What Goes Up Invariably Comes Down

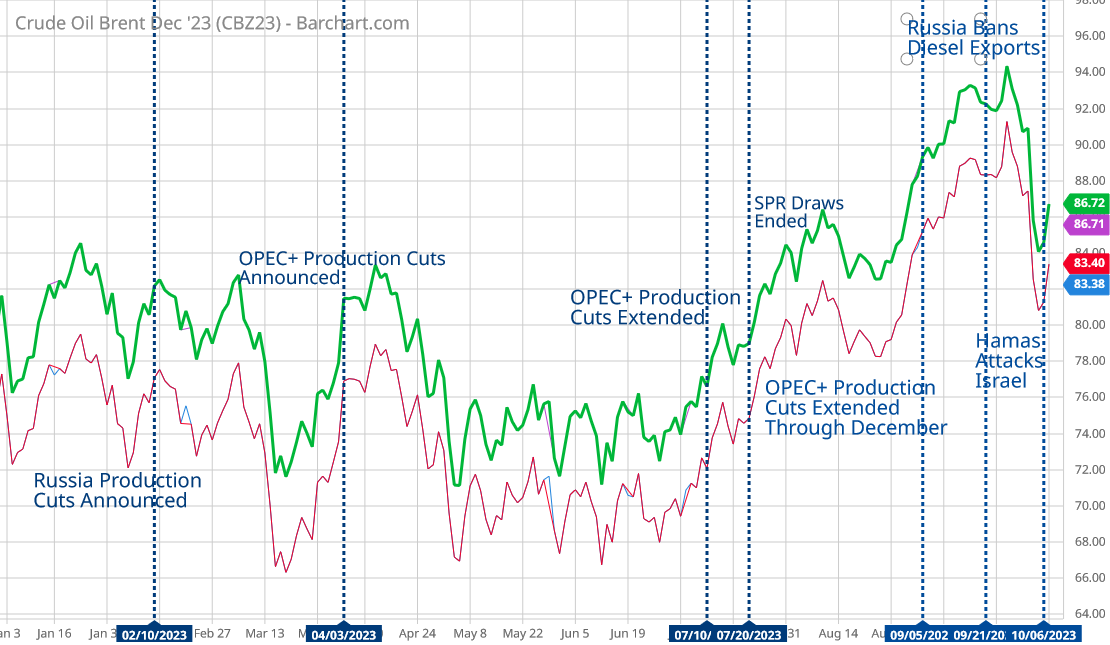

Oil Prices Crash Below Levels Established By Production Cuts

While the corporate media has been flirting with the notion of $100/bbl oil, I have been steadily reiterating a slightly different theme: without demand the upward price pressures from production cuts are not sustainable.

Without fresh organic demand pressures, the current production levels will still result in a new plateau being reached in the relatively near future. The OPEC production cuts are already set, and that means that future supply as well as current supply are reliably known quantities. This in turn means that inputs for the production of various fuels such as diesel are also reliably known quantities. With higher oil prices bringing in more oil production and delivery from outside OPEC and Russia, it is most likely that current market estimates of future supply will tend to underestimate the amount of future supply.

And while last week brought about a serious flirtation with $100/bbl oil thanks to Russia’s ban on diesel exports, this week brought about a dramatic correction.

Despite the Russian ban, oil prices have tumbled even as US oil inventories continue to decline.

Crude oil prices continued to move lower despite the Energy Information Administration report that inventories had shed 2.2 million barrels in the week to September 29.

After weeks of more or less making a mockery of my take on oil prices, they finally decided I was right and headed back down to earth.

Even Oilprice.com conceded the point, that the psychologically important threshold of $100/bbl is off the table for the time being.

The worst week for crude since March, oil prices have shed $10 per barrel this week, pressurized by the US bond selloff that soured the economic outlook into 2024 and then suffered another blow from this week’s EIA numbers that indicated a steep drop in gasoline demand across the US. With Friday focused on US non-farm payroll data, ICE Brent climbing to triple digits is firmly out of bounds for now, currently hovering at $84 per barrel.

This was always inevitable. Whenever prices—and in particular oil prices—go up, the one certainty we have is that they will eventually come down again.

Note: Most of the analysis detailed here was developed prior to Hamas’ attacks on Israel over the weekend. Exactly how that event will alter the geopolitical backdrop for oil prices is still very much an open question, although I will explore what oil traders are considering towards the end of the article.

When we say oil prices tumbled, one could almost say they crashed.

Oil prices are now below the thresholds established first by OPEC and Russia extending their production cuts through December and then from Russia banning diesel exports.

Despite the efforts of OPEC and Russia to prop up oil prices, the entire decline of nearly $10/bbl has occurred in little more than a week.

