Despite the 11th-hour sale of First Republic Bank to JPMorgan Chase, despite the assurances of this generation’s version of J Pierpont Morgan, JPMorgan CEO Jaime Dimon, the media and Wall Street have still spent most of the last week having a case of the vapors over the burgeoning bank crisis.

Small regional banks, such as Los Angeles-based Pacific Western Bank (PacWest) and Phoenix-based Western Alliance Bank, have been at the forefront of Wall Street fears that First Republic is but one of many banking dominoes soon to fall.

On Wednesday, shares in PacWest plunged by as much as 60pc in after-hours trading, prompting the bank to announce that it was seeking salvation either through an emergency cash call, or, like its stricken rivals, in the arms of a bigger competitor.

The following morning, Western Alliance was forced to deny it was exploring a fire sale despite its share price plummeting 40pc at one stage. Zions Bancorp and Comerica were also under the microscope as investors continued their frantic efforts to work out where the weakest links in the financial system lie hidden.

As of the close of trading on Friday, no more banks appear to be on the verge of FDIC takeover. Has Wall Street once again calmed its nerves and returned to rational thinking? Or is the media still correct that more banks have yet to fail?

It is either a sign of a return to sanity or a deepening sense of panic that Reuters on Thursday reported that the American Bankers Association has asked SEC Chairman Gary Gensler to investigate presumably “questionable” stock short sales of the recently failed First Republic and Silicon Valley Bank, suggesting that their collapse may have been the result of a devious stock market ploy.

The American Bankers Association on Thursday urged federal regulators to investigate a spate of significant short sales of publicly traded banking equities that it said were "disconnected from the underlying financial realities."

In a letter to U.S. Securities and Exchange Commission Chair Gary Gensler, the lobby group said it had also observed "extensive social media engagement" about the health of various banks that was out of step with general industry conditions.

While such a request smacks of industry self-serving, at the same time it is difficult to dismiss the notion out of hand that stock trading strategies may have played a role here. We must not forget that banks are thus far largely saddled with low-yield securities being dragged down by interest rate risk in an environment of rising interest rates.

How solvent US banks are is not a question of how many loan defaults have they endured, or how many defaulted securities are they carrying on the books, but how much are the otherwise sound securities losing in value because they are yielding well below what the markets now offer. It is not an exaggeration to say that, but for the depositors pulling their money out of banks at an accelerated pace, there would be no banking crisis.

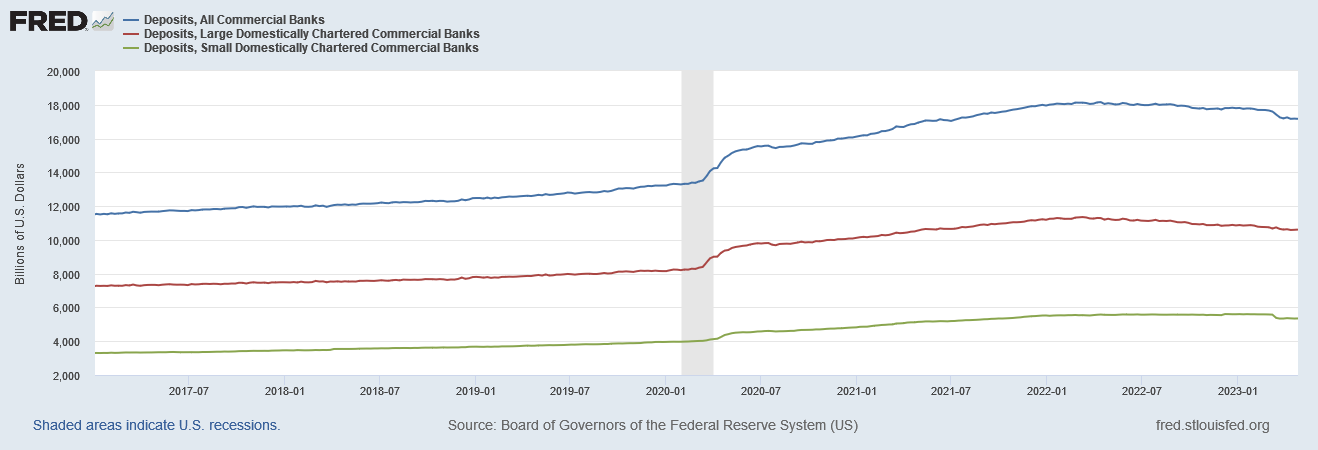

Still, banks are losing deposits, and are continuing to lose deposits. We see that every week in the latest bank data from the Federal Reserve.

