DOGE Is Not Telling Us Anything New. That’s The Problem

Fraud In Government Is A Given. Fixing It Is Not.

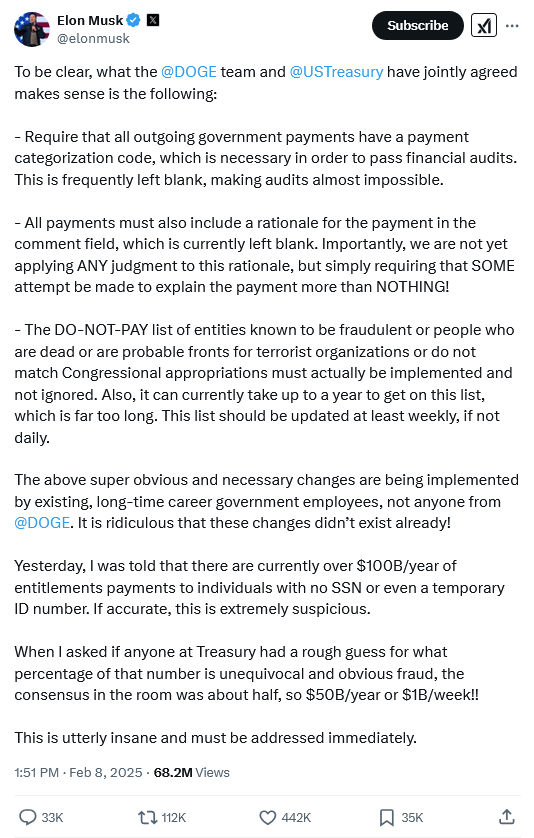

Elon Musk has certainly captured the social media spotlight with his seemingly daily revelations of reckless government spending discovered by the Department Of Government Efficiency (aka, the US Digital Service), and in particular indicators of potentially massive fraud within the Social Security Administration and the Treasury Department.

To call Musk’s claims “alarming” would be an understatement. If there is any substance at all to them, the level of fraud, waste, and abuse within the federal bureaucracy exceeds all easy articulation.

Rather, they would exceed all easy articulation except for one thing. Nothing Elon Musk is claiming is new or revelatory. Nearly every problem Musk has brought to light has already been established and documented, frequently by the General Accounting Office, but also by various Inspectors General.

For all the hysterics being applied to DOGE on social media, nothing that has been uncovered is new.

That, however, is the problem. We are so accustomed to incompetence and illegality within the federal government we no longer take notice when the usual watchdogs bark. DOGE is a new face for government accountability, and so we notice DOGE, and overlook that DOGE is surveying familiar territory.

Fake Social Security Accounts?

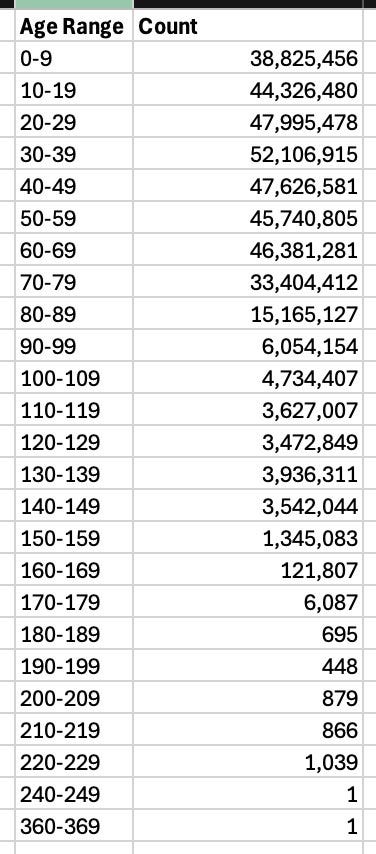

Perhaps the most incendiary tweet Elon has shared was a simple posting of a snippet of spreadsheet which listed by age bracket the number of individuals in the Social Security Administration databases with no date of death listed.

With that snippet showing millions of individuals within SSA records age 100 or higher, it did not take long for that tweet to go viral.

Musk’s commentary certainly helped add fuel to that fire.

The inference here is obvious: there are millions of individuals receiving Social Security payments who are not entitled to them.

The inference is problematic at best and unlikely to be fully true in every scenario. The reality is that even if we take Musk’s tweet at face value, it does not actually tell us much.

However, what that tweet does do is present a problem: unless Elon Musk is simply making things up out of nothing he’s pointing to questionable and even tainted data within the Social Security Administration’s records. While Musk’s tweet is not at all the proof of massive fraud that the Twitterverse has made it out to be, it is very much an indication of the sort of recordkeeping problems that facilitate fraud.

