At this point, the epidemiological data coming out of China regarding its COVID outbreak is so tainted and corrupt that it has lost all informational value. We do not know—nor are we likely to ever know—how many cases there have truly been in China since the end of Zero COVID last December, nor how many actual COVID deaths.

Truth has been the greatest COVID casualty in China (moreso there than in the rest of the world).

Thus reports from China that COVID cases are down significantly must automatically be taken with several grains of salt and a double dose of skepticism.

In a report published on Wednesday, the Chinese Centre for Disease Control and Prevention (CDC) said there were 434 Covid-related deaths on Monday, down 89.8 per cent since peaking on January 4 when there were 4,273 deaths per day.

With no other source against which to validate the CCDC numbers, we must proceed with caution regarding them.

Yet it could very well be that China’s COVID cases are down, and that the ginormous “first wave” of COVID has passed. Cases would naturallly recede if that is the case.

Moreover, given that this outbreak started back in November, and took off shortly after Zero COVID was rescinded on December 5, 2022, it is hardly abnormal for the COVID wave to have passed by now. While the raw numbers regarding China’s COVID outbreak are problematic, the time distribution of cases reported by China does track with the duration of COVID outbreaks elsewhere in the world.

From late October/early November to mid-January, a period of roughly three months, is not that much different in duration than the United States’ first Omicron “wave” starting in late 2021.

While this is hardly a guarantee that China’s COVID cases are receding, it is certainly reasonable to say that this is about the time in the COVID “wave” where cases begin to drop off and the virus has infected everyone it is going to infect.

We cannot and dare not blithely trust China’s COVID reporting, but at first glance this claim by China is hardly unreasonable.

Then we have reporting such as this from the Epoch Times:

Still, local officials have been seeking to downplay the severity of the crisis. On Jan. 17, authorities in Shanghai said the COVID outbreak had been on “an obvious downward trend” since late December, with visits to fever clinics and emergency rooms declining. Health authorities also claimed that “the current outbreaks in Shanghai have now passed the peak.”

But China’s official infection and death tolls have been viewed as markedly undercounting the impact of the COVID crisis by health experts abroad, including those at the World Health Organization. As researchers turn to anecdotal evidence on the ground to gauge the impact on global health, more than a dozen of governments around the world have mandated COVID tests or imposed other precautionary measures on travelers from China.

While much of the data the Epoch Times cites involves cases up to about mid-January, thus leaving open the possibility that the past couple of weeks have seen the case declines claimed by China, if China was lying about their cases then, there is little reason to dismiss the possiblity they are lying now.

When the WHO—itself no paragon of reporting probity and integrity—puts disclaimers in its own COVID bulletins regarding China’s reported data, we are left with little alternative but to look askance at all that China claims about their COVID outbreak.

On 25 January, the Chinese Center for Disease Control and Prevention issued an update4 on the COVID-19 situation in the country (all subsequent references to China exclude Hong Kong SAR, Macao SAR, and Taiwan). Below is a summary of what was reported. WHO has not yet conducted an independent analysis of the COVID-19 pandemic situation in China as we do not have access to the data underpinning this overview.

Moreover, China’s claims about the COVID outbreak are wildly inconsitent, leading to results that are not merely improbable, but impossible. For example, in order for China’s claim that 80% of its people were infected with COVID during this outbreak to be true, it would have to have had the most rapid community spread of any country on Earth.

Yet if that claim is true, it makes China’s official count of COVID deaths absolutely absurd.

84,190 deaths out of some 1.1 billion COVID cases (0.007% Case Fatality Rate) would make China’s experience with COVID a mild head cold, rather than a deadly and dangerous infectious respiratory disease.

