China Tells IMF One Thing, China's Economic Data Says Something Quite Different

Premier Li Keqiang Denies Signs Of Economic Collapse In The Middle Kingdom

China’s Premier Li Keqiang wants the IMF to believe that the Chinese economy is rebounding and growing thanks to Beijing’s prompt and proactive measures put in place at the first sign of economic distress earlier this year.

With key economic indicators declining significantly earlier this year, China was quick to put in place a policy package to stabilise the economy and implement follow-up measures, Li said as he briefed [IMF managing director Kristalina] Georgieva on the situation in his country.

The moves were able to “reverse the downward trend in time”, with the economy showing a steady upwards trend at present, he added.

There is one slight problem with this narrative: China’s economic data tells a vastly different—and much grimmer—tale.

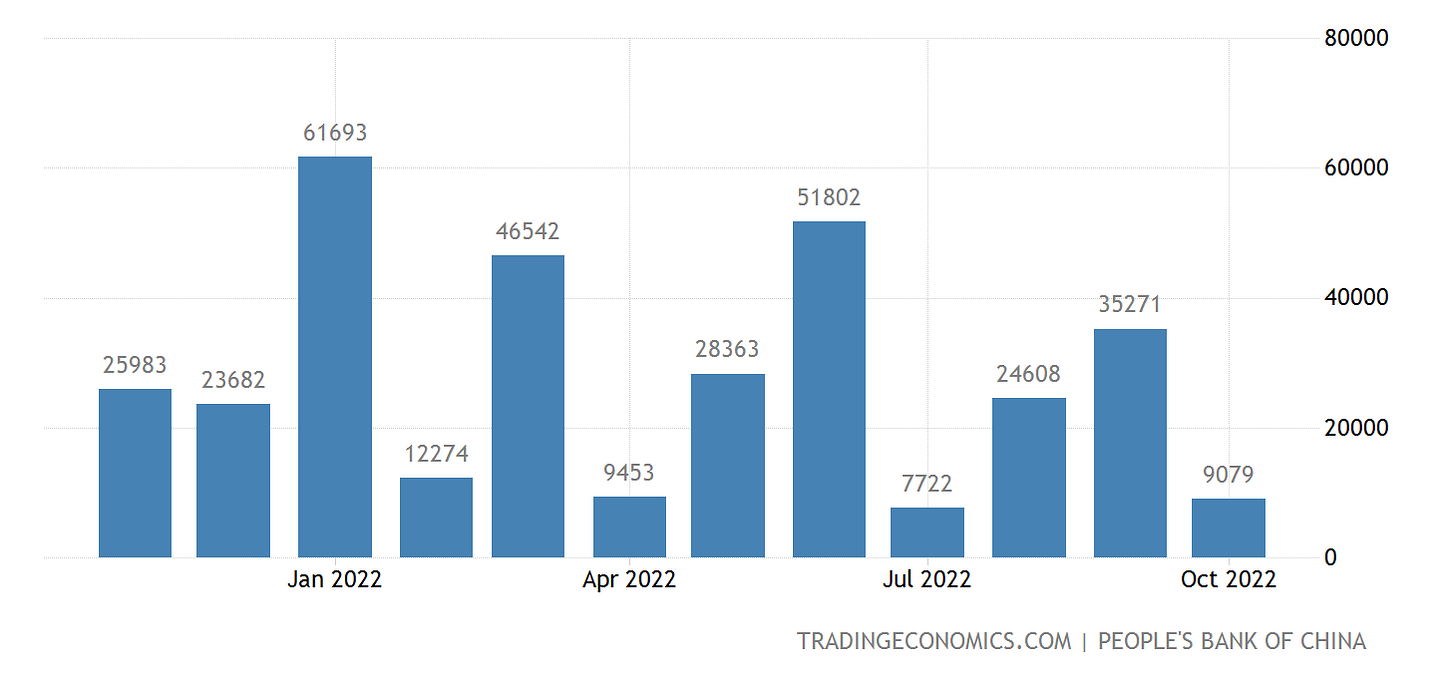

Loan Demand Is Collapsing

An immediate red flag pointing to China’s economic distress is the collapse of loan demand. Total social financing—China’s metric of overall credit and liquidity—collapsed from 3.53 trillion yuan in September to 0.91 trillion yuan in October.

