Earlier this evening, the Federal Reserve, the FDIC, and the US Treasury jointly announced that the government would guarantee the deposits of shuttered Silicon Valley Bank, as well as just-closed Signature Bank of New York.

After receiving a recommendation from the boards of the FDIC and the Federal Reserve, and consulting with the President, Secretary Yellen approved actions enabling the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, in a manner that fully protects all depositors. Depositors will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.

We are also announcing a similar systemic risk exception for Signature Bank, New York, New York, which was closed today by its state chartering authority. All depositors of this institution will be made whole. As with the resolution of Silicon Valley Bank, no losses will be borne by the taxpayer.

How much faith should be put in the phrase “no losses will be borne by the taxpayer” is left for the reader to decide.

Signature Bank, a New York bank that had a presence in crypto and was largely seen as a potential beneficiary of Silvergate’s demise, had been struggling with its own stock-price and, apparently, liquidity issues in the wake of the FTX crypto scandal.

Though Silvergate’s troubles could result in more companies tapping Signature as a banking partner that’s familiar with crypto, Thursday’s declines suggest investors are hesitant towards banks that are involved with the asset class more broadly.

Last month, Signature was hit with a class-action lawsuit over its prior relationship with bankrupt cryptocurrency exchange FTX, which alleged Signature “had actual knowledge of and substantially facilitated the now-infamous FTX fraud.”

Ironically, Signature Bank was edging away from the crypto space when it was closed by state regulators.

“We want to make it clear again that Signature Bank is a well-diversified, full-service commercial bank with more than two decades of history and solid performance serving middle market businesses. We have built a strong reputation serving commercial clients through nine business lines and reached in excess of $100 billion in assets by continually executing our single-point-of-contact, relationship-based model where banking teams are capable of meeting all client needs,” said Joseph J. DePaolo, Signature Bank Co-founder and Chief Executive Officer.

“As a reminder, Signature Bank does not invest in, does not trade, does not hold, does not custody and does not lend against or make loans collateralized by digital assets,” DePaolo concluded.

“We have repeatedly communicated that our relationships in the digital asset space are limited to U.S. dollar deposits only, and we remain fully committed to executing on our plan to deliberately reduce these deposits further. Since we opened our doors, we have been a ‘deposit-first’ institution and have always been committed to our depositors’ safety, first and foremost. As shown by our current metrics, we intentionally maintain a high level of capital, strong liquidity profile and solid earnings, which continues to differentiate us from competitors, especially during challenging times,” added Eric R. Howell, President and Chief Operating Officer.

Although there were other outstanding issues, including a class-action lawsuit alleging Signature Bank “facilitated” the FTX fraud, the immediate catalyst for its closure appears at first glance to be “guilt by association”, having been caught up in the same panic wave that engulfed Silvergate and Silicon Valley Bank.

However, it is important to understand that, regardless of how one view the propriety and necessity of the government’s eleventh-hour decision to backstop SVB and Signature Bank depositors, what has been unfolding has not been a replay of the 2007-2008 Great Financial Crisis, as a quick perusal of loan delinquency and default rates from both then and now illustrates.