Musk’s tweet is also sharing a piece of information that the Social Security Administration has known for quite some time—easily a decade or more, as Tom Fitton, President of Judicial Watch, pointed out.

In fact, the Office of Inspector General for the Social Security Administration issued an audit report on this very thing in July of 2023.

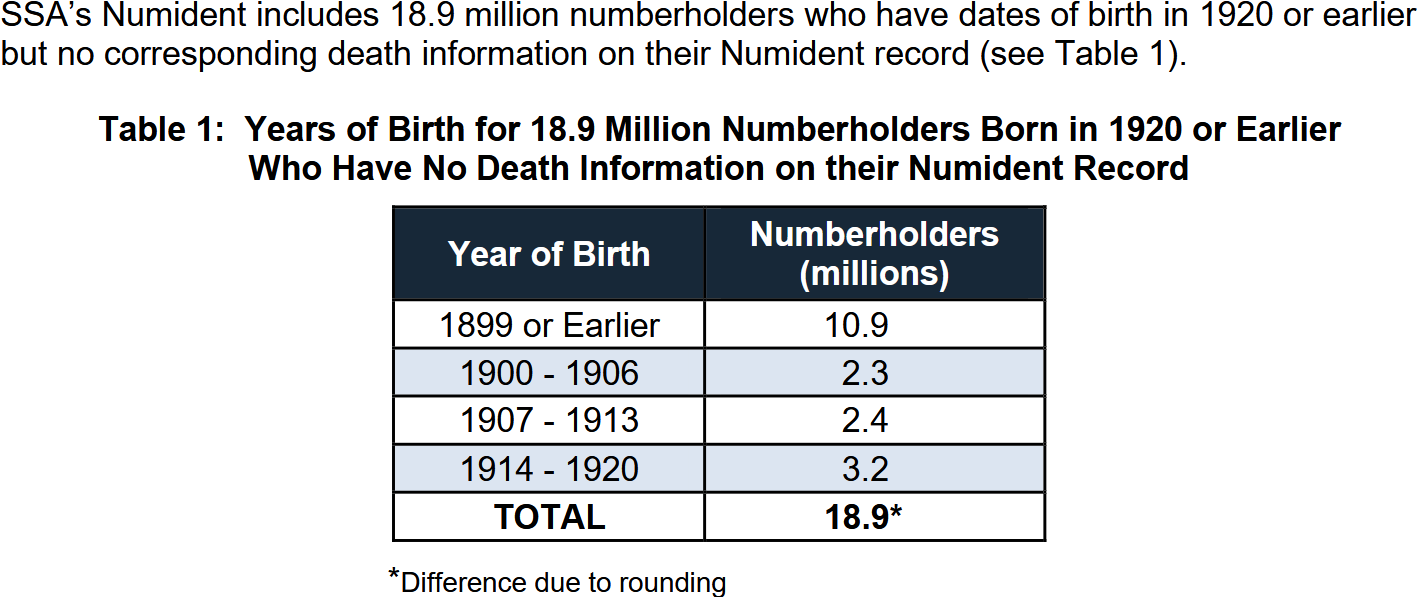

According to the OIG report, within the SSA records there were some 18.9 million numberholders Age 100 or older who are missing their death information.

At least 18.4 million of them are presumed to be deceased.

If this is a known issue, why hasn’t anything been done to fix it? The answer is that the Social Security Administration simply decided against fixing it.

The Agency Decided Not to Address These Discrepancies

In response to our 2015 report, SSA considered multiple options, including adding presumed death information to these Numident records. SSA ultimately decided not to proceed because the “. . . options would be costly to implement, would be of little benefit to the agency, would largely duplicate information already available to data exchange consumers and would create cost for the states and other data exchange partners.” SSA also believed a regulation would be required to allow it to add death information to these records, and adding presumed death information to the Numident would increase the risk of inadvertent release of living individuals’ personal information in the DMF.

We note that, as of January 2023, the full DMF included death information on approximately 137 million deceased numberholders. Over 18 million missing death records represents more than 10 percent of the records in the full DMF. Therefore, the death information SSA currently provides Federal benefit-paying agencies--and will begin providing to the Department of the Treasury’s Do Not Pay initiative in December 2023--to help prevent improper payments to deceased individuals, omit information for more than 1 of every 10 deceased numberholders

The Social Security Administration decided there was no point in cleaning up the data, so they opted to leave the bad data undisturbed.

Nothing Has Been Done

SSA left the erroneous data in place because they saw no benefit in resolving it.