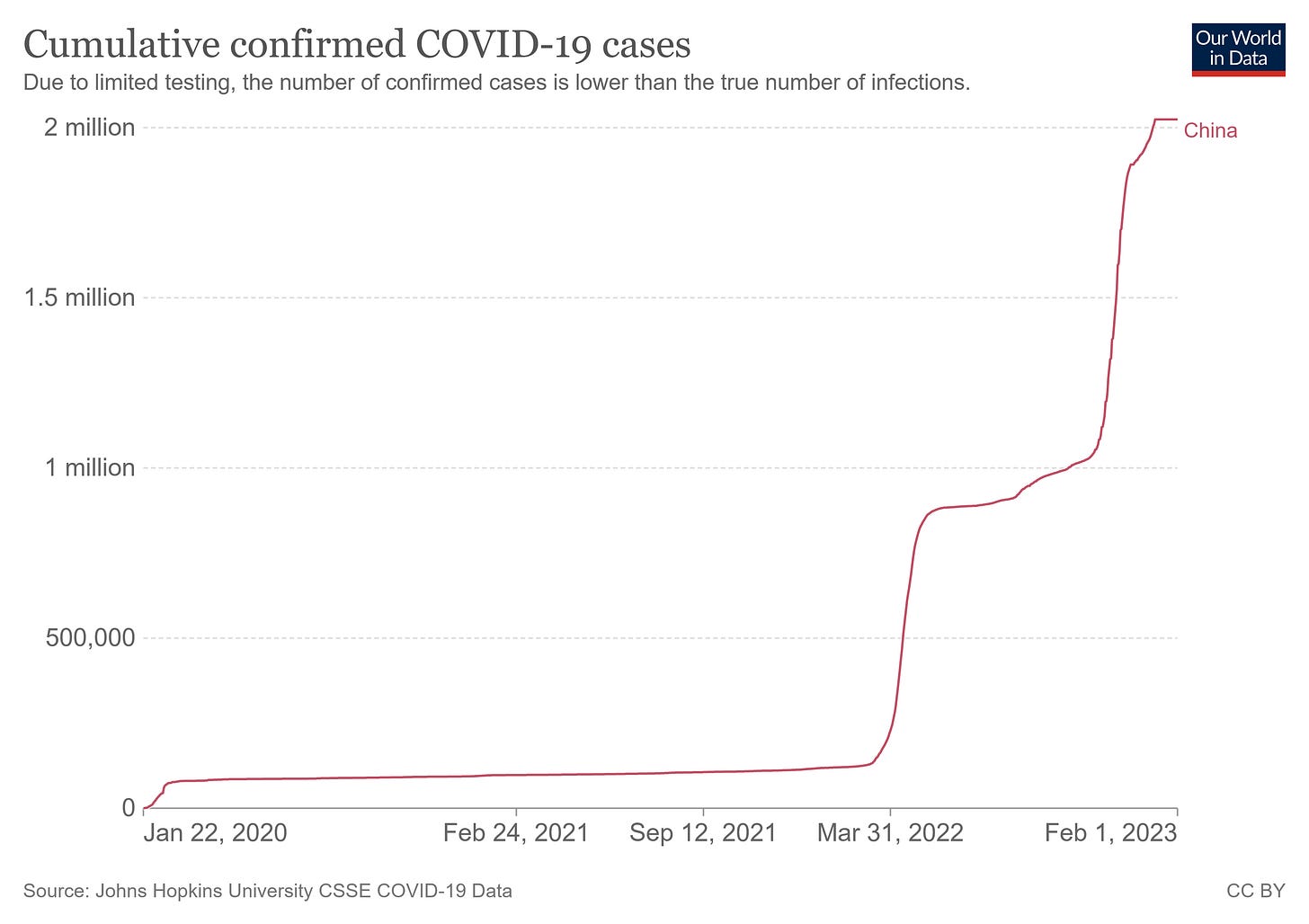

Additionally, the 2,020,000 official COVID cases acknowledged by China is well short of 80% of the population.

