Energy Price Inflation Came...And Went?

Winter Is Coming, Energy Price Inflation Is Fading?

We seem to be missing some inflation lately.

Earlier this year, the media narrative and the economic outlook was for constantly rising energy prices, as energy demand was forecast to outstrip energy supply.

Since the start of 2021, prices for oil and gas have jumped roughly two-fold or more, as demand roars back from the shock of 2020 Covid lockdowns.

The war in Ukraine, which has pushed countries in the West to shun Russian energy supplies, has only sharpened their climb.

As the market heats up, forecasts suggest US production will increase by about one million barrels per day this year.

But that's less than 10%, not enough to meet the rise in demand - and a far cry from the response the last time prices were this high, in 2014, when US oil output jumped 20% and the fracking revolution was in high gear.

Even as recently as the beginning of November, industry analysts and commentators have been predicting a rise in crude oil prices above $100/barrel.

Despite global economic headwinds, oil prices could soon return to above $100 per barrel again, sooner than analysts thought two months ago.

While slowing economies and fears of recession have weighed on oil prices for months, the OPEC+ cuts as of this month and the EU embargo on imports of Russian crude by sea from next month—and of Russian oil products from February 2023—could overtighten the market and send oil above $100 a barrel again.

Goldman Sachs is projecting $125/barrel for crude sometime in 2023.

Oil prices could be headed significantly higher in 2023, especially if China shifts away from its COVID-19 lockdown policies and towards a full reopening, according to Goldman Sachs.

In a Monday note, the bank highlighted that its 2023 forecast for Brent crude oil to trade at $110 per barrel has plenty of upside risk to $125 per barrel due to a consistent decline in inventories and spare capacity. On top of that, there is a risk "of meaningful supply disruptions" in Libya, Russia, Iraq, and Iran, which could send oil prices higher.

Even I, at the beginning of the month, anticipated more energy price inflation on the horizon.

Yet oil prices are not rising, but falling, declining significantly at the same time these inflationary forecasts were being made earlier this month.

Oil prices fell more than 2% at the start of Asia trade on Monday after Chinese officials on the weekend reiterated their commitment to a strict COVID containment approach, dashing hopes of an oil demand rebound at the world's top crude importer.

Brent crude futures dropped $1.58, or 1.6%, to $96.99 a barrel by 2336 GMT, after hitting as low as $96.50 earlier. U.S. West Texas Intermediate crude was at $90.84 a barrel, down $1.77, or 1.9%, dropping to a session-low of $90.40 a barrel earlier in the session.

As of this writing, West Texas Intermediate crude is trading approximately $2 above where it was at the start of the year.

Brent crude is up slightly more year to date, but not much more.

Crude prices peaked during the summer, and have been generally trending down ever since.

Nor is it merely crude oil that is showing a deflationary trend.

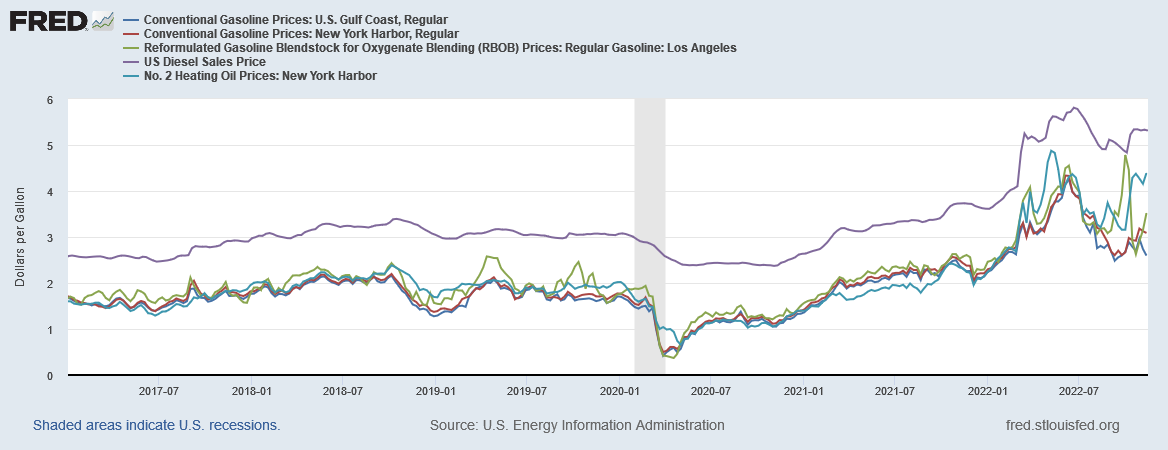

Gasoline, diesel, and home heating oil all peaked earlier this year, only to decline.

