Big Bank Boom? Or Bust?

Second Quarter Results Show The Big Banks Doing Well...But For How Long

There are reasons it is hard to take Wall Street seriously. There are reasons it is hard to take the Federal Reserve seriously.

Sadly, a good many of those reasons are found on Wall Street financial statements. As per usual, the numbers tell a great many things over and above the message Wall Street hopes you’ll hear.

Case in point: In May JP Morgan took over “failed” First Republic Bank, and immediately earned, by their own accounting, billions from the deal.

PMorgan’s second-quarter profits rose by 67% as the nation’s largest bank made more loans to customers, took advantage of higher interest rates, and got a boost from its recent acquisition of First Republic Bank.

As I observed when the announcement was made, deals of this sort don’t usually become accretive to earnings immediately.

Apparently, the second quarter has been very kind to the Big Banks!

A 67% net income growth year on year is an astounding accomplishment for any business, bank or otherwise. However, when that 67% growth takes place during a quarter when there is a major acquisition being made, that level of growth becomes even more remarkable.

As readers may recall, First Republic Bank, after languishing in a bank run hell for nearly two months after the Silicon Valley Bank collapse, was seized by the FDIC who immediately sold the juicy parts of the bank’s carcass to JPMorgan.

Some important highlights of the transaction that were disclosed at the time:

JPMorgan paid the FDIC $10.6 Billion to buy First Republic’s assets.

JPMorgan managed to structure the deal to show a $2.6 Billion gain on the transaction. It’s quite a remarkable deal maker who can buy a bank and post a profit on the transaction itself.

JPMorgan projected it would spend $2 Billion to fold First Republic into JPM operations.

The FDIC remained on the hook for about 80% of mortgages held by First Republic.

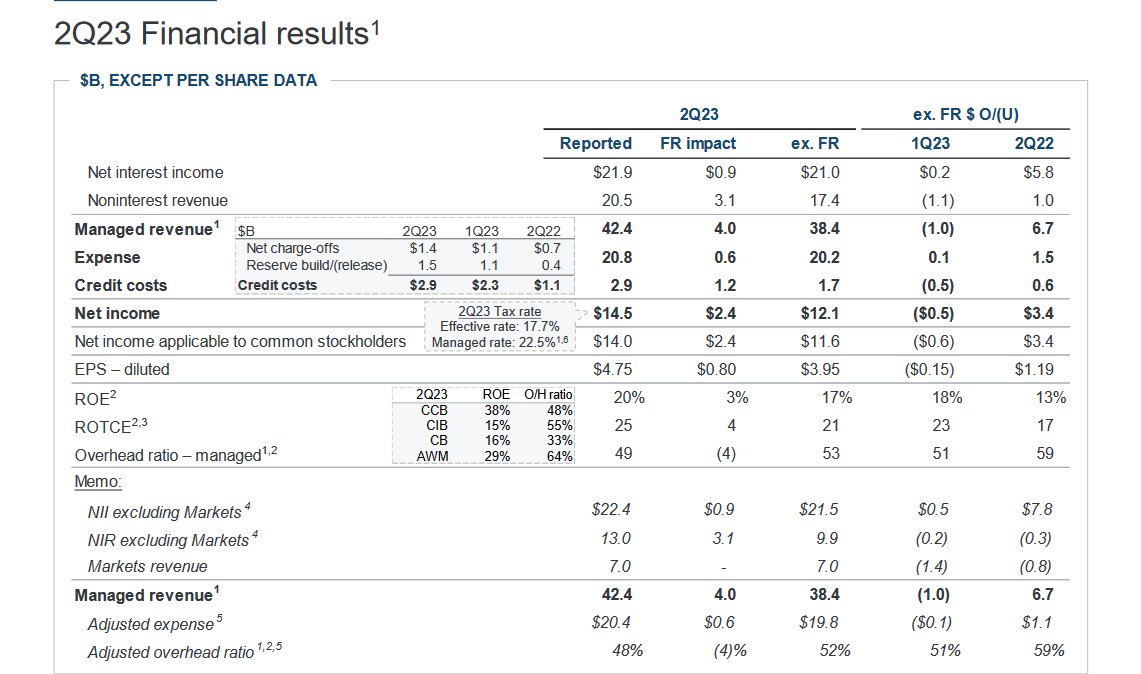

Even by the terms disclosed at the time of the deal, JPM got a sweetheart deal for the assets of First Republic Bank. When we look at their slide deck for their investor presentation on their 2Q earnings, however, we see that the deal was quite a bit sweeter than that.