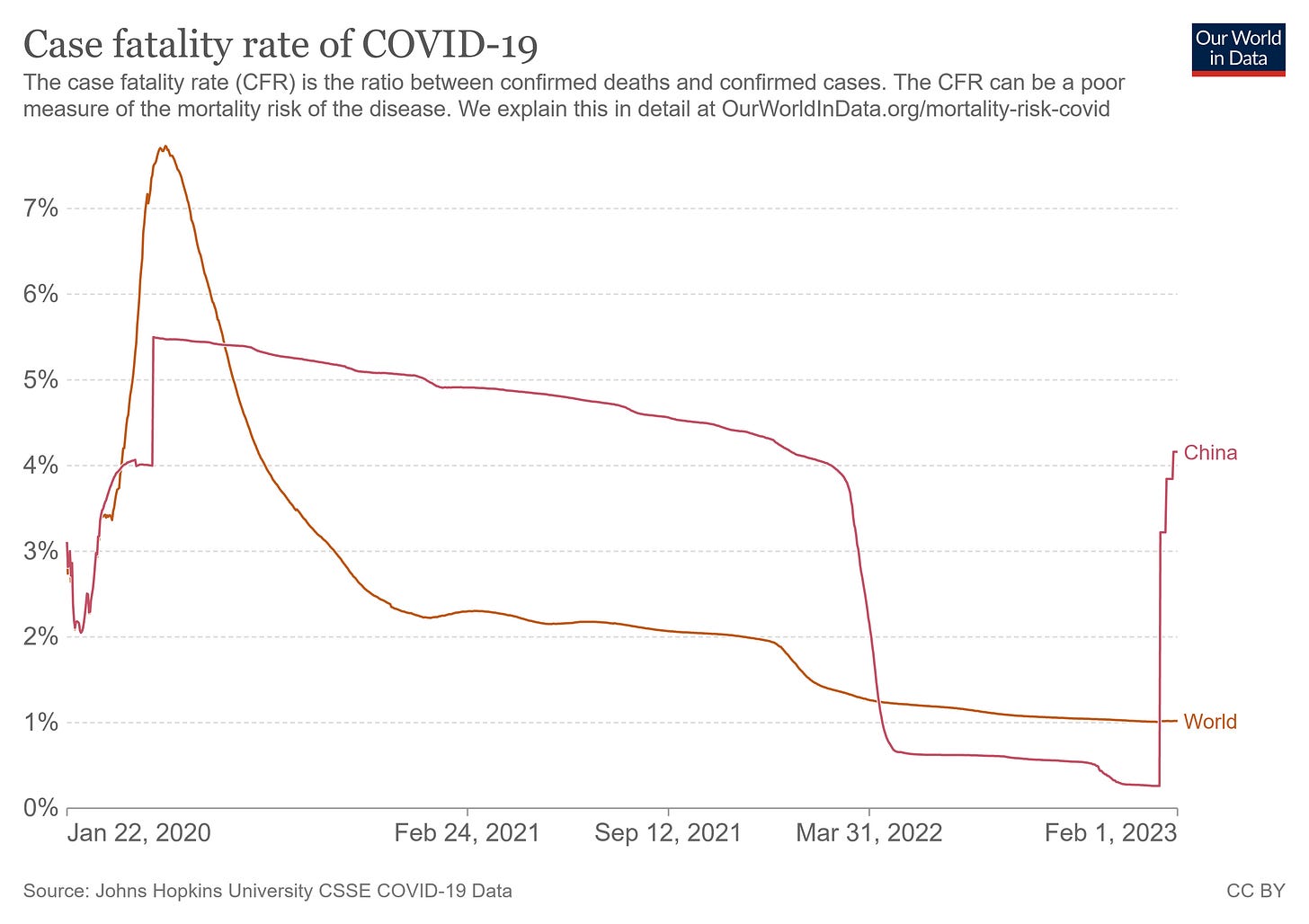

At 2 million COVID cases, China’s deaths work out to a surprisingly high 4.2% CFR, at a time when the world’s overall case fatality rate is approximately 1%.