We should also note that the bulk of the deposit flight has occurred among the country’s 25 largest banks—the ones classified by the Federal Reserve as “large domestically chartered banks.” This becomes immediately apparent if we index bank deposits to January 1st, 2022.

Large banks have shed more deposits, both in absolute dollar terms and as a relative percentage, than small banks. We should be wary, therefore, of anyone disseminating the notion that the country’s smaller banks are the source of this latest financial instability. Silicon Valley Bank was the nation’s 17th largest bank at the end of 2022. First Republic was the nation’s 15th largest.

This has very much been a “big bank” crisis. This has very much been a “big bank run” crisis.

One reason to be somewhat suspicious of the narrative is the odd fact that, despite the most significant bank failures, SVB and First Republic, being among the nation’s largest, in the immediate aftermath of Silicon Valley Bank’s collapse, while a staggering $192 Billion in deposits flowed out of smaller banks, $67 Billion of those deposits flowed into the remaining large banks.

Two large banks fail and small bank deposits get hammered. What could be suspicious about that?

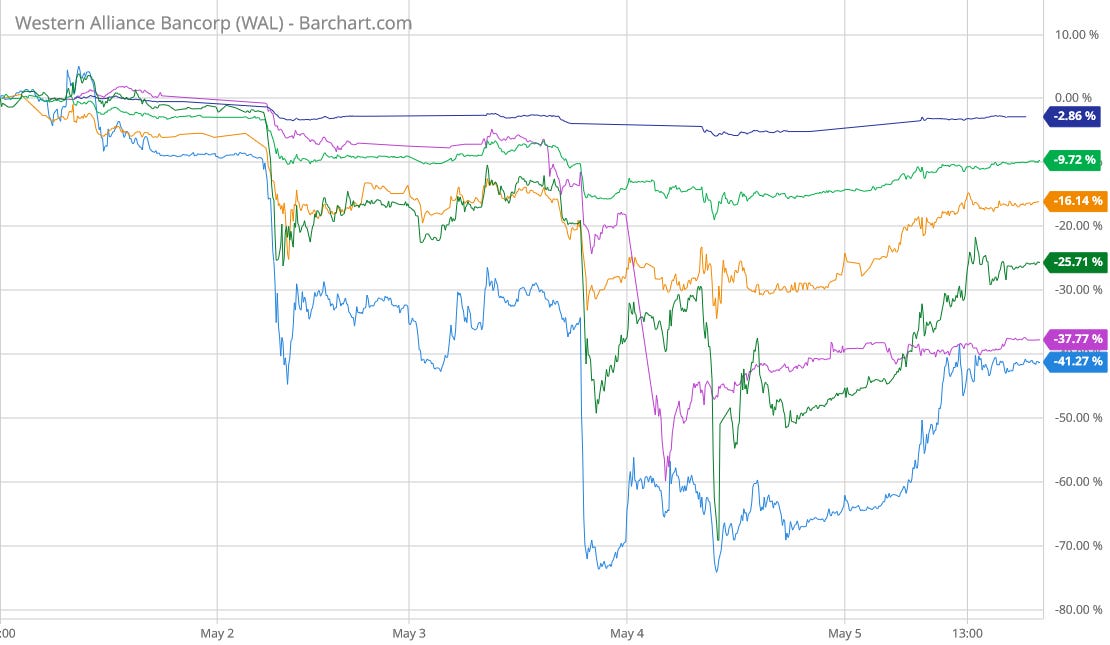

Similarly, if we look at the stock market performance of the presumably “shaky” small banks next in line for trouble, Western Alliance, Pacific Western, Zion’s, and First Horizon, we can certainly see Wall Street’s crisis of confidence in these institutions.

