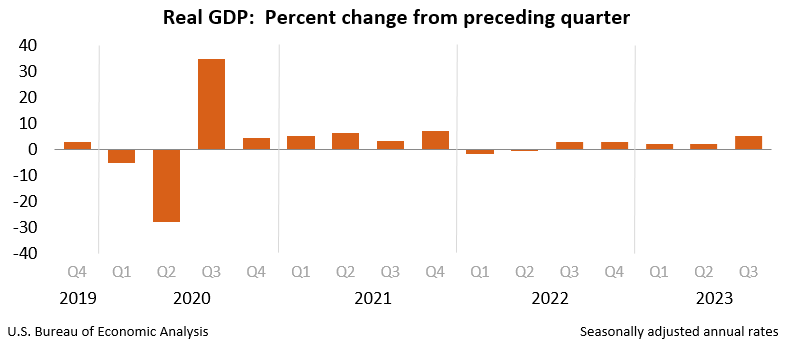

If we take the Bureau of Economic Analysis at face value—key word being “if”—the US economy grew at a respectable 5.2% annualized rate during the third quarter of 2023.

Real gross domestic product (GDP) increased at an annual rate of 5.2 percent in the third quarter of 2023 (table 1), according to the "second" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 2.1 percent.

On its face, this is a remarkable performance for the US economy, with third quarter economic growth printing at more than double second quarter growth.

Was the third quarter really that good? Let’s drill into the data and see if the detail supports the headline figure.

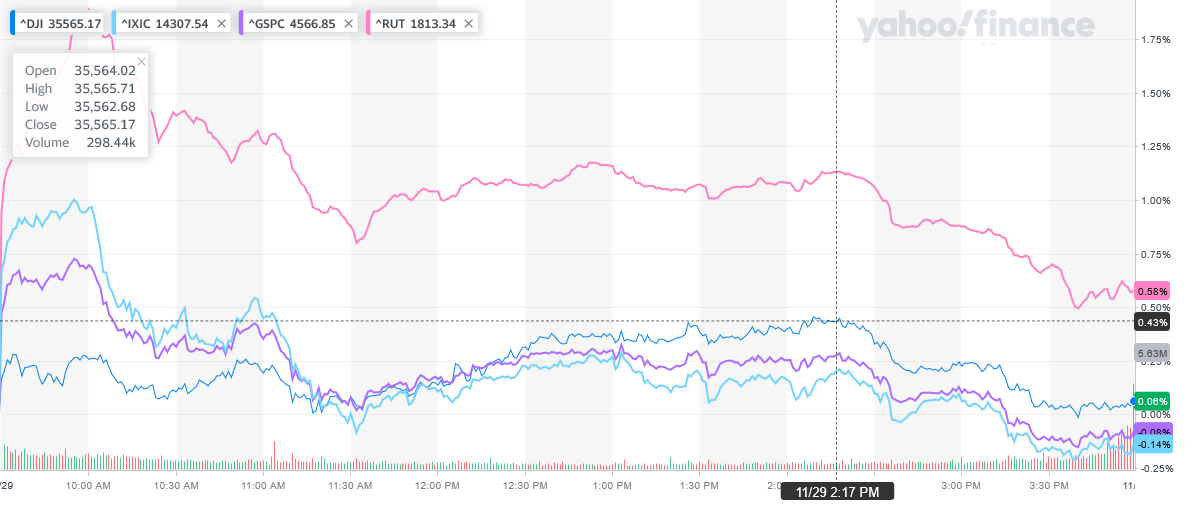

We should note first that Wall Street was not all that impressed with the BEA report. An early rally in the stock markets faded throughout yesterday, with only the Dow Jones index holding on to any gains.

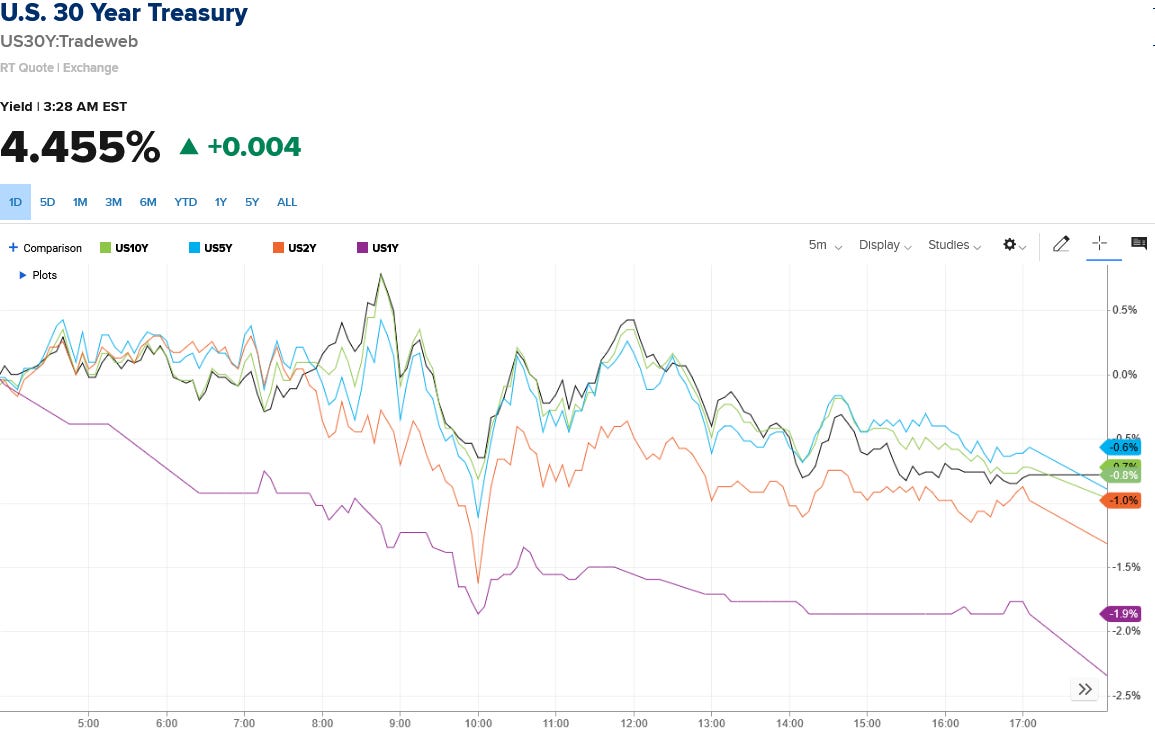

Treasury yields responded rather more positively, with yields trending down throughout the day.