Even before JPMorgan has had a chance to “restructure” First Republic—a $2 Billion, 18-month process, or so we were told—First Republic managed to contribute $2.4 Billion to JPMorgan’s bottom line. First Republic’s assets also generated 3% of JPMorgan’s return on investment.

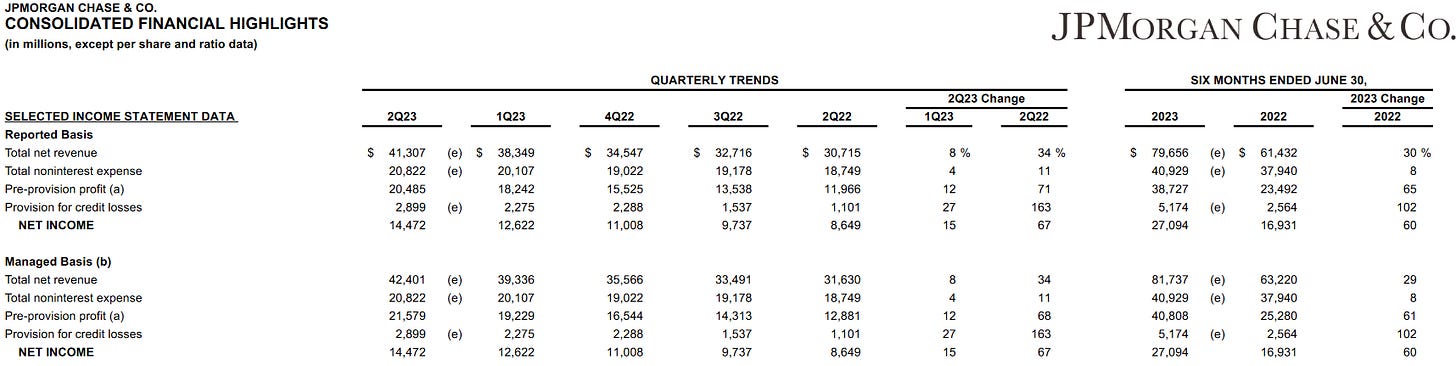

In fact, but for the First Republic Bank acquisition’s contribution to the bottom line, JPMorgan’s net income for the second quarter would actually have declined by about $0.5 Billion from the first quarter of 2023. Not only does their slide deck confirm this, but it is the plain implication of the math when comparing their first and second quarter results directly:

$14,472 Million in 2Q 2023 net income (with First Republic) is only $1.9 Billion more than the $12,622 Million from 1Q 2023 (without First Republic).

JPMorgan would have seen net income decrease by $0.5 Billion but for First Republic? Exactly who bailed out whom?

Certainly there are some indications that JPMorgan might be anticipating some trouble in the near future, not the least of which is a dramatic increase in loan loss reserves.

During the second quarter, JPMorgan increased its provisions for credit losses by $624 Million. That is compared to a $13 million decrease during the first quarter, and the largest provision for credit losses since the fourth quarter of 2022, which had a provision made of $751 Million.

