First Time Unemployment Numbers Dropped Last Week. Does That Mean August Inflation Will Rise?

August Likely Will Give The Fed No Comfort That It Is Winning The Inflation Fight

Jobless claims are presenting a mixed message this week with regards to the Fed’s ongoing but misguided fight against consumer price inflation.

This week’s Weekly Unemployment Insurance Claims Report showed some positive news for job seekers, with first time claims dropping 6,000 on a seasonally adjusted basis.

In the week ending September 3, the advance figure for seasonally adjusted initial claims was 222,000, a decrease of 6,000 from the previous week's revised level. The previous week's level was revised down by 4,000 from 232,000 to 228,000. The 4-week moving average was 233,000, a decrease of 7,500 from the previous week's revised average. The previous week's average was revised down by 1,000 from 241,500 to 240,500.

This optimistic note was moderated, however, by a rise in continuing claims.

The advance seasonally adjusted insured unemployment rate was 1.0 percent for the week ending August 27, unchanged from the previous week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending August 27 was 1,473,000, an increase of 36,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 1,438,000 to 1,437,000. The 4-week moving average was 1,439,000, an increase of 10,750 from the previous week's revised average. The previous week's average was revised down by 250 from 1,428,500 to 1,428,250.

While declining initial claims is indicative of labor market strength (and is thus potentially a signal for rising inflation), rising continuing claims indicate the exact opposite, as it means people who are unemployed are remaining so for longer period.

Overall the changes in unemployment claims suggest a sideways movement where the unemployment situation is getting neither better nor worse.

Ultimately, this does not bode well for the Fed’s inflation fight, as it suggests inflation rates won’t be coming down much if at all when the August numbers come out next Tuesday. While there may be some marginal decrease in consumer price inflation, it is likely to be a marginal drop that leaves consumer price inflation well above 8% year on year.

Producer Price Inflation Continues To Signal Peak Inflation Is Past

Other indicators of what August inflation holds in store similarly suggest at most a marginal drop in the Consumer Price Index.

Producer Price Inflation here in the US trended down in July, dropping by more than 5% year-on-year from June—a significant disinflationary signal, particularly in light of July’s concurrent decrease in Consumer Price Inflation (remember, PPI is generally seen as a leading indicator for changes in CPI).

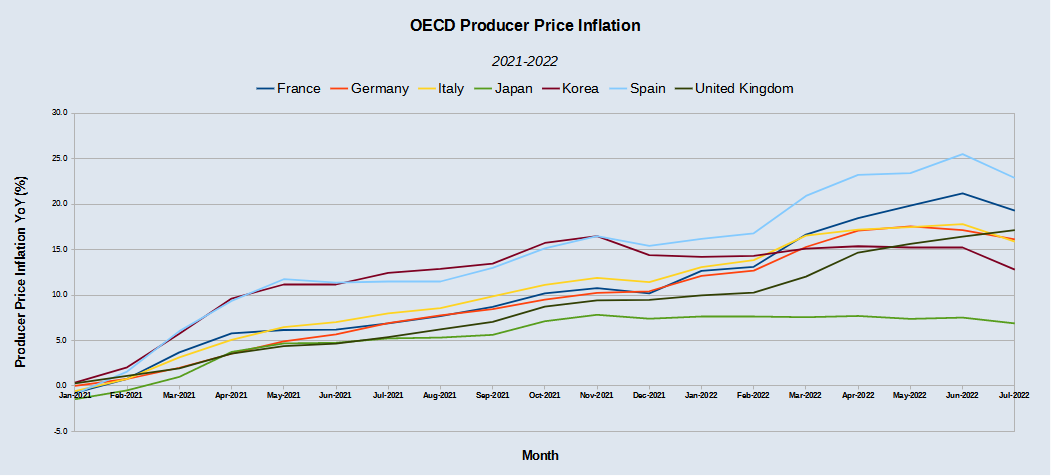

Globally, producer prices are sending the same disinflationary signal, as year-on-year PPI declined across the OECD countries in July.

However, none of these signals suggest a major drop in consumer price inflation is likely for August. Marginal decreases are the best this data suggests.