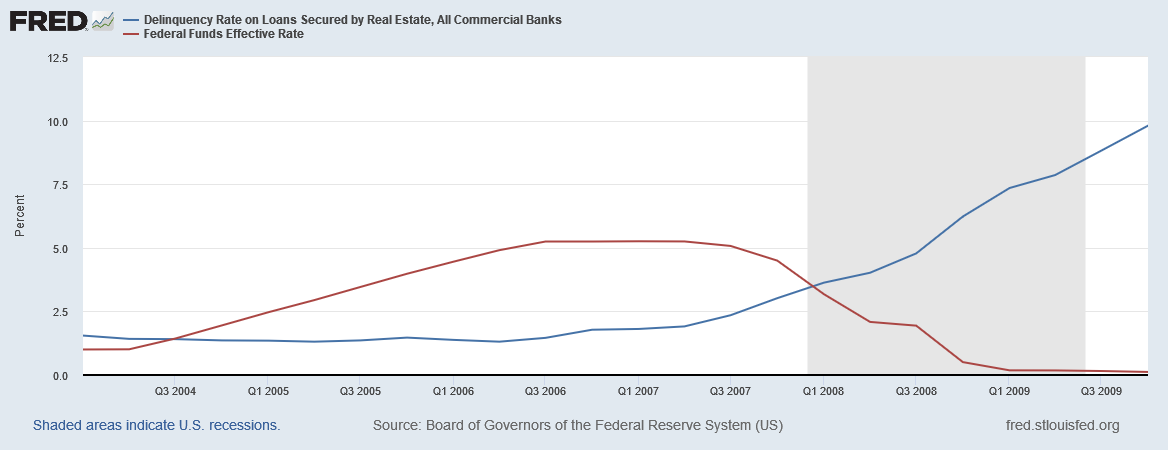

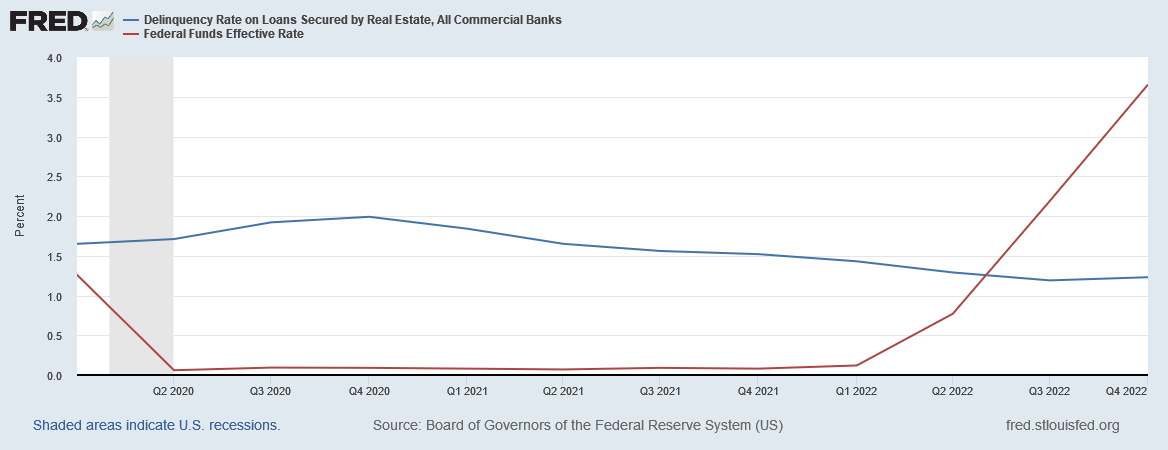

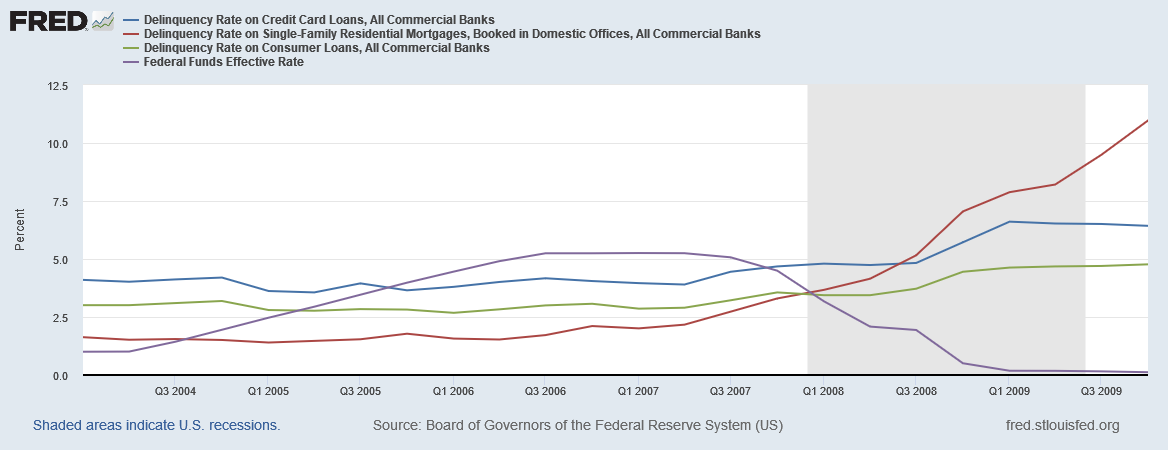

Before and during the GFC, rising interest rates catalyzed an increase in delinquency on real estate loans.