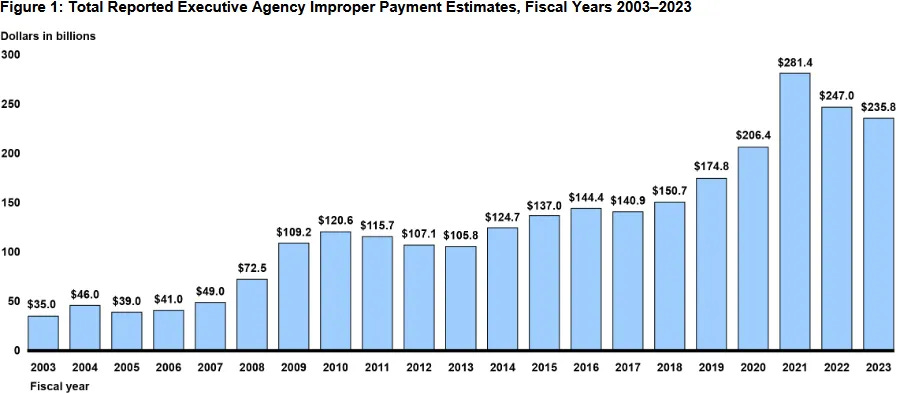

This reasoning, however, is difficult to accept even critically, because the OIG last year released another audit report detailing that at least $71.8 Billion in improper payments had been made by SSA between 2015 and 2022.