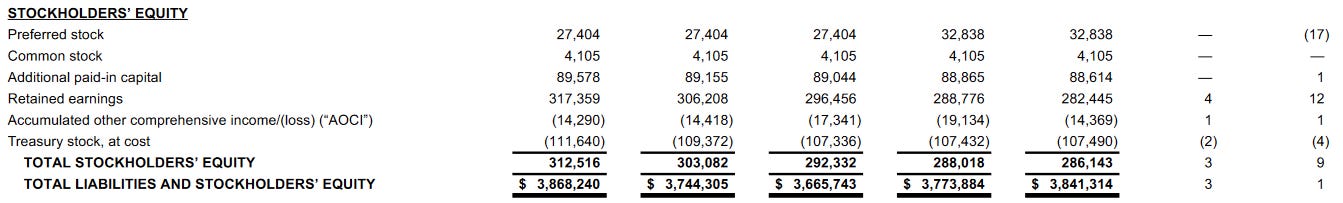

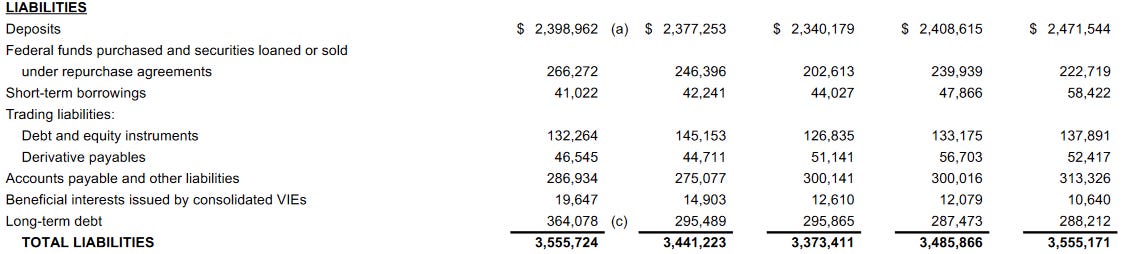

However, not every part of JPMorgan’s posted results are negative. Unlike SVB and even First Republic, JPMorgan appears to have made headway in unloading toxic portfolios of securities, based on their “Accumulated Other Comprehensive Income/(Loss)”.

With an accumulated loss of -$14290 Million, vs an accumulated loss at the end of 2Q 2022 of -$14390 Million, JPMorgan has managed to resolve some $100 million of loss at the end of the quarter.

Further bolstering their financial results is the fact that JPMorgan managed to staunch the outflow of deposits by the fourth quarter of 2022.

It’s short term (FHLB?) borrowing has also been getting reduced in recent quarters.

It would appear that JPMorgan is anticipating some rough waters ahead with regards to outstanding loans, which does not bode well for the overall economy, but at the moment they appear to be ahead of the curve in booking loan loss reserves to address loan defaults as they happen.