Yet we would be remiss not to note that the nation’s largest banks have also seen their share prices suffer lately—including this country’s banking Borg, JPMorgan Chase:

Bank of America, Citi, Wells Fargo, and PNC Bank have all had a fairly rough week.

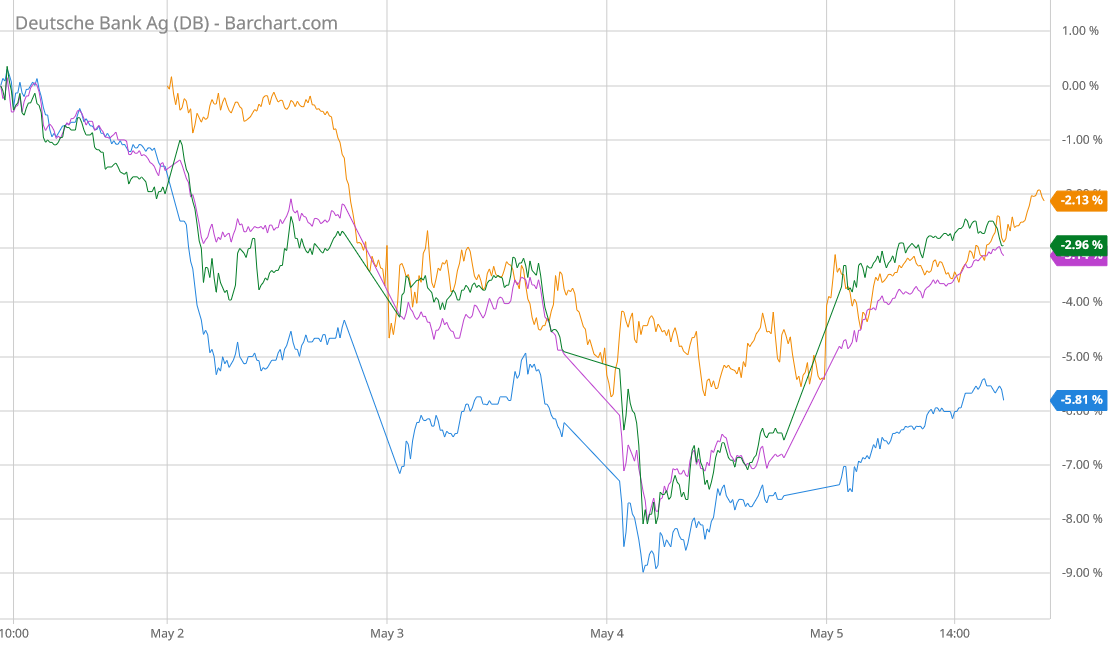

So, too, have European banks, such as Deutsche Bank, BNP Paribas, BBVA, and UBS

Deposit outflow, underwater securities, and loan books which may or may not be a problem when they mature over the next twelve months are an issue for all banks, regardless of size, and regardless of where they are located.

Which, then, of these banks will be the next to fall? Will it be a smaller bank such as PacWest (#60 in asset size at the end of last year) or Western Alliance (#44 in asset size)? Rumors abound that both are looking for buyers to bail them out.

Could PNC (#6 in asset size) be in trouble? Of the large domestic banks, it has had the worst ride over the past week.

Is Spanish bank BBVA headed for rough waters? It, too, had a wild ride down last week.

Much depends on what new wrinkle emerges within the banking sector. There is no shortage of pundits who argue that banks, and in particular the smaller regional banks, engaged in “reckless lending”, with the result that many are saddled with commercial real estate loans of questionable value.