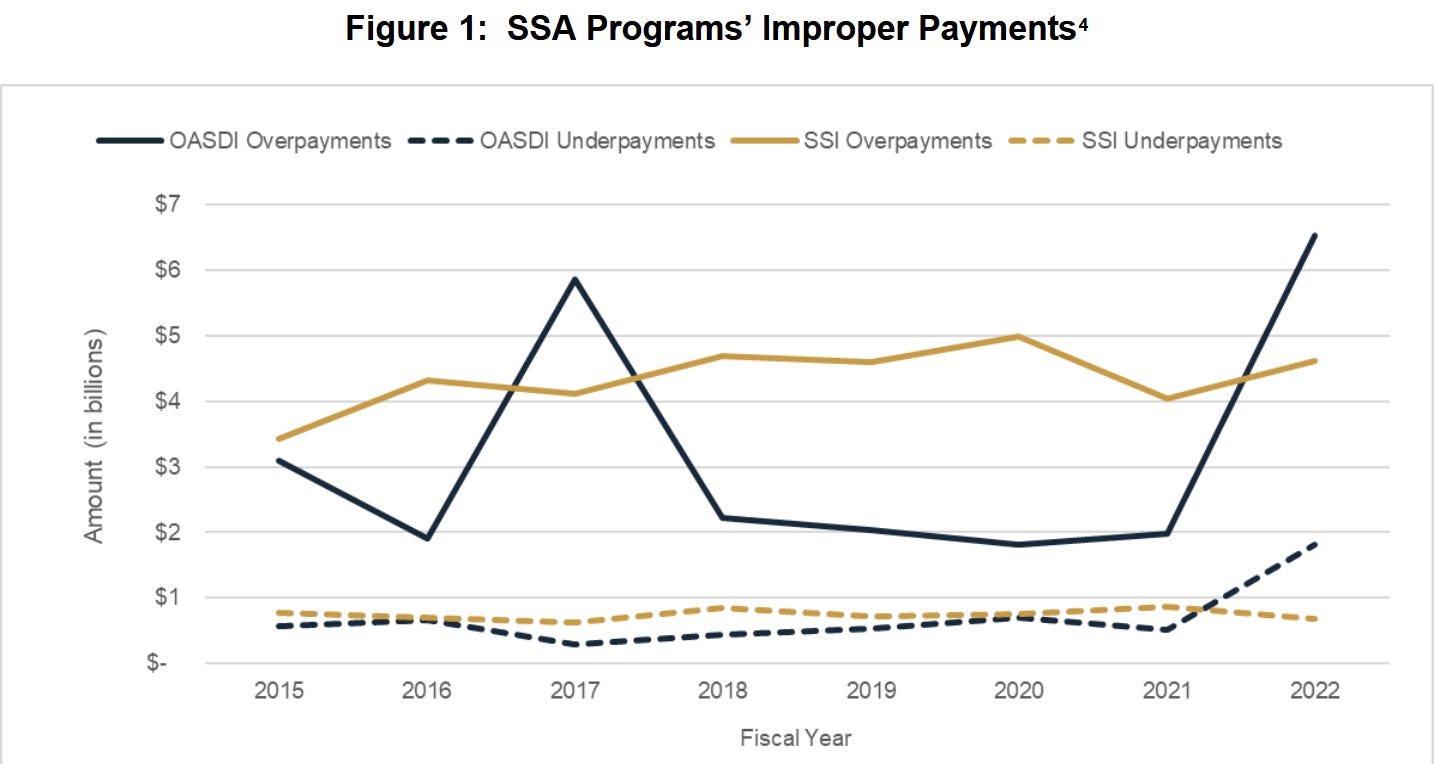

SSA issues over $1 trillion in benefit payments annually. Even the slightest error in the overall payment process can result in billions of dollars in improper payments. For example, from FYs 2015 through 2022, SSA paid almost $8.6 trillion in benefits and made approximately $71.8 billion (0.84 percent) in improper payments, most of which were overpayments (see Figure 1).

Moreover, when we look at the OIG’s charting of those improper payments, the problem appears to be growing.

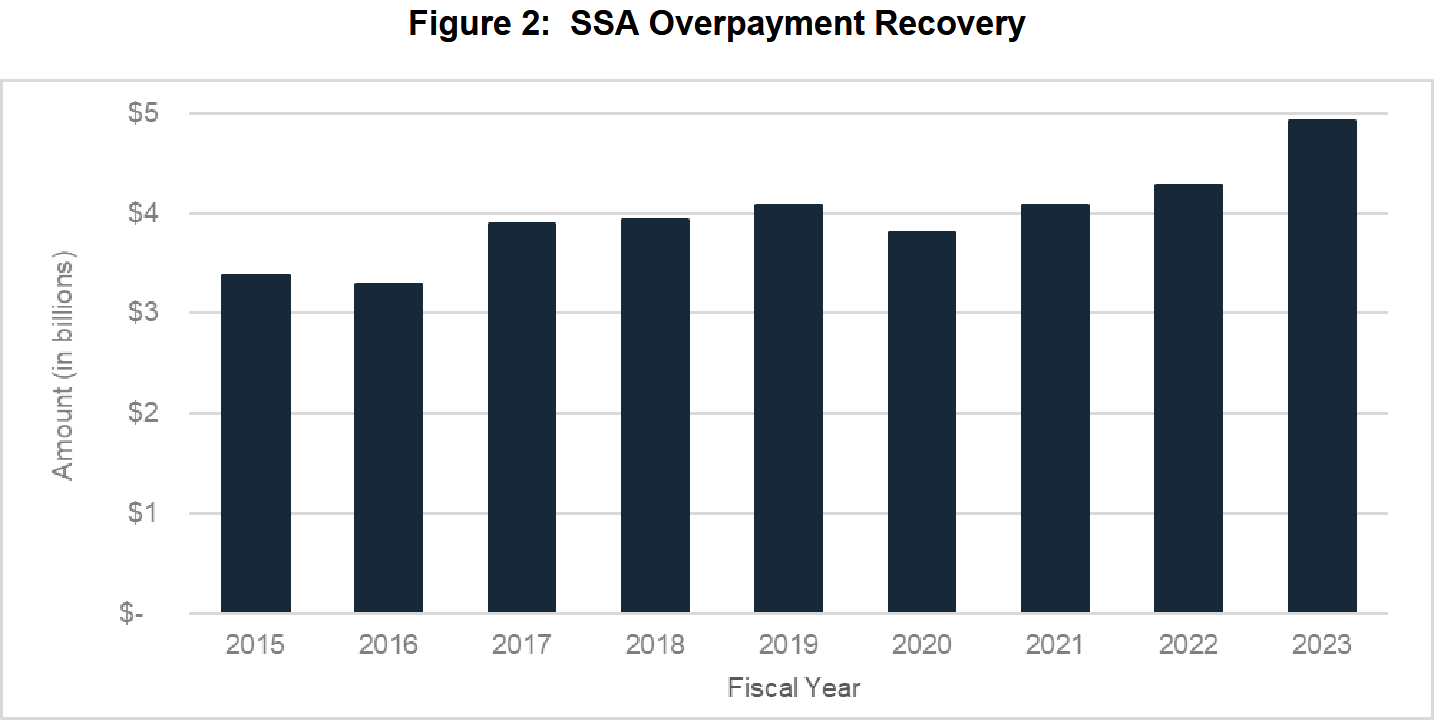

While SSA does make an effort to recover the overpayments, the OIG reports that there remains at least $23 Billion in uncollected overpayments.

How did the improper payments happen? There are many reasons, but the primary cause can be summed up in two words: insufficient controls.

Our audits also found that SSA failed to update benefit amounts timely when it relied on insufficient controls in automated and manual processes. Had SSA implemented effective controls to promptly process information and automated more of its processes, it could have prevented some overpayments.