A Ray Of Hope From The Cleveland Fed’s CPI Nowcast

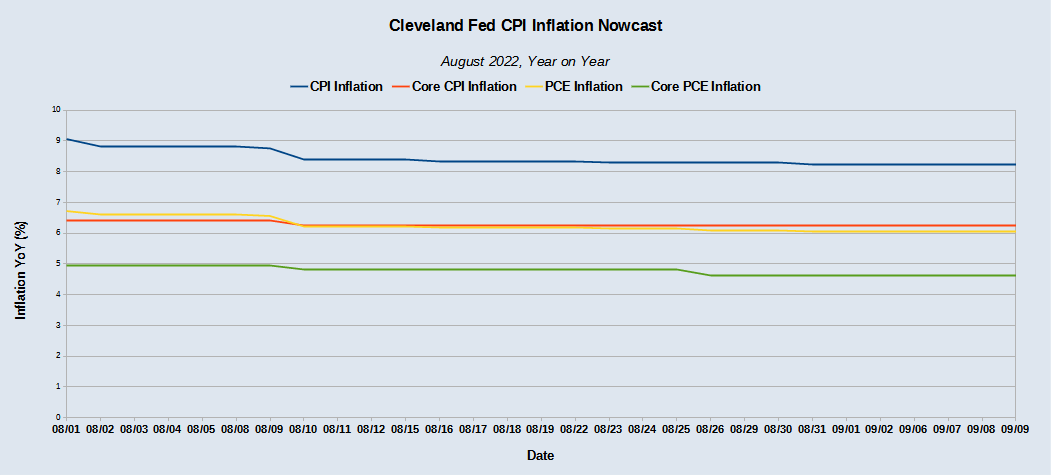

All is not lost for the Fed, however, as the Cleveland Fed’s CPI Nowcast for August suggest that non-core CPI inflation may be about to decline significantly month-on-month.

While core CPI barely moved within the August nowcast, overall CPI has dropped significantly, from a month-on-month projection of 0.53% to 0.06% as of August 31. The Fed’s preferred inflation indicator, the Personal Consumption Expenditures index, is showing a similar decrease overall but not in core inflation.

The difference between overall and core inflation for both the CPI and PCE indices is the inclusion of energy and food price inflation in the overall index. Because food and energy prices are prone to greater volatility, excluding them from the “core” index yields a more consistent picture of the broader macroeconomic inflationary trend.

However, even a significant month-on-month decline in consumer price inflation does not translate into significant movement for the more commonly reported year-on-year figure, and the Cleveland Fed CPI nowcast is no different, with the current year-on-year projection for August coming in at 8.24%

Pricing In Food And Energy Suggest Peak Inflation Has Passed For Both

One definite hopeful signal for August’s inflation numbers is the easing of food price inflation found in high-frequency data sources such as Datasembly’s Grocery Price Index. While the GPI has been charting significant price increases since last summer, for August the index largely flattened out, charting neither significant increase or decrease.

At the same time, spot prices on commodity markets for energy goods such as natural gas, gasoline, and crude oil declined during August.

These positive trends in food and energy prices reinforce the Cleveland Fed’s nowcast projection of a significant drop in non-core consumer price inflation. At the very least, food and energy prices are not likely to have gotten worse during August.

Stalemate: Economy In Recession With Inflation Still High

Unfortunately for the Fed, while several signs point to a marginal drop in consumer price inflation for August, the economy remains mired in recession, with housing sales dropping significantly in July and the Atlanta Fed’s GDPNow nowcast of Real GDP growth projecting an anemic 1.3% for the third quarter (and dropping). Recession plus inflation equals stagflation, and that is exactly what is emerging in the data: a true stagflationary scenario as bad as or even worse than what was experienced during the 1970s.

With important economic sectors like retail sliding farther into recession even as prices remain high, marginal improvements in inflation are hardly a win for the Fed. Indeed, deepening recession coupled with high inflation is more like an economic variant of the Chinese execution method “Death Of A Thousand Cuts” (lingchi, 凌遲)—a slow, drawn out, lingering economic decline perhaps even leading to outright economic collapse.

Marginal improvements in consumer price inflation when that inflation is more than 3 times the long-term pre-pandemic average are not improvements at all, but are little more than statistical noise. Moreover, they offer little buffer against future exogenous shocks, such as further supply chain dislocations emanating from China thanks to Xi Jinping’s ongoing Zero COVID lunacy.

For all of Jay Powell’s hawkish rhetoric at Jackson Hole and since, the unfolding economic reality of inflation in the United States is that Powell and the Fed are well and truly stalemated in their efforts to contain it. With interest rates a problematic weapon at best against inflation, short of an apocalyptic multi-percentage-point increase in the federal funds rate there is little Powell can do to get on top of inflation—and a sudden increase in interest rates of that magnitude would roil credit markets to such a degree that it would be an economic collapse all on its own.

This much is certain: Jay Powell is not winning his fight against inflation. With a fall of likely ongoing shocks to the system emanating from China and Europe, as the geopolitical and economic situations in both regions deteriorate in dramatic fashion, Powell is perilously close to suffering a major setback against inflation.

While the media and Washington will likely try their level best to spin any drop in consumer price inflation during August as a policy win, the reality is there is likely no comfort to be had in August’s forthcoming inflation data.

I will preface this comment by saying that I am not an economist and do not what the hell I am talking about. However, it seems to my simple mind that the current inflation situation is a result of two root causes: oversupply of money and an under-supply of goods. Shrinking the fed’s balance sheet and raising interest rates does nothing to address the under-supply of goods. In fact, higher interest rates may inhibit production of goods and exacerbate under-supply. Raising corporate income taxes also penalizes supply. So my question is: Has anyone proposed addressing under-supply by providing incentives for production like tax credits for the production of energy and food?

My personal portfolio is perhaps foolishly overweight natural gas pipeline companies. Therefore I'm sensitive to spot prices of natgas.

Contrast ridiculously cheap natgas in the US to ridiculously expensive natgas in Europe. So while we pad the pockets of US weapon makers here in the US by sending things that go boom to Ukraine, US politicians care not a whit about whether our European friends will freeze this winter. The proof is right there in your charts.