Enter The BRICS Non-Currency

BRICS Has A Steep Hill To Climb To Get To Reserve Currency Status

As much as the corporate media has earned its share of opprobrium, given its penchant in recent years for fake news, propaganda, and complete horse hockey, it would be a mistake to assume that the alternative media outlets are immune from such vices.

Thus we must pause to unpack a bit of fertilizer circulating yet again courtesy of Bitcoin News, a news portal with a focus on Bitcoin-related (and generally Bitcoin-friendly) news items. Specifically, we are treated to yet another round of “The Dollar Is Dying, BRICS Is The Dollar Killer” hype.

Heritage Foundation economist and research fellow E. J. Antoni sounded the alarm on the potential calamity of the U.S. dollar losing its reserve currency status in an interview with the Daily Caller News Foundation, published Sunday.

“The Biden administration has taken so many actions to dethrone King Dollar that it would be difficult to rank them all by their destructiveness,” the economist stated, warning:

Losing reserve currency status … would mean 70 years of deficits flooding back to the U.S., all competing with existing dollars held domestically to buy goods and services. That’s a hyperinflation scenario.

“It also means we could no longer export inflation abroad, so we’d bear the full cost of future inflation ourselves,” he opined.

As for what would take the place of the dollar in the world’s stores of foreign exchange reserves, that would be the supposedly upcoming BRICS currency.

One currency that many expect to challenge the dominance of the U.S. dollar is the proposed BRICS currency. The economic bloc comprises Brazil, Russia, India, China, and South Africa. Russian news outlet RT recently claimed that the BRICS nations are launching a gold-backed currency. Antoni opined: “A gold-backed currency represents a real threat to all fiat monies, including the dollar.”

If BRICS launches a currency it might dethrone the dollar at some point. Right now there is no BRICS currency, and there are some fairly large obstacles to BRICS launching a currency.

This latest round of the BRICS currency rumormongering begins with a well-timed tweet earlier this month from Russia-backed media outlet RT:

The impetus for this news item appears to be a statement from Russia’s embassy in Kenya that the BRICS summit next month will include the introduction of a BRICS currency backed by gold. The RT news blurb was first picked up on July 9 by Bitcoin News, a few days after it appeared.

Intriguingly, the RT item appeared to be confirmed by The Times of India shortly after it first appeared.

The BRICS alliance with Brazil, Russia, India, China & South Africa is planning to float a new currency to settle international trade payments to challenge the global reserve status of the US dollar. The bloc of the five nations is likely to jointly decide on floating a new BRICS currency during its next summit in August, 2023 to be held at Johannesburg in South Africa. Although all other countries constituting BRICS, including Brazil, Russia, China, and South Africa seem to be on the side of issuance of a common BRICS currency, India seems to be the only country that has not shown interest in the plans to launch a new currency.

The BRICS countries’ development bank, the New Development Bank, stated publicly that developing an alternative to the dollar is an “ambition” for the bank, but in the “medium to long term”.

Leslie Maasdorp, vice president and chief financial officer of the New Development Bank, also known as the BRICS Bank, shared some information about the economic bloc’s common currency plan in an interview with Bloomberg on Wednesday. The New Development Bank was established by the BRICS nations to mobilize resources for infrastructure and sustainable development projects in emerging markets and developing countries.

He explained that while BRICS members are pushing for the use of national currencies, shifting away from the U.S. dollar, the BRICS does not have an immediate plan to create a common currency to challenge the dominance of the USD. Noting that the BRICS Bank has the U.S. dollar as its anchor currency, he described:

The development of anything alternative is indeed a medium to long-term ambition.

However, as of July 20, South Africa, the host of the summit, is denying that a new currency is even on the agenda.

A BRICS currency will not be on the agenda of the bloc's summit in South Africa next month, but Brazil, Russia, India, China and South Africa will continue to switch away from the U.S. dollar, South Africa's senior BRICS diplomat said on Thursday.

"There's never been talk of a BRICS currency, it's not on the agenda," Anil Sooklal, South Africa's Ambassador at Large: Asia and BRICS, told a media briefing.

As I have observed previously in discussing CBDCs, a key criterion for a successful currency is acceptability.

It is rather difficult to see how acceptability for a potential BRICS currency is achieved by denying it will even happen. Surprise is not something that bodes well for currency strength.

We should keep in mind, also, that this is not the first mention of a BRICS currency to displace the dollar as the world’s premier reserve currency. The suggestion was made last year after the close of the 2022 BRICS summit by Russia President Vladimir Putin.

Russian President Vladimir Putin has suggested that the BRICS countries – Brazil, Russia, India, China and South Africa – are working on a new global reserve currency.