Is the SSA taking steps to address the procedural issues behind the improper payments?

Not exactly. The OIG found that several of their recommendations had not been implemented, in part because the SSA disagreed with them:

SSA disagreed with the recommendation stating, “While [it] has the legal authority to collect [WC/PDB] information, there is no legislative requirement for [s]tates or other entities to share the information . . . .” SSA cited other factors when considering a data exchange “. . . including data quality, technological and logistical challenges, anticipated program savings, and estimated costs.” Finally, SSA stated, per its policy, the beneficiary “is the primary source for verification of WC/PDB information.”

In at least one instance, the SSA simply had not followed through on the recommendation.

To be clear, when we read the OIG reports we are not discussing “possible” waste, fraud, or abuse. When we read the OIG reports we are discussing proven waste, fraud, or abuse. We are discussing improper, perhaps even illegal, payments that have been positively identified.

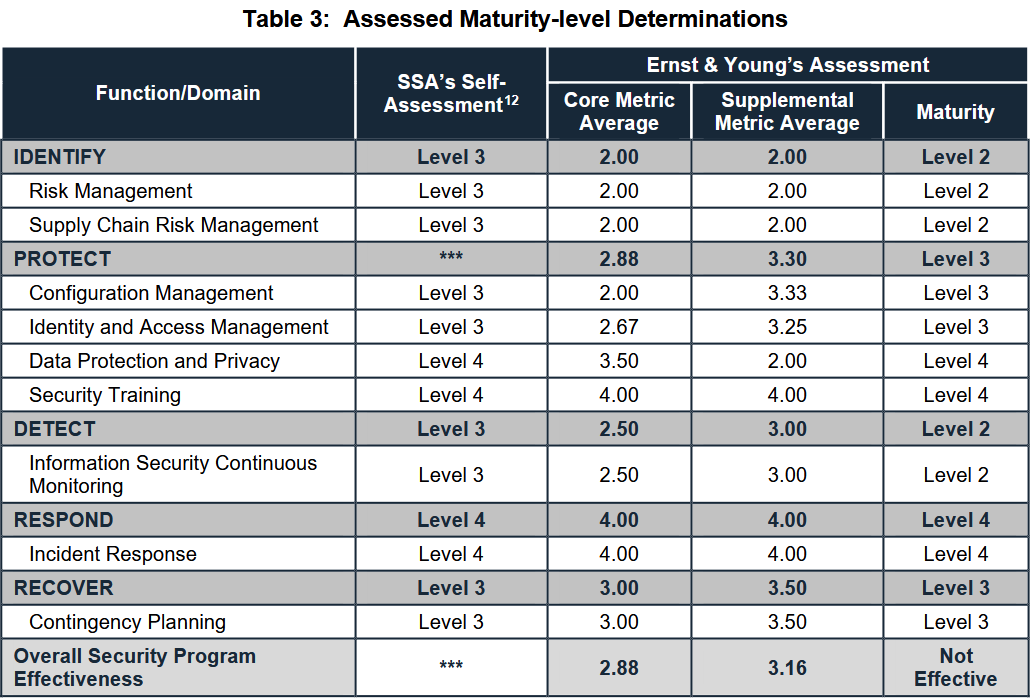

Even more disturbing is the fact that, according to the OIG, the Social Security Administration has for the last several years at least failed an annual information security audit, with the security program being rated as “Not Effective.”.

Despite proof of ongoing problems of waste, fraud, and abuse, the SSA has not sought to improve its information security programs.

Moreover, these are reports that pre-date DOGE. They predate any revelation by Elon Musk on X.

These reports are public record and have been presented to Congress. These reports are, in every sense of the word, “known”.

Yet these reports themselves indicate that recommendations made were not implemented. In some instances they were rejected. Some may simply have been ignored. These details also are, in every sense of the word, “known”.

Elon Musk’s tweets may be theatrical. They have grabbed considerable public attention. What they are not are a revelation of any issue within the Social Security Administration not already well documented and publicized.

We have known about the missing dates of death. Congress has known about the missing dates of death. This public knowledge has not produced any impetus to fix the system and correct the data.

Fraud At Treasury?

Before Elon Musk kickstarted the kerfuffle over Social Security Numbers, he had previously made headlines with tweets discussing fraud within the US Treasury itself.

This claim garnered particular attention as it came just as a federal judge sought to block DOGE’s access to the US Treasury’s payment systems with the Bureau of The Fiscal Service (BFS).