Not only is that a 75% reduction in a single month, it is just under 57% of the consensus forecast for October of 1.6 trillion yuan.

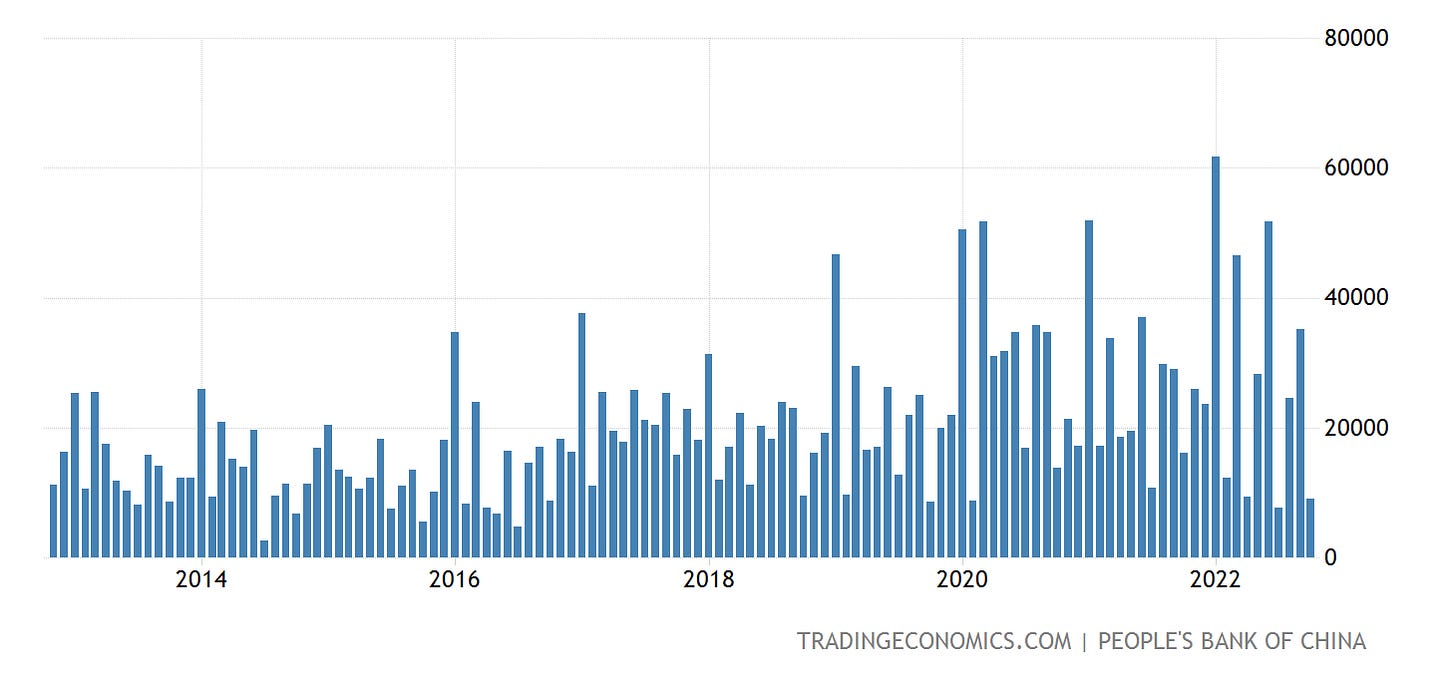

Additionally, it is a continuation of a pattern going back to the beginning of the year of a stimulus-driven surge in financing in one month, followed by a collapse in financing thereafter. However, outside the transitory spikes in financing, the overall trend is still downward.

