A Time Of Choosing For China: Zero COVID Or Economic Recovery?

Beijing's Stimulus Measures Are Nullified By Zero COVID

To appreciate the extremism embedded in China’s Zero COVID policy—even the “Dynamic Zero COVID” variant that is supposed to be a kindler gentler hellscape than this past spring’s Shanghai lockdown—one only has to understand one thing: Chinese officials are testing fish for the SARS-CoV-2 virus.

In China's Xiamen, fishermen have been ordered to be get tested along with their seafood even as video footage of officials undertaking COVID-19 PCR tests on fish and crabs went viral on Chinese social media.

This despite research indicating that mammalian vertebrates are at the highest risk of contracting a SARS-CoV-2 infection1, while fish have some of the lowest risk—and many species of fish are not able to contract the disease at all. Even more so than America’s own anti-science cohort of Faucists, China’s public health bureaucrats at every level of government are not bothered by such niggling details as facts.

The policy is Zero COVID within China, and so bureaucrats will stop at nothing to ensure Zero COVID is what is achieved.

According to the political and legal committee of the Xiamen Jimei district, it was necessary to swab both returning workers and their "materials" immediately upon disembarking each day, because some fishers had made illegal trades or contact with overseas vessels while at sea, "resulting in the import of the coronavirus."

No other considerations enter into the policy discussion, and certainly not economic considerations. Reason is not necessary in a policy that calls for testing animals structurally unable to support the SARS-CoV-2 virus for the SARS-CoV-2 virus (no virus can virus that much!).

80 Million Locked Down Even Now

At a time when China’s economy is reeling from multiple shockwaves emanating from the collapse of its grossly inflated real estate sector, China needs all parts of its economy functioning well to keep China on a path of robust economic growth.

That need is directly refuted and rejected by Zero COVID lockdowns that have roughly 80 million people restricted—80 million people who contribute approximately 8% of China’s overall GDP.

Nomura says 22 cities are implementing full or partial lockdowns or some kind of district-based control measures with 79.6 million people affected. That affects more than 8 per cent of China’s GDP.

When 80 million people can’t spend (can’t go shopping) and can’t earn (can’t go to work), their contribution to overall GDP is effectively eliminated, or at least greatly reduced. Straight away Zero Covid, “dynamic” or otherwise, is squelching economic activity that could equal as much as 8% of GDP if sustained indefinitely.

Foreign Companies Are Losing Money Under Zero COVID

Zero COVID has been a clear money loser for global enterprises that have previously looked to China’s markets for new revenue opportunities.

Luxury goods in particular are not thriving under China’s Zero COVID regime, as even without actual lockdowns in effect many Chinese citizens are simply choosing to avoid the shopping districts where such products are sold.

Major Chinese cities have imposed multiple rounds of restrictions this year following Beijing's "dynamic zero-COVID", leaving companies with a presence in the country stuck with piles of unsold stock as cautious consumers avoid visiting crowded shopping districts.

Company after company is reporting dismal 2022 earnings and attributing their revenue decline to Zero COVID.

Tapestry and Estee Lauder join the likes of Gucci owner Kering SA (PRTP.PA), Ray-Ban maker EssilorLuxottica (ESLX.PA) and Ralph Lauren Corp (RL.N) in flagging a sales hit in China, a key growth market for high-end fashion companies.

Estee, which makes MAC lipstick, gets over a third of its revenue from China, while Coach handbag maker Tapestry generates about 20% of its sales from the region, according to analysts.

Tapestry, which also owns the Kate Spade and Stuart Weitzman brands, said it was beginning to see a recovery in demand in China, with sales expected to fall 15% in the first quarter compared to a 32% drop in the fourth quarter.

If Zero COVID ever ends, the revenue growth for these companies might return—and many industry analysts maintain a certain optimism for the China markets once Zero COVID does end.

"The weakness in China has only really come about because of the lockdown. Once that region is out of those lockdowns, we see green shoots of the consumer coming back there," Jane & Hali Associates analyst Jessica Ramirez said.

The problem with that assessment is that China will never exit the Zero COVID lockdowns. The post-Shanghai snap lockdowns of the “Dynamic Zero COVID” policy have proven that.

Instead of allowing “green shoots” to emerge, Zero COVID is the economic equivalent of lingchi (凌遲)—”the death of a thousand cuts”—that snuffs out each green shoot as soon as it appears.

China’s Own Industries Are Losing Money Under Zero COVID

Perhaps no company’s recent performance demonstrates the economic destruction of Zero COVID quite as dramatically as that of Xiaomi, the world’s largest cell phone manufacturer.

Sales fell 20% year on year to 70.17 billion yuan ($10.31 billion), missing estimates and marking a steeper decline from the previous quarter, when the company posted its first-ever revenue drop since listing.

Net income fell 67% to 2.08 billion yuan, missing analysts' estimates.

The lockdowns have simply destroyed the domestic market for Xiaomi, as consumer demand simply collapsed because of them.

China's consumer consumption has struggled to rebound from the impact of lockdowns in Shanghai and other cities in the first half of the year.

Data this week showed China's economy slowed unexpectedly in July, indicating the world's second largest economy is struggling to shake off the June quarter's hit to growth from COVID restrictions and prompting a central bank rate cut.