As subscribers and followers will no doubt recall, it was the corporate media reporting that Musk and DOGE had been given “full access” to the BFS systems that had triggered just about everyone within the chattering class.

At the time corporate media was having a meltdown over DOGE having allegedly “full access” to the BFS systems, Musk was already challenging the adequacy of the Treasury’s internal controls.

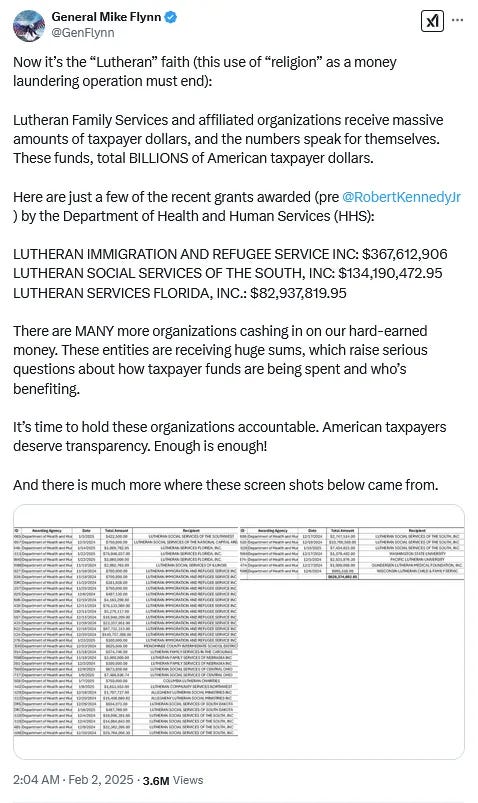

We should also note that Lt. General Mike Flynn had, apart from DOGE, already been putting out information challenging Treasury payments to numerous organizations.

As I noted at the time of Musk’s tweet, the magnitude of the problems at Treasury had already been documented by the General Accounting Office.

Remember, the General Accounting Office confirmed last fall, before DOGE even existed, that Trillions in improper payments have been made by the Treasury over the years.

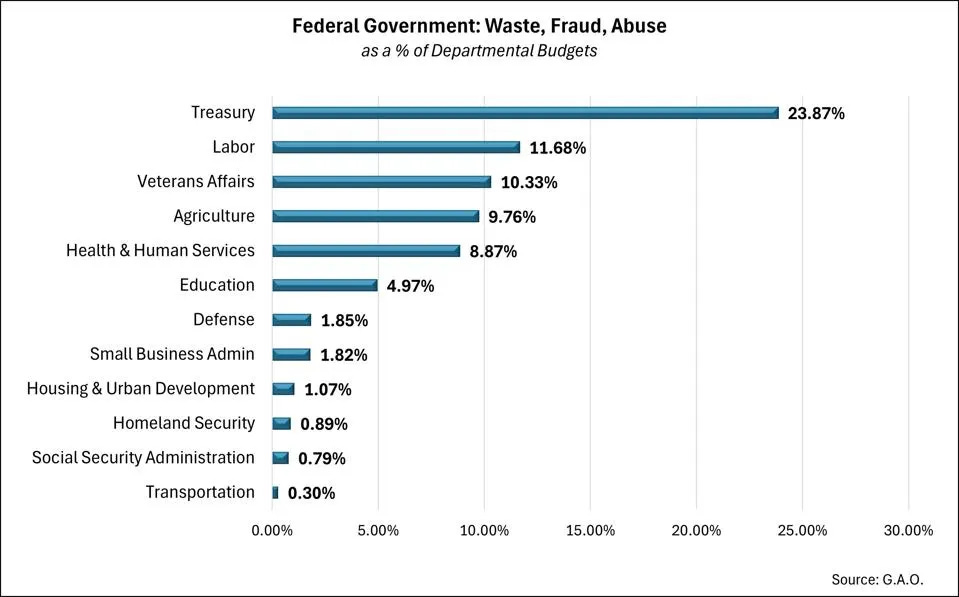

Forbes last fall reported that 23% of the Treasury’s budget was being mis-spent due to waste, fraud, and abuse—citing the GAO as their source.

As with the Social Security numbers, Elon Musk has not disclosed anything that even corporate media has not reported in the past. The problems at Treasury, including the inadequacy of the department’s internal controls and compliance structures, have been reported at some length.

Indeed, last April the General Accounting Office estimated that fraud costs the government as much as $521 Billion each year.

GAO estimated total direct annual financial losses to the government from fraud to be between $233 billion and $521 billion, based on data from fiscal years 2018 through 2022. The range reflects the different risk environments during this period. Ninety percent of the estimated fraud losses fell in this range.