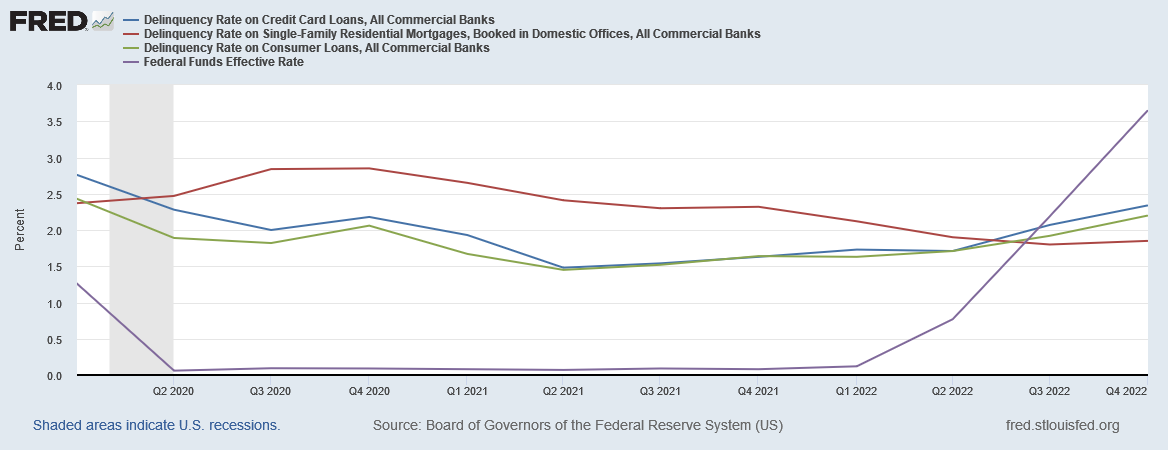

At present, real estate loan delinquencies are declining.