A doubling of the prior quarter’s economic performance should count as very good news, so why was Wall Street so nonplussed by the third quarter GDP numbers?

Part of the reason for the muted reaction has been the Fed’s own mixed messaging on the future of its rate hike strategy, with some voices indicating the rate hikes were over, and that rate cuts might even be in the offing.

Fed Governor Christopher Waller, a hawkish and influential voice at the central bank and seen to be close in thinking to Fed boss Jerome Powell, clearly indicated the Fed's swingeing rate hiking was over as current settings bear down on inflation.

"I am increasingly confident that policy is currently well positioned to slow the economy and get inflation back to 2%," he said, and also "reasonably confident" of doing so without a sharp rise in the unemployment rate, now at 3.9%.

Other Fed governors, particularly Michelle Bowman, continue to argue for at least one more rate increase.

Bowman said Tuesday while speaking at the Utah Bankers Association and Salt Lake City Chamber Banker and Business Leader Breakfast that the level of inflation remains high and recent progress has been uneven.

Bowman said she thinks much of the improvement in inflation so far has been thanks to the resolution of supply-chain bottlenecks and that it’s unclear if that will continue to lower inflation. She also thinks there’s a risk too few workers could put upward pressure on inflation and also said government policies such as the CHIPS Act and Inflation Reduction Act could be inflationary.

"My baseline economic outlook continues to expect that we will need to increase the federal funds rate further to keep policy sufficiently restrictive to bring inflation down to our 2% target in a timely way," she said.

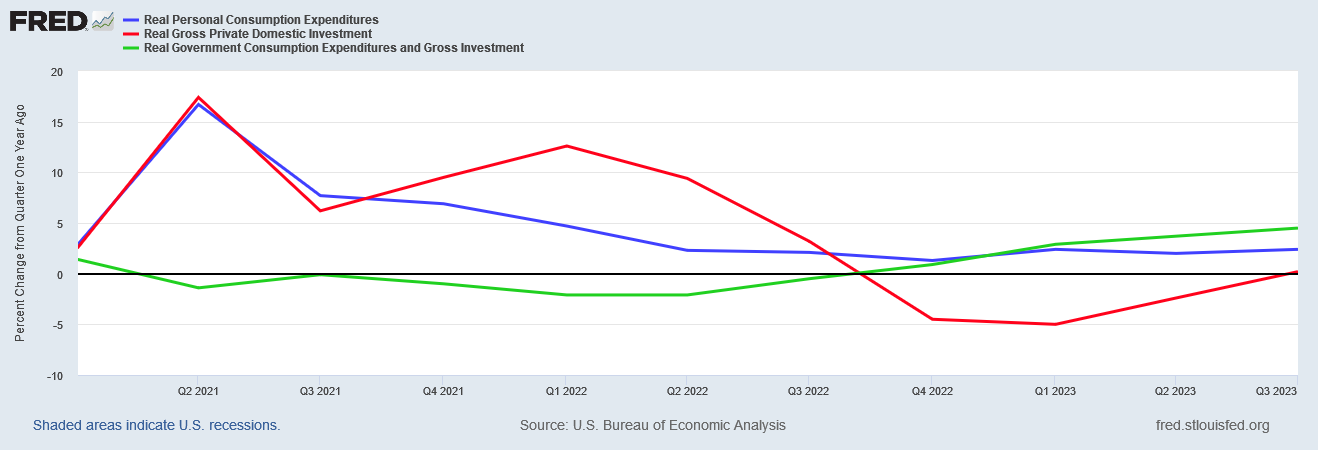

Both the corporate and alternative media also took note of the fact that the BEA numbers, while good in the aggregate, also contained a decrease in consumer spending—not a good sign for an economy largely powered by consumption.

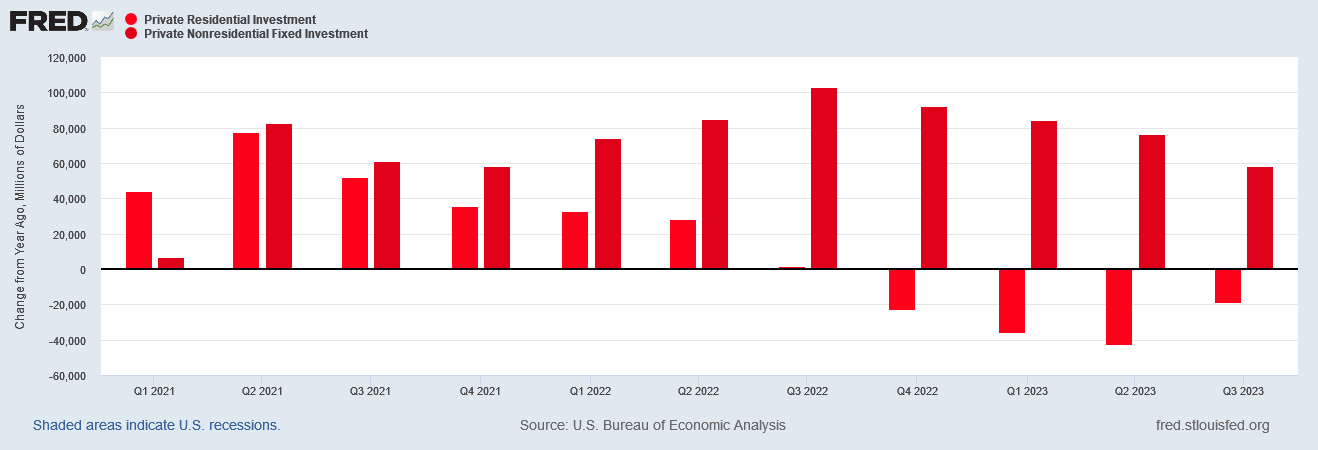

Primarily, the upward revision came from increases in nonresidential fixed investment, which includes structures, equipment and intellectual property. The category showed a rise of 1.3%, which still marked a sharp downward shift from previous quarters.