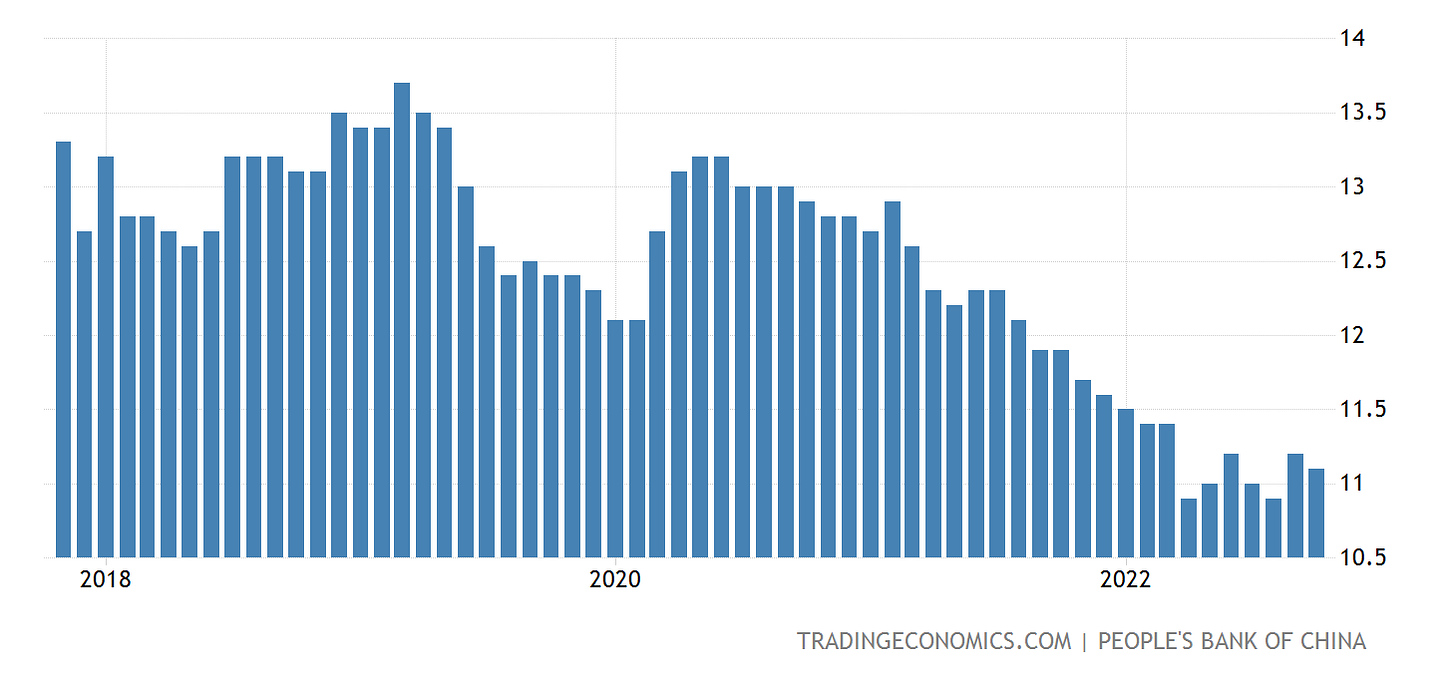

Even in the narrower metric of outstanding bank loans, China is seeing contraction, not expansion. Bank loan growth also came in below consensus at 11.1%, rather than the forecast 11.2%.

While a less dramatic decline month on month than total social financing, it is part of a larger and longer-term decline in loan activity in China.

Just as is the case here in the US, shrinking loan activity is a sign of economic contraction, not economic expansion.