With $521 Billion in losses due just to fraud annually, Elon Musk’s claim of being able to find $1 Trillion in savings within government spending does not seem quite so extravagant.

Again—Nothing Has Been Done

As with the Social Security numbers, alas, nothing much appears to have been done regarding the many findings of fraud losses by the US government. While various government agencies accept and concur with the GAO recommendations, those recommendations nevertheless remain “open”—meaning not implemented.

The recommendations for more stringent fraud identification and estimation guidelines was agreed to by the Office of Management and Budget, but had not been implemented as of the GAO report’s issuance.

The recommendation that the Secretary of the Treasury develop more stringent tools to estimate and address fraud, as well as to prevent fraud, was accepted by the Treasury Department, yet remained unimplemented as of the GAO report’s issuance.

The inaction is striking, because the agencies involved have not contested the GAO’s report or its findings. The Office of Management and Budget even expressed support for the GAO’s work in this regard.

OMB also expressed support for our ongoing analysis of fraud risks, efforts to estimate program-specific fraud rates to inform future program design, and guidance provided by our Fraud Risk Framework. OMB highlighted its collaboration with us and others to identify and reduce fraud risk. For example, OMB noted collaboration through the Joint Financial Management Improvement Program’s Payment Integrity Initiative and the issuance of a Controller Alert on identifying and assessing fraud risks.55 OMB also described several actions agencies have taken to reduce fraud and improper payments. This includes implementing additional safeguards and investing in antifraud and modernization efforts for state unemployment systems.

Everyone agrees that there is rampant fraud within government operations, and even more waste and abuse…and yet no one has ever felt any sense of urgency about addressing the underlying issues.

Let that sink in: The GAO—the government’s own accounting staff—says that the federal bureaucracy loses $521 Billion to fraud each and every year, and no one in the federal bureaucracy sees that as an urgent problem to be fixed urgently.

We Have Been Here Before

Nor should we lose sight of the fact that we have been here before.

DOGE is hardly the first time the government has undertaken a major government reform initiative with an eye towards rooting out the waste, fraud, and abuse.

President Reagan attempted to do this with in the 1980s with the Grace Commission.

By the authority vested in me as President by the Constitution and laws of the United States of America, and in order to establish, in accordance with the provisions of the Federal Advisory Committee Act, as amended (5 U.S.C. App. I), an advisory committee to study cost control in the Federal Government, it is hereby ordered as follows:

Section 1. Establishment. (a) There is established the Executive Committee of the President's Private Sector Survey on Cost Control in the Federal Government. The Committee shall be composed of not more than 150 members appointed by the President from among citizens in private life.

President Clinton and Vice-President Gore attempted to do this with the National Partnership on Reinventing Government in the 1990s. Both Clinton and Gore touted the project as a great success:

Under Reinventing Government:

$136 billion has been saved since 1993.

Per capita government spending has actually gone down for the first time since President Eisenhower's administration.

With 377,000 fewer employees, the federal government is now the smallest it has been since President Eisenhower.

The National Partnership for Reinventing Government is now working to achieve further progress for the American people:

Even President Obama tried his hand at this, when he created the U.S. Digital Service.

Late last year, a team of digital and technology experts helped to turn-around HealthCare.gov. Today, building on the same proven strategic approach that ultimately enabled millions of Americans to sign up for health insurance, the Administration is launching the U.S. Digital Service. This small team of America’s best digital experts will work in collaboration with other government agencies to make websites more consumer friendly, to identify and fix problems, and to help upgrade the government’s technology infrastructure.

Obama’s effort deserves a particular notice, because that agency is what President Trump repurposed to establish DOGE.

Sec. 3. DOGE Structure. (a) Reorganization and Renaming of the United States Digital Service. The United States Digital Service is hereby publicly renamed as the United States DOGE Service (USDS) and shall be established in the Executive Office of the President.

There is a perverse irony in having an innovator such as Elon Musk tackle something as non-innovative as figuring out government efficiency. We have been through this exercise many times, and it has yet to produce lasting results. We certainly have not succeeded in preventing $521 Billion in annual fraud losses!

What Else Has Gone Wrong? Van Halen’s “M&M Rule”

It would be an extreme exaggeration to say that Elon Musk has detailed voluminous examples of waste, fraud, and abuse within the federal bureaucracy. His tweets are inflammatory, even incendiary, but, as tweets and therefore necessarily abbreviated communications, they do not provide the full factual basis for even a single allegation of fraud.

Yet that is not to dismiss what DOGE has made public, and it certainly is not to demean Elon Musk. Rather, it is to acknowledge the functional limitations of a tweet.

