What Goes Up Invariably Comes Down, An Update

Oil Prices Show The Limits Of "Fear Trade"

Rarely are intraday oil price shifts economically significant over the longer term. Even a sudden spike or plunge in prices frequently reverses itself and evens out to a much smaller shift over a span of days.

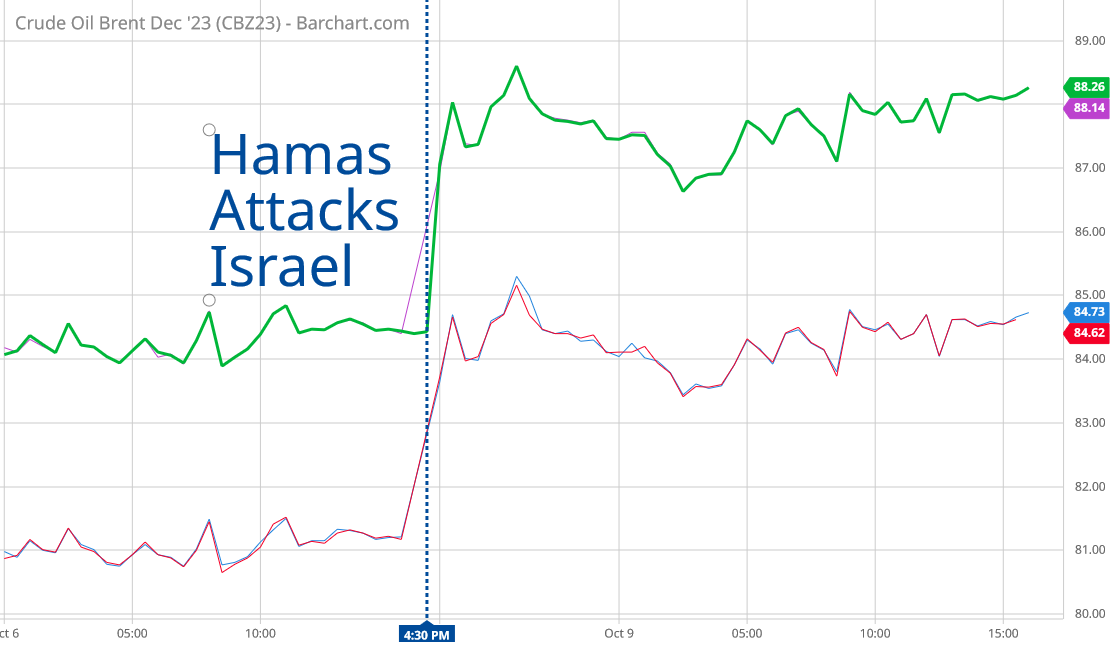

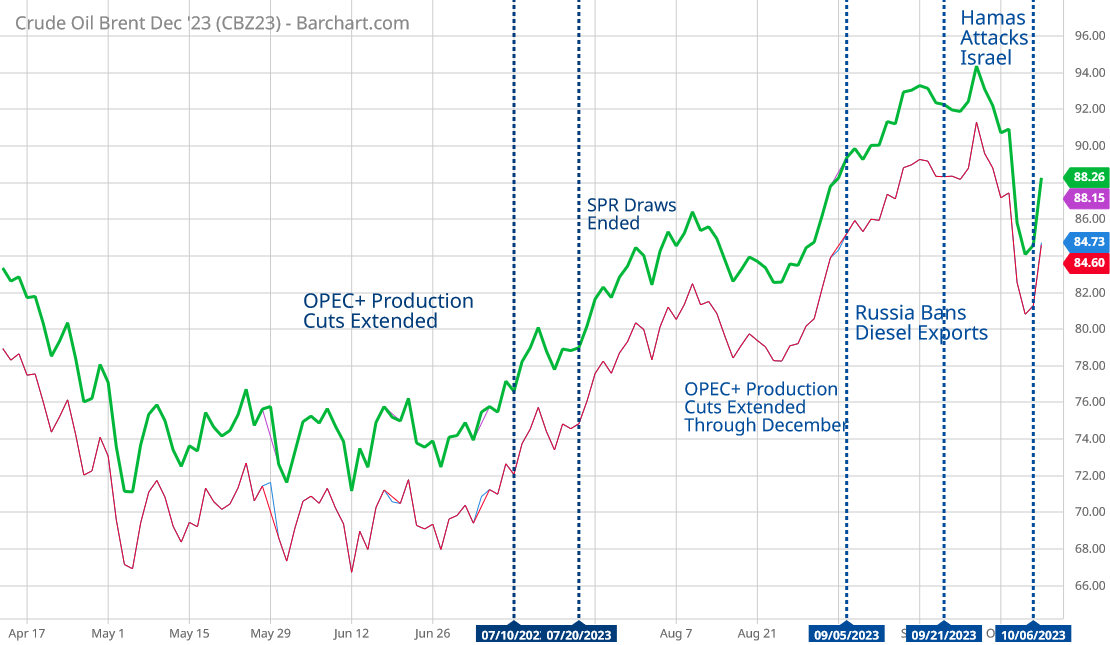

However, given the events roiling the Middle East since the weekend, today’s activity in oil trading is illuminating as to how markets are assessing the attack on Israel, as well as Israel’s ongoing response and retaliation against Hamas. Given that oil prices only last week dropped by more than $10/bbl, it is worth taking a moment to look at how oil markets behaved on the first trading day since the attacks began.

As anticipated, oil did surge in weekend trading, even flirting with $90/bbl late Sunday evening.

This surge is exactly what was to be expected, in the so-called “fear trade” which is an almost-reflexive response to major dislocations in the Middle East especially.

The ultimate question is, of course, is will oil prices go much lower?

Given Hamas’ massive attack on Israel over the weekend, the short term answer to that question is almost certainly “no”. Quite the contrary, over the next few days at least we are almost sure to see oil prices jump again.

“There is definitely going to be a fear trade put in place. While in the short term there is no impact directly on supply, it’s obvious how things play out over the next 24 to 48 hours could change that,” Phil Flynn, analyst at Price Futures Group in Chicago, told MarketWatch.

Movements in oil prices, meanwhile, will also serve as a gauge for broader market worries around the conflict, analysts said.