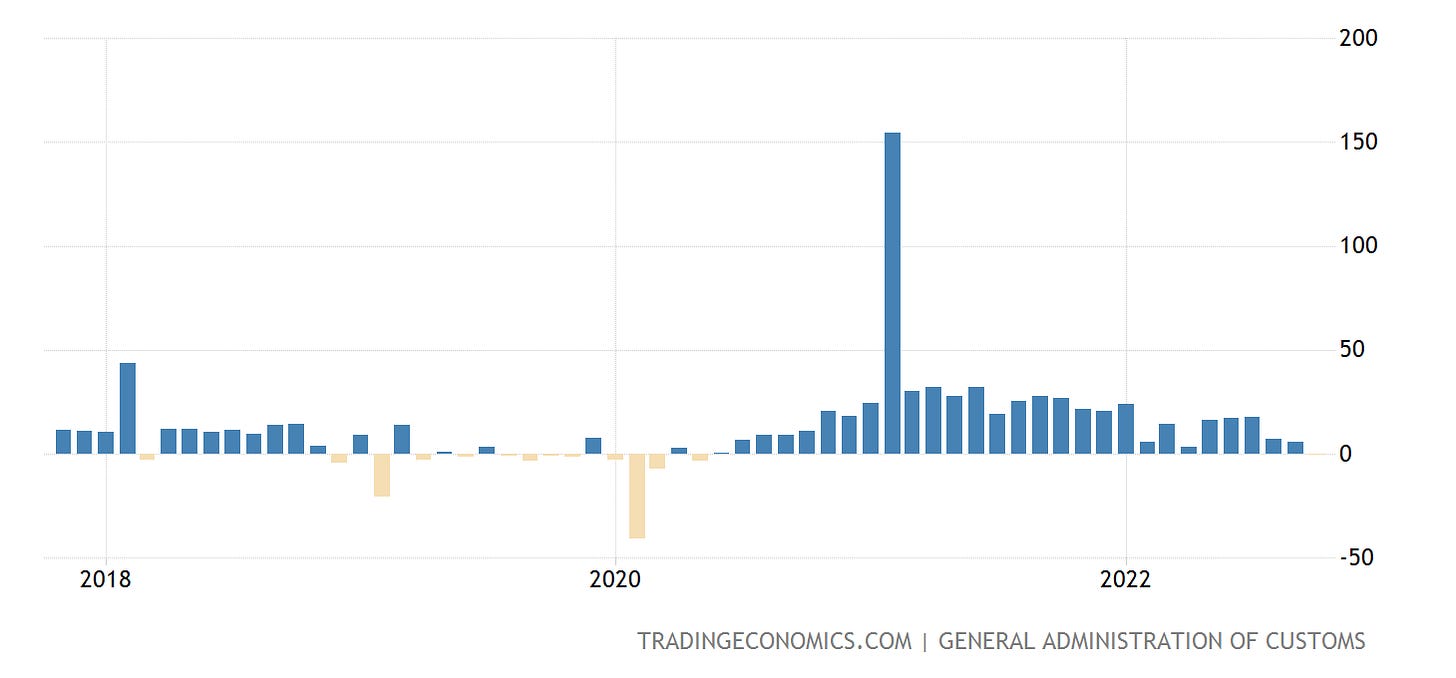

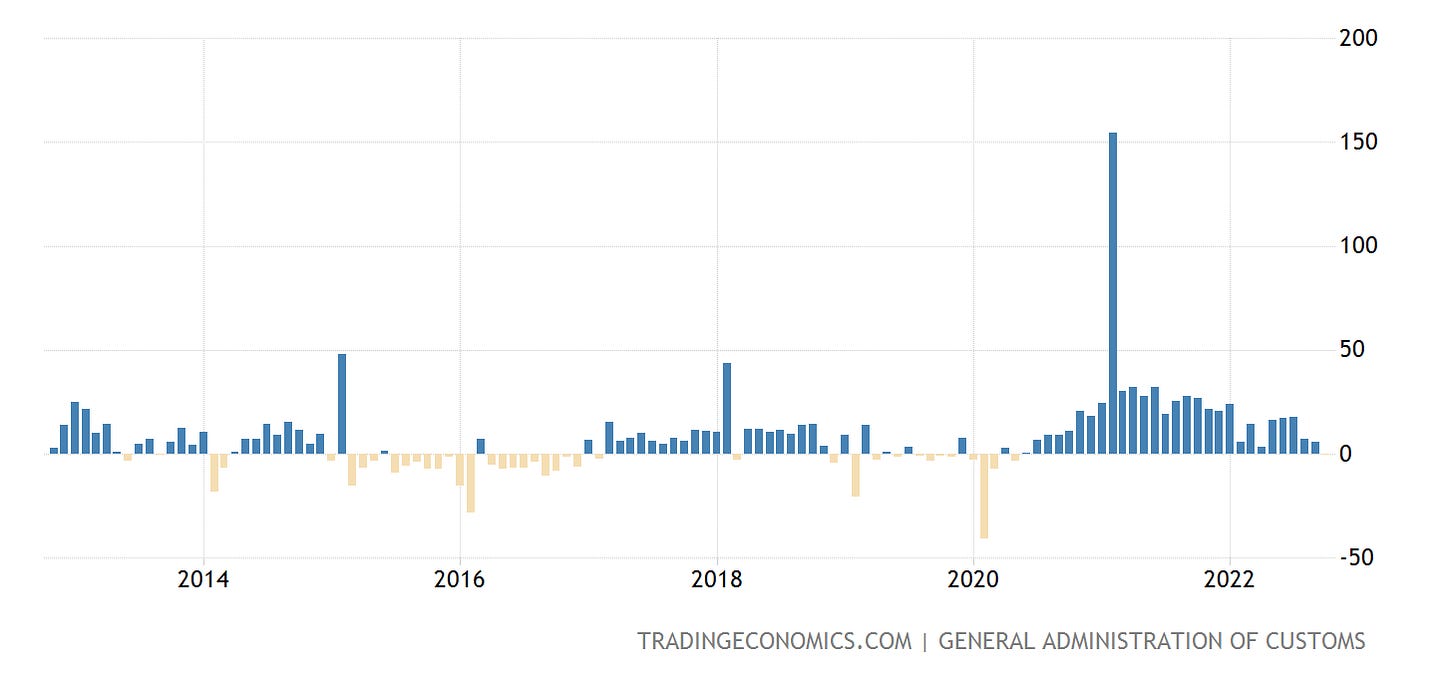

Exports Shrank In October

Another red flag of China’s economic woes is the loss of export volume. After China watchers had a consensus forecast of 4.5% growth in exports in October, export volumes actually declined 0.3% year on year.

The outright decline is a continuation of a longer downward trend in export growth in China, following an early 2021 surge as the global economy begain attempting to emerge from the 2020 lunatic lockdowns. However, the ongoing global economic contraction is also moving China’s export volume needle, but in the opposite direction.

China’s trade has supported its economy throughout the pandemic. Its exports rocketed in 2020 and 2021 as global markets shifted to buying goods rather than services.

But the latest data highlight the country’s exposure to a global slowdown as other big economies raise interest rates to tackle higher inflation. Unlike China, most countries have largely removed Covid restrictions.

Declining Chinese exports add to pessimism about the world economy as leaders of the world’s 20 most advanced countries (G-20) prepare for a meeting in Indonesia next week.

Even before the pandemic, export volume in China was showing significant decay for several years, indicating that China’s economic engine of exports has been sputtering and dying for quite some time.

A post-pandemic surge is proving to have been little more than a sugar rush, and China is returning to the long term trend of stagnation and decline in exports.

