From Whimper to Scream: ADP Report Shows US Losing Jobs

The Jobs Recession Is Getting Worse

If Tuesday’s Job Openings and Labor Turnover Summary was a whimper, yesterday’s National Employment Report from ADP was an agonized moan.

While the ADP jobs report is usually overshadowed by the Employment Situation Summary from the Bureau of Labor Statistics, that the BLS is shuttered due to the government shutdown means the ADP report is likely the only data we are going to have on US labor markets for the month of September.

The National Employment Report was not any sort of good news, or even “good” bad news. The National Employment Report was dire news, charting job loss for the United States (emphasis mine).

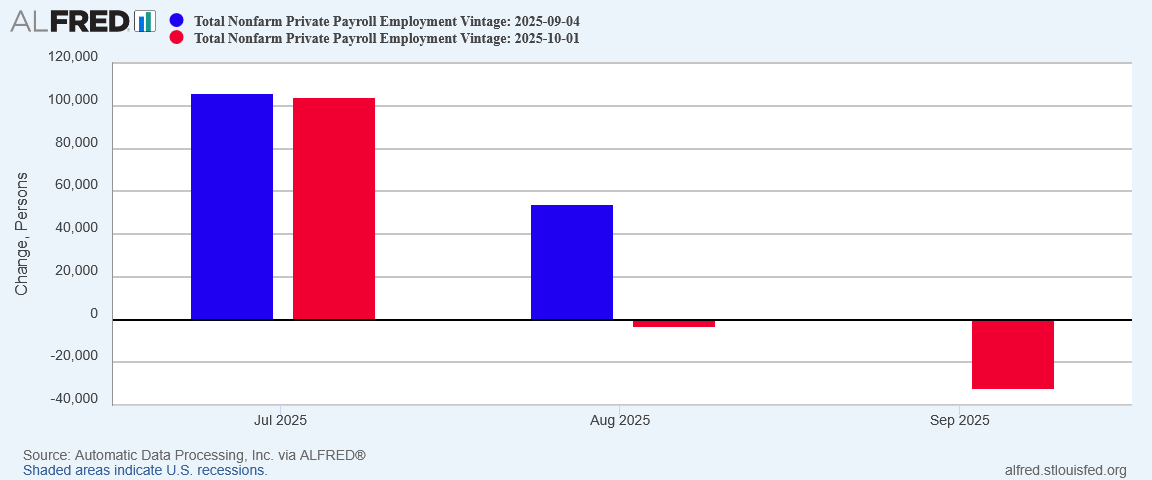

Private employers shed 32,000 jobs in September

ADP conducted its annual preliminary rebenchmarking of the National Employment Report in September based on the full-year 2024 results of the Quarterly Census of Employment and Wages. This recalibration resulted in a reduction of 43,000 jobs in September compared to pre-benchmarked data. The trend was unchanged; job creation continued to lose momentum across most sectors.

Note that the ADP report is admitting that employment in this country has been trending down of late.

Note that I have been reporting on that downward trend for over a year.

The sobering truth of the ADP jobs report is that its confirmation of what I have been reporting on the jobs recession in this country is about its only bright spot. There certainly are not any economic sectors where jobs are growing significantly.

The even more sobering truth of the ADP report is that, while calling the employment situation a “collapse” is for now premature, peeling back the layers to examine the data underneath shows that a collapse may not be all that far-fetched. Things are steadily getting worse for American labor.

We ignore this at our peril. Employment and job growth, along with real wage growth, are far more meaningful indicators of overall economic health than what Wall Street is doing or what level of GDP is being recorded. There is no economy that can be considered “healthy” when it is not producing jobs and not increasing real wages.

Right now, the US economy is not producing jobs.

Labor markets in the US are deteriorating, and the pace of decline has been increasing. These are ominous warning signs for our economic future.

ADP Admits There Has Been Lou Costello Labor Math

In addition to the obviously horrendous jobs numbers, ADP also said the quiet part out loud about the BLS and its jobs reporting: Lou Costello Labor Math in the monthly Employment Situation Summary really is a thing.

Note what ADP said about their re-benchmarking: the jobs level for September was ratcheted down 43,000 jobs from where it was before the benchmarking process.

With September showing job loss after the benchmark revisions, a 43,000 adjustment suggests that, pre-benchmarking, the ADP survey for September was on track to show some 11,000 jobs added to America’s payrolls.

Pre-benchmarking, August’s ADP jobs figure was 54,000. After benchmarking, ADP printed job loss of 3,000 in August.

A 43,000 downshift in September jobs is a sizeable correction, but the August correction is an even worse 57,000 reduction, eliminating 54,000 jobs and producing a deficit of 3,000 jobs.

One obvious conclusion to be drawn from this: the jobs data from earlier in the year has been significantly overstated, particularly in the BLS reports. When we index the ADP and BLS data sets to the start of 2025, ADP charts increasingly slower job growth.