“The issue of creating an international reserve currency based on a basket of currencies of our countries is being worked out,” he said at the BRICS business forum.

According to the Russian president, the member states are also developing reliable alternative mechanisms for international payments. The group said it was working on setting up a joint payment network to cut reliance on the Western financial system. The BRICS countries have also been boosting the use of local currencies in mutual trade.

The denial by South Africa that a new currency is even on the agenda indicates Putin’s suggestion has not exactly been embraced by Russia’s partners in the economic bloc.

Meanwhile, India, as the Times of India quote above shows, has come out definitively against the idea of a BRICS currency.

Foreign minister S. Jaishankar said that the five-member BRICS group – consisting of Brazil, Russia, India, China, and South Africa – isn't currently planning to develop a greenback substitute for trade and investments.

"On what we will discuss at the BRICS meeting, we'll have to see because there are many other issues – but there is no idea of a BRICS currency," he said, as shown by footage from the Hindustan Times.

As the Times of India article elaborated, India has particular and definitive reasons for not backing a BRICS currency:

India particularly is skeptical about the intentions of China for the following reasons:

India is wary of China’s power & her prowling nature, and hence wants to remain alert of thepossibility of China, a communist & authoritarian country using BRICS for her self-interest.

India feels theBRICS alliance is becoming China-centricmaking the communist nation the recipient of international trade deals.

India feels, Xi Jinping ledChina is trying to become a global economic and military superpower and BRICS could be the stepping stone to achieve her goal.

China is pressurising several countries to settle trade using Chinese Yuanto outdo every other member of BRICS to enable China to follow her plan of action & impose Xi Jinping’s vision of the global order, once the new currency reigns on the international stage.

China and India have been at odds for more than a decade now despite being together as members in BRICS. It is noteworthy that India previously banned Chinese goods from entering the country and placed a ban on Chinese apps, including TikTok, a short-form video hosting service and Shein, the Chinese online fast fashion retailer.

India is therefore rightfully worried that Beijing is using the platform of BRICS for imposing President Xi Jinping’s vision on the countries of the world by dethroning the US dollar & becoming a global economic & military superpower.

While there is no inherent obstacle precluding the BRICS countries from creating a new currency, the devilish details that would need to be resolved before it could be launched rather preclude its being launched when two of the primary BRICS countries are at loggerheads. If India says “no currency”, chances are very good there will be “no currency.”

Yet the challenges confronting the creation of a BRICS currency extend far beyond the desire of the member states.

First and foremost, there is the challenge of a growing BRICS membership. There are a number of countries interested in joining the economic bloc, which currently consists of just the five countries Brazil, Russia, India, China, and South Africa.

The question of how far and fast to expand the club - centred around Brazil, Russia, India, China and South Africa - is top of the agenda at the summit of nations seeking to offset to the perceived hegenomy of the U.S.-led West in global affairs.

Aside from the 22 countries that had formally asked to join, Sooklal said there was "an equal number of countries that have informally expressed interest in becoming BRICS members ... (including) all the major global south countries".

To launch a BRICS currency union, just as was the case with the EU, the member states, new and existing, will have to accede to the currency. While the economic benefits among the “global south” countries—essentially those nations not part of the G7/G20 group of nations1—of joining a common economic and trading alliance could be considerable, countries cannot simply swap currencies the same way one might swap hats.

Keep in mind it took nearly a decade for the European Union to progress from the Treaty of Maastricht in 1991 to the launch of the euro in 19992. If the BRICS countries started work on a currency treaty this August, they might potentially have the treaty ready for acceptance by the member states by next year’s conference, and possibly be ready for formal currency launch some time in the mid-2030s. It is difficult to believe the BRICS countries would be able to complete the necessary negotiations and preparations in a shorter time frame than the EU required to launch the euro.

Mid-2030s for a currency launch is an optimistic timeline for such an event.

Could BRICS launch a currency? Absolutely. But next decade, not next month.

Even if the political will to establish the currency is there, the question of a central bank to manage the currency would still have to be addressed. The BRICS Bank might have ambitions for floating its own currency, but what it does not have is enough money to float its own currency.

With $10.4 Billion in equity, $12.3 Billion in liabilities, and $22.7 Billion in assets3, the BRICS New Development Bank lacks the capitalization necessary to even think about floating its own currency.

With 20+ countries formally asking to join BRICS and another 20+ seriously thinking about it, the New Development Bank also has to address the issue of how to spread the capitilization among new members joining BRICS. Currently, the capital of the bank is largely distributed among the founding BRICS countries.

While these are all resolvable issues, they are still issues and will not be addressed in a single day or even a single summit, especially with new member nations clamoring to join.