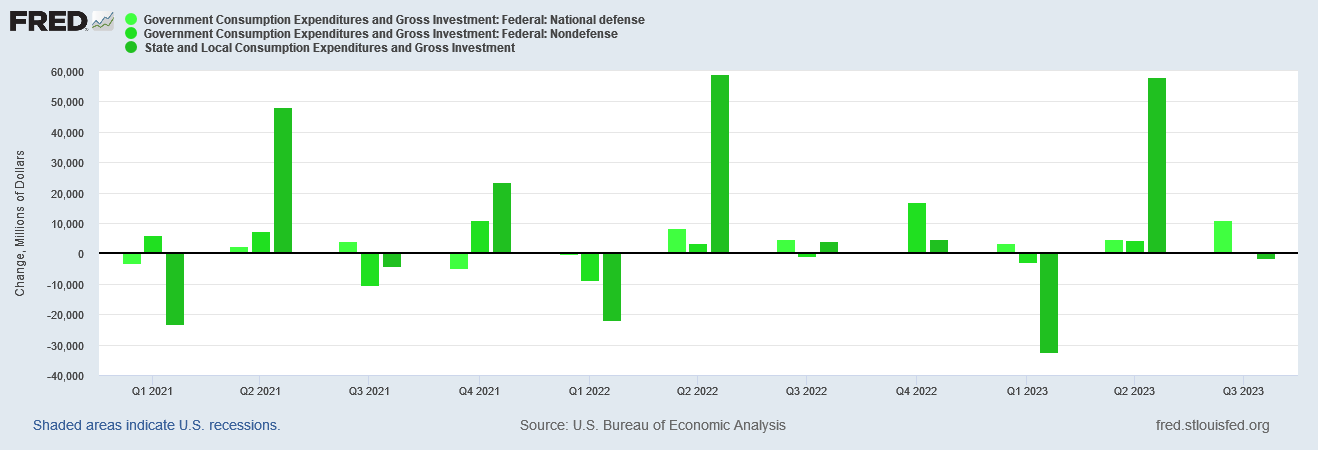

Government spending also helped boost the Q3 estimate, rising 5.5% for the July-through-September period.

However, consumer spending saw a downward revision, now rising just 3.6%, compared with 4% in the initial estimate.

At a minimum, Wall Street itself is viewing the BEA data somewhat askance. There are reasons why.

A major reason for the muted response in the marketplace to the economic data is the fact that the economic data even in the aggregate has been uneven for the past few years.

