Allianz chief economist Ludovic Subran is not at all optimistic about where financial markets are headed.

Investors should brace for months of market readjustments overshadowed by the threat of a new “financial accident,” according to Allianz chief economist Ludovic Subran.

“We have all the ingredients of a so-called Minsky moment,” he told Bloomberg Television on Monday, referring to economist Hyman Minsky’s description of a precipitous drop in asset prices after a build-up of debt. “You see that everywhere, these liquidity pools or liquidity crunches are starting to be visible.”

Is he right? Are financial markets about to come tumbling down like a pile of Jenga blocks?

What does the data say?

First, a brief description of the term “Minsky Moment"1 is in order. Such moments occur when financial markets reverse suddenly in the face of too much debt, too much speculation, and too little solid data.

Minsky Moment refers to the onset of a market collapse brought on by the reckless speculative activity that defines an unsustainable bullish period. Minsky Moment is named after economist Hyman Minsky and defines the point in time where the sudden decline in market sentiment inevitably leads to a market crash.

A principal cause of the market crash comes when a disorderly forced liquidation of assets occurs due to margin calls or some other sudden event.

The term refers to the end stage of a prolonged period of economic prosperity that has encouraged investors to take on excessive risk, to the point where lending exceeds what borrowers can pay off. At that point, Minsky wrote, there’s an increase in “speculative and Ponzi finance.” When a destabilizing event as simple as an increase in interest rates occurs, investors can be forced to sell assets to raise money to repay loans. That in turn sends markets into a spiral amid a demand for cash. There have been attempts to distinguish between a Minsky moment and a Minsky process that leads up to it.

Certainly there have been gathering signs of instability within financial markets. Just over a month ago I detailed the growing weaknesses within corporate real estate, and the exposures the banking industry had to outstanding low-yield real estate loans.

While corporate real estate valuations are falling, we should not overlook that the commercial real estate sector is distressed globally. We see this when we see that European Real Estate Investment Trust vehicles—as tracked by the Euronext Ieif REIT Europe Index—have declined in value more greatly than their US counterparts since 2020.

Looked at by sector, a number of tradable REIT sub-sectors have declined in market valuation as well, even as others have gained in market valuation.

With real estate valuations thus coming under increasing stress, this does not augur well for the billions of commercial real estate debt maturing this year.

With some $450 billion in commercial real estate loans maturing in 2023, these market forces present a powerful case for a rise in defaults on commercial real estate loans and mortgages.

There's nearly $450 billion in commercial real estate loans that are maturing in 2023, and about 60% of them are held by banks, according to a recent note from JPMorgan that cited data from Trepp.

Analysts at JPMorgan are projecting a substantial wave of CRE debt defaults beginning this year and extending through the next several years, as outstanding loans come due and are either paid off, successfully refinanced, or succumb to default.

"We expect about 21% of commercial mortgage backed securities outstanding office loans to default eventually, with a loss severity assumption of 41% and forward cumulative losses of 8.6%... Applying the 8.6% loss rate to office exposure, it would imply about $38 billion in losses for the banking sector," JPMorgan said.

JPMorgan’s estimate of commercial mortgage backed securities (CMBS) heading for default continues to pan out, as funds focused on these securities have lost between 11% and 12% of their value since the start of 2022.

More importantly, CMBS delinquencies have been slowly rising since last fall, when the delinquency rate was just under 3%.

The commercial mortgage-backed securities delinquency and special servicing rates both increased in November, according to Trepp LLC and DBRS Morningstar.

Trepp said the CMBS delinquency rate inched up three basis points during the month to 2.99%. “The increase in the delinquency rate was only the fourth in the last 29 months,” the firm’s latest CMBS Delinquency Report said.

Most property types showed improvement, Trepp reported. Only the multifamily sector saw an increase. “Without the multifamily blip, the overall delinquency rate would have been lower in November,” the report said.

Moreover, we should note that the fall increase was not merely fairly incremental at 3 basis points, but that it was also narrowly derived within the multifamily sector.

In April, the delinquency rate rose to just under 4%.

The delinquency rate was 16 basis points higher than the prior month’s rate of 3.77 percent. Increased distress in commercial real estate has deservedly dominated the March and April news cycles, and underlying data compiled by CRED iQ for April underpinned continued commentary on industry distress.

Additionally, the office sector space has become a visible driver of the CMBS delinquency and distress rates. For reasons detailed previously, commercial real estate is heading into some very rough times.

While interest rate risk continues to be the main factor in CMBS’ loss of market value, default risk is becoming increasingly significant.

Intriguingly, while CMBS defaults are on the rise, bank loan default rates for commercial real estate have not been—so far.