A tweet does not offer the space to provide a detailed ennumeration of all the data which might support a particular claim. Even if Elon Musk were a ruthlessly methodical communicator, the text limitations of his X social media platform inevitably limits what can be readily furnished within that platform.

Yet what Musk does offer up are indications of what has come off the rails within the spending habits of the US Government—i.e., everything. We need to take these indications seriously not just because of the billions and even trillions of dollars that have already been reported to be at stake, but because just these relatively few items that Musk has tweeted out justify subjecting the government to particularly rigorous examination, under what might somewhat flippantly be called the “M&M Rule”.

During their heyday as a 1980s hard rock band, the group Van Halen was infamous for their outrageous behavior. An example that is often touted as proof that the band was a group of prima donnas was the rider in their touring contract that within the amenities to be provided in the band’s dressing room back stage was a bowl of M&M candies, with all the brown ones removed.

That this contract rider really existed has been documented.

Yet it was not until frontman David Lee Roth published his autobiography in 1997 that a pragmatic and practical explanation for that unusual requirement was given:

Van Halen was the first band to take huge productions into tertiary, third-level markets. We’d pull up with nine 18-wheeler trucks, full of gear, where the standard was three trucks, max. And there were many, many technical errors—whether it was the girders couldn’t support the weight, or the flooring would sink in, or the doors weren’t big enough to move the gear through.

… So just as a little test, in the technical aspect of the rider, it would say, “Article 148: There will be 15 amperage voltage sockets at 20-foot spaces, evenly, providing 19 amperes … ” This kind of thing. And article number 126, in the middle of nowhere, was, “There will be no brown M&M’s in the backstage area, upon pain of forfeiture of the show, with full compensation.”

So, when I would walk backstage, if I saw a brown M&M in that bowl … well, line-check the entire production. Guaranteed you’re going to arrive at a technical error. They didn’t read the contract. Guaranteed you’d run into a problem. Sometimes it would threaten to just destroy the whole show. Something like, literally, life-threatening.

Whether Roth’s explanation is true remains a matter of eternal conjecture. However, true or not, the operative logic is both simple and undeniable: the bowl of M&Ms presumably provided the band members with a quick “sanity check” to ensure that the tour promoter had read the contract in full, including all the technical specifications for the stage setup. If there were brown M&Ms they knew that the contract rider had not been read in detail, and the question thus had to be asked “what else did they overlook?”

We need to be applying similar logic to Elon Musk’s tweets regarding DOGE’s work. We need to be treating Musk’s tweets as brown M&Ms and asking ourselves “what else has gone off the rails in government spending?”

The numerous GAO and OIG reports detailing various instances of fraud alone assure us that quite a bit within government spending has gone off the rails.

The inability of the SSA to pass an information systems audit assures us that quite a bit within government spending has gone off the rails.

There is no reason to presume that the $521 Billion in fraud losses reported by the GAO is all the fraud losses there might be within government spending.

There is no reason to presume the $72 Billion in improper payments by the SSA in recent years identified by the OIG are all the improper payments that were made.

We do not know if that is the case because we cannot know if that is the case. We cannot know because what we have is already conclusive proof that there are multiple serious failures of internal controls within multiple agencies within the US government.

What we do know is that the problems DOGE is revealing have been around literally for decades.

What we do know is that prior Presidents from both parties have recognized there were problems and sought to correct them—and largely failed.

What we do know is that our government’s recordkeeping practices are atrocious to the point of incompetence. “Criminal negligence” is not an extreme term to be applied here.

What we do know is that Congress and the federal bureaucracy have had little to no interest in confronting these inadequacies. On that basis alone, Congress has been an abysmal failure as steward of the public fisc, and all 535 members of Congress should be ashamed and humiliated at what is known about the state of the US government’s finances. It is their obligation to both prevent these things from happening and to remedy them when they do happen; they have failed in both aspects.

Neither Elon Musk nor DOGE is telling us anything we did not already know, and that’s the problem.

Will this time be the time that something is finally done to correct the government’s serial information handling inadquacies?

Hopefully the answer is “Yes.” I want the answer to be “Yes.”

I fear the ultimate answer will be something other than “Yes.”

That all of this was known is not as important as it being well publicized now. A GAO or IG report is easily buried on page 12 or completely ignored. Musk putting it out to millions of voters on X cannot. Having Trump looking over everyone’s shoulders should provide all the impetus needed to affect real change.

"While Musk’s tweet is not at all the proof of massive fraud that the Twitterverse has made it out to be, it is very much an indication of the sort of recordkeeping problems that facilitate fraud."

You can be SURE that if fraud is facilitated that it is indeed taking place.