much marginal. They don’t alter, for example, the reality that unadjusted new orders for manufactured durable goods have largely trended horizontally for over a year.

Nor does it change the reality that the levels of new home sales are still not at the levels they were at in 2020 and 2021.

While the recent trends have been positive, much larger and longer trends are needed to reverse the contractionary influences that have been appearing in the PMI data this year.

Nor is Powell likely to take into account the fact that longer term yields have yet to approach even their March 2023 peaks, and are currently declining.

As a means of raising interest rates and boosting the cost of capital, Powell’s rate hike strategy continues to be an abysmal failure. The markets are simply refusing to allow treasury yields to rise.

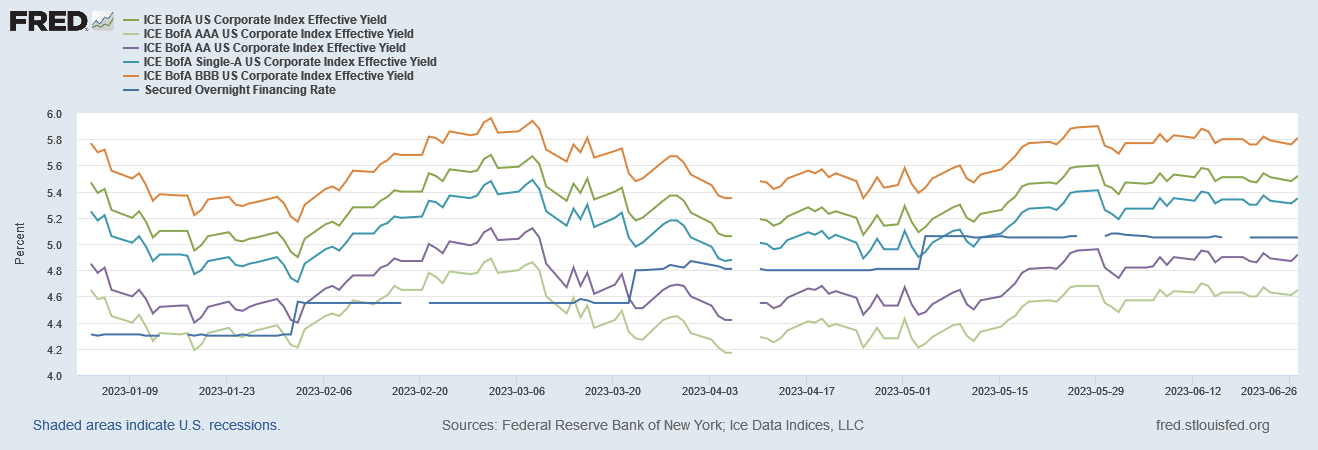

The same is true for yields on corporate debt as well.

With commodities such as copper unable to sustain price rises for any length of time, it is difficult to anticipate manufacturing growth increases of any significant size.

Manufacturing is the process of turning such commodities into goods for purchase—and if there is not an increasing demand for commodities, where is the future output of goods to power increased inventories and consumer sales?

The recent economic releases by the US Census Bureau are undeniably positive. Of that there is no question. However, they show at most marginal improvements in trends that have been in decline or simply stagnant for quite some time. If these trends could be sustained then there would in time be genuine sustained economic growth, and the US economy could at last be said to have broken out of its current stagflationary doldrums.

For that to happen, however, presumes that Powell can resist the urge to keep pushing rates up until the economy breaks again—and not even Wall Street believes there’s a hope in Hell of that being the case.

Inflation in groceries is getting worse and gas has gone up where I live, just outside of Houston, Tx. Wages are still stagnant and layoffs continue in many sectors. To me this uptick you showed in charts, thanks for your hard work, by the way, does not reflect the reality of most Americans and is falsely created by Congress pumping money into 'infrastructure'. But I am not nearly as smart about this as you. I still feel like the ship is sinking, even if people on the top deck are having a party.

Michael Maharrey at Schiff gold had an interesting article about some of these numbers as well : Economic Data Isn’t as Strong as the Headlines Claim

https://schiffgold.com/key-gold-news/economic-data-isnt-as-strong-as-the-headlines-claim/

Don't know if you have read it. Linking your article and his as well today @https://nothingnewunderthesun2016.com/