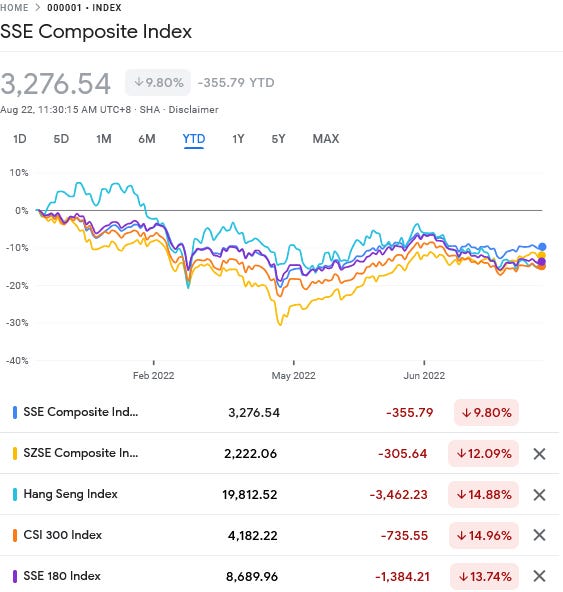

Across the entirety of China’s stock markets in Shanghai, Shenzen, and Hong Kong, share prices have declined significantly, with all major stock indices well into correction territory (decline greater than 10%) on the year.

It is no coincidence that the most significant declines occurred during the period of Shanghai’s lockdown.

Commodity Prices Are Declining Due To Zero COVID

The economic impact of China’s Zero COVID is not contained entirely within China. Because China has had such a voracious appetite for a number of commodities, from fossil fuels to raw materials to intermediate goods, the lockdowns which disrupt China’s internal economic activities are having a pronounced ripple effect on world commodity prices.

Global steel prices rose sharply at the beginning of the year as a result of the Russo-Ukrainian War, but have declined recently as Zero COVID has quashed China’s demand for steel.

Price fluctuations have eased since June, with steel prices in the Asian market falling by 3.2-4.9% in June and further declining by 5.2-16.3% in July, said Nava Chantanasurakon, chairman of the FTI's Thailand Iron and Steel Industry club.

The decrease was attributed to China's zero-Covid policy, which led to the enforcement of lockdown measures in cities where infections were reported.

When China announced its grim July economic data, the price of oil dropped more than 5%.

The price of West Texas Intermediate slipped more than 5% Monday to $87 per barrel—its lowest level since January—while international benchmark Brent crude also fell more than 5% to a six-month low of about $93 per barrel.

The plunge came after overnight data from China showed that the nation’s economy slowed in July amid ongoing Covid lockdowns, property market uncertainty and global recession fears—prompting a surprise interest rate cut from the People’s Bank of China to help bolster consumer demand.

While economic weakness is a recurring theme globally, financial markets have consistently looked to China to pull the world economy out of any downturn, and China under Zero COVID has left those same markets greatly disappointed in 2022.

"It's been an underwhelming start to the week in financial markets with the eternal optimism of investors clashing with the reality of Chinese economic data," noted Oanda senior market analyst Craig Erlam.

China's central bank slashed key interest rates in a surprise move Monday as a raft of data showed weakness in the world's second-largest economy.

The figures showed China's industrial production and retail sales growth for July came in lower than expected.

With recession looming large worldwide, as of July China is in the lead in the global race to the bottom—and is dragging global commodity prices down as well.

Beijing Must Choose: Zero COVID Or Economic Growth

The economic news and the data coming out of China places Beijing on the horns of a very stark dilemma: either ease the Zero COVID protocols (and, given their extreme nature to ease would be functionally to eliminate the policy) or forfeit economic recovery and future growth. There is not a third option on the table, and neither interest rate cuts by the PBOC nor fiscal stimulus by the CCP will craft one. Zero COVID nullifies all stimulus proposals and measures, and will continue to do so.

At the moment, and for the foreseeable future, Beijing has chosen Zero COVID—which makes economic collapse a near certainty.

However, it is important to be clear on what that “collapse” will look like. YouTube commentator Winston “SerpentZA” Sterzel, a South African who lived in China for fourteen years, makes an important point about the state of affairs in China in one of his recent videos:

As Sterzel explains quite well, a “collapse” does not mean that the CCP will immediately tumble and fall from power, or that a mass uprising is sure to occur in coming weeks and months. The control the CCP exerts over the Chinese population is enormous, and that is not going to change any time soon. Even a disintegrating economy is not going to immediately weaken that control or dislodge the CCP from power.

Yet while the CCP can maintain their control over the people of China, the economic trends show they are losing what little control they ever had over the economy of China, and that is the loss of control that will ultimately doom the CCP. At some point, that loss of economic control will reveal itself as political impotence and the inability to maintain their control over the people. Once the authoritarian is revealed as a toothless paper tiger, his downfall is inevitable.

China is in a time for choosing: Zero COVID or economic growth. Beijing thus far has chosen Zero COVID, and the Chinese people are thus committed to the path of Zero COVID. The Chinese people are going to remain on that path—right up to that unseen point somewhere in the future when they will refuse to walk that path any further.

Damas, Joana et al. “Broad host range of SARS-CoV-2 predicted by comparative and structural analysis of ACE2 in vertebrates.” Proceedings of the National Academy of Sciences of the United States of America vol. 117,36 (2020): 22311-22322. doi:10.1073/pnas.2010146117

"Commodity Prices Are Declining Due To Zero COVID"

Good!

That said, Zero Covid is like an endless game of whack-a-mole.

Somehow the Zero-Covid thing reminds me of Chairman Mao's determination to anihilate the swallows who were eating too much of the grain harvest.

It was disastrous. Of course birds also eat pests...