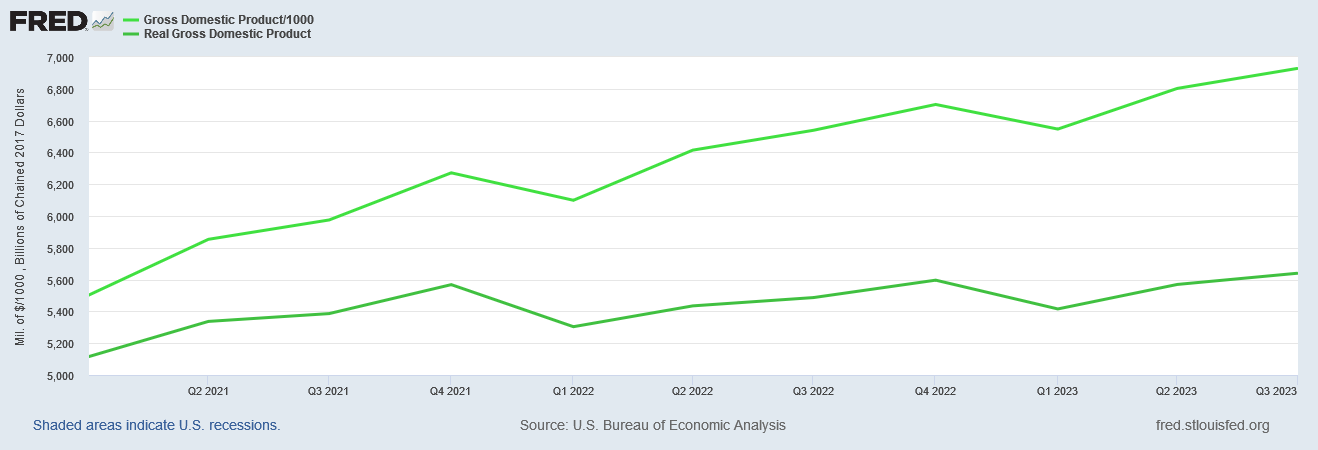

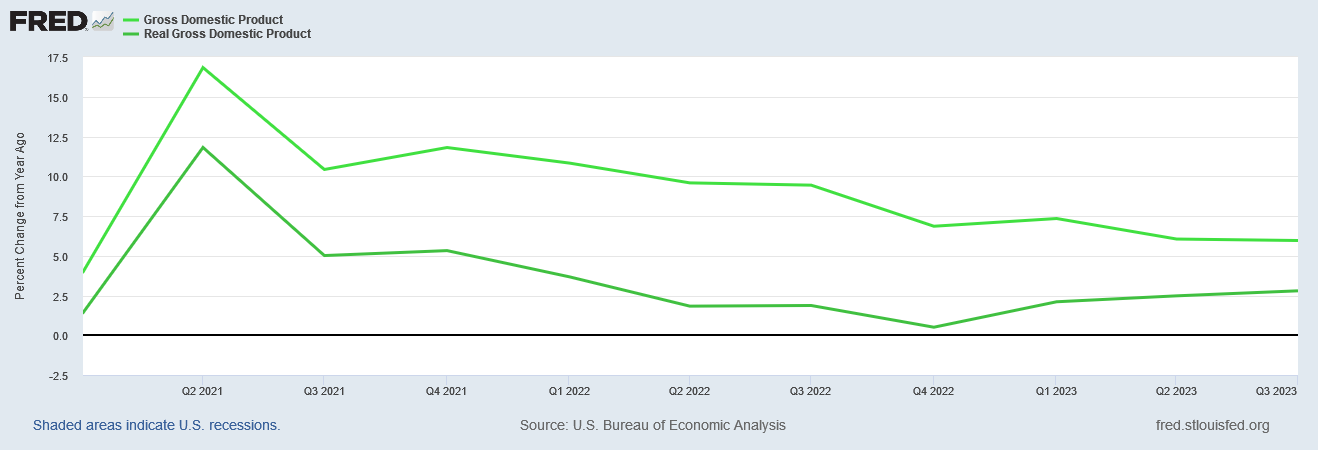

Even with a doubling from the second quarter growth numbers, the unadjusted real GDP still only printed 0.8% above where it was in the fourth quarter of 2022.

The unadjusted GDP data also continues to show a long-term cooling trend, with recent year on year percent changes printing at about half of 2021 levels.

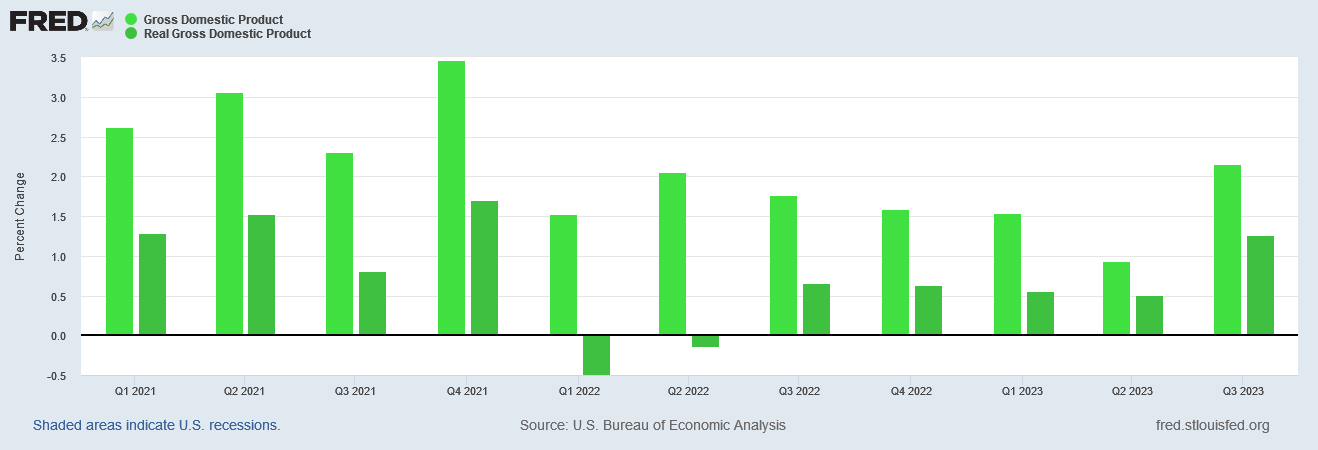

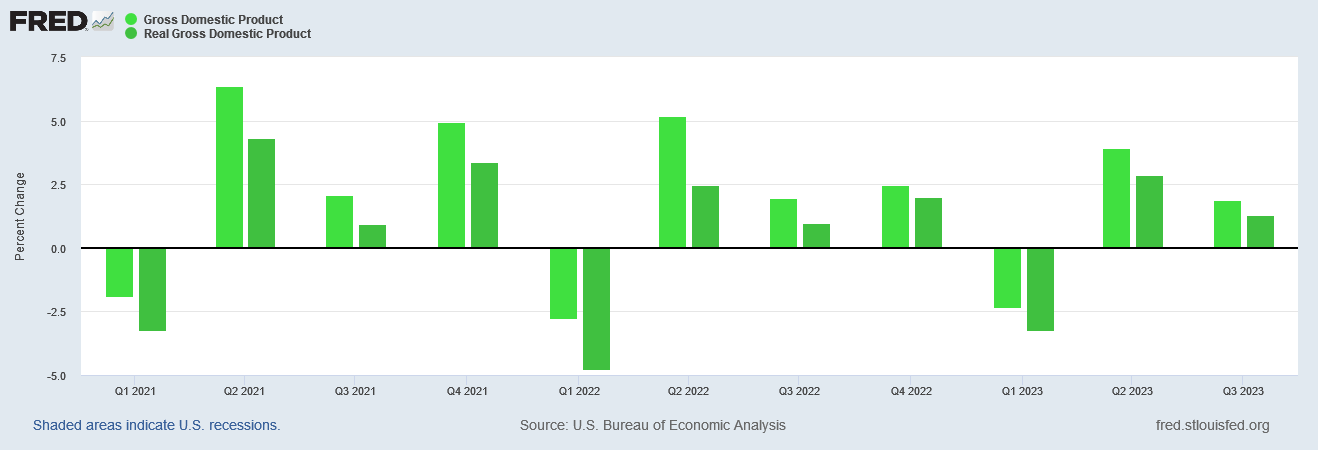

The unadjusted data also stands in stark contrast to the seasonally adjusted data used in the BEA report, which showed a surge in economic growth even in the quarter on quarter percent changes for both nominal and real GDP.

The unadjusted quarter on quarter percent changes are not nearly as optimistic.

Even before we drill into the details, therefore, we have reason to be skeptical of the BEA report. The seasonal adjustments are arguably dressing up the numbers somewhat, and masking actual longer term trends in the data.