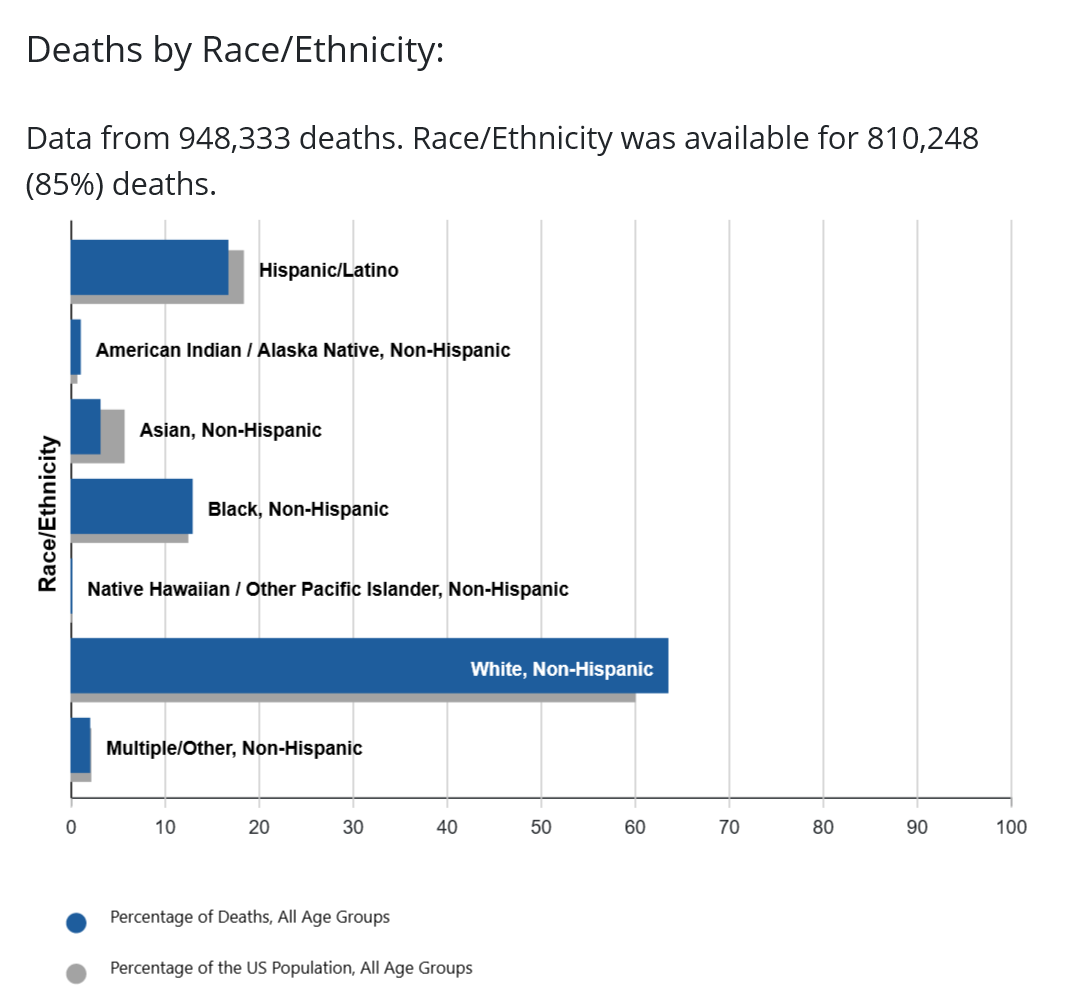

Yet even at that seemingly more reasonable level, China’s numbers do not make any sense. Why is China having a fatality rate 4x the world’s overall rate, when in the US Asians (which includes a sizeable community of Han Chinese) have the lowest proportion of COVID deaths?

With China’s COVID data so obviously mis-stated, manufactured, and mis-presented, it is clear no sound conclusions about the SARS-CoV-2 virus or the COVID pandemic within China can be drawn from it.

Thus comes the question “why does it matter?”

The importance of China, of course, is that it is still the factory for all things globalist, and China’s economic prosperity—or lack thereof—all too easily becomes the world’s prosperity (or lack thereof). While it has been nearly two months since Zero COVID was recsinded, China’s much lauded and hyped “reopening” has yet to truly take off.

With COVID fading, China is running out of excuses for not showing more economic vitality—and as of this writing China’s economy is anything but vital. According to the Caixin Manufacturing PMI data just released, China’s pivotal manufacturing sector is still contracting.

China’s industrial profits in 2022 were 4% less than in 2021. Between COVID cases and Zero COVID lockdowns, China was apparently less open for business in 2022 than in 2021.

China may have officially ended Zero COVID, but until the waves of COVID infection have receded, economic resurgence will have to wait.

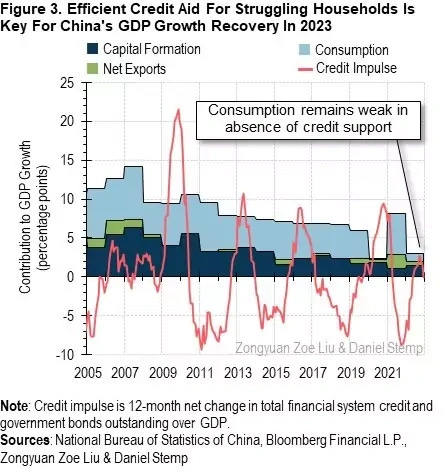

If, as more than a few economists have projected, the key to China’s economic recovery in the aftermath of Zer COVID is domestic consumption, then reaching an end to an infection wave becomes an imperative.