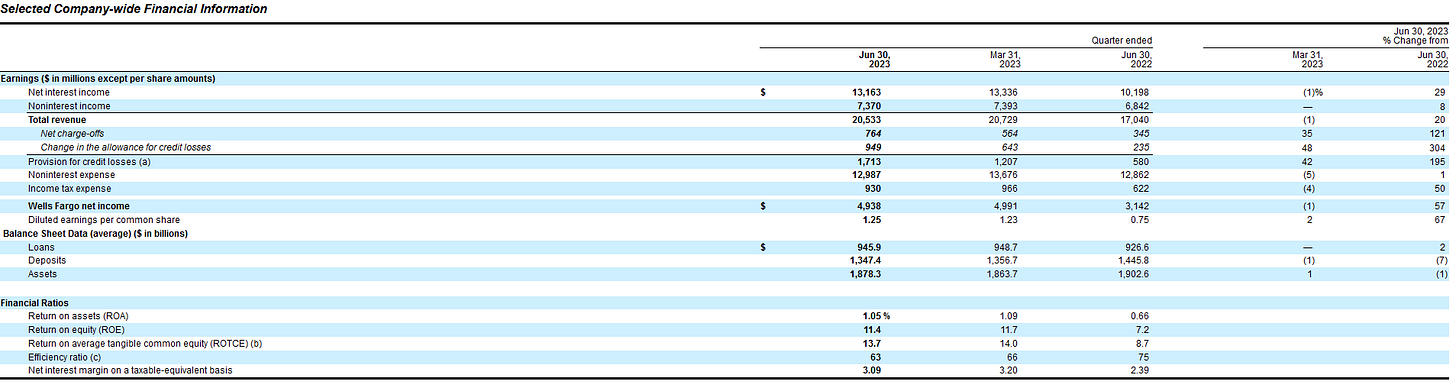

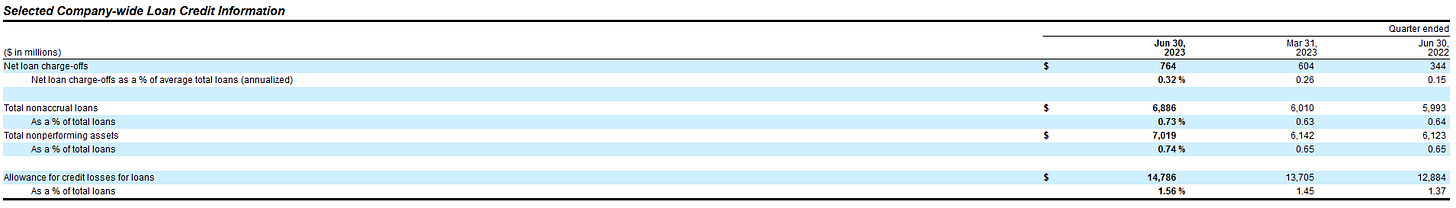

JPMorgan is not the only bank starting to batten down the loan hatches. Wells Fargo, which also announced its second quarter results, has also made substantial provisions for credit losses during the second quarter.

Wells Fargo’s total provision for credit losses during the second quarter included a $949 Million increase in the allowance for credit losses (which they attribute mainly to problematic commercial real estate loans), a $300 million increase over the first quarter allowance, as well as $764 Million worth of charge-offs—loans which Wells Fargo has decided were uncollectible.

Let those numbers sink in for a moment: Wells Fargo had over three quarters of a billion dollars worth of loans they wrote off just in the second quarter alone. While anticipating almost another billion worth of bad loans yet to be written off.

Wells Fargo is a big “systemically important” bank—which is to say it’s positively ginormous. $1.7 Billion in bad loans for a single quarter still sounds like a big number. It certainly does not reflect well on the health of the banking and finance industries themselves.

While Wells Fargo is at least working on establishing its buffers for bad loans and other debt write-offs, the other hard truth about its loan book is that there still considerable bad loans yet to be resolved.

$6.8 Billion of its loans are in a “nonaccrual” state (generally that means no payments received in the last 90 days). $7 Billion of its assets are in a “nonperforming” state. While these numbers only represent less than 0.75% of total loans and assets, these are still not small numbers overall, and stand as grim testament to the actual health of the banking and finance industries.

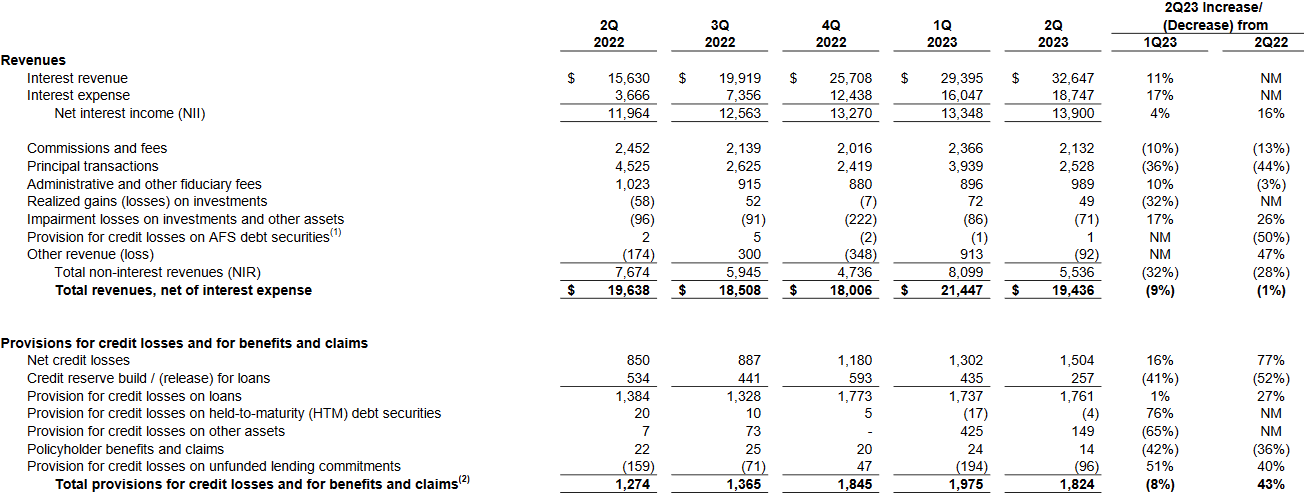

Citi has likewise been taking significant loan write-offs of late. In the second quarter alone, it incurred net credit losses (loan writeoffs) of $1.5 Billion.

Intriguingly, Citi only added $257 Million to its allowance to its credit reserves during the second quarter, although its net credit losses and provisions for credit losses on the quarter amounted to $1.8 Billion.