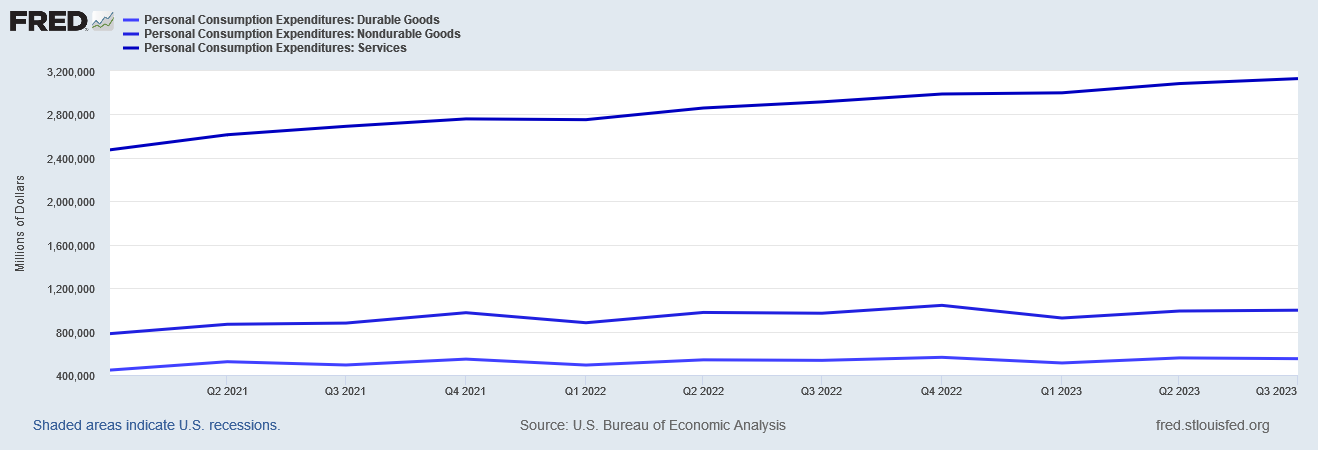

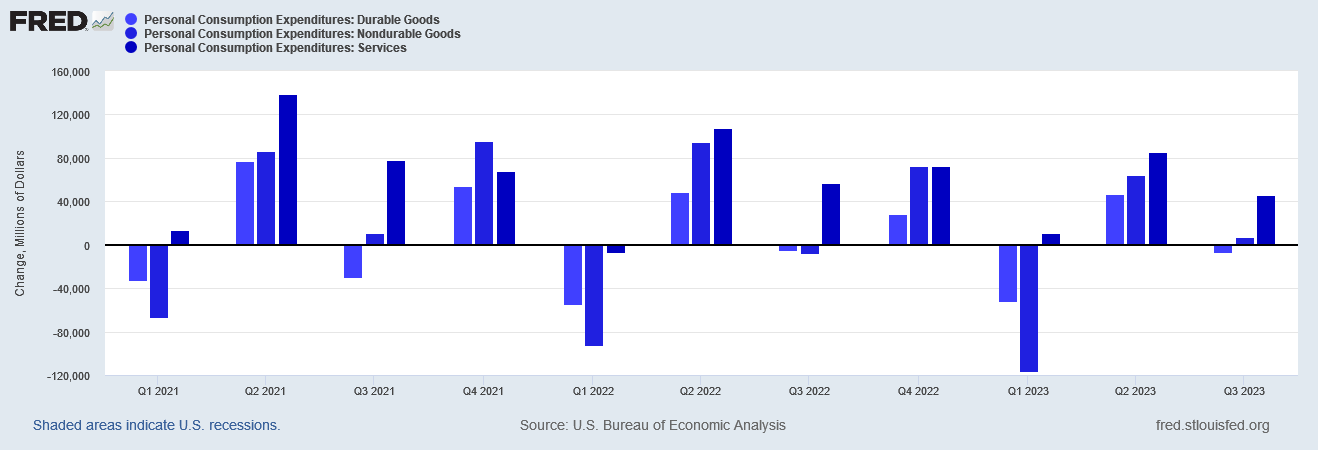

Within the details, once again the actual numbers are far less rosy than the headline figures. While consumption of services did rise during the quarter, goods consumption remained largely flat relative to prior quarters—and has not returned to the peak reached in the fourth quarter of 2022.

Unadjusted durable goods consumption actually declined during the quarter—not exactly a good look for a presumably growing economy.

Within the fixed investment category, unadjusted residential investment continued to shrink, while unadjusted non-residential investment grew but at a cooler pace, continuing the trend of the past several quarters.

Unadjusted government spending rose, principally within the national defense category.

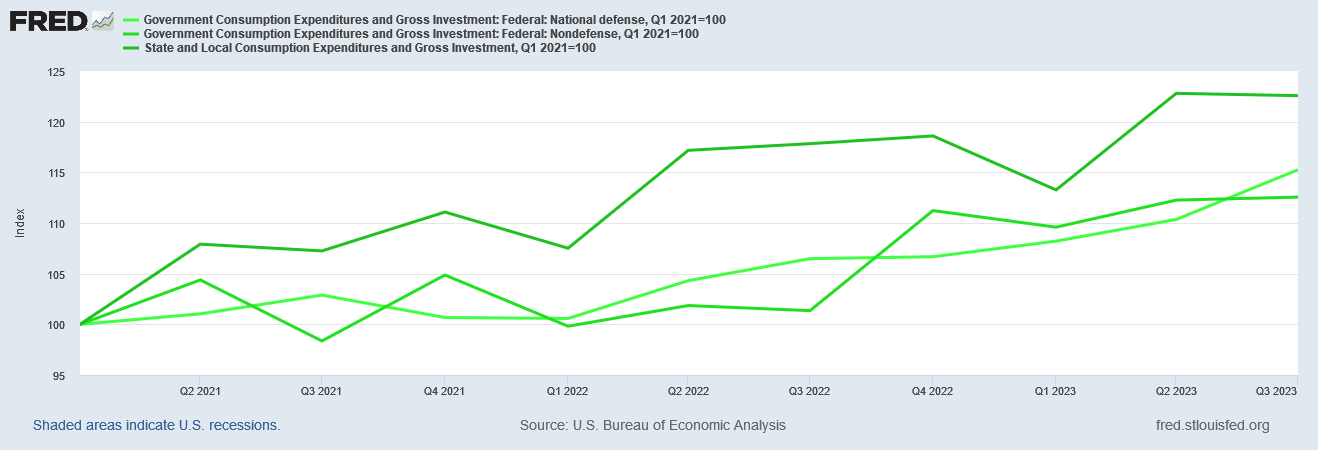

While the growth has been uneven, the expansion of government spending in recent years has been significant, with unadjusted state and local government spending having risen 22.6% since 2021.