Finally, once the internal hurdles of actually creating the currency are overcome, the currency still has to prove itself in the global marketplace as a suitable substitute for the dollar. That’s not going to be a given.

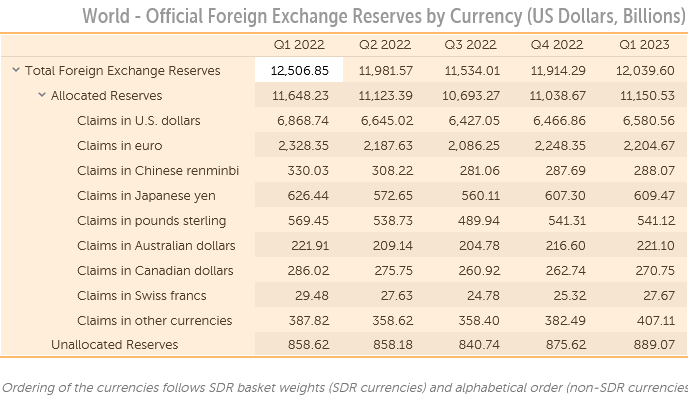

Despite all of the hype surrounding “de-dollarization” and the presumed interest in countries using a currency other than the dollar for its foreign currency transaction, the reality is that in the first quarter of 2023, the dollar’s share of total global reserves per the International Monetary Fund has actually increased4.

First Quarter 2023 actually is the second consecutive quarter that US Dollar reserves increased in the world.

While total foreign exchange reserves fell during the first three quarters of 2022, as of the end of the first quarter of 2023, the dollar was at 95.7% of its First Quarter 2022 level, while the Chinese remninbi/yuan was only at 87.3% of its First Quarter 2022 level.

To the extent there is a trend in foreign exchange reserves, at the moment that trend is towards the dollar rather than away from it.

Moreover, while the dollar has been somewhat in decline as the currency used in cross-border payments in recent years, the currency benefiting from that decline has been the euro, not the remninbi/yuan5.

The dollar might be decreasing in SWIFT payments, but so is every other currency except the euro.

Additionally, while there is talk of the “weakening dollar”, that narrative focuses mainly on the dollar index, which measures the value of a dollar against a basket of currencies. With respect to a potential BRICS currency, it is surely instructive that one currency against which the dollar has strengthened this year has been the Chinese yuan.

Before a BRICS currency can compete with the dollar in forex markets, it first has to find its starting position in forex markets. With China being perhaps the most significant economy within BRICS, the Chinese yuan is almost certainly going to weigh heavily on that initial valuation. If the yuan is weakening against the dollar how likely is it that the proposed BRICS currency would fare much better at least initially?

“De-Dollarization” is a media boogeyman of the moment, whose purpose appears to be more centered on “clickbait” rather than substantive analysis of the issues—and the issues have not substantially shifted since the last time I explored this topic.

While they do not preclude the eventual displacement of the dollar by another currency, the economic and financial dynamics necessary for that displacement to occur are not anywhere near fruition at the present time.

As I opined to a reader at the time:

Will the dollar eventually be replaced as the world's premier reserve currency?

Absolutely. And just as soon as a better alternative comes along.

That has always been the case, and it will always be the case.

The dollar’s days as the global reserve currency are numbered, and have been numbered for years if not decades. There will eventually be a better option for global reserve currency than the dollar, and when that better option does arrive, it will quickly displace the dollar as the leading currency internationally.

However, the dollar’s day is not yet done, and it has a number of years left before it is displaced as the world reserve currency. It certainly has a number of years before the BRICS non-currency can gain the necessary strength to do the displacing.

Mahler, Anne Garland. 2017. "Global South." Oxford Bibliographies in Literary and Critical Theory, ed. Eugene O'Brien. https://globalsouthstudies.as.virginia.edu/what-is-global-south

Directorate-General for Communication, European Union. Euro – History and Purpose | European Union. https://european-union.europa.eu/institutions-law-budget/euro/history-and-purpose_en.

New Development Bank. Investor Relations. Mar. 2022, https://www.ndb.int/wp-content/uploads/2022/11/Investor-Memo_202203.pdf.

International Monetary Fund. Currency Composition of Official Foreign Exchange Reserves (COFER). 30 June 2023, https://data.imf.org/?sk=e6a5f467-c14b-4aa8-9f6d-5a09ec4e62a4.

Perez-Saiz, H., et al. Currency Usage for Cross Border Payments. 24 Mar. 2023, https://www.imf.org/en/Publications/WP/Issues/2023/03/24/Currency-Usage-for-Cross-Border-Payments-531324.