Again, while these potentially toxic debts are not particularly large relative to Citi’s overall loan book, we are still looking at a significant increase in debt default just in the second quarter, and just in these three banks. What will the second quarter results from the more than 20 other “large” banks in the US show about loan delinquency?

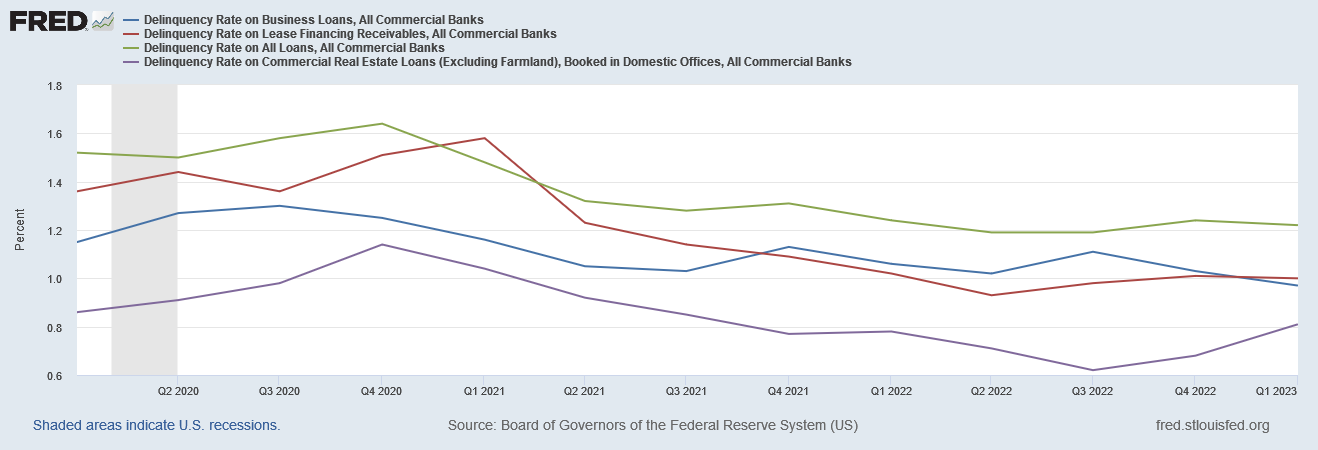

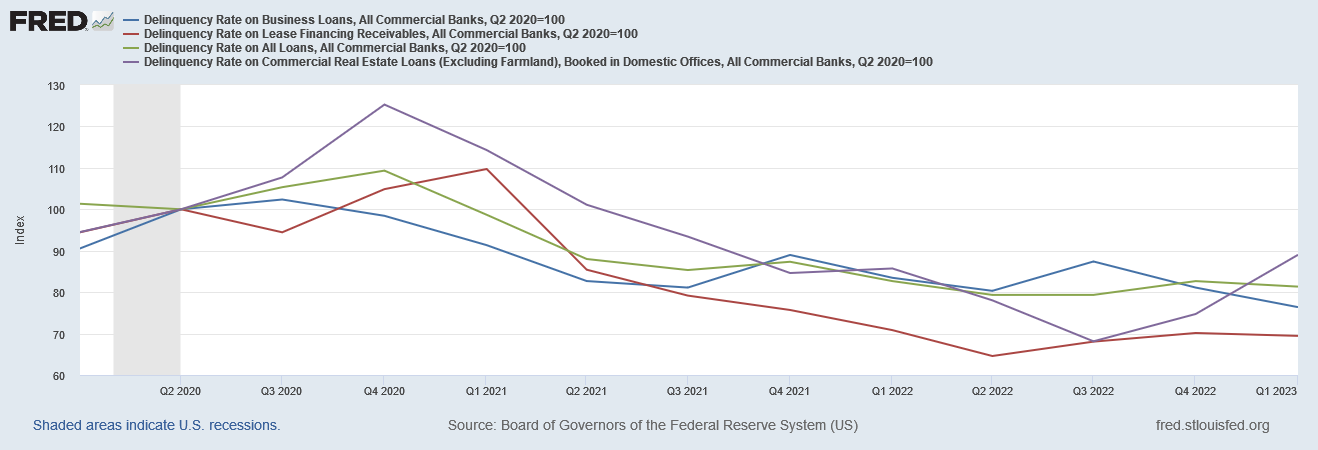

At least as of the first quarter of the year, business loan delinquencies are largely in decline.