While the ADP data does not show the job loss the Employment Level from the Current Population Survey (the Household Survey) charts for 2025, it still reiterates that the Current Employment Statistics survey (the Establishment Survey)—that part of the BLS jobs report which produces the headline jobs figures—has been consistently overstating job growth.

The headline jobs numbers reported by the BLS have been consistently wrong for quite some time, and ADP has just reiterated that point. Lou Costello Labor Math is confirmed yet again.

Job Loss Spread Across Multiple Sectors

Among the most worrisome portions of the ADP report is that manufacturing shed jobs for the second month in a row.

Adding to that misery is construction, which gave up some 5,000 jobs in September, continuing and magnifying August’s decline.

In services, Trade, Transportation, and Utilities also shed jobs for the second month in a row. Among the service sectors, Trade Transportation and Utilities is one of the traditional mainstays of employment. Job loss in this sector is a major loss for the economy.

Only three economic sectors showed any job growth in September: Education and Health Services, Information, and Natural Resources.

Even in those sectors, however, job growth for 2025 as a whole has been problematic at best.

The ADP jobs report for September paints a grim employment picture for economy as a whole, where there is job loss rather than job growth, and where the weakness touches quite literally every part of the economy, from the production of goods to the delivery of services.

Job Market Deterioration Accelerating In 2025

For anyone still wondering why I have been harping on a “jobs recession” since last summer, the ADP jobs report highlights a major reason: Job growth has been either anemic or nonexistent across the board, not just for September but for most of 2025.

Moreover, in sector after sector, labor market deterioration has accelerated in 2025. Throughout the summer there has been a clear inflection downward in the ADP data, a slowing of job growth in the BLS Establishment Survey data, and a steepening decline in the BLS Household survey data.

These trends align with the decline in net hiring we saw the other day in the August JOLTS report.

While corporate media and TDS-afflicted Democrats will naturally want to blame the decline in job market health on President Trump and his policies, the reality is that labor markets in this country have been in decline since late 2023.

The decline might be accelerating under President Trump, but it would be complete nonsense to suggest the decline started with President Trump. It did not. This predates President Trump by at least a year.

Has Trump’s policies—and in particular his tariff and trade war policies—made a bad jobs situation worse?

While we cannot rule that out completely, the sustained disinflationary trend in factory gate prices for 2025 argues against that interpretation.

If President Trump’s tariff and trade war policies were the primary contributor to America’s labor market woes, we would see also factory gate inflation increasing, and that has not been happening.

We do well to remember that President Trump is not the only significant economic actor able to influence employment trends int his country. We especially should not overlook the influence of the Federal Reserve and the befuddled policies of an equally befuddled Fed Chair Jay Powell.

I and other commentators have argued in the past that the Federal Reserve needs to trim the federal funds rate by a significant amount in order to stimulate job creation.

We quite possibly are witnessing the consequences of Powell’s failure to move more adroitly on bringing down the federal funds rate. Jay Powell’s mismanagement of the federal funds rate arguably is a more plausible cause of the worsening jobs picture than President Trump’s economic policies.

Powell, not Trump, is the actor able to directly influence the cost of capital for American businesses. Powell, not Trump, is the actor able to most directly influence the ability of businesses to finance expansion, investment, and therefore employment.

Regardless of the cause, America’s labor markets are deteriorating to the point where we are likely to see mounting expectations that President Trump do “something” to stimulate job growth. Democrats especially are likely to call ever more loudly for the Trump Administration to backtrack on the Liberation Day tariffs, even though it is hardly certain that reversing direction on tariffs will have any immediate stimulative effect on jobs.

America’s job markets are in serious trouble. They have been in serious trouble for years. The data has been showing that for quite some time, just as it has been showing the problems getting steadily worse.

As America’s job markets go, so goes America’s economy as a whole. There can be no economic prosperity without job growth and wage growth. At present, a lack of job growth is a major problem for American job markets, and an urgent red flag for the American economy.

America’s employment problems are reaching the point where ignoring them will no longer be an option. Even if only for political reasons, Washington as a whole will be pressured to do “something”. That is not a good place to be, not politically and certainly not economically.

The whimper that was the August JOLTS is now the agonized moan of the ADP August jobs report. Whether that moan will become a full-throated scream before it can capture Washington’s attention remains to be seen.

Great, factual analysis on bad news. Sigh.

There’s another factor in job loss that I hope the Trump administration will highlight: the failed economic policies at the state, city, and local levels of government. These are chiefly Democratic Party policies in Woke cities, where job loss as a result of leftist policies have been accelerating for years. I sure hope that the voters can discern this!

A note regarding AI: it’s maybe mostly hype at this point, but if AI can surmount its problems with electricity and water use, it will affect productivity. Historically, productivity has been defined as “output per man-hour of work”. So, theoretically, AI could greatly increase productivity, but at the cost of job losses. Peter, if you ever encounter data regarding this (maybe a year or so from now), I’d love to see your analysis of the trade offs on this new technology. Thanks in advance, Magnificent Man!

The false BLS numbers were the basis of economic policies (high fed rates) that are now causing human pain and suffering in the real world. Lysenko has been reincarnated.