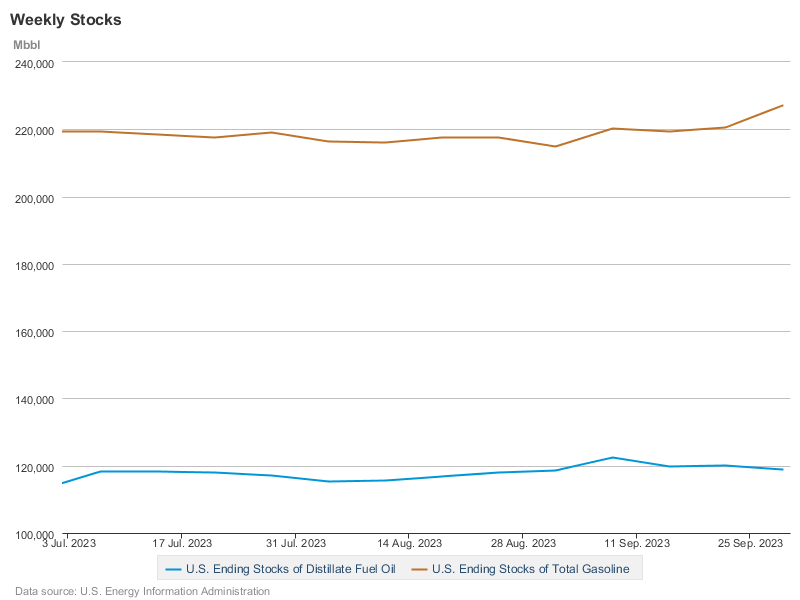

What is fascinating about this abrupt decline is that it occurs despite oil inventories declining—the EIA reported another 2.2 million barrel draw in US oil stocks for the week ending September 29, matching the draw reported during the previous week.

Intriguingly, the same report also noted an increase in the Strategic Petroleum Reserve, essentially restoring the draw that had taken place the week prior.

The driving force behind at least the tail end of the price declines is being attributed to a build in gasoline inventories.

In fuels, meanwhile, the EIA reported mixed inventory changes, but it was a build in gasoline and fears of weakening gasoline demand that traders paid attention to.

However, that is likely not the entire story, in part because the decline in crude oil prices began before the latest EIA report came out, and also because gasoline inventories have been moving up for a few weeks, well before the recent crude oil price peak north of $94/bbl.