Without government spending, the economic numbers for the third quarter would not be nearly as rosy as reported, as government spending growth easily outpaced consumption spending, with fixed investment spending growth practically nonexistent.

These are not trends one associates with healthy economic growth. These are signs of an economy that is becoming increasingly sclerotic and stagnant.

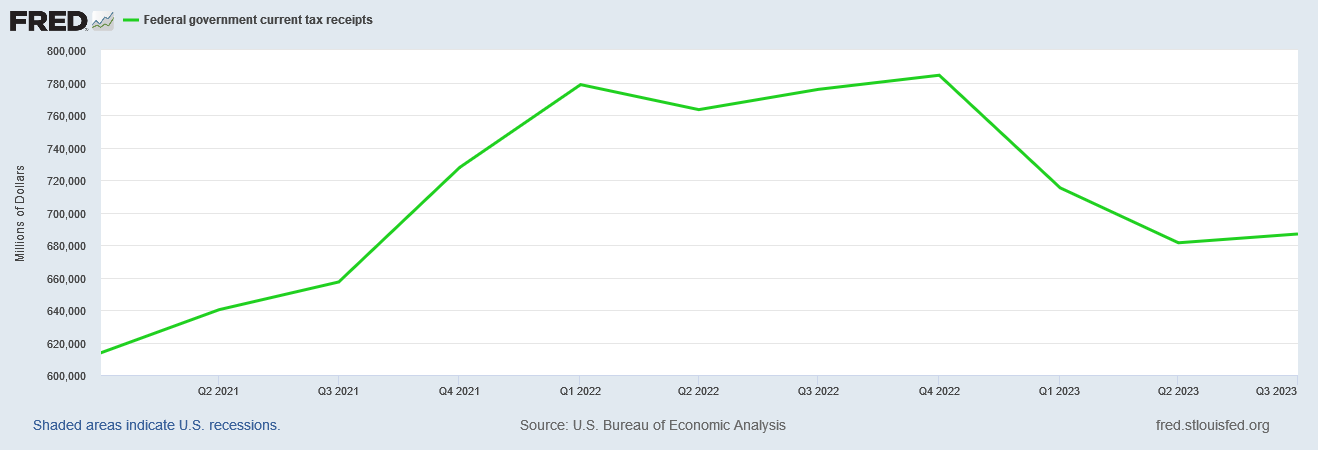

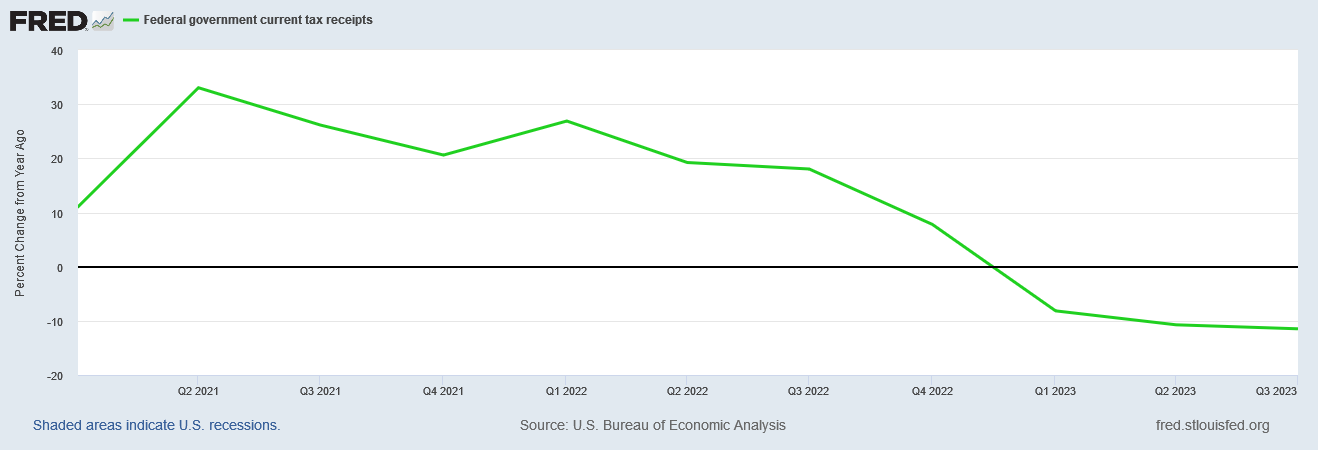

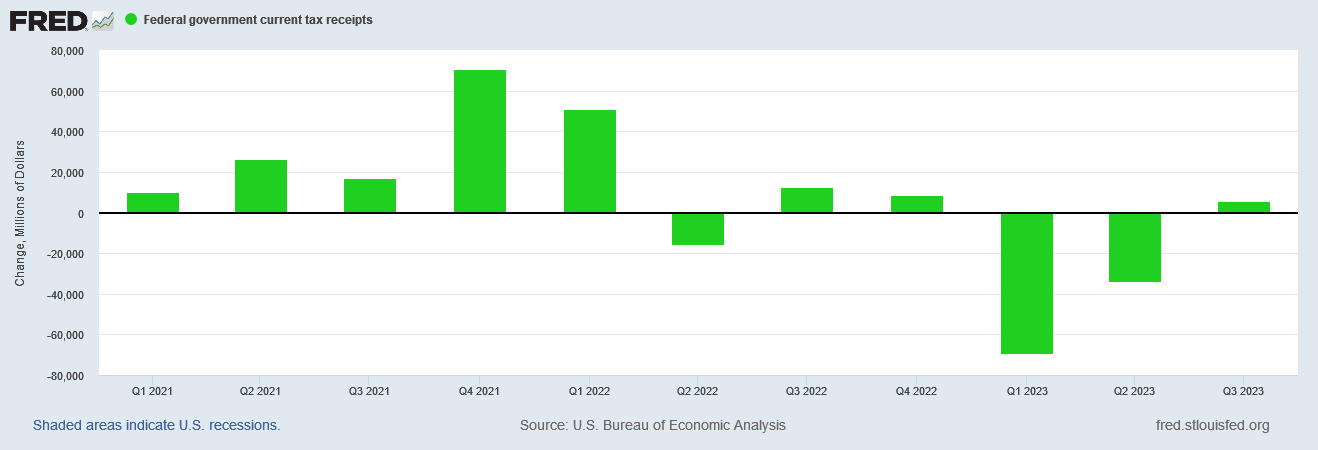

By far the biggest concern, however, is that federal tax receipts peaked in the fourth quarter of 2022, and have been on the decline ever since.

Growth in federal tax receipts has actually been slowing since early 2021.

The third quarter was the first quarter all year which showed even a slight increase in tax receipts.

This is worrisome all on its own, as the less tax revenue the government receives, the more it has to borrow to cover its spending ambitions (this being government, we know better than to expect a real-world reaction to decreased income such as trimming spending). In an era of rising interest rates, more government borrowing increases the amount the government has to spend on interest just to service the ever-expanding pile of government debt.

