Forget October's Bad News, Focus On November's Good News

November Jobs Data Is Good, But Still Just One Month

One month does not a trend make. One good month does not a good trend make.

Corporate media and Wall Street would do well to remember this little cautionary when assessing the November Employment Situation Summary. The jobs data is definitely an improvement over October—but it is still only one good month, against a backdrop of several months of less than good data.

Total nonfarm payroll employment increased by 199,000 in November, and the unemployment rate edged down to 3.7 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care and government. Employment also increased in manufacturing, reflecting the return of workers from a strike. Employment in retail trade declined.

Perhaps even more surprising was the relatively small prior months revisions: just 35,000 jobs disappeared from the September data.

The change in total nonfarm payroll employment for September was revised down by 35,000, from +297,000 to +262,000, and the change for October remained at +150,000. With these revisions, employment in September and October combined is 35,000 lower than previously reported.

There is no denying that these are better numbers than we had last month, and when we drill into the detail most of the underlying numbers are likewise an improvement.

However, this one good month does not by itself eliminate the deficits of the previous months, and we do well to remember that.

November was a good month for jobs relative to October, but that is before we consider the potential for prior months corrections. If the BLS jobs data from the Establishment Survey shows anything at all it is that there will be revisions over the subsequent two months.

We have certainly seen this over the past few months, where the jobs data has been consistently revised downward.

Even if we look back during the summer months, we see the jobs data being almost always revised.

Overall, throughout 2023, the BLS has through subsequent revisions to the Establishment Survey data eliminated 372,000 previously reported jobs.

October stands out as the first month all year where there were no revisions in the month immediately following, and is one of only four months where there was not a downward revision in the month immediately following. With only two months through September showing positive revisions in the second month immediately following, we should at year end and in January expect to see some revisions to October and November, and most likely those will be downward revisions. The 199,000 jobs reported in the November report are not likely to last for very long.

Corporate media, for its part, completely ignored the BLS’ history of revising the jobs data downward, preferring instead to simply swoon over the current data beating Wall Street expectations.

Job creation showed little signs of a letup in November, as payrolls grew even faster than expected and the unemployment rate fell despite signs of a weakening economy.

Nonfarm payrolls rose by a seasonally adjusted 199,000 for the month, slightly better than the 190,000 Dow Jones estimate and ahead of the unrevised October gain of 150,000, the Labor Department reported Friday.

Instead of looking at the November report in the context of the entire year to date, corporate media looked at the numbers and declared the economy robust, healthy, and far from recession.

Employers added 199,000 jobs last month, the Labor Department reported Friday, while the unemployment rate dropped to 3.7 percent, from 3.9 percent. The increase in employment includes tens of thousands of autoworkers and actors who returned to their jobs after strikes, and others in related businesses that had been stalled by the walkouts, meaning underlying job growth is slightly weaker.

Even so, the report signals that the economy remains far from recession territory despite a year and a half of interest rate increases that have weighed on consumer spending and business investment. Reinforcing the picture of energetic labor demand, wages jumped 0.4 percent over the month, more than expected, and the workweek lengthened slightly.

Wall Street responded mostly positively, with equities rising on the day.

The initial reaction to the jobs data was quite enthusiastic, although there was some profit-taking and a bit of reality setting in later in the day.

Treasury yields, on the other hand, were rather more cynical of the data, with yields surging on the report, and largely holding afterwards throughout the day.

The increase is being attributed in the corporate media to lowered expectations of of future rate cuts by the Fed as a result of this “strong” jobs report. Next March is the earliest month Wall Street anticipates any rate reductions from the Fed, and Wall Street is pricing in lower probabilities of rate reductions in March.

With the BLS highly likely to eliminate some of the 199,000 jobs reported in November over the next two reports, Wall Street’s assessment of what the Federal Reserve will do next March as a result is problematic at best.

We should also pause to consider that, while the Employment Situation Summary is relatively good news overall, we still should not ignore that the data is always being at least somewhat massaged if only through the seasonal adjustment process. If we look at the seasonally adjusted and unadjusted data from the Establishment Survey, we see the unadjusted jobs number actually declining from October to November.

Even the employment level numbers from the Household Survey are a little rosier after seasonal adjustments.