What is perhaps more significant, however, is the speed with which oil prices stabilized during the day. Oil prices are up more than $3/bbl, but that is still a major decline from last week.

Such is the apparent extent of the “fear trade” after one day’s trading.

What does this say about events unfolding in Israel and Gaza? Probably nothing more than is already known: events on the ground there are extremely serious and dangerous, but, unless some other event changes the state of affairs from where it is now, not catastrophic and not completely destabilizing to the Middle East as a whole.

Such an event could easily happen. Iran could get involved directly, as could the Middle Eastern countries. Hezbollah or Fatah might attempt attacks of their own—although Hezbollah earlier today was on the receiving end of an Israeli pre-emptive strike, which limits the probability of such a strike.

Barring such an additional event expanding the scope of the conflict, however, we appear to be seeing the economic ramifications of Hamas’ weekend attack on Israel. Those ramifications may be fairly summarized as “not much.” $100/bbl oil is still not a possibility any time soon. Oil supply has not been drastically altered. Oil production is not being drastically curtailed.

If oil prices are any guide, events in the Middle East are, perverse as it may seem, moderating from “apocalypse now” to “apocalypse maybe.” Hopefully that proves to be the case.

Why haven't the Powers that Be come after Substack yet?

https://billricejr.substack.com/p/what-i-learned-in-the-past-week?utm_source=profile&utm_medium=reader2

“apocalypse maybe” and that means maybe if we let them scam us.

If you read my article "False Flag" you know what I mean.