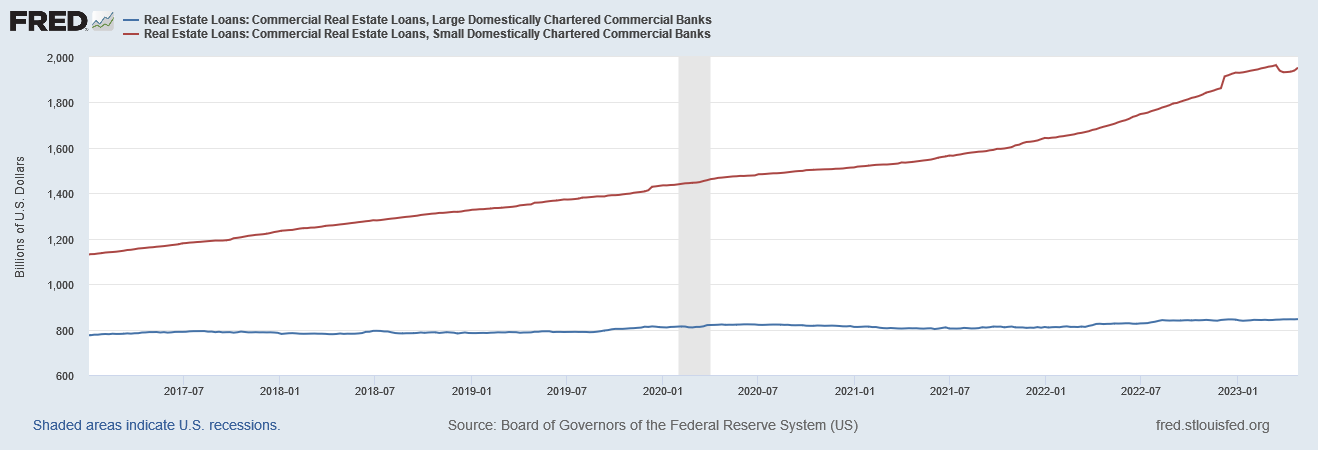

This could prove significant for banking stability, for commercial real estate loans are heavily concentrated among smaller regional banks in the US.

However, CMBS assets are a favored investment by larger banks, which hold a larger portion of their total assets as CMBS products.

Thus large banks are getting ever closer to providing an object lesson in mismanaged systemic risk. While large banks appear to be gathering a larger share of underwater securities, they are also losing the larger share of bank deposits.

Smaller banks, on the other hand, are showing proportionally less deposit flight (although this is a concern for them as well), and their commercial real estate exposures are somewhat lagging the rising delinquencies among CMBS issuances. While the deterioration among CMBS issuances intrinsically implies a rising default risk on commercial real estate loans for the smaller banks in the US, they may enjoy a bit more time before it greatly impacts the asset side of their balance sheets.

With deposit flight on the one hand, and what could easily become a perfect storm of interest rate risk and credit default risk on the other, the larger banks within the global financial system are becoming increasingly likely candidates for a bank run and then collapse. With the larger banks overall at greater risk, and at increasing risk, the potential for an outsized market reaction is also rising. If large banks are among the next dominoes to fall, the potential for there to be a true “Minsky Moment” in financial markets more broadly grows almost exponentially.

Moreover, if the larger banks are caught up in the metastasizing bank crisis, the potential for contagion increases as well—there is little chance with large bank failures of the crisis not impacting banking on a global scale (there is a reason the largest banks are categorized as “global systemically important”).

Until it happens, there really is no way to know for certain which banking domino will be the next to fall, only that there will be a next banking domino to fall.

We really cannot say with certainty whether that next domino will be in Europe or in the United States.

We can say that, with both the ECB and the Federal Reserve having raised their core interest rates lately, both Europe and the US have dominoes ready to fall.

While the media has portrayed the banking crisis as one localized to US regional banks, the vulnerabilities which have driven the bank failures to date are truly systemic and affect virtually all banks. In both the United States and Europe, banks are under duress, and do not have either the liquidity or the capital to deal with deposit flight while facing growing losses from deteriorating loans and securities portfolios.

As we saw with both Silicon Valley Bank and First Republic Bank, when the final crisis comes it will unfold literally in a matter of days or weeks. Which means the banking sector both here in the US and in Europe could erupt into fresh crisis overnight.

With banks in Europe as well as the US under duress, with one major European institution already having failed in Credit Suisse, and with growing exposure to distressed commercial real estate markets, the odds of a true “Minsky Moment” are real, are significant, and are rising.

Ganti, A. “What Is a Minsky Moment? Definition, Causes, History, and Examples”, Investopedia. 27 July 2022, https://www.investopedia.com/terms/m/minskymoment.asp.

I think your analysis is brilliantly sound and, as always, you have the data to support it. But Biden is running out of time before his party’s convention, and he is by no means certain to receive the Presidential nomination. He’s going to have to hide, obscure, deny to high Heaven that anything is wrong with the economy. I’m wondering how successful his handlers are going to be at this, and if some investors are going to be caught unaware because of this attempt to gloss over every ominous signal in the economy. The Covid era has shown us that we certainly cannot rely on the main stream media to give us objective facts. What do you think - to what extent are normal market signals going to be disrupted and misinterpreted by political maneuvers in the next few months?