The one area of concern that we do see in business loan delinquencies through the first quarter is in commercial real estate, where there has been a decided uptick beginning in the fourth quarter of last year.

If we index the loan delinquencies to the end of the 2020 recession, we see that commercial real estate loans are turning toxic far more rapidly than most other forms of commercial loans.

However, even with the recent increase in such delinquencies the delinquency rates are still well below 2020 levels, and well below even pre-pandemic levels.

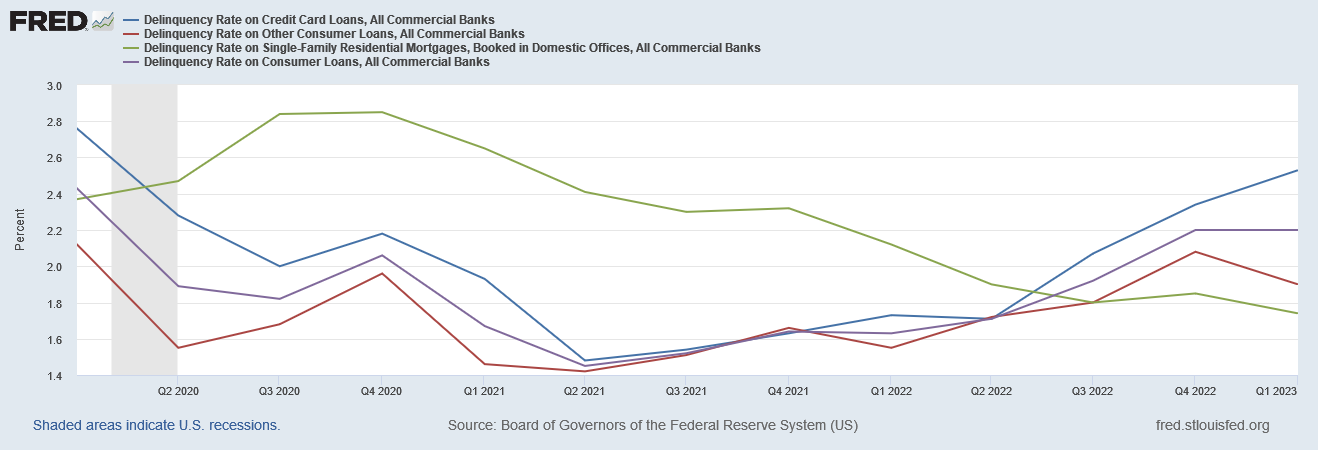

The delinquency rates on consumer loans, however, are not quite as rosy a picture.

With the exception of mortgage delinquencies, which are still declining, consumer loan delinquencies have all increased since 2021, and credit card debt is leading the way.