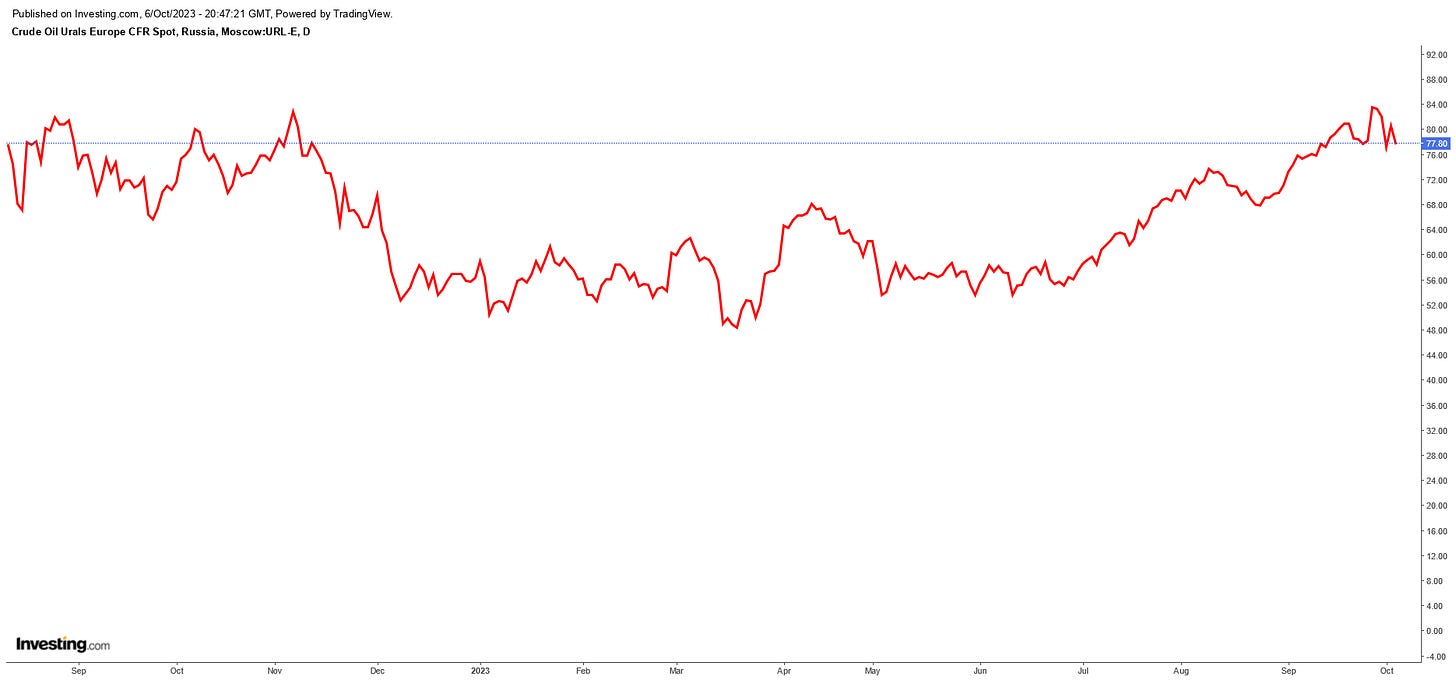

In a rather surprising reversal, Russia lifted the diesel export ban it imposed just a few weeks ago.

Russia lifted on Friday the ban on most of its diesel exports, two weeks after announcing export restrictions on diesel and gasoline to curb soaring domestic prices.

The Russian government said in a statement on Friday that as part of additional measures to keep the domestic fuel market stable, it is lifting the ban on exports of diesel delivered to seaports by pipeline, provided that the diesel producer supplies at least 50% of the diesel to the domestic market.

A not-unreasonable conclusion might be that the export ban was not producing the intended consequences for Russia.

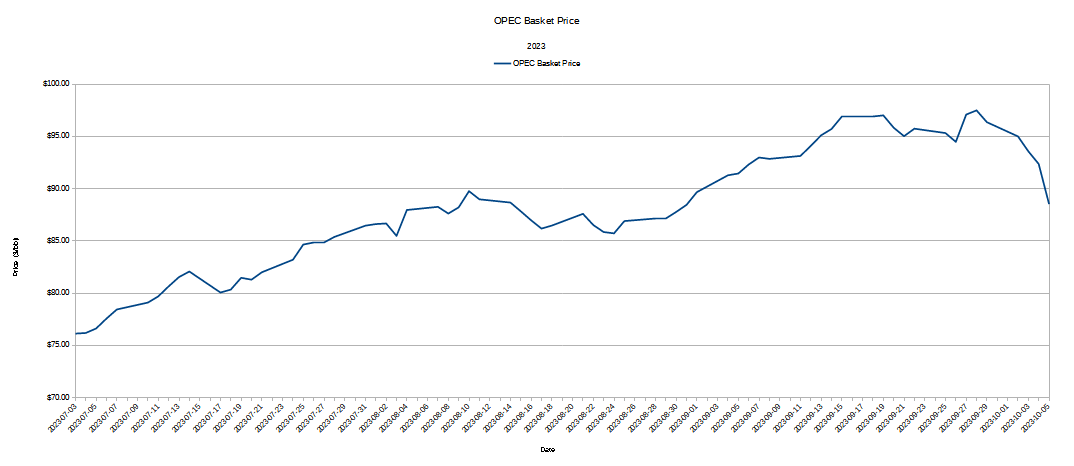

Moreover, there are indications beyond Russia’s backtracking on the diesel ban that even OPEC is not getting the desired results from their production cuts.

Despite the apparent success of the production cuts in pushing oil prices upward, Saudi Arabai has recently refrained from enacting significant increases to its oil prices charged to Asian customers.

In an environment like this, Saudi Arabia’s national oil company Saudi Aramco was expected to hike Asian prices by a solid margin. Surprisingly, the anticipated OSP increase did not happen. Saudi Arabia’s medium sour grades were hiked by $0.10 per barrel each, moving Arab Light to a $3.60 per barrel premium vs Oman/Dubai. In fact, the only Saudi grade that saw a notable increase in October was Arab Super Light, a very rare condensate-like grade that sees 1-2 cargoes per month, that was hiked by $0.50 per barrel. Overall, the lack of pricing ambition reflected wider worries about the health of Chinese demand into the remaining months of 2023, as well as significantly lower Indian nominations lately. India’s imports of Saudi crude are set to come in at the lowest monthly level in almost a decade, below 500,000 b/d. Considering Saudi Arabia sets the tone for other countries’ price-setting, the temptation to raise Asian formula prices was most certainly there.

While OPEC has thus far been able to maintain a premium on its crude oil blends, its prices have nevertheless declined alongside Brent and West Texas Intermediate.

Even Russia’s Urals Crude Blend has suffered a significant price correction recently.

Across the board, energy prices are in retreat. Gasoline prices in the US have been in decline for the past couple of weeks.