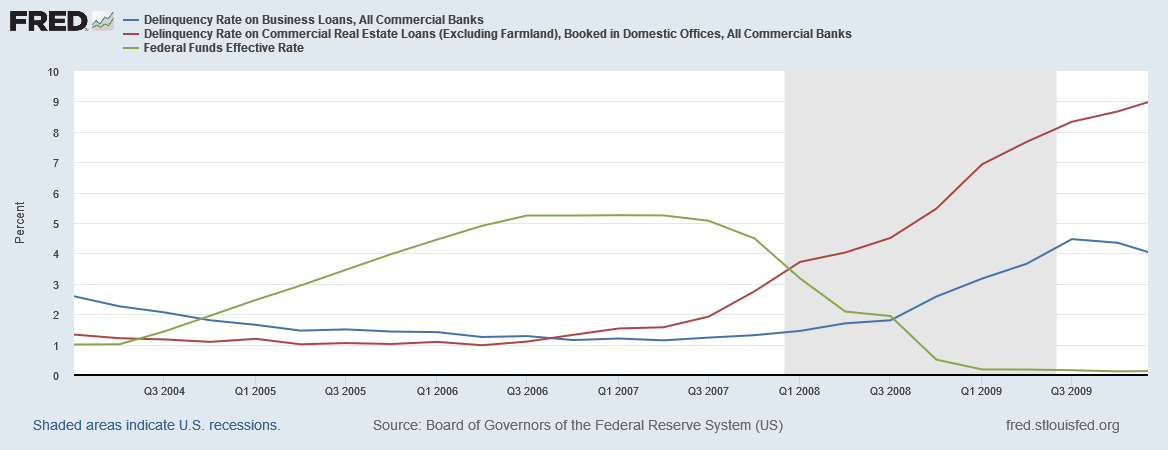

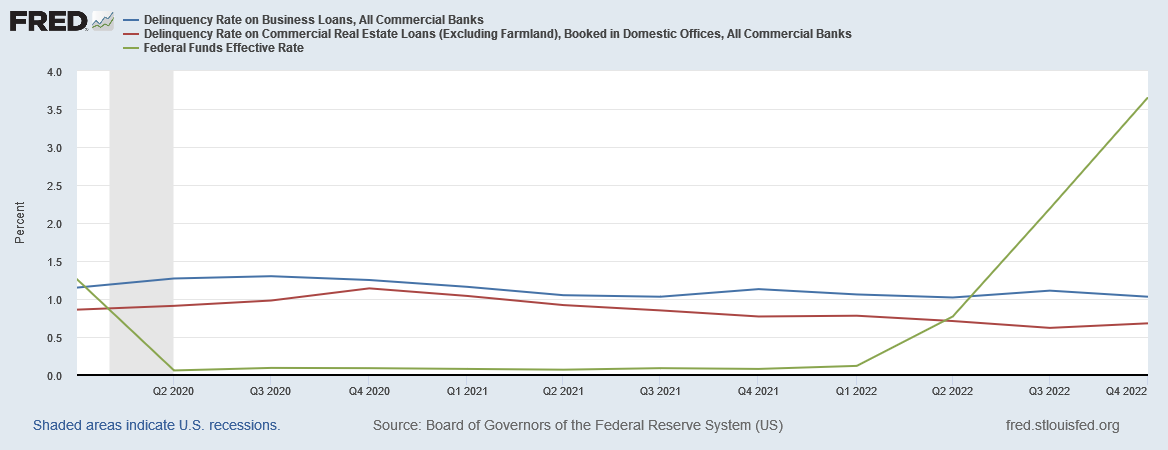

Commercial loan delinquencies also rose before and during the GFC.

That has yet to happen in this rate cycle.

In the run-up to the GFC, residential mortgage delinquencies eventually outpaced other consumer loan delinquencies.

At present, residential mortgages have lower delinquency rates than other types of consumer loans.

While shorter-term consumer credit is deteriorating, the principal area where this is occurring is in credit card debt.

In other words, collateralized debts are holding up at the present time, which they did not do during the GFC—deterioration in collateralized debts was a primary catalyst of that crisis. That is a significant difference between then and now.

Following on the liquidity issues that took down Silicon Valley Bank, what is unfolding is the paradox that has always been hovering over the Fed’s interest rate hike strategy: raising interest rates will eventually cause a shortage of cash.

While it may be counterintuitive to think of there not being enough cash, when the general apprehension of inflation is that it is caused by having too much cash in the system, the concern arises when banks and financial institutions do not have adequate liquid reserves to settle transactions. Because rising interest rates permanently impair the value of previously bought/sold interest-bearing assets, entities which are holding their “liquid” reserves in the form of such assets potentially face a problem where the losses they must take on their underwater interest-bearing assets leaves them with inadequate cash on hand to meet their needs. Thus, Powell’s efforts to reduce the money supply and thereby corral consumer price inflation are almost guaranteed to deprive critical entities in the financial system of necessary cash.

The problem has been magnified by Wall Street’s persistent refusal to rescue themselves. Interest rates have been rising for a year, and had been discussed for weeks prior to that. Yet Wall Street is still holding onto underwater assets and attempting to softpedal any impacts that might have on their liquidity.

If banks insist on refusing to confront the impaired nature of their investments in Treasuries and Mortgage-Backed-Securities, then the backstop will be of little use, as the bank runs will eventually continue.

Has the government prevented another banking crisis? Or has it merely postponed it? Unfortunately, we will not know the answer until more banks start failing.

Fractional reserve banking is an intrinsically dishonest enterprise, and we made it much worse in March of 2009, when we effectively legalized accounting fraud by the banks.

So many are going to cash, exchanging bond funds for MM settlement funds, buying ST Treasuries and creating TBill ladders, recommended in various financial forums, so in one sense citizen taxpayers are either contributing to the liquidity problem or funding the rescue. Repos are now a percentage in MM funds which is new (eg VMFXX)