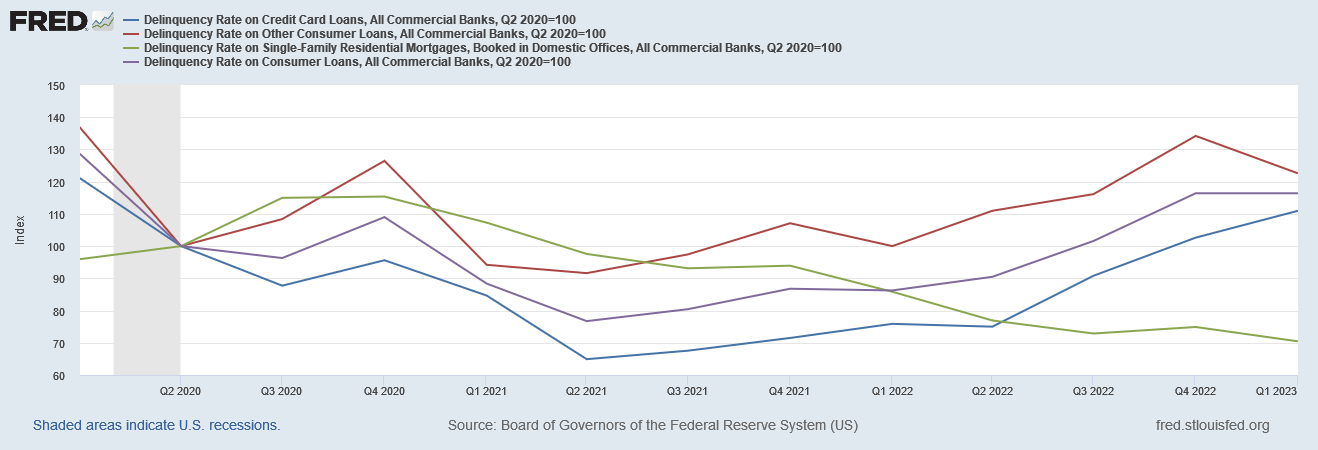

If we index consumer loan delinquencies to the end of the 2020 recession, we see that “other consumer loans” (usually car loans) have seen the most dramatic rise in recent quarters.

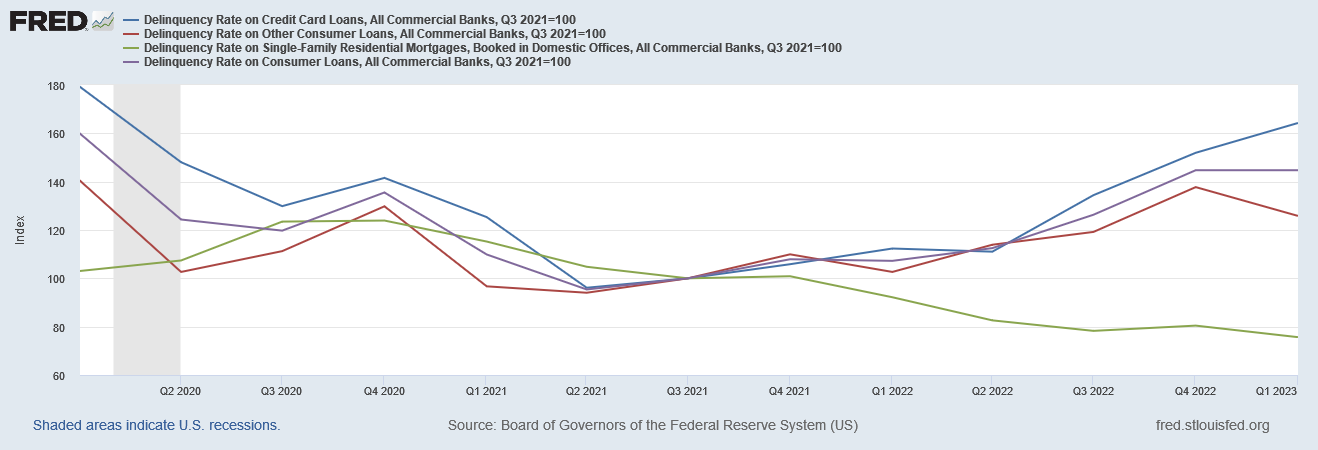

This is quite probably an artifact of consumers using their initial stimulus checks to pay off their credit cards in 2020 and 2021. If we index to the start of the third quarter in 2021, credit card debt is still the big delinquency gorilla in the room.

Between consumer and commercial loans of all types, however, there is a definite increasing trend towards delinquency. More loans are going bad.

Not only are we seeing this in the aggregate data from the FDIC, but we are seeing confirmations of this trend in the loan defaults and loan default provisions in the second quarter financials of JPMorgan, Wells Fargo, and Citi.