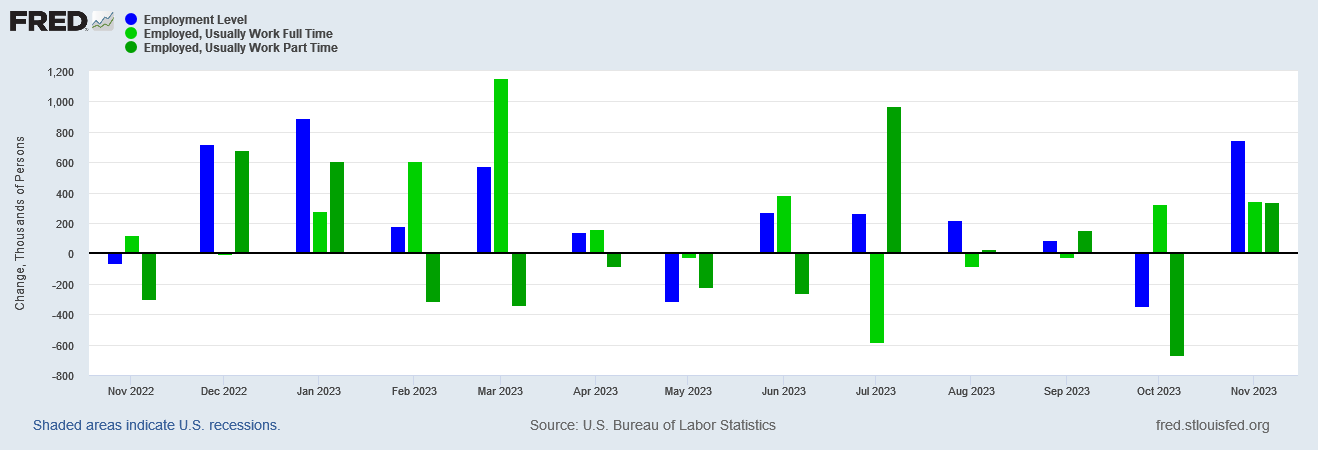

Moreover, according to the seasonally adjusted data from the Household Survey, half of the jobs created in November were part time jobs.

Part-time employment is considerably less helpful and considerably less of an economic plus than full time employment. With a large percentage of new jobs coming from part time employment, the data becomes rather less optimistic just on that alone.

Within the unadjusted data, full time employment per the Household Survey actually fell in November.

That would mean the jobs gains for November were entirely from part time employment, which arguably is a sign of economic weakness rather than strength.

Nor should we overlook the many months of jobs weakness that we have seen over the past few years. While the Establishment Survey numbers (seasonally adjusted) show modest job growth since the beginning of 2021 at 9.9% for nonfarm payrolls and 10.7% for private nonfarm payrolls, and the ADP jobs report shows similar growth at 10.5%, the Household Survey lags the other metrics and has done so persistently since March of 2022, when the Household Survey reported a plateau in job growth for most of the summer last year. With another plateau having occurred this year as well, jobs growth per the Household Survey’s employment level is only 8.1% since 2021.

November might have been a good month for jobs, but there needs to be much more than one good month to overcome the job growth deficits of 2022 and early 2023.

If we look at the month on month changes in the jobs levels for both the Household and Establishment Surveys, we see that job growth overall has been steadily weakening especially in 2023, with the Household Survey showing occasional spikes of employment growth.

The November surge in the Household Survey suggests November was much more of an outlier than corporate media wants to admit.

The Household Survey confirms this assessment that, while November is a good month, it does not overcome the many months of weak or negative data.

Indeed, across the board the Household Survey shows that the bulk of improvement in the jobs picture occurred during 2021, and employment growth in 2022 and 2023 has been rather more problematic.

If we index the Household Survey data to January of 2022, we see that unemployment is only 3.4% lower for November 2023 than it was at the beginning of 2022, while labor force participation actually did not change from 2022.

If we index the data to January of 2023, the results are not at all pleasant, with unemployment actually increasing since January of 2023 by 10.5%, compared with relatively modest job “gains” for Nonfarm and private nonfarm payrolls.

That unemployment declined in November from October does not eliminate unemployment’s rise for the year. November is an improvement, but only a modest one.

Even when we look at the average hours worked, while November does show more hours worked than October, overall the workweek is still shorter now than at the beginning of 2023.

The workweek is shorter still relative to the beginning of 2021.

Among goods-producing jobs, the workweek is longer now than in 2021 only for construction. For every other goods-producing category, people are working less now than previously.

Wages tell a similar story. While nominal wages have been rising, they have not been rising as fast as consumer price inflation since January of 2021 at least.

Only if we include the last year of the Trump administration, 2020, do we show any semblance of real wage growth in the past few years.

Wages may be rising now, but they have a long way to rise before they have overcome the effects of inflation in the post-pandemic era.

Ultimately, that is the real takeaway from the November jobs report. The data is good, but it is not great. While the jobs numbers show overall gains even when we drill down into the detail, the good data from November does not overcome the months of less than good data that preceded it.

The notion that the November jobs report alone proves the economy is not anywhere near recession territory is itself simply absurd. The many other signs of recession are still there, and are still standing as recessionary red flags.

The 3rd Quarter GDP numbers are still not that impressive.

October’s Producer Price data still shows the economy mired in stagflation and drifting towards deflation.

The October JOLTS data still shows recession spreading through the economy.

All of these signals still stand, and the November jobs data does not undo a single one of them.

One month is not a trend, and one good month is not a good trend. Corporate media wants to overlook that reality. Wall Street has completely forgotten that reality. My recommendation, for what it’s worth: remember that reality.