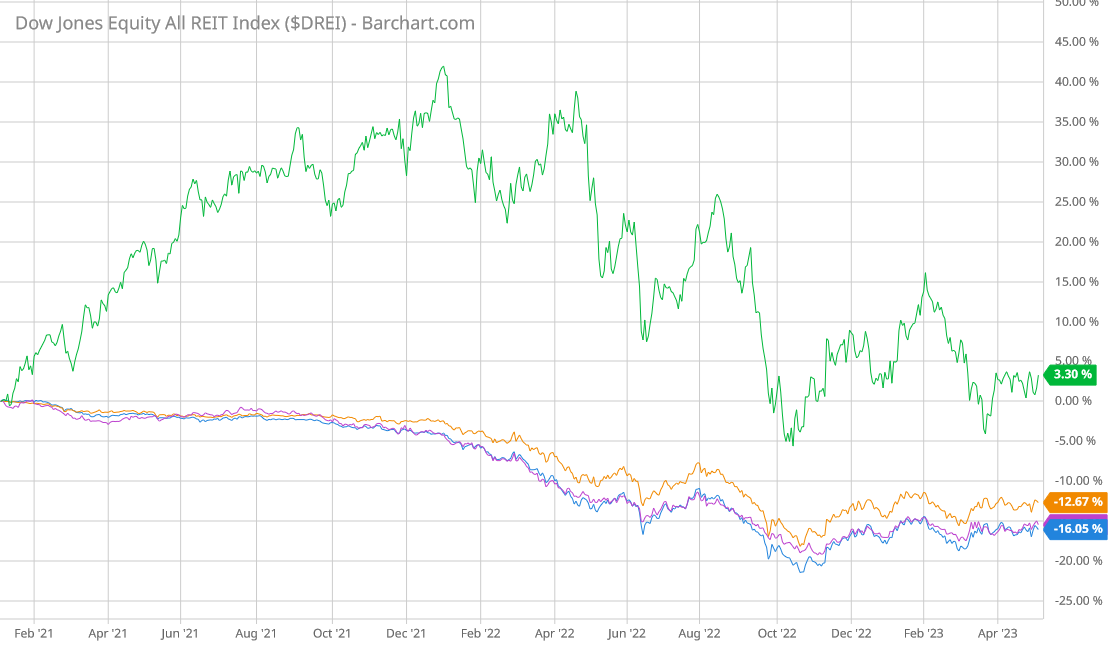

It is difficult to predict what may unfold here. Certainly small banks hold the vast majority of this country’s commercial real estate loans. Commercial real estate is an asset class that is definitely heading into a turbulent period, as COVID lockdowns and the resulting shifts to “work from home” situations have done much to reduce the value of commercial real estate—or so we are told.

The troubled institutions have something in common: Their assets are heavy in commercial real estate and loans to tech companies. Remote work that emptied office buildings during the pandemic has left some of the once most expensive office towers in cities such as San Francisco and Seattle in trouble. One, in the City by the Bay, is now being offered at a fire-sale price, suffering an 80% drop in value over the past four years.

While office vacancies are undoubtedly an issue, one market indicator of real estate valuations is the index of traded Real Estate Income Trusts (REITs), the Dow Jones Equity All REIT Index is up 3% year to date. Mortgage backed bond Exchange Traded Funds are down by roughly 11%-12%.

While these indices show that Wall Street does have concerns about the state of commercial real estate, predictions of a real estate crisis and collapse are, for now, simply that.

This much is certain: The Federal Reserve continues to push up interest rates as best it can, increasing the federal funds rate to 5.25% and all but guaranteeing that deposit flight will continue.

Likewise, banks with large securities portfolios, heavy on mortgage-backed securities and Treasuries, are going to be faced with dwindling market value of those portfolios, as rising interest rates sap the securities of their market value. Whether banks can avoid the rocky shoals of collapsing share price until the underwater securities can be resolved is itself a question.

The longer the deposit outflows continue, the greater the likelihood there will be more banks caught up in bank run and liquidity squeeze. The longer the deposit outflows continue, the greater the certainty that more than one bank will need to be closed and bailed out through the remainder of this year.

More banking dominoes will fall. We do not yet know for certain which banks those dominoes will be.

Good read!

I’ve got a case of the (economic) vapors so bad that I’m buying precious metals to stash under my bed.

There seems to be more of a ‘bailout’ mentality in government circles these days than there was a few decades ago. The banking authorities have been making noise recently about guaranteeing all deposits, even those above the FDIC limit of $250,000, and in spite of the moral hazard. Do you think they will?