While diesel prices ticked up as of October 2 in the US, they are still below their most recent peak price.

In keeping with the usual narratives from the usual suspects, a number of analysts are projecting a substantial rebound in oil prices, believing prices below $90/bbl are just too low.

The bulls can, however, take some comfort in the fact that some Wall Street experts are now saying that oil markets are ready for a rebound. According to commodity analysts at Standard Chartered, the recent price dynamics are less a function of poor fundamentals but have more to do with a burst of volatility in a market where volatility was too low, combined with end-of-quarter rebalancing effects and the stopping out of some of the most recently added and least committed crude oil longs, particularly among momentum traders.

StanChart says recent price movements have been heavily distorted by contract expiry in a steeply backwardated market, noting the steep oil price crash is likely to embolden the bears.

However, the experts say current prices remain both fragile and too low given current fundamental balances, and are likely to rebound once the steep front-of-the-curve backwardation is stripped away and the effects of over-extended speculative length are factored in.

On Wednesday, Saudi Arabia and Russia said they will maintain voluntary oil supply cuts to the end of the year, in an effort to support an oil market where prices have pulled back sharply in recent days. Saudi Arabia has cut crude production by 1M bbl/day while Russia has trimmed oil exports by 300K bbl/day, on top of earlier cuts made with other OPEC+ nations. Saudi production for November and December will total ~9M bbl/day.

However, with Russia having already backed off its diesel ban and Saudi Arabia moderating its pricing strategies for the Asian market, one has to wonder how much upward price pressure is left in the current environment.

The ultimate question is, of course, is will oil prices go much lower?

Given Hamas’ massive attack on Israel over the weekend, the short term answer to that question is almost certainly “no”. Quite the contrary, over the next few days at least we are almost sure to see oil prices jump again.

“There is definitely going to be a fear trade put in place. While in the short term there is no impact directly on supply, it’s obvious how things play out over the next 24 to 48 hours could change that,” Phil Flynn, analyst at Price Futures Group in Chicago, told MarketWatch.

Movements in oil prices, meanwhile, will also serve as a gauge for broader market worries around the conflict, analysts said.

Despite the likely “fear trade”, however, analysts’ expectations are at the moment that the longer-term impact of events in Israel on oil prices will be minimized.

“The impact on the oil price will be limited unless we see the ‘war’ between the two sides expand quickly to a regional war where the U.S. and Iran and other supporters of the parties get directly involved,” Middle East managing director of energy consultancy Facts Global Energy, Iman Nasseri, told CNBC.

Similarly, French businessman and hedge fund manager Pierre Andurand said that since the Levant is not a large oil producing region, the war is unlikely to impact oil supply in the short term.

If the conflict between Israel and Hamas does not spread to include the oil producing countries of the Persian Gulf, its impact on oil supply and oil production is going to be minimal. Israel and Gaza are neither oil refining centers nor oil producing centers, nor are they even near major oil terminals. Even with the Persian Gulf states joining the conflict, the most likely scenario where oil supply gets disrupted is if the conflict interferes with shipping traffic coming through the Suez Canal, which is roughly 100 miles from the Egyptian side of Gaza.

We must also remember that any disruption arising from this conflict is still a constraint in supply. This war is not likely to stimulate global oil demand, and so its likely impact on oil prices will be of a piece with Russia's diesel ban and the OPEC production cuts.

Thus while it would not be at all surprising to see oil return to its September 28 peak price, unless there is a significant widening of the conflict we should expect that surge to be short-lived with a fairly rapid return to Brent crude prices in the mid-80s.

The Israel-Hamas conflict aside, the market reality for oil is that, without the Russian diesel ban, the most recent upward price pressure is effectively gone. On that basis alone a future of $100/bbl oil begins to look less and less probable. With oil prices having started to show signs of stability before the diesel ban was announced at the end of September, it is not at all certain that there is sufficient oil demand in the world necessary to keep oil prices even above $90/bbl.

Even with the overshot of a too-volatile oil market, one reality has never changed for oil: sustained price rises require rising oil demand relative to oil supply. While production cuts do have the effect of shifting the relative balance between oil supply and oil demand, if demand is soft and problematic at OPEC’s maximum target production levels, that demand will still be soft and problematic when OPEC and Russia trim their production targets to constrain supply. A demand profile that resulted in a downward trend in oil prices before OPEC and Russia collectively removed a million or so barrels from the oil market will still result in a downward trend in oil prices after those production cuts are implemented. The only difference is the original base price prior to the decline.

Oil markets have been given a blunt reminder of reality regarding prices in recent days: without sustained levels of demand, without sustained upwards price pressures driven by demand, price hikes from the supply side are never sustainable.