Home heating oil is starting to trend up again, but following an initial surge at the beginning of October, prices appear to have somewhat stabilized. While benchmark Reformulated Gasoline Blendstock surged in September, departing from conventional gas prices in the US, RBOB quickly returned to the larger gasoline trend, and while there has been some upward movement in gasoline prices, the surges and price levels are nowhere near what was reported earlier in the summer.

The spot price for natural gas has been dropping since late August.

The spot price for propane peaked in March and, save for a modest uptick in recent weeks, has been declining ever since.

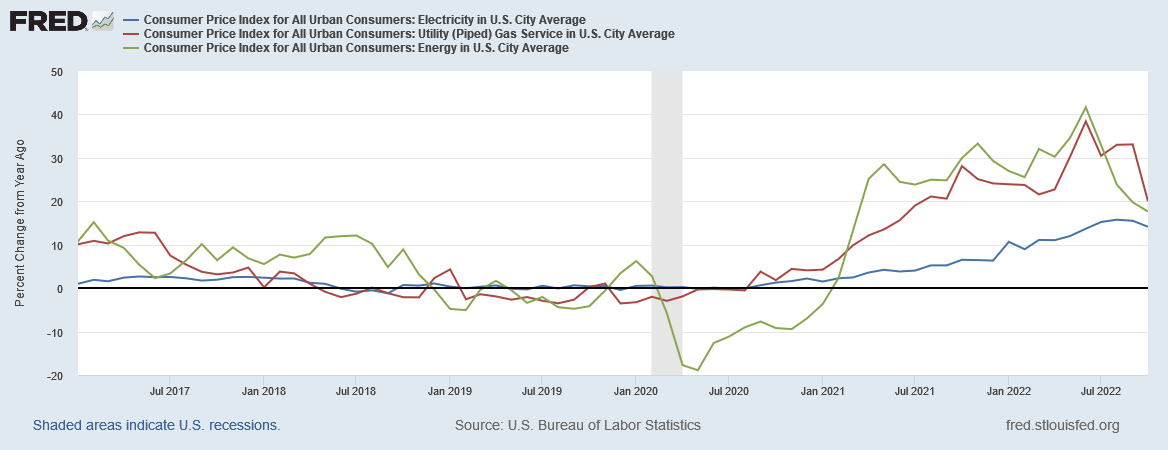

To be sure, all energy prices are well above historical levels, having generally risen post-pandemic and, even with declines are at or above pre-pandemic peak prices.

Yet while energy prices remain high from the historical perspective, energy price inflation itself has been receding since the summer.

While price trends can and do reverse themselves, the current state of energy prices in the US is that the previous expectations of rising (and even skyrocketing) energy prices have simply not been met.

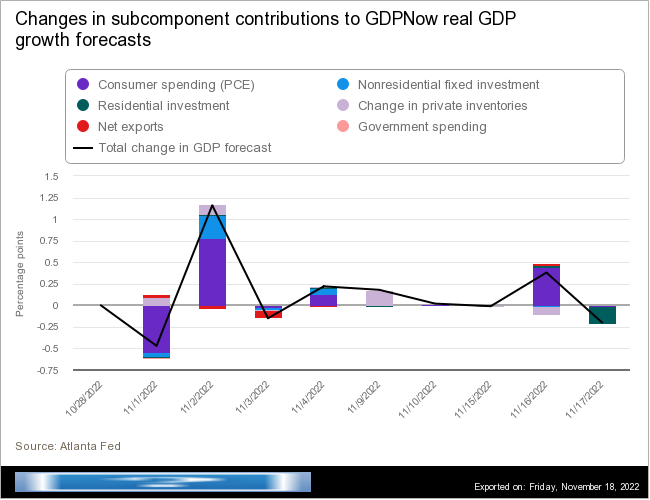

Making the downward trend in energy prices even more counterintuitive is the projection by the Atlanta Fed that the US economy is going to grow rather robustly in the fourth quarter.

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2022 is 4.2 percent on November 17, down from 4.4 percent on November 16. After this morning’s housing starts report from the US Census Bureau, the nowcast of fourth-quarter real residential investment growth decreased from -7.6 percent to -11.7 percent.

The projection is based on strengthening consumer consumption taking up the slack for modest declines in residential and non-residential investment.

Consumer spending is presumably trending up heading into winter, yet energy demand is weakening and pulling energy prices down? Shouldn’t increased consumer spending result in greater energy demand and therefore rapidly rising energy prices?

Certainly that would be the expectation. However, it is not the current reality. Current economic projections and observed energy price trends are diverging. Whether they resolve, reconcile, and ultimately converge once more remains to be seen—with the outcome likely having significant impact on the state of the US economy.

The US economy is either recovering and actually growing, or the stage is being set for an even deeper collapse. Only time will tell which outcome we will have.

The draining of the strategic petroleum reserves and desperate retailers.