For China’s economy to rebound in 2023, the government needs to stimulate domestic consumption. Figure 3 shows that China’s growth faltered last year because domestic consumption collapsed when large segments of the urban population were placed under prolonged lockdown. Now that China has fully re-emerged from the lockdowns, the latest economic forecasts call for pent-up demand from China’s households to push retail sales growth higher to 7.3 percent year-over-year in 2023 (compared to only 1.4 percent in 2022) as the primary driver of overall GDP growth.

While China’s economy has traditionally relied heavily on exports and real estate in the past, both have suffered mightily during the Zero COVID years, both because of the policy and because of preexisting defects in China’s economic foundations.

Thus the nascent Chinese consumer is all that remains to provide the economic spark to relight the fires in China’s economic engines.

China might have “pent up demand” from the past two years, but before that demand can be unleashed, the population must first return to some semblance of the pre-COVID healthcare status quo.

Moreover, the degree to which government can stimulate China’s economy at all is itself a question. China’s local government entities are already vastly over-leveraged, with 2023 as the year that bill comes due for many of them.

Credit conditions for China’s heavily indebted local governments are likely to worsen this year, according to analysts, as weak land sales revenue, high fiscal deficits and growth in liabilities persist, triggering concerns about rising default risks.

Despite growing economic pressure, the central government has said debt control remains a priority in 2023, according to recent interviews by finance minister Liu Kun and chairman of China’s banking and insurance regulator Guo Shuqing.

If the next step in China’s economic resurgence is government stimulus, then the next step taken is likely to be a very small one, even as COVID’s denouement adds to the pressure for that step to be large and impactful.

With the rest of the world sliding further into recession and stagflation, how quickly China’s economy picks up steam after Zero COVID becomes an essential question, with the ending of China’s latest COVID outbreak making up a large portion of the answer. With China’s data irretrievably tainted and corrupted, it is an answer we will only come to know in hindsight, after it has happened.

In a perfect globalist world, China would now shrug off the last few cases of COVID, celebrate its Lunar New Year holiday (which largely shuts down the country for a week or so every year in the normal course of events), and then fire up its factories, open up its ports, and proudly let the world know that China is once more open for business. The rest of the world will flood China with new orders for goods and happily re-engage with China’s export economy in order to re-animate the global economy.

This is, however, not a perfect globalist world. China will celebrate its Lunar New Year holiday. At present, China is on track to fire up some but not all factories. China will open up ports as best it can (and to the extent workers are available and not sick), and will try to persuade the world that it is really ready to do business, pointing to its official COVID stats as proof of this. The rest of the world will order goods from China to the extent the stagnant global economy has demand. The rest of the world will have to choose how much faith to put in China’s COVID stats. The rest of the world will have to choose how much re-engagement with China’s export economy is prudent after the economic horror show that has been the Pandemic Panic Narrative.

Choose wisely.

When assessing the validity of data, one should always consider both the motivations and the ability of the entity issuing that data. That said, at least in China the outright falsification of numbers assembled by huge bureaucracies is probably not the preferred method of manipulating them. More subtle approaches - e.g. fudging - are the norm. The definition of 90% of Omicron cases as 'asymptomatic' prior to December 2022 was a good example of this. This was accomplished by only accepting CERTAIN symptoms as qualifying - a silly trick which backfired on them when the tsunami hit. In this particular case, since testing has almost completely ceased, China's national health authorities probably honestly had very limited hard data regarding cases and deaths to go on. So the numbers they released in December may not have been technically false. In fact, given the obvious huge discrepancy between the numbers released and reality, the numbers were probably not even fudged. Since then they stopped releasing numbers completely.

That said, of course they COULD alternatively publish data on excess deaths, but given their complicity in the course of events, their instinct as usual is to hide their head in the sand and delay any discussion of such matters until many months down the road. In other words, their sin is probably more one of omission than of outright lying. This is par for the course and not surprising to any of us in China. Such behavior is expected and as such does not have much impact on reality.

We estimated a total mortality rate of around 0.42% of the total population, or around 6 million people:

https://austrianchina.substack.com/p/estimating-chinas-omicron-death-toll