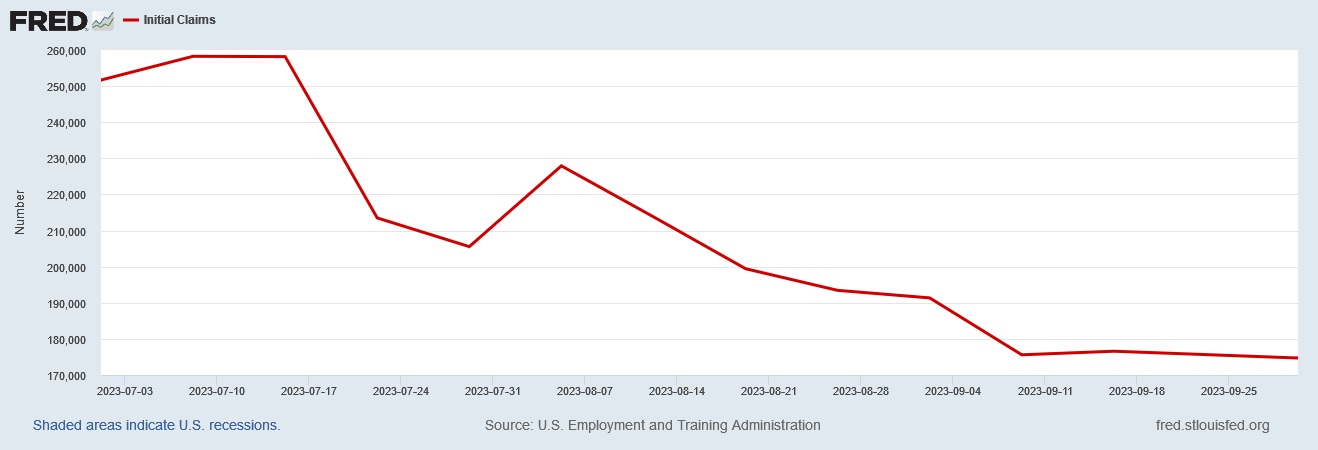

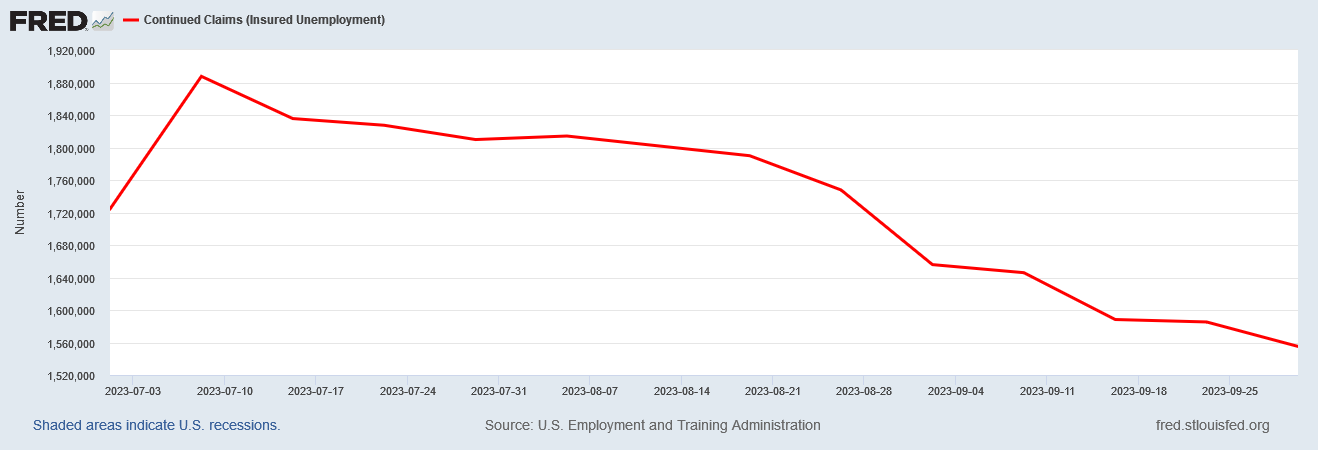

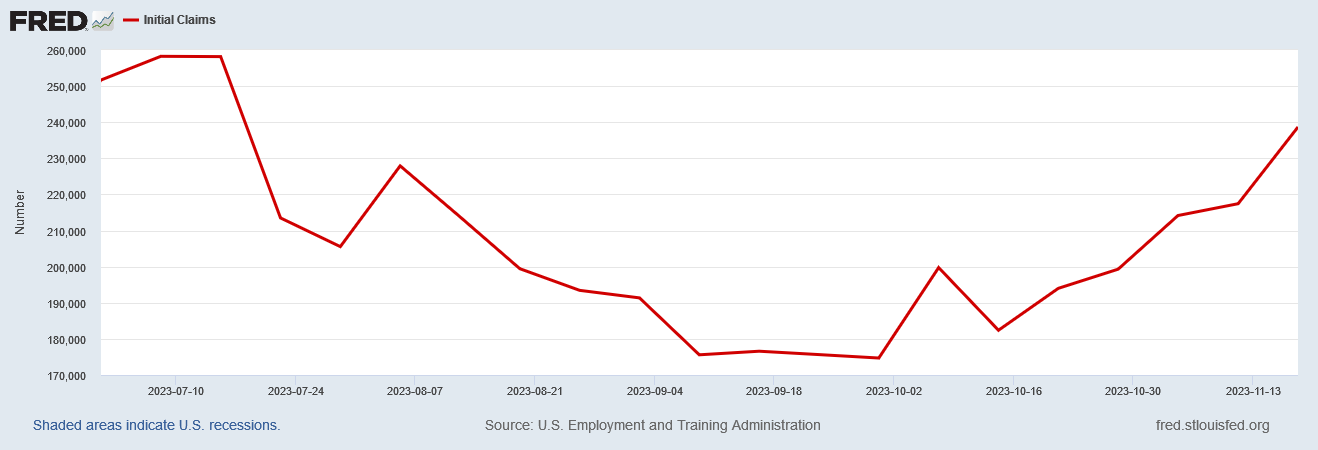

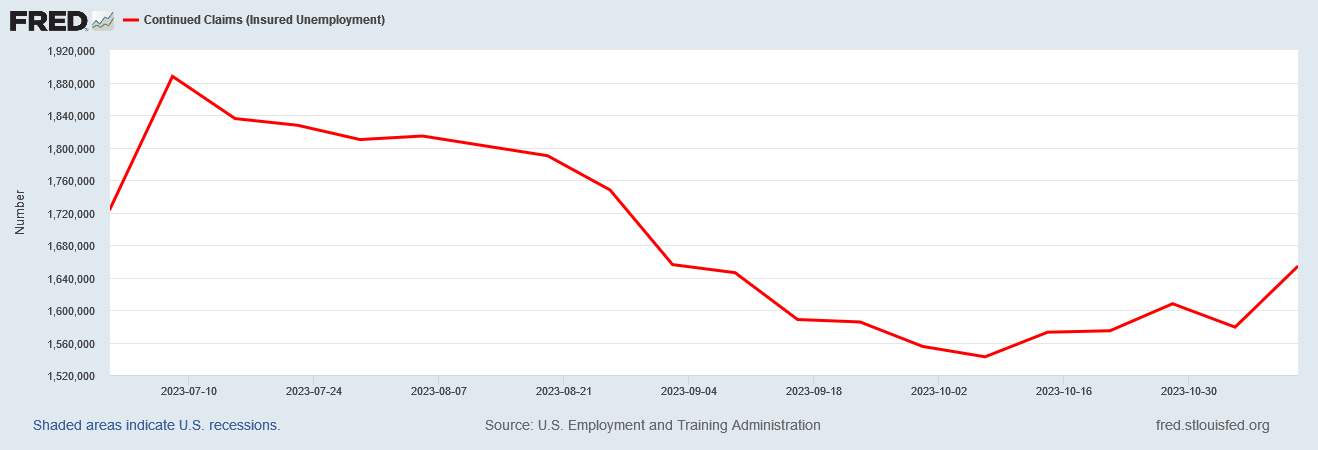

We should note, however, that the BEA’s assessment of economic growth does find some confirmation in a general downward trend in unadjusted weekly unemployment claims, both for initial claims and continuing claims.

However, that trend ends with the third quarter, as the trend for the fourth quarter to date is that of rising claims, with both initial and continuing claims moving sharply upward since the beginning of October.

However we take the BEA’s third quarter numbers, the jobless claims data alone suggests the fourth quarter will not be nearly as good. One good quarter in a year of less than good quarters leaves little room for optimism.

Ultimately, the BEA report on the third quarter GDP data is good news only if you are a fan of centralized government economies. If you are part of Xi Jinping’s cult of personality, you probably think the BEA data is pretty good.

If you pay attention to what happens in the real world, you already know that countries such as China are even in the present circumstance showing the world all that is wrong with reliance on government control and centralized planning. However sclerotic and stagnant the US economy is becoming, the Chinese economy is clearly already there, mired in a metastasizing deflationary crisis that continues to deteriorate with each passing news release.

Investors have already rendered their opinion on China’s government control economic model, and they are not at all in favor of it, with foreign investment currently fleeing The Middle Kingdom.

That government spending was the primary driver—arguably the sole driver—of economic growth in the US for the third quarter means the US economy is becoming more like China’s. That is not a good thing. There is not a single instance in the whole of human history where government has proven to be a good steward of a country’s economy, nor is there a single instance in the world today where government interventions have proven to be an economic benefit and not an economic harm.

Yet this is the economy the BEA is saying we have. Government spending may be generating artificially good growth numbers today, but that same government spending is bleeding away capital from private investment, without which there will be no growth numbers at all tomorrow. This will never end well.

A good economic report would be one that showed shrinking government spending and expanding private investment. For the third quarter, the BEA gave us close to the polar opposite of that good economic report.

It’s not hard to see why Wall Street was unimpressed by the GDP numbers. When one drills past the headline figures, the GDP numbers for the third quarter just aren’t impressive. Not at all.

I think any info from the government must be viewed with skepticism any more. Linking once again @https://nothingnewunderthesun2016.com/

It's so funny to see David Stockman these days, as if sensible management or policies, marginal-rate cuts, adults, are going to save us. The only respectable position these days is Austrian School combined with a heavy dose of Oswald Spengler, long-term storable food, guns and ammo, and analog books for the quiet times. The only way out of this is through!