Core Inflation Is Proving More Stubborn Than Jay Powell

Nothing To Show For A Year Of Futile Fed Funds Rate Hikes

The Bureau of Economic Analysis has released their report on Personal Incomes And Outlays for March, only to confirm what has been apparent for a while: Core consumer price inflation doesn’t give one tinker’s damn about Jay Powell’s rate hikes.

The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.3 percent (table 9). Real DPI increased 0.3 percent in March and Real PCE decreased less than 0.1 percent; goods decreased 0.4 percent and services increased 0.1 percent (tables 5 and 7).

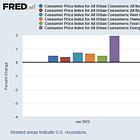

Just as with the Consumer Price Index Summary earlier this month, core consumer price inflation moved higher than the headline figure.

One piece of bad news is that “core” consumer price inflation (CPI inflation less food and energy), actually rose a tenth of a percentage point year on year. The primary driver of the decline in the headline inflation metric was the significant drop in energy prices—6.9% year on year.

All of March’s improvement on inflation came from declines in energy prices. For every other metric year on year and even month on month inflation gained ground in March.

The Personal Consumption Expenditures inflation metrics for March show substantially the same thing: The main driver of declining headline consumer price inflation are substantial drops in food and energy price inflation, with core inflation largely holding steady.

For the PCE inflation metrics this was true with both the year on year inflation gauges and the month on month gauges.

The entire report could have been summarized with thus: “nothing to see here, just move along.” The Fed certainly doesn’t want people looking too closely at these numbers because they only confirm that 12 months of hiking the federal funds rate has had virtually no impact on core consumer price inflation.

The corporate media certainly has had a muted reaction to the data, delicately skirting around the obvious problem of core inflation not responding to the Fed’s interest rate hike strategy.

U.S. consumer spending was unchanged in March, while underlying inflation pressures remained strong, which could see the Federal Reserve raising interest rates again next month.

The unchanged reading in consumer spending last month, reported by the Commerce Department on Friday, followed a downwardly revised 0.1% gain in February. Consumer spending, which accounts for more than two-thirds of U.S. economic activity, was previously reported to have increased 0.2% in February. Economists polled by Reuters had forecast consumer spending dipping 0.1%.

CNBC was a bit more direct, actually mentioning that the Fed has been “battling” inflation for a year with little to show for it.

Despite a year’s worth of interest rate increases, inflation rose again in March, according to economic data released Friday that the Federal Reserve watches closely.

The personal consumption expenditures price index excluding food and energy increased 0.3% for the month, in line with the Dow Jones estimate. On an annual basis, so-called core PCE increased 4.6%, slightly higher than the expectation for 4.5% and down 0.1 percentage point from February.

After months of corporate media carrying water for the Fed, even this much forthrightness is something of a radical departure.

Even Dementia Joe’s handlers had the good sense not to do their usual unearned Twitter victory lap, instead merely putting out some anodyne word salad about a “blue collar blueprint” for rebuilding America.

Nor is it hard to figure out why they are reluctant to comment too much on this latest inflation data—it is clear proof that the Fed’s rate hike strategy is simply not working, and hasn’t been working for months (assuming it had any positive impact at all, which is doubtful).

While headline consumer price inflation as measured by the PCE Price Index has gone up and come down again, the core metric (PCE Index less food and energy), has simply fluctuated in a band around 5% ±0.5%

Given that the core gauge reached the 5% threshold in December 2021, peaked at 5.4% in February of 2022, and has oscillated in the 4.5%-5.5% band ever since, the argument that the Fed’s rate hikes have had any positive impact on inflation is problematic to the extreme.

The argument becomes even more problematic when one realizes that core inflation as measured by the Consumer Price Index shows the same plateau, but at the 6% level.

The Fed using the federal funds rate to push interest rates higher has not had any demonstrable impact on core inflation.

Lately the Fed’s efforts to push rate up have not had any demonstrable impact on Treasury yields, either. The 2-Year and 10-Year Treasury yields both took the March PCE report in stride, trending down by less than 10 basis points each.

Which reaffirms another conclusion to be drawn about the Fed’s inflation strategy—it no longer has any significant control over interest rates (assuming that it ever did). Market rates are not moving in response to Federal Reserve actions.

Another demonstration of the Fed’s failure with the rate hike strategy has been the stubborn persisetence of market yields on Treasuries remaining below even the more moderate PCE inflation gauges.

As yields approached the core inflation metrics from below, they too hit a plateau, with the 10-Year Treasury posting noticeable declines since.

In March the 1-Year Treasury yield finally moved above both the headline and core PCE inflation metrics at 4.64%, but the 2-Year and 10-Year Treasuries declined and remain significantly below core inflation.

It is worth noting that, during the Volcker Era, when former Fed Chair Paul Volcker first deployed the rate hike strategy to combat inflation, Treasury yields were already significantly above both core and headline consumer price inflation.

Even so, the degree to which rising interest rates contributed to consumer price inflation’s decline is problematic and almost certainly overstated. One principal reason the Fed’s strategy, which is largely a replay of Volcker’s strategy, hasn’t worked is because it has never really “worked.”

Buried in the numbers is another damning admission for how the “experts” have managed the US economy: Real Disposable Personal Income growth was negative throughout 2022, and only moved positive during the past few months.

So bad has been the real disposable income decline that Real DPI has declined 10% since the end of the 2020 recession.

Aside from a burst of income growth in March and April of 2021—a burst which, unlike inflation, actually was transitory—substantive income growth did not begin within Dementia Joe’s Reign of Error until June/July of 2022, and even at that has only succeeded in getting back to the level of February 2021.

Moreover, the report lays to rest any possible remaining shred of credibility to the nostrum that the US labor markets are “hot”, “red hot”, or “tight”.

Superheated labor markets, where workers are snapped up quickly, do not have more than six months of rising unemployment compensation—yet that is exactly what the US has from September, 2022, onward.

Rising unemployment compensation means paying more people after they have lost their jobs and failed to find another. Clearly workers are not in quite the demand the government wants people to believe they are.

Perhaps the best way to describe the March Personal Incomes and Outlays report is just to say that it is “drab”.

There are no bits of good news buried in the details.

There are no dramatic and dire revelations of bad news buried in the details.

There are simply more confirmations that the Fed’s strategy to fight inflation remains a grotesque and economically destructive failure, that has diminished most everything but inflation.

Rate hikes are not touching core consumer price inflation, and even though the Fed will likely boost the federal funds rate yet again when it meets next week, there is no reason to believe this next rate hike will have any of the desired effects.

The economy remains stagnant. The regime in the White House remains clueless. Jay Powell remains confused.

That is how the March PCE report summarizes.