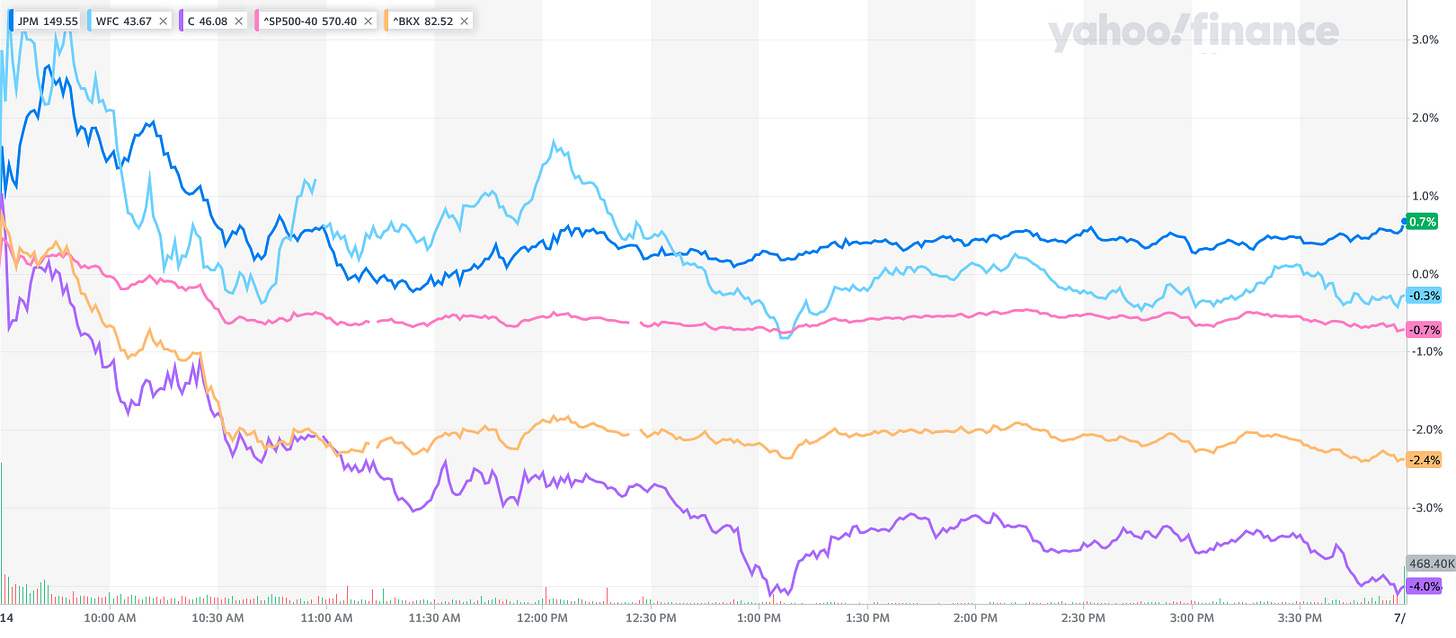

Wall Street apparently senses the same thing. Despite reporting stellar net income results for the second quarter, JPMorgan did not receive even an initial bump from their results. Wells Fargo actually saw its share price decline, and Citi took a substantial 4% hit.

With the broader banking indices also taking a substantial hit on Friday’s trading, it would appear that Wall Street recognizes that banks are going to be writing off more loans in the near future.

With the Federal Reserve likely committed to the reckless and heedless path of needless federal funds rate hikes, these increases in loan delinquencies beg the question of whether the stage is being set for a resurgence of the serial banking crises we witness this past spring. With an increasing proportion of bank loan books turning toxic, and the likely further decline in their securities portfolios as a result of more Fed rate hikes, are we seeing the seeds of yet more liquidity problems?

Even more disconcerting is the reality that these warning signs are showing up among the nation’s largest banks. The biggest sources of instability appear to be happening among the “systemically important” institutions, not the smaller regional lenders out there.

If the biggest banks are the ones most likely to have the biggest problems, are these boom times for banks, or the prelude to their going bust?

Somehow, I don’t think I’m going to like the answer to that question.

FYI - I am a turnaround specialist, which means I bring companies (approx $20-$500 MM Gross Sales Annually) back to life, reorg them, pull them out of Forebearance & Special Assets with the Banks, and then double them in size and sell them to Private Equity for 5X EBITDA...that background was to let you know that the banks have not called me nor referred any of their troubled clients to me in a couple of years now, (whereas they used to beg me to get their loans paid back!) and I have had to go seek out people who are being manipulated by Predatory Lending Practices, forced to pay hundreds of thousands of extra $ for CFO/CPA's to audit their books while paying 18% on their agreed to 4 to 7% LOC rate, trying to get them to shut down, and for some strange reason, all of the owners being targeted are conservatives...so, when the Fed says anything, even presents data on inflation, I have a hard time believing anything from them, as I have seen so many lies, even on the stand under oath by them...carry on!

I would say brace for impact. 😐🤦♀️

Is there anything particular that happens in the banking sector in October? Im picking up lots of noise in various industries that seem to be pointing to something big happening by October.