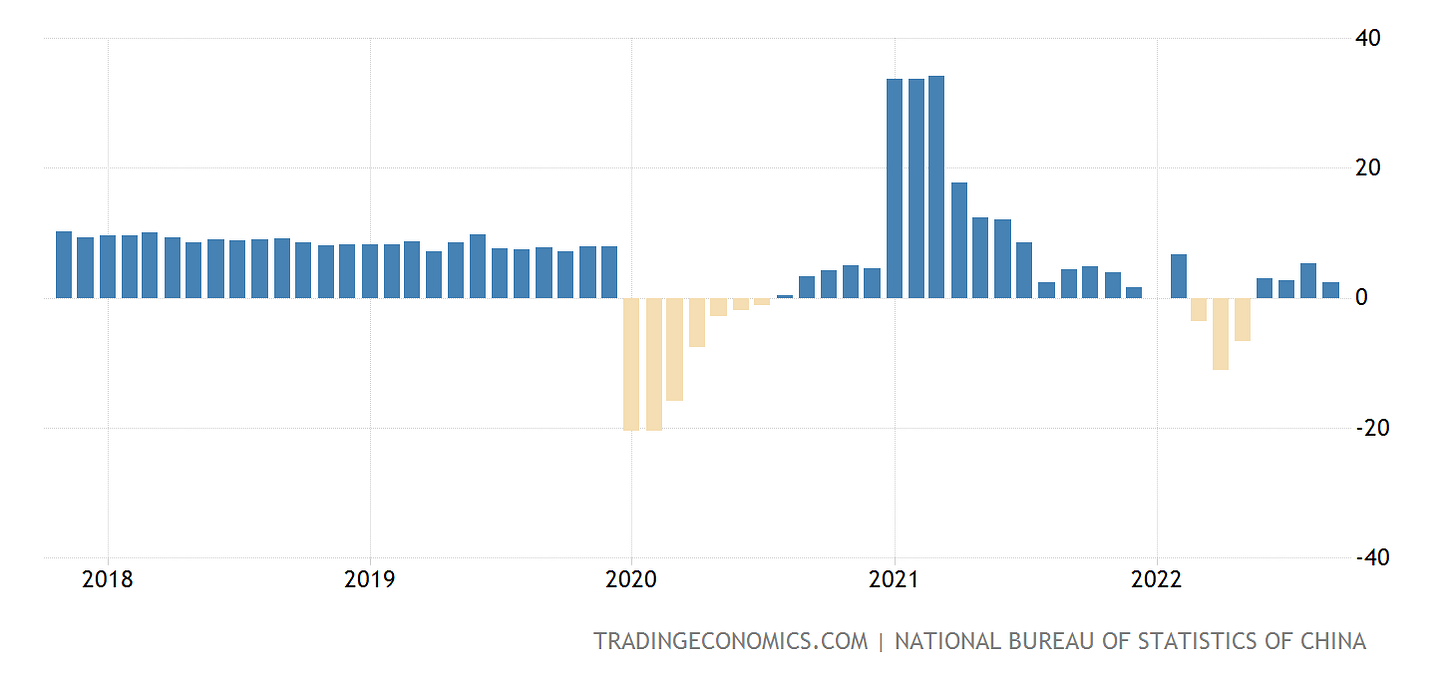

Diminishing Retail Sales Growth In October

Not only did China export less in October, it sold less than expected domestically as well. Retail sales, projected to have grown 3.3% year on year in October, only managed 2.5% year on year growth.

Not only is this a continuation of a downward trend from the brief surge in retail growth in early 2021—again, the sugar rush of post-pandemic resumption in economic activity—but it is significantly below pre-pandemic trends, indicating that China’s efforts to build up internal consumption as a replacement for declining exports are achieving less and less success.

Without exports and without domestic consumption, there can be no economic growth.

Pressure For More Stimulus, But Would More Stimulus Even Work?

As Li Keqiang accurately relayed to the IMF, China has gone against the global trend and deployed both fiscal and monetary stimulus to shore up its economy.

Despite those efforts, October was still a grim month, with red flags across the whole of the Chinese economy.

Signs of weakness are emerging from across the economy: exports fell; inflation slowed; new bank lending tumbled. And all despite the authorities bucking the global trend so far this year and deploying monetary and fiscal easing this year.

Major global investment banks are anticipating further monetary stimulus from the PBOC very soon, although October’s data not only makes a case for stimulus, it also suggests that monetary stimulus will have marginal impact at best.

But the latest figures also suggest that the stimulus would not have the desired impact as long as domestic and external demand remain subdued, especially as China pursues a policy of eradicating COVID-19 outbreaks as soon as they occur.

"Much weaker than expected credit growth ... underlines the difficulties policymakers are facing stimulating growth while activity is suppressed by zero-COVID," said Mark Williams, chief Asia Economist at Capital Economics

Once again, China’s efforts to goose its economy are nullified at the outset by Zero COVID lockdowns.

No more than the rest of the world, China simply cannot have both draconian and dysfunctional Zero COVID lockdowns and economic growth (nor even stimulus measures to promote economic growth). Lockdowns and economic growth are and forever will be mutually exclusive.

China’s Economy Is NOT Expanding

To be blunt, Premier Li Keqiang’s message of an healthy Chinese economy is pure propaganda. It is a lie.

China’s economy is not at all healthy. Its export engine is being throttled by the ongoing global economic recession. Its internal consumption is being throttled by Zero COVID as well as knock on effects from the bursting of the property bubble.

China’s economy is contracting, not expanding. At least some parts of China’s economy are collapsing.

That is the message Li Keqiang should have transmitted to the IMF. That is the message supported by the data.

When Chinese people suffer, all the peoples of the world